Smart contract platforms have the potential to impact society significantly and Ethereum (ETH-USD) is currently the clear leader in the space, although there are competitors who arguably have superior platforms. There is still significant uncertainty over how widespread adoption will be, whether permissioned or permissionless blockchains will be more widely used, the optimal protocol to provide security and scalability, which blockchain will be most widely adopted and how much of a blockchain’s value will be captured by tokens. Despite this uncertainty, I believe Ethereum is an attractive speculative investment at the right entry price, given the potential of smart contracts.

Figure 1: Ether Price History

(Source: Created by author using data from coingecko)

Blockchain

Blockchains have received a lot of hype since Bitcoin’s (BTC-USD) introduction and while they do offer advantages in some use cases there are also significant drawbacks which limit their applicability. In general, I believe the advantages of blockchains are overhyped and the disadvantages downplayed or overlooked, but that does not necessarily mean that cryptocurrencies are in general overvalued. A realistic appraisal of the costs and benefits of blockchains is necessary to develop an understanding of which use cases are genuine candidates for the deployment of blockchain technology.

Immutable

Blockchains are practically immutable, meaning that once data is written onto the blockchain it cannot be altered. This is one of blockchain’s most important advantages and makes blockchains attractive in applications where a tamper proof record is necessary. It should be kept in mind that immutability is not an absolute advantage as incorrect transactions are impossible to reverse. Immutability is also not necessarily absolute, as evidenced by Ethereum’s Distributed Autonomous Organization (DAO) hack where a security flaw caused Ether to be lost and the Ethereum community decided to reverse the transaction. It should also be kept in mind that an immutable record is only as good as the data being recorded. An immutable database of incorrect data is worthless, which highlights the importance of oracles.

Censorship Resistant

Data recorded on a blockchain is based on a consensus, which is resistant to censorship. This is a highly attractive feature in societies with totalitarian or corrupt governments. Blockchains can and will be subject to the same regulations as centralized systems though and this creates the potential for censorship. The ability of governments to do this is dependent on how decentralized a blockchain truly is, with on and off ramps like exchanges acting as centralized points where censorship is easier to enforce.

A decentralized system is only as decentralized as the most centralized component and if most users access cryptocurrencies through centralized exchanges it is still a fairly centralized system. It should be noted that decentralization goes hand in hand with many of the other features of blockchains like immutability, security and censorship resistance and these properties are only present to the extent that decentralization is present.

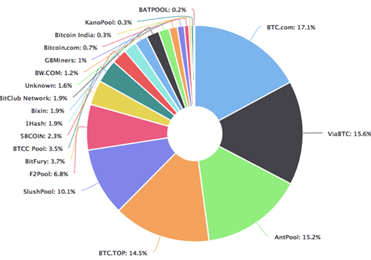

Only 3 entities would have to collaborate to successfully launch a 51% attack on the Bitcoin blockchain. PoS is a theoretically sound concept and should help to reduce the tendency for centralization over time but in practice validators must remain fragmented, which may be difficult.

Figure 2: Bitcoin Mining Power Distribution

(Source: blockgeeks)

Secure

A truly decentralized blockchain has no central point of failure and is secured using cryptography, providing protection against fraudulent activities. In the case of smart contracts, it should be kept in mind that security is only as good as the programming, which will often have flaws.

Trustless

Permissionless blockchains allow transactions to be conducted without trusting a central organization, which can be highly valuable in environments where corruption is a concern. While there is no need to trust a central organization, users must trust the blockchain technology and the people who create it as most people have no ability to assess smart contracts to ensure they will do what they are supposed to and that there are no vulnerabilities.

Transparent

Blockchains provide transparency which can be useful for cases like allowing users of a decentralized bank to audit the balance sheet of the bank themselves to assess risk, although this assumes people have the willingness and expertise to perform this type of assessment. Some people will not want transparency into their transactions though and this is one of the reasons that JP Morgan developed Quorum from Ethereum.

