The bitcoin and cryptocurrency world was rocked last week by news U.S. authorities had levied charges against major bitcoin and crypto exchange BitMEX and its leadership team.

BitMEX executives Arthur Hayes, Benjamin Delo and Samuel Reed were indicted by the U.S. government on October 1, accused of flouting U.S. banking laws while serving American customers.

Now, in a further blow to the controversial Seychelles-based bitcoin and cryptocurrency exchange, the influential blockchain data company Chainalysis has branded BitMEX a “high-risk” exchange—with external data showing investors have removed almost 50,000 bitcoin tokens from BitMEX since last week.

The chief executive of bitcoin and cryptocurrency exchange BitMEX, Arthur Hayes, was accused of … [+]

On Monday this week, Chainalysis warned its clients that BitMEX, which rose to prominence throughout bitcoin’s massive 2017 bull run and was up until recently the largest bitcoin-derivatives exchange, would be considered a “high risk exchange” from October 13.

“Any transfers from October 1 and later should be considered high risk,” Chainalysis told clients in an email that was first reported by bitcoin and cryptocurrency news and analysis outlet The Block, adding BitMEX transfers will trigger alerts for those using the Chainalysis monitoring tool.

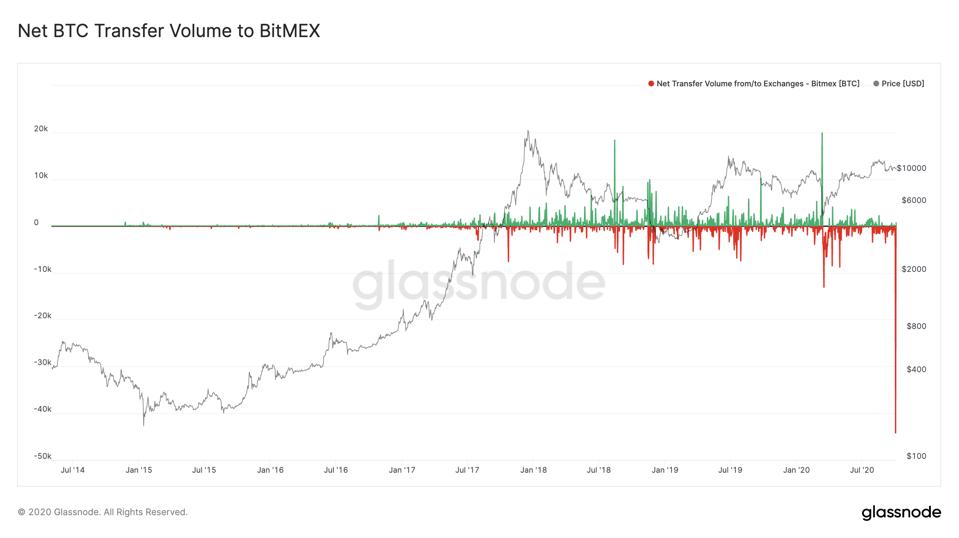

The Chainalysis warning compounds data from blockchain analytics firm Glassnode that shows around 45,000 bitcoin tokens have been withdrawn from BitMEX since the start of the month, representing a 27% drop in the total bitcoin on the exchange.

“On Friday 2 October, the day after the announcement, BitMEX saw its largest ever day of net outflows as investors rushed to remove their funds from the now-risky platform,” Glassnode analysts wrote in a market update.

BitMEX saw its largest-ever day of net outflows last week as investors rushed to remove their … [+]

Elsewhere, open interest on BitMEX’s bitcoin derivatives market dropped off 16% the day after charges were brought against the company, data from Arcane Research showed.

“The BitMEX case has shown that crypto businesses must work according to the rules of the existing financial system, as far as the U.S. is concerned,” Anatoliy Knyazev, co-founder of investment firm Exante, said via email, adding he thinks other bitcoin and crypto exchanges around the world that don’t require identification documents from all users will likely fall into line.

“The U.S. authorities have made it clear that the crypto sector, including its ‘gray’ alleys, is now under control and will have to play by the rules.”