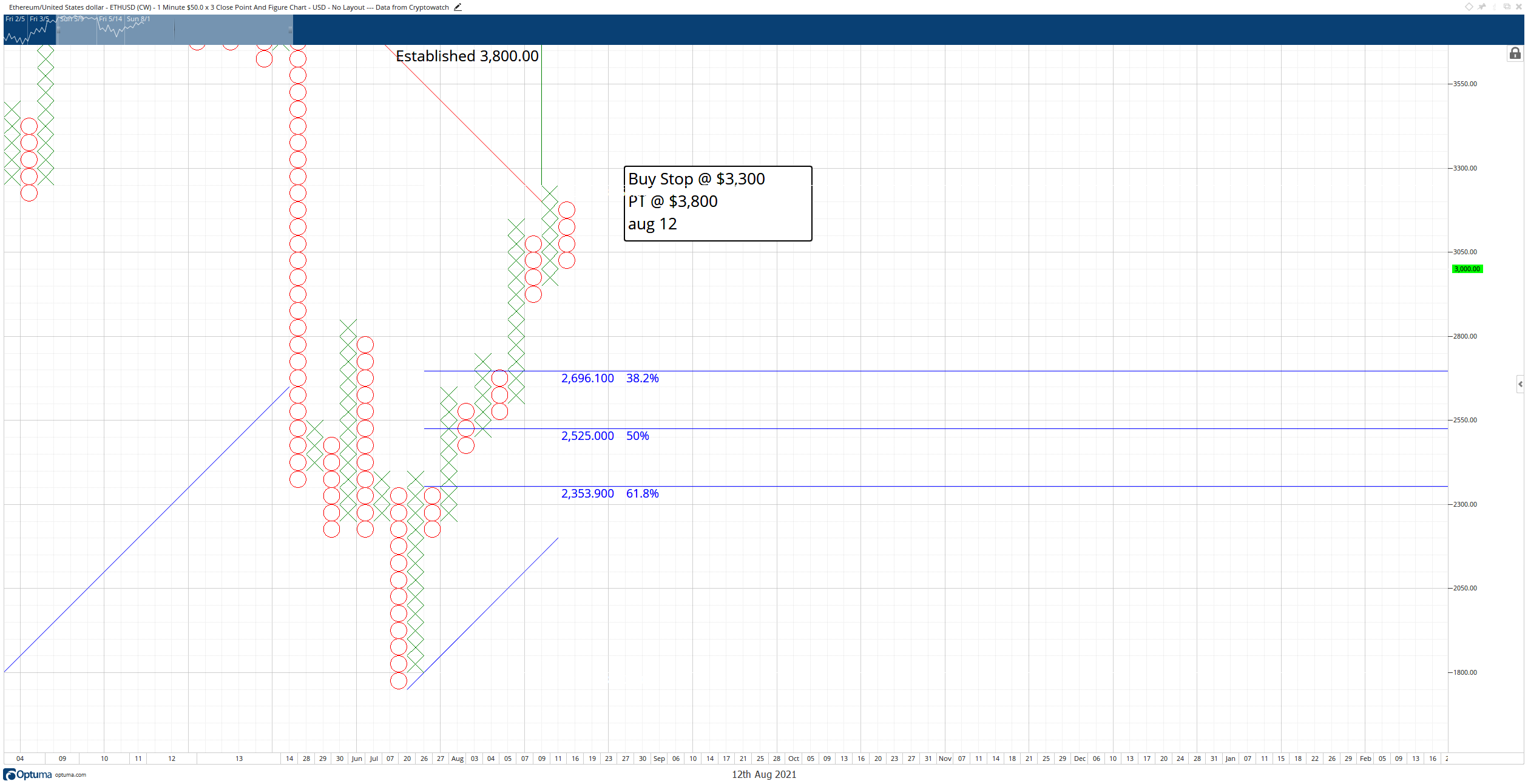

Ethereum (ETHUSD)

Above: Ethereum (ETHUSD)

Ethereum finally broke above the dominant bear trend line on its $50/3-box reversal Point and Figure chart. A slight pullback is warranted and expected. The long idea I see is a buy stop @ $3,300 with a profit target at $3,800. There is an opportunity to short with the break of a double bottom at $2,900, but that entry would be directly above a prior bullish entry zone – so not the best place to go short. The only way I would consider the sell stop entry at $2,850 would be if there was a triple bottom or a split triple bottom. Otherwise, the trade doesn’t have a lot of profit potential on the short side.