Pseudonymous

Pseudonymous transactions are one of the purported benefits of blockchains and this feature led to Bitcoin’s early adoption on the dark web. Blockchain transactions are not as anonymous as many people believe and blockchains provide a permanent record of transactions which can often be traced to individuals. As the technology matures, regulation will continue to increase and KYC/AML requirements are likely to result in most if not all transactions being tied to individuals.

Equal

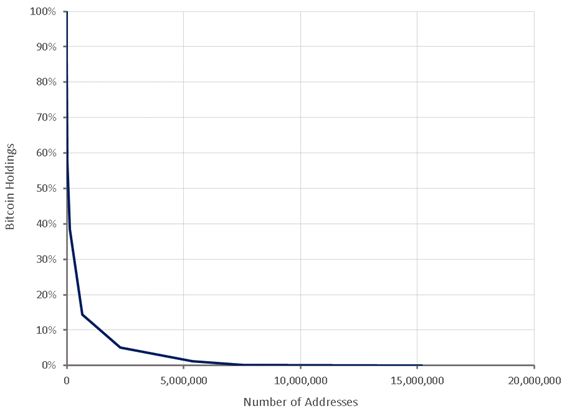

It is often argued that the decentralized nature of blockchains provides equal opportunities to everyone, which will contribute to equality in society. Ignoring the argument of whether equality is actually desirable it should be recognized a distributed infrastructure does not automatically lead to equal outcomes. Power law distributions are the norm in social systems and this will likely include blockchains, unless significant and explicit efforts to alter economic incentives are made. This is evident in the distribution of Bitcoin amongst addresses, which is as unequally distributed as any other form of wealth.

Figure 3: Distribution of Bitcoin Holdings by Address

(Source: bitinfocharts)

Blockchains are yet to find widespread adoption but potential use cases include:

- Financial instruments

- Ownership of underlying physical assets

- Ownership of non-fungible assets

- Decentralized exchange

- Financial derivatives

- Peer-to-peer gambling

- On-blockchain identity and reputation systems

- Prediction markets

- Censorship resistant publishing and communication

- DAOs

Early adoption is likely to be in areas where there are significant pain points such as:

- High friction in current systems (capital market post-trade settlement and regulatory reporting, cross-border payments and trade finance)

- Low trust in centralized institutions (banking in some developing countries)

- Poor quality existing systems (cross-platform identity and reputation systems)

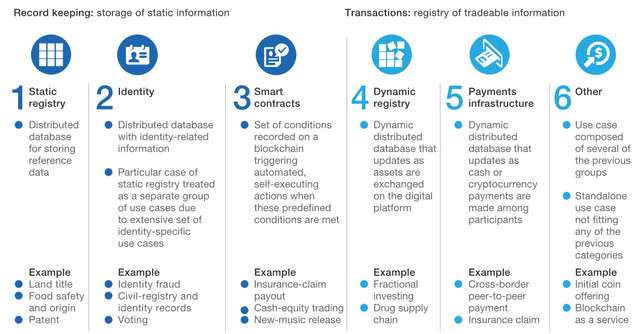

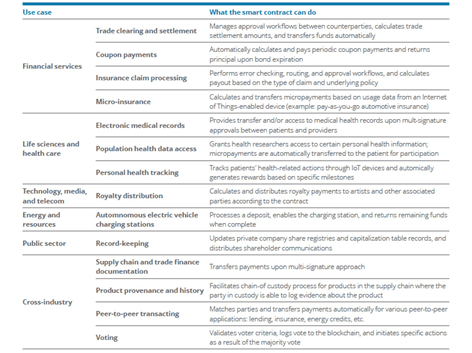

Figure 4: Blockchain Use Cases

(Source: McKinsey)

Figure 5: Smart Contract Use Cases

(Source: Deloitte)

