Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

Web 3.0 is the new generation of the internet – which leverages blockchain technology to offer decentralized protocols through various cryptocurrency tokens. The best Web3.0 crypto coins leverage these technologies to provide multiple use cases.

With Web3.0 cryptos expected to witness rapid growth in the coming decade, this guide reviews 12 of the best Web 3.0 cryptocurrency projects in 2022.

Best Web 3.0 Cryptocurrency to Invest in Now

The web 3.0 crypto coins list below provides a quick look at the top digital assets we will be reviewing shortly:

- Tamadoge – Best Web 3.0 Coin with Ongoing Bull Run

- Battle Infinity – New Cryptocurrency Project with Multi-Use P2E Platform

- Lucky Block – Decentralized Cryptocurrency Competition Platform

- Solana – Web 3.0 blockchain Offering High Throughput

- Decentraland – Metaverse Real-Estate Project to Buy Now

- Ethereum – Top Smart Contract Protocol with $166 Billion Market Cap

- Aurora Finance – Layer-1 Blockchain with Ethereum Bridge

- Binance Coin – Binance’s Governance Token Running on BSC

- Yearn.finance – Web 3.0 Protocol Offering Passive Income Opportunities

- ANKR – Blockchain Network with Multi-Token Compatability

- League of kingdoms – Gaming Project Leveraging Web3 Technology

- Uniswap – Web3.0 Ecosystem with a Decentralized Exchange

Analyzing the Best Web 3.0 Crypto Coins

The best web 3.0 crypto tokens offer unique use cases by leveraging decentralized protocols. Furthermore, some of the coins on this list have provided high returns to investors, with the potential to grow further.

Continue reading to get an in-depth look at the best web 3.0 crypto coins in 2022:

1.Tamadoge – Best Web 3.0 Coin with Ongoing Bull Run

On the top of our list is Tamadoge – a play-to-earn (P2E) ecosystem which leverages blockchain technology to implement in-game earning opportunities for players. Tamadoge offers these P2E features via TAMA – the native cryptocurrency.

With TAMA, players can purchase Tamadoge Pets, which take the form of digital dog-like characters. These pets are minted as NFTs via smart contract functionality, each offering unique characteristics and designs. One of the best utility NFTs to buy, Tamadoge Pets can be grown and bred for inter-community competitions.

On Tamadoge, players can utilize their Tamadoge Pets to earn points on a monthly leaderboard. The top performers are rewarded with TAMA tokens. Completing one of the best crypto ICOs in 2022, Tamadoge raised $19 million in over 8 weeks of the presale.

One of the reasons for the successful round stems from the tokens’ tokenomics. TAMA is a deflationary asset with a limited supply of 2 billion tokens. Moreover, 5% of all tokens spent on the ecosystem will be burnt to ensure the demand increases in the long term.

This can potentially make TAMA more valuable than some of the best meme coins like Dogecoin – which displays inflationary tokenomics due to its 132 billion token supply. While 50% of the tokens were available during the presale, 20% were made available for ongoing centralized (CEX) and decentralized exchange (DEX) listings.

In September 2022, Tamadoge was listed on OKX – a global cryptocurrency exchange with 20 million + investors. Notably, TAMA is available to purchase on OKX via its CEX and DEX – making it available to all regardless of any geographical locations. After listing on OKX at $0.03 per token, TAMA reached an all-time high (ATH) of $0.19 – a 533% price increase.

Tamadoge is currently trading at $0.86 – an 8.5x price increase since the presale listing price of $0.01.

2. Battle Infinity – New Cryptocurrency Project with Multi-Use P2E Platform

Battle Infinity is one of the new Web 3.0 crypto projects – offering 6 unique P2E features in its ecosystem. One of the best metaverse crypto coins, Battle Infinity, gives participants access to a virtual environment where all characters and avatars are minted using ERC 721 smart contracts.

The NFT avatars can be purchased and upgraded on Battle Infinity’s NFT marketplace – the Battle Market. Web 3.0 elements are implemented with the IBAT Premier League – a decentralized NFT-based sports fantasy league which lets players compete by purchasing NFT passes. Rewards are paid out in IBAT – the native cryptocurrency.

