What is Autopilot?

Autopilot is a trading bot that uses “quant trading” to find profitable moves in the crypto market. Quant trading, which stands for quantitative, aims to sift through market data to spot indicators and market conditions to execute profitable trades on your behalf.

OSOM, the fintech firm behind the robot, claims that Autopilot is able to limit drawdowns and protect your balance when trades go against it, increasing the profitability of the bot over time.

Autopilot offers some very promising indications of its validity, including a realistic yearly return rate of 50% and charging some fees for transactions — many platforms offer zero fees, but as the old adage goes: you get what you pay for. By charging fees, OSOM, the company behind the bot, is able to generate revenue, which means there’s more money to reinvest into improving the platform.

Launched just last year in September 2019, Autopilot is still relatively new to the emerging trading bot space. However, since its launch, the bot has delivered an impressive 50% yearly return on investment.

Standout Autopilot features

Only 0.005 BTC needed for minimum deposit — This is a relatively small amount of BTC, so new users can test the success rate of the bot relatively inexpensively. Other robots on the marked have much higher minimum deposits, which is always risking when trying out a new bot.

Maximum drawdown — Autopilot protects your capital by only tolerating losses up to 21%. If you plan to use the bot for an extended period, this is an invaluable risk management mechanism that simulates the sort of techniques a successful human trader would use.

Monthly portfolio statements — As well as providing the bot, OSOM also sends out monthly emails that update users on how the bot performed month to month. This is great for investors who want to ‘set and forget’ the Autopilot’s auto-trading features and occasionally keep up to date with how it’s performing without having to log into the platform.

No configuration needed — Many trading bots require users to adjust settings depending on market conditions. Autopilot takes care of this for you, as OSOM will update the bot on your behalf to allow your investments to grow and take the stress out of trading.

EU regulated — The exchange adheres to EU regulation and has an office in Brussels, meaning that the bot can be integrated with regulated exchanges to keep your funds secure.

Trades up to 30 altcoin pairs — The platform offers trading pairs for BTC for up to 30 altcoins, granting the bot more opportunities to make profitable trades.

Autopilot Robot: Pros and cons

Pros

- Trades against BTC and BTC trading pairs to maximise trading opportunities

- Offers 50% year-on-year ROI

- Is regulated and verified by the EU

- Much smaller starting capital than many bots on the market

- Claims to perform better than indexes

Cons

- Relatively high fees — arguably though, this makes the platform more trustworthy and secure

- Not offered in every territory in the world

- Has only been operating for a year, so has limited performance data compared to some other platforms

How to sign up

- Enter email address

- Submit passport number for KYC and enter personal details

- Make deposit to the platform and get started

For KYC purposes, OSOM requires users to submit their surname, forename, address, telephone number, date of birth and email address. As well as this, they will also require a passport number to verify your identity. See their privacy policy to see how your data is stored and what it is used for.

By adhering to KYC practices, Autopilot safeguards against money laundering by ensuring that money can be traced back to account holders.

Performance

The platform returns all profits in BTC, but is not just limited to the BTC/EUR trading pair, as it trades against carefully chosen altcoins on the market that offer BTC trading pairs. This means profits returned can take advantage of moves in up to 30 markets to maximise profits.

To choose altcoins to trade against BTC, OSOM has a strict criteria, including:

- Coins with a high market cap

- High liquidity to ensure trades can be easily made

- No privacy coins (such as Dash and Monero)

- No joke coins with super high circulating supplies (Dogecoin)

- No forks (Bitcoin Cash, Ethereum Classic)

- No stablecoins (Tether)

- No commodity-backed coins

- No derivatives or synthetic products

The graph above shows Autopilot’s performance over time compared to Bitcoin’s. By trading altcoins throughout the year, the robot is able to mitigate downturns in the Bitcoin market by profiting when other altcoins are doing well.

As the crypto market tends to reflect moves made by Bitcoin, the robot is able to find trading opportunities in altcoins while Bitcoin is in a downturn. Over the long term, this means the robot can make more returns on investment than a bot that is just trading against BTC.

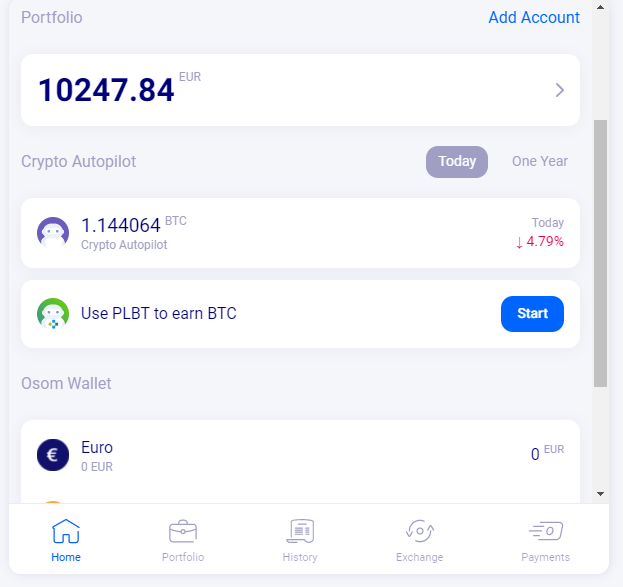

User interface

The platform’s user interface is nicely presented and intuitive to use. We were impressed with how easy it is to look through the past performance of the bot to assess the bot’s features.

Users can monitor how Autopilot has performed on the day and also see its success rate over the last year. As can be seen, the platform supports euros, so it is best suited for traders who want to use this currency.

In summary

OSOM has produced a really clever platform here, with a good range of features for those who want their BTC holdings to ‘work’ but are willing to take on a bit more risk than using a traditional index to potentially maximise returns.

Although the fees are higher than one might typically expect, the rate offered is realistic and lends authenticity to the platform as the bot provides a mutually beneficial tradeoff for individual traders and the platform itself — which means the bot can maintain its high performance rate and ensure the platform is secure.