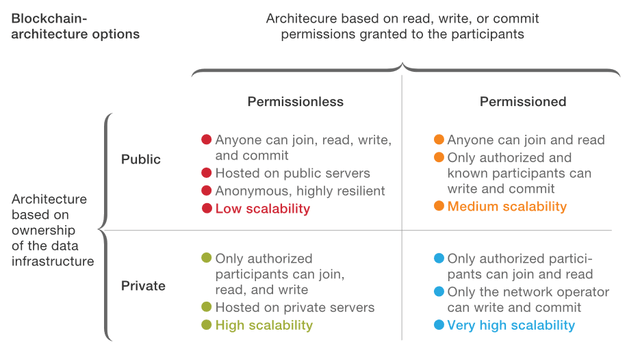

Even in applications where blockchains are adopted there will be a choice between permissioned and permissionless blockchains. There are tradeoffs between scalability, security and decentralization and depending on the relative importance of these features many potential use cases may utilize permissioned blockchains rather than permissionless blockchains. Blockchain does not have to be a disintermediator to generate value and in the short term value will predominantly come from reducing costs not the creation of transformative business models. Both of these facts point towards the adoption of permissioned blockchains, particularly in the near term. The degree to which incumbents adapt and integrate blockchain technology will be the determining factor on the scale of disintermediation in the long term.

Figure 6: Blockchain Architecture Options

(Source: McKinsey)

Ethereum

Ethereum was launched in 2015 and is the second largest cryptocurrency by market capitalization. It is a decentralized open-source blockchain which utilizes a Turing complete language that offers the equivalent of a virtual machine. This programmability enables Ethereum to execute smart contracts and has led to its leading position as the protocol for decentralized applications (DApps). A smart contract is a system which automatically moves digital assets according to arbitrary pre-specified rules. Ethereum has also created the potential for more advanced functionality like DAOs, which are long-term smart contracts that contain the assets and encode the bylaws of an entire organization.

The Ethereum Virtual Machine (EVM) runs on the Ethereum network and makes the process of creating blockchain applications easier and more efficient by eliminating the need to build a blockchain for each new application. Ethereum utilizes off-chain governance via Ethereum Improvement Proposals (EIPs). EIPs are usually detailed design documents which provide suggestions on improving the Ethereum blockchain. These processes are not presented, recorded, passed or voted for on the blockchain itself. While this process has worked relatively well so far it could be argued that the process is open to politicization and is not necessarily democratic. Ethereum uses Solidity as the programming language for smart contracts, a language developed specifically for this purpose. This creates a learning curve for the platform which has been eased somewhat by using syntax that is similar to the widely used javascript language.

Ethereum’s primary issue at this point is scalability as the network generally operates near 100% utilization which can result in transaction fee spikes. There are a number of avenues to resolve this problem including proof of stake consensus, sharding (horizontal partitioning of a database) and second layer solutions like state channels. PoS achieves consensus by having validators stake coins on blocks they think can be added to the chain and rewarding them amount proportional to their stake if the block is appended. To add a malicious block a validator would need to own 51% of all cryptocurrency on the network. PoS helps achieve:

- Decentralization (prevents centralization by reducing economies of scale in mining)

- Energy efficiency (eliminates wasteful PoW consensus)

- Economic security

- Scaling

While PoS is more scalable than PoW there are still concerns about how scalable it is and as a result some blockchains are pursuing variations like delegated PoS. While delegated PoS may be more scalable there are tradeoffs and reasons to be concerned that delegated validators will engage in rent seeking behavior. Ethereum will transition to PoS by initially utilizing a hybrid PoW/PoS consensus using the Casper FFG algorithm before transitioning to Casper CBC. Hybrid consensus is achieved by overlaying a PoS protocol on top of the normal ethash PoW protocol. Blocks are still mined via PoW but every 50th block is validated using a PoS checkpoint where finality is assessed by a network of validators.