One of this ecosystem’s most notable P2E features is IBAT Battle Stake – Battle Infinity’s staking protocol. One of the best proof of stake cryptos, IBAT, can be staked on this protocol to earn up to 25% APY (Annual Percentage Yield).

In August of this year, Battle Infinity’s IBAT token successfully sold out during its best crypto presales – gathering 16,500 BNB in just over three weeks. Afterwards, the cryptocurrency was listed on PancakeSwap – one of the most popular DEXs. From a $0.0015 presale price, IBAT reached an ATH of $0.0105 – a 600% price increase.

Battle Infinity’s native token is currently trading at $0.0023 per token.

3. Lucky Block – Decentralized Cryptocurrency Competition Platform

Lucky Block is a new cryptocurrency project aiming to leverage blockchain technology to offer a fair and transparent way for players to participate in weekly prize draws. The project promotes itself as an NFT-based competition platform, hosting weekly NFT and crypto draws.

Lucky Block mints several NFT collections on its ecosystem, which must be purchased to enter different draws. For example, this web 3.0 blockchain coin has minted 10,000 NFTs that comprise the Platinum Rollers Club NFT collection. Holding one of these NFTs will give the individual access to exclusive Platinum draws on the ecosystem.

One of the best crypto faucets in the crypto space, Lucky Block’s giveaways include Lamborghinis, $1 million worth of houses, luxury watches, and 5-day holiday packages. Lucky Block governs the platform with LBLOCK – the native cryptocurrency. Created initially as a BEP-20 token, LBLOCK has also released an ERC-20 (V2) token.

The V2 token is listed on CEXs such as MEXC exchange and Gate.io and charges no sales tax from customers. On the other hand, the BEP-20 token is listed on DEXs and charges a 12% sales tax.

Currently, LBLOCK’s V2 token is trading at $0.00023 per token.

4. Solana – Web 3.0 blockchain Offering High Throughput

A layer-1 blockchain, Solana (SOL), has been created to deploy smart contracts and support the creation of various decentralized finance (DeFi) protocols and decentralized applications (DApps). While Ethereum is a popular smart contracts platform with the most number of DApps, Solana’s network offers high-speed transactions at a low cost.

This blockchain network can conduct up to 65,000 transactions per second (TPS), with an average cost of just $0.00025 per transaction. Solana can offer such high speeds due to its unique algorithm – which combines Proof-of-Stake (PoS) with Proof-of-History (PoH).

After trading at $1 at the beginning of 2020, SOL reached an ATH of $260 in the same year, making it one of the fastest growing cryptocurrency assets in the year. As of October 2022, SOL has corrected to $34 with a $12 billion market cap.

5. Decentraland – Metaverse Real-Estate Project to Buy Now

Decentraland leverages Web3.0 protocols to offer participants a metaverse ecosystem where virtual real estate can be built, traded and purchased. Built on the Ethereum blockchain, Decentraland has implemented several NFT-based use cases for participants.

For example, Decentraland offers LAND – an NFT minted as an ERC 721 smart contract representing a digital land parcel. Over 90,000 unique LAND pieces on the ecosystem can be bought, sold and traded. Another NFT on the game is Estate, an ERC 721 smart contract comprising multiple LAND pieces.

These NFTs can be traded via MANA – the governance token of Decentraland. An ERC-20 token, MANA, is also used to govern the platform on the MANA DAO (decentralized autonomous organization). Players can stake MANA and participate in community-wide voting to maintain and secure the network.

With a current price of $0.7, MANA is the 41st largest cryptocurrency with a market cap of $1.3 billion.

Invest in Decentraland via eToro

6. Ethereum – Top Smart Contract Protocol with $166 Billion Market Cap

Similar to Solana, Ethereum is an open-sourced and decentralized Layer-1 blockchain. Ethereum was one of the first blockchains to deploy smart contracts to support DApps creation by developers. The most widely used network, Ethereum, has over 2,700 DApps built on its network.

One of the best web 3.0 coins, Ethereum supports multiple NFT marketplaces such as OpenSea – which offers the biggest NFT tokens like the Bored Ape Yacht Club collection. In 2022, Ethereum officially announced its switch from a Proof-of-Work (PoW) to a PoS consensus. This move is expected to allow Ethereum to reduce gas fees and increase transaction speed.

