Ievgeniiya Ocheretna

Thesis Summary

Ethereum (ETH-USD) is set to become the most valuable cryptocurrency in existence. Following the merge, the supply of ETH has almost become deflationary, and, on top of that, staked ETH, which is a derivative of ETH, has become a yielding asset.

This makes Ethereum the perfect “commodity” to hold during the next few years. It offers advantages over oil and gold and will perform well in both an inflationary/loose monetary and deflationary/tight monetary policy environment.

Ethereum is the all-weather asset you’ve been looking for.

Ultra Sound Money

As we approached the merge, many began talking about Ethereum becoming “ultra sound money”. Sound money preserves the value of your wealth. Gold has traditionally performed this role quite well. In the case of Ethereum, we can talk about Ultra Sound Money because the supply will very likely become deflationary, which means ETH tokens could systematically increase in value.

The reason Ethereum has become (almost) deflationary since the merge can be found in the change in rewards from mining to staking and the introduction of EIP-1559, which was part of the London Hard Fork.

First off, EIP-1559 introduced a burning mechanism. Block sizes were increased, and part of what was then mining rewards began to be burned (destroyed).

On top of that, following the move to Proof-of-Stake, Ethereum rewards have become much smaller. There’s not an exact way of knowing what rewards for staking will be in the long-term since these depend on the percentage of ETH stakes, but Tim Beiko, a key ETH developer, predicted rewards would be 5x-10x less under staking.

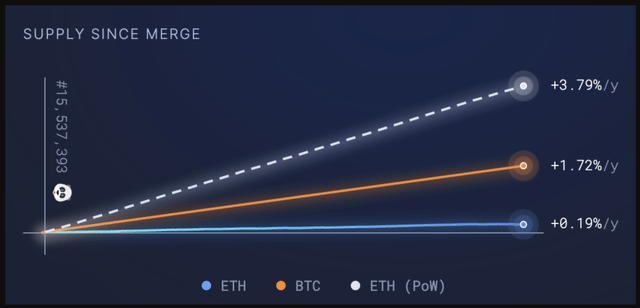

The chart below shows the growth in ETH supply since the merge, an estimate of what it would have been pre-merge, and a comparison with Bitcoin’s (BTC-USD) supply growth.

ETH Supply growth comparison (Ultra Sound Money)

The Ethereum supply is now growing at a rate of 0.19%. However, this rate could become negative as the number of transactions increases since this will lead to more burning.

Better than Oil and Gold

Bitcoin is often referred to as digital gold, and I have talked about Ethereum being digital oil before. After all, ETH is literally used to fuel the blockchain, since each transaction carries a gas fee, which is defined in gwei, which is one billionth of an Ethereum.

Ethereum has become the go-to blockchain for dApps, and it has a flourishing DeFi ecosystem. It is used by large companies like JPMorgan (JPM) and it is also hosting the nascent NFT market. Ethereum’s blockchain is in demand, and so is Ethereum. Like oil, it is a necessary input if one wants to use the blockchain, and even in an economic recession, it would hold up well since, like oil, its price might be quite inelastic.

Unlike oil, though, Ethereum is not under pressure from alternative energy sources. Don’t get me wrong, I am invested in oil, but it’s undeniable that humanity is working hard to replace fossil fuels, and one day they will succeed. This is why Ethereum is arguably “better” than oil.

Now, when it comes to gold, a lot of people argue that the precious metal has lost its shine because it is an asset that does not yield anything, at least not since we abandoned the gold standard.

Since the merge, Ethereum has become a yielding asset, as pretty much anyone who owns Ethereum can stick it in a staking pool and receive interest. In fact, most pools will create a synthetic asset, stETH, which means you can receive interest on your Ethereum while also remaining “liquid”. stETH can still be transferred and used as a form of payment or even collateral for loans.

An All Weather Asset Class

There’s a lot to like about Ethereum, and in my opinion, its unique characteristics make it an ideal investment for any environment. Recently, the bank of England had to do a complete 180 on monetary policy, going from quantitative tightening to buying long maturity Gilts. This followed a steep decline in the pound’s value, which has since recovered a little bit.

The actions of the BoE are a clear indication of the choice that every central bank is facing right now. Either they continue to prop up a system riddled with debt by printing more money, or they allow financial contagion to ensue.

In the first scenario, ever-increasing amounts of monetary stimulus will be needed. This has been the path the Fed has been on since 2008. Continuing like this would probably mean systemic inflation and a continued loss in money’s purchasing power. Under this regime, stocks, commodities and real estate would be the most benefited. Real assets are often touted as inflation hedges, and there’s nothing more real than the asset fueling tomorrow’s internet. Ethereum would perform well in this scenario without a question.

On the other hand, Central Banks could bite the bullet and let the system fail. This would mean mass liquidations, financial contagion, deflation and probably currency collapse. What are the best assets to hold in this case?

In a deflation, cash is a good place to be, but not if there’s also a currency collapse and your bank is insolvent. In this case, something like gold and oil would be a good hedge, and I believe Ethereum, and probably Bitcoin, would fare very well too. These two cryptocurrencies literally hold the potential to replace our financial and monetary systems. Even if currencies survive, Ethereum is still a solid bet as a store of wealth since it is deflationary and it is on the way to becoming a necessary asset. Moreover, it is said that innovation is born out of necessity. A global crisis would be the ideal environment for Ethereum to flourish as a better and more efficient alternative for many struggling companies.

Final Thoughts

Though it may not seem like it today, Ethereum is much more than a speculative asset. It could one day become the centre of many industries and a de facto currency for all of those that rely on the Ethereum blockchain. No matter what happens going forward, I believe Ethereum will be one of the best-performing assets of the next decade.

Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today