It is expected that ETH 2.0 will contain a central blockchain known as the Beacon Chain which will coordinate 64 sidechains called shards. Every shard will act as a full PoS system, containing an independent piece of state and transaction history. This has the potential to dramatically improve scalability as instead of processing all network transactions, each node only processes transactions for a certain shard. Zilliqa was the first public blockchain platform to have implemented sharding and was able to achieve 2,828 Transactions per Second (TPS) in its testnet. Sharding should enable scalability without compromising decentralization and security like some other methods. It is expected that sharding and PoS will be implemented on ETH 2.0 as a separate network and once the capabilities are proven the new and existing networks will be merged. If this approach is successful a shard of shards approach could also be possible which would lead to an exponential increase in scalability.

There are a number of proposed second layer solutions to the scalability issue including Optimistic Rollups and State Channels. Second layer solutions move almost all the work off the main chain into the participants application while ensuring security for these applications on the Ethereum main chain. Off-chain solutions allow transactions to be scaled almost independently of the TPS limit of the main blockchain which has the potential to improve scalability significantly. With a combination of shards of shards and layer 2 solutions it is easy to envision TPS in the range of hundreds of thousands to millions with extremely low costs.

Ethereum does not have a cap on the total supply which is a potential problem when assessing the value of Ether but it should not be considered a negative for the network, provided investors have confidence in Ethereum’s governance. Ethereum was designed as a smart contract platform and it is being managed to achieve that goal, not to create a speculative bubble in the Ether token. While there is no cap on the total supply of Ethereum there is an 18 million Ether per year limit on growth.

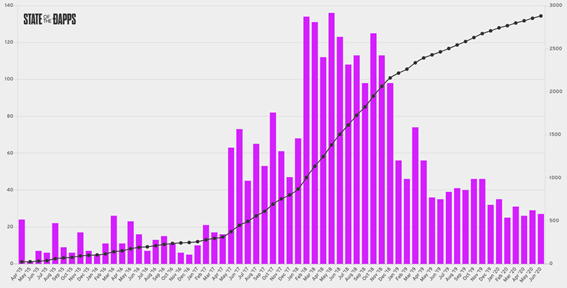

Ethereum is the platform of choice for DApp developers with approximately 80% of all DApps built on the Ethereum platform. The pace of DApp development has declined significantly since the peak in late 2017 and early 2018 but remains relatively robust. At issue is the state of adoption which remains relatively low with daily active DApp users generally less than 100,000 across all platforms.

Figure 7: Ethereum DApps

(Source: consensys)

Competition

There are a number of competing blockchain based smart contract platforms, including:

Smart contract platforms compete across a number of features including but not limited to governance, security, scalability and economics. A well governed and secure platform should be considered table stakes for a smart contract platform and the platform’s economics should be structured so that desirable behavior is rewarded and undesirable behavior is punished. At this stage, competition is primarily based on scalability and if any platform is to take Ethereum’s lead it is likely to be a result of offering a significantly higher number of transactions per second while remaining decentralized.

EOS

EOS is a decentralized operating system which aims to support industrial-scale DApps and claims the ability to conduct millions of TPS without transaction fees. Scalability is achieved by utilizing delegated PoS which instead of being the platform’s biggest attribute now appears to be a significant downside, as there are fears that EOS has become overly centralized.

EOS’ delegated PoS consensus algorithm achieves higher throughput by decreasing the number of nodes that participate in consensus. There are 21 Block Producers (BPs) at any time who establish consensus on the chain, make governance decisions and earn rewards and the majority of these entities are based in China. There is concern that the current BPs are abusing their power and are not doing enough to prioritize building new DApps to attract users. EOS is not the high throughput chain preferred by enterprises that was originally envisioned and is primarily a chain for running gambling DApps.

Cardano

Cardano is a PoS blockchain platform which aims to provide security and scalability to DApps, systems and societies. Cardano balances the need for regulation with the privacy and decentralization of blockchain technology and offers more regulatory control than competitors for those who want to use it.

Much of Cardano’s platform is still undeveloped and progress is moving slowly, which is a potential cause for concern, but there is significant optimism about the platform as it is being built on the strength of academic peer review. Cardano could be one of the most technically proficient platforms for smart contracts but its slow development may leave it behind competitors, even if it is superior. I do not believe this is a problem in the short term as most protocols are still evolving and user adoption is unlikely to reach a tipping point in the foreseeable future. Even if Cardano does develop superior technology there is also the risk that competing platforms implement the best ideas from Cardano as they are published.