After reaching an ATH of $4,900 in 2021, Ethereum has corrected to $1,350 per token. Despite the price correction, Ethereum is the largest altcoin with a massive market cap of $166 billion.

7. Aurora Finance – Layer-1 Blockchain with Ethereum Bridge

Aurora Finance is a layer-1 blockchain and an Ethereum Virtual Machine (EVM) – a software developers leverage to create DApps, based on the Ethereum network.

Aurora Finance offers the Aurora Bridge – a tool which connects its network with the Ethereum blockchain. Thus, developers can access the Ethereum network to deploy DApps on the chain without paying the network’s high gas fees. Moreover, the bridge can be leveraged to transfer ERC 20 and ETH tokens between Aurora and Ethereum.

By providing more scalability to the Ethereum network, Aurora Finance has become a popular Web 3.0 blockchain project. AURORA, the native cryptocurrency, is used to settle transactions between the bridge. The token also gives users access to the AURORA DAO – the governance mechanism that promotes decentralized decision-making.

AURORA is trading at $1.1 with a market cap of $83 million.

8. Binance Coin – Binance’s Governance Token Running on BSC

Binance Coin is the native cryptocurrency of the Binance exchange – the biggest cryptocurrency exchange in terms of trading volume.

Built on the Ethereum chain, Binance Coin (BNB) is now trading on the Binance Smart Chain (BSC) – a highly scalable blockchain network that offers high throughput, smart contract deployment and faster transaction speeds. BSC is a project built to support the Binance exchange – which handles the buying and selling over 600 digital assets.

Leveraging BNB on the exchange, the token offers lower transaction costs and is used to govern the network. The BSC allows BNB to conduct up to 160 TPS – which is greater than Ethereum’s 17 transactions per second. BNB is the 4th largest token with a market cap of $47 billion and one of the best altcoins right now.

Binance Coin is trading at $293 per token, with a circulating supply of more than 161 million tokens.

9. Yearn.finance – Web 3.0 Protocol Offering Passive Income Opportunities

Yearn.finance (YFI) provides various decentralized finance products, which can be leveraged to access passive income via cryptocurrencies. Among the available DeFi products are yield generation, lending aggregation and receiving insurance on the Ethereum blockchain.

One of the platform’s main features is vaults – which are staking pools that work to provide returns depending on the market factors. Another DeFi protocol is ‘Earn’ – a lending aggregator that connects with decentralized exchanges like AAVE and Compound to exploit the best interest rates possible for users.

A deflationary token, YFI is the native cryptocurrency with a maximum supply of 36,666 tokens. Currently, YFI is trading at $8,251 per token.

10. ANKR – Blockchain Network with Multi-Token Compatability

ANKR is a blockchain-based cross-chain infrastructure network which aims to create an accessible platform to support the development of Web3 operations.

The network deploys smart contracts to support DeFi protocols and promotes the growth of DApps through its network. One of the first products of Ankr was Stkr – a staking platform which lets investors stake ETH in exchange for aETH. The aETH token represents future gains on the deposited staking balance.

ANKR, the utility token, is used to settle transactions between the network. Notably, ANKR demonstrates multi-token compatibility, supporting transactions between ERC-20, BEP-2 and BEP-20 tokens.

With a market cap of $296 million, ANKR is trading at $0.03 per token.

11. League of kingdoms – Gaming Project Leveraging Web3 Technology

One of the emerging sectors from the Web3 world is GameFi – a combination of gaming and finance. By leveraging blockchain technology, platforms offer in-game currencies and DeFi protocols through video games.

One of the best gaming crypto coins is LOKA – the native cryptocurrency of League of Kingdoms. This platform is a massively multiplayer online (MMO) game built on the Ethereum chain. Similar to Decentraland, investors can access digital land in this fantasy game.

One of the in-game NFT avatars is Dragos – which represents virtual dragon avatars. After purchasing Dragos, players can access Dragon Soul Tokens (DST) – the utility token that can be leveraged to buy in-game products.

Transactions and governance on the platform are maintained by LOKA – which is the tradable cryptocurrency. With a market cap of more than $13 million, LOKA is trading at $0.52 per token.