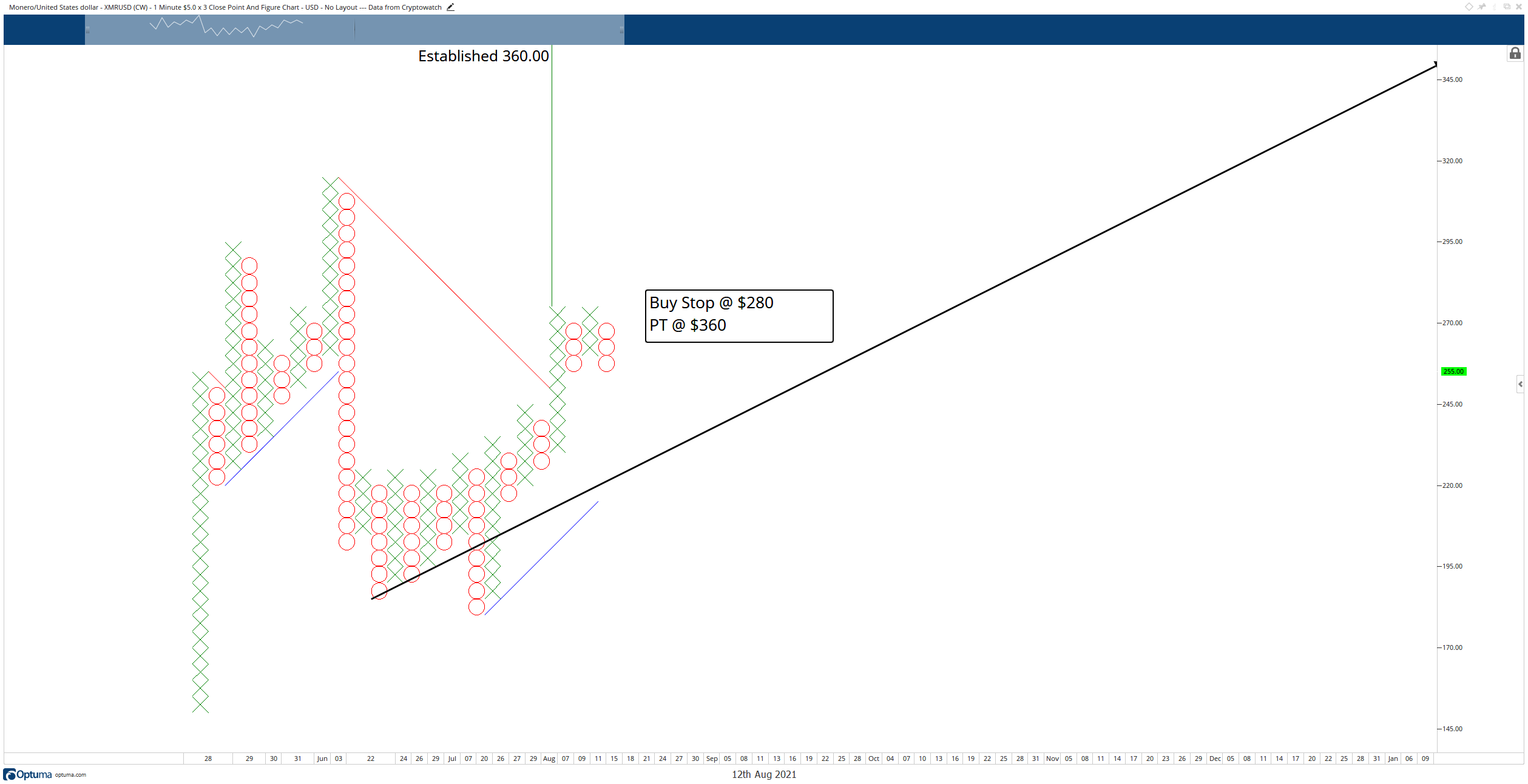

Monero (XMRUSD)

Above: Monero (XMRUSD)

Monero’s trading during the Thursday session has been overwhelmingly to the downside. At the time of writing (1900 EST), it is down -5.8% from the daily open, but down -9.1% from its intraday high. The selling pressure here should not be a surprise as Monero has outperformed its peers over the past few weeks. It is currently testing a strong support zone at $250 where the daily Tenkan-Sen and top of the Cloud (Senkou Span B) share the same value area. I would expect this level to hold. When I look at Monero’s $5/3-box reversal Point and Figure chart, I see significant less chop and a more clear looking chart setup. There is a double-top and a double bottom on the chart. Because Monero broke out above the prior bear market trend line, I’m only looking at a long idea. The entry would be at the break of a triple top and a buy stop at $280, with a profit target at $360. There are three scenarios we should look for:

1.The current O-column extends one box lower to $250: in this scenario, we want to see Monero drop down to $250 and then create a reversal column of X’s that then creates the buy entry at $280. This would fulfill the break of a triple top and it would confirm a bear trap pattern.

2.The current O-column extends two boxes lower to $200: in this scenario, we want to see Monero drop down to $200 and then create a reversal column of X’s that creates the buy entry at $280. This would fulfill the break of a triple top and it would confirm a bearish fakeout. The bearish fakeout pattern is much stronger and more rare than the bear trap pattern.

2.The current O-column extends two boxes lower to $200: in this scenario, we want to see Monero drop down to $200 and then create a reversal column of X’s that creates the buy entry at $280. This would fulfill the break of a triple top and it would confirm a bearish fakeout. The bearish fakeout pattern is much stronger and more rare than the bear trap pattern.

3.The long idea would be nullified and voided if Monero were to drop three or more boxes $255. In other words, if Monero drops down to $240, then the long idea is cancelled and we look for another trade setup on another day.

Advertisement

Save money on your currency transfers with TorFX, voted International Money Transfer Provider of the Year 2016 – 2020. Their goal is to connect clients with ultra competitive exchange rates and a uniquely dedicated service whether they choose to trade online or over the telephone.

Find out more here.