Cardano’s platform will use a dual-layer approach with the addition of side chains. The two layers are used to separate transaction data from contract data about why transactions occurred and the side chains provide interoperability between layers and other blockchains. In comparison Ethereum has smart contract computation and transaction settlement happen on the same layer. Cardano’s smart contracts will be written in a new language called Plutus which is still in the prototype phase and as a result no smart contracts are yet to be deployed on the platform.

TRON

Tron was founded in 2017 with the goal of providing infrastructure for a decentralized internet and is one of the largest blockchain-based operating systems in the world. It is similar to Ethereum but with a focus on enabling simple and cost-effective sharing of digital content and high scalability and availability.

Tron achieves scalability using a delegated PoS consensus algorithm, but similar to EOS this has led to allegations of excessive centralization in addition to accusations that Tron is neglecting to foster the development of commercial applications. Tron’s former CTO quit the project claiming:

Token distribution is centralized, Super Representatives are centralized, code development is centralized. Even the community is organized under centralization.

The former CTO also said that real internet applications can’t currently function on the Tron network.

NEO

NEO is an open-source platform that is leveraging blockchain technology and digital identity to digitize assets, automate the management of digital assets and realize a “smart economy”. NEO has been referred to as the Ethereum of China as their platform offers a Turing complete language enabling developers to create DApps and ICOs.

Some of the features of the NEO platform include:

dBFT2.0 – Delegated Byzantine Fault Tolerance consensus algorithm offering high stability, high TPS and single block finality

NeoVM – Lightweight, cross-platform and scalable virtual machine

Smart Contracts – Cross-platform, multi-language supported smart contract system

NeoID – Customizable decentralized self-sovereign identity protocol

NeoFS – Distributed object storage solution for on-chain data applications

Voting Mechanism – A voting mechanism that enables on-chain governance

Oracle – Built-in oracle enabling smart contracts to access external resources

NEO supports programming in all mainstream languages including C#, Java, Go, Python, and Kotlin, which facilitates contribution from a large community of developers.

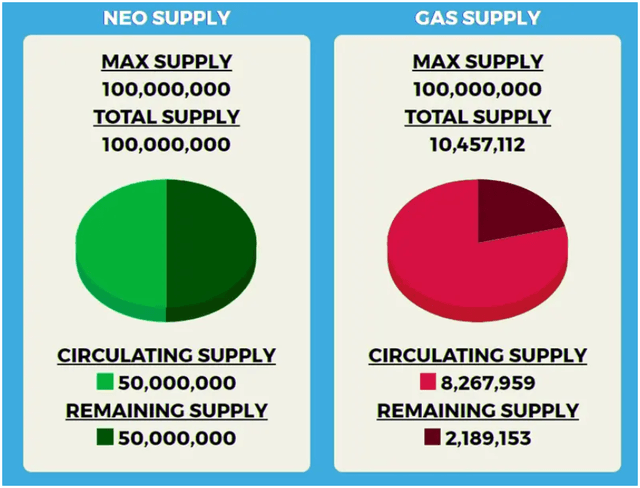

The NEO platform has NEO tokens which give the holder rights to manage and make decisions for the network and GAS tokens that fuel smart contracts. GAS acts as a currency inside the ecosystem and provides economic incentives to the various projects taking place in it.

Figure 8: NEO and GAS Supply

(Source: blockgeeks)

The focus on digital identity and regulatory compliance combined with on-chain governance and a built-in oracle makes NEO interesting from a technology perspective. NEO is also working on cross-chain interoperability, a file storage protocol and addressing the risk posed by quantum computing.

Tezos

Tezos is a decentralized blockchain that is focused on improving dispute resolution through on-chain governance. The Tezos blockchain is linked to a digital token called the tez and token holders receive a reward for taking part in the PoS consensus mechanism. The main aim of Tezos is to make their token holders work together to make decisions that will improve the protocol over time. Tezos has three unique capabilities:

- On-chain governance and self-amending

- A liquid PoS consensus mechanism

- Smart contracts with formal verification

The liquid PoS consensus algorithm requires users to stake a certain number of Tezos tokens to participate in consensus, a process referred to as baking. Token holders are able to delegate their validation rights to other token holders without transferring ownership but unlike EOS, delegation is optional. This appears to be a means of achieving delegation and the corresponding scalability while avoiding some of the potential for bad behavior caused by centralization. Tezos aims to formalize community consensus and mitigate contentious hard forks via self-amendments and on-chain governance. On-chain governance means proposed amendments are decided through on-chain voting where Tezos users can vote directly or delegate their vote to others.

Tezos uses Michelson which is a functional language whereas Ethereum uses Solidity which is an imperative language. The biggest advantage of the functional approach is that it helps with creating a high assurance code because it is easier to prove how the code is going to behave mathematically. The disadvantage is that there is a lack of experts in the functional programming field because they are not that popular.

Hyperledger

The Hyperledger organization was founded in 2015 by the Linux Foundation as an open-source collaborative effort to advance cross-industry blockchain technologies. It counts high profile organizations like Airbus, IBM, Intel, American Express and JP Morgan as members. Hyperledger is not one blockchain, but an organization facilitating industrial blockchain projects that do not have currencies. Hyperledger initiatives like Hyperledger Fabric are more of a substitute than a direct competitor to Ethereum, although if permissioned blockchains gain traction it has the potential to shrink the market for permissionless blockchains significantly.

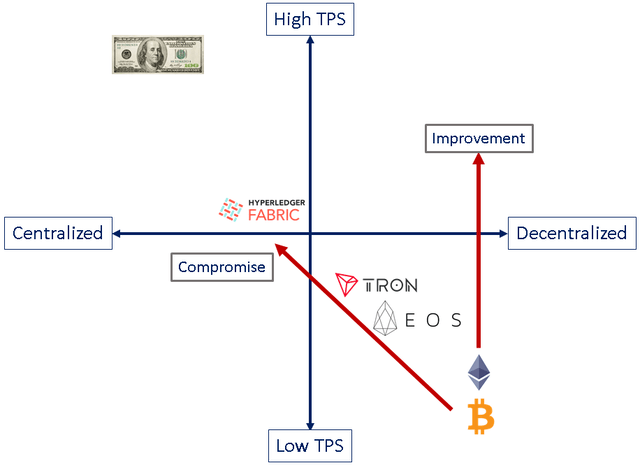

Blockchains must currently face a tradeoff between decentralization, scalability and security that is yet to be resolved. Ethereum is trying to improve scalability while refusing to compromise on decentralization and security whereas other smart contract platforms have compromised decentralization to achieve scalability creating the risk of bad behavior.

Figure 9: Decentralization versus Scalability Trade-Off

(Source: Created by author)

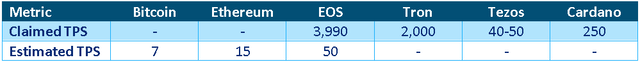

While some smart contract platforms have claimed high transaction rates, there appears to be a gap between theory and practice. Smart contract platforms must not only demonstrate high transaction rates in practice but also drive adoption of the platform so that the maximum transaction rates are actually utilized.

Table 1: Blockchain Transactions per Second

(Source: Created by author using data from cointelegraph)

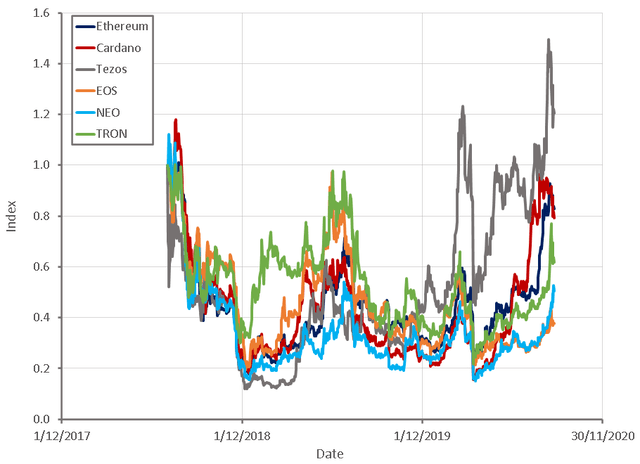

I believe there are solutions in the pipeline that will make scalability a secondary concern and shift the basis of competition to governance and security. There are reasons to believe that Tezos’ on-chain governance and functional programming language could provide superior governance and security. Cardano’s dual layer approach may also offer superior security to Ethereum. While EOS and NEO have attractive features, I believe they will face difficulty in the current environment as developers and users are likely to be reluctant to rely on infrastructure which is seen as being closely associated with China.

Figure 10: Smart Contract Token Price Indexes

(Source: Created by author using data from coingecko)

Valuation

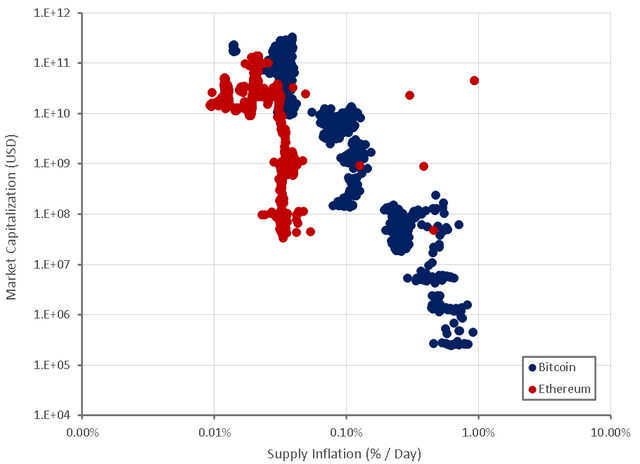

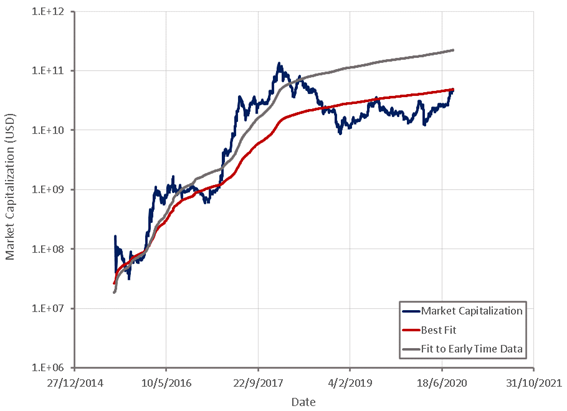

Valuing Ether is a difficult prospect as it is an asset that does not generate any cash flow and its value derives from functionality and widespread use. Methods that are relatively useful in valuing Bitcoin, like Metcalfe’s law and supply growth changes appear to be of limited use in valuing Ether, which is not surprising given the nature of the platform.

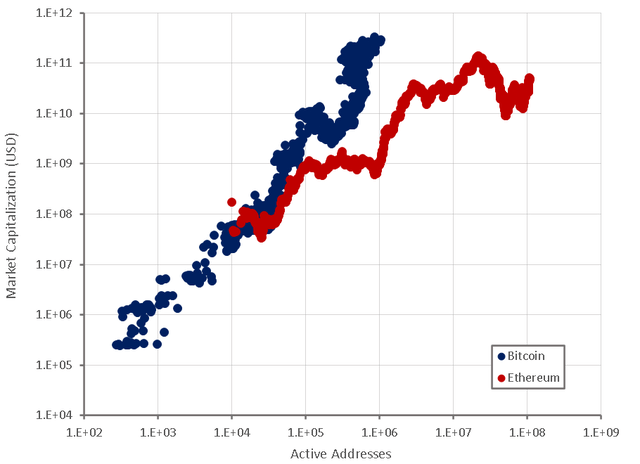

Metcalfe’s law states that the value of a communication network or protocol is proportional to the number of users squared. Ethereum can be considered to be a network for communicating value and hence it may be reasonable to expect its value to be proportional to the square of the number of active addresses, assuming that addresses are an accurate proxy for users. This relationship is weak and the best fit is sub-linear rather exponential, as expected from Metcalfe’s law.

Figure 11: Ether Valuation based on the Number of Active Addresses

(Source: Created by author using data from etherscan)

The relationship between active addresses and market capitalization is far stronger for Bitcoin than Ethereum. I would argue that this is a result of Bitcoin being viewed primarily as a store of value compared to Ethereum which is viewed as a smart contract platform. As a smart contract platform, Ethereum’s value is dependent on the virtues of the platform relative to competitors, developer activity on the platform and user adoption, as reflected by the number of transactions.

Figure 12: Effect of Active Addresses on Market Capitalization

(Source: Created by author using data from etherscan and blockchain.com)

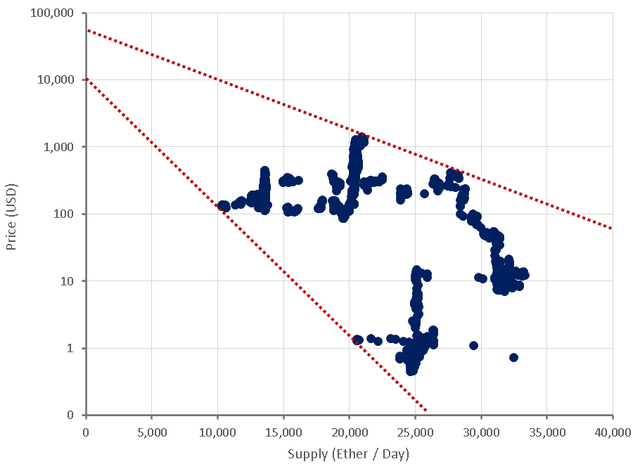

If Ether is considered a scarce asset, then its supply rate should be expected to have an impact on price. It is not clear that there is any relationship between Ether’s supply growth and price, which is not surprising given that there is no limit on total supply.

Figure 13: Ether Valuation based on Supply Growth

(Source: Created by author using data from etherscan)

Figure 14: Effect of Supply on Market Capitalization

(Source: Created by author using data from etherscan and blockchain.com)

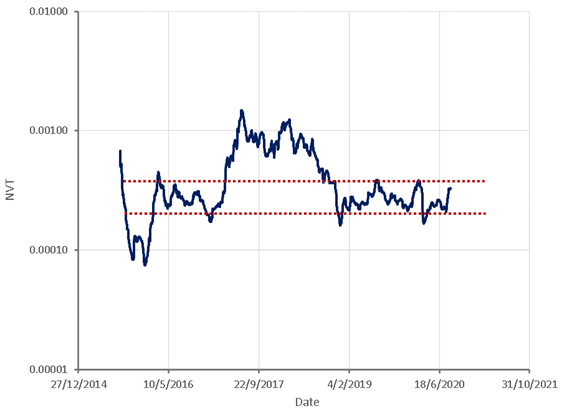

Ethereum’s network value to transaction ratio is probably the best indicator of relative valuation given the nature of the platform and there appears to be a relatively consistent range in which this ratio fluctuates. The validity of this approach is dependent on to what extent transactions represent genuine economic activity.

Figure 15: Ethereum Network Value to Transactions Ratio

(Source: Created by author using data from etherscan)

Ethereum is well positioned to be the dominant smart contract platform in the future, although it faces significant competition and I don’t believe a tipping point in the market has been reached yet. Ethereum will have to resolve scaling issues and developers will have to create applications that drive adoption for Ether to continue increasing in value. Based on relevant metrics and past performance Ether appears to be at the upper end of what I would consider a fair value range.

Disclosure: I am/we are long ETH-USD, BTC-USD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.