12. Uniswap – Web3.0 Ecosystem with a Decentralized Exchange

Popular cryptocurrency exchanges such as Binance offer a centralized exchange – where investors can connect with the exchange to trade cryptocurrencies while the assets are held on the platform.

Uniswap offers a decentralized exchange – allowing traders to buy and sell tokens in a decentralized manner. This platform is an Automated Market Maker (AMM) which leverages smart contracts to provide a decentralized liquidity protocol. Instead of traditional order books, Uniswap uses liquidity mining, where the investors are the liquidity providers.

UNI is the native token of Uniswap. With UNI, holders can access the Uniswap DAO – which gives one voting access to govern the network and decide the roadmap of the decentralized exchange. With a price of $6.92, UNI has a market cap of $5.2 billion.

What is Web 3.0 Crypto?

Web3.0 refers to the decentralized form of the internet. Initially, Web 1.0 was categorized as the beginning of internet technology which first introduced an online forum. Web 2.0 refers to the development of the internet with the introduction of peer-to-peer communication methods. Some of the best technology companies, including Apple, Meta, Amazon and Netflix, are a part of the Web 2.0 community.

However, Web 3.0 looks to make the internet decentralized and give individuals more autonomy. Web 2.0-based companies all act in a centralized manner – where a central authority controls what the consumer can and cannot control. Web 3.0 leverages blockchain technology to implement smart contracts, which can be used to offer decentralized finance products and protocols.

Web 3.0 cryptos offer DeFi initiatives by providing staking opportunities to allow multiple users to govern the networks, validate transactions and vote towards community-building projects. Thus, the main users of the platform have a say in controlling the network.

Is Web 3.0 Cryptocurrency a Good Investment?

Here’s a look at the top reasons why Web 3.0 cryptos may be a good investment opportunity:

Decentralization

The main benefit of Web 3.0 cryptocurrencies is providing decentralization – simply meaning that there is no need for third parties to complete activities. For example, banks and financial institutions are the third parties involved in centralized finance. Decentralized finance, on the other hand, allows each individual to have complete control over their assets.

Automated Market Makers like Uniswap allow individuals to directly access liquidity by making them liquidity providers. Thus, funds can be accessed more quicker and can be transferred and swapped at a rapid rate.

Earning Opportunities

With the growth of web 3.0 cryptocurrency projects, investors can earn crypto-based rewards in multiple ways. Platforms like Yearn.finance offer passive income-earning opportunities via lending aggregators, yield farming, and staking initiatives.

Furthermore, GameFi cryptos like League of Kingdoms let users access in-game tokens to participate in its fantasy game and battle for cryptocurrency rewards. Similarly, platforms like Battle Infinity offer tradable NFTs, staking platforms and NFT marketplaces with its decentralized platform.

What Drives the Price of Web 3.0 Coins?

Before investing in the best web 3.0 crypto coins, it is important to learn about the price movements and the main driving factors of this space. Similar to other cryptocurrency assets, web 3.0 coins experience high levels of volatility. In the past few years, Bitcoin’s performance has determined the price performance of other digital assets.

For example, some of the best web 3.0 coins, such as Ethereum, Solana and Binance Coin, experienced high upwards movement towards the end of 2021 – simultaneous to the Bitcoin bull run. In 2022, Bitcoin’s price correction has also resulted in a bear market among the web 3.0 cryptocurrencies.

Another important driving factor in Web 3.0 is the growing popularity of use cases. With the popularity of the metaverse – web 3.0 cryptos are implementing playable NFT avatars and in-game earning opportunities. Cryptocurrencies like Tamadoge have soared due to their unique use cases – such as playable NFT avatars, upcoming AR-based applications and new metaverse partnerships.

Finally, long-term momentum is one of the main drivers of web 3.0 projects. Ethereum has experienced major growth and has become the biggest altcoin in the space. One of the main reasons for this is the implementation of smart contracts and DeFi protocols. Many investors see Web 3.0 as the future of the internet and want to get in early. Therefore, many platforms experience tremendous growth and regular volatility due to the unpredictable nature of these assets in the long-term.

How to Buy Web 3.0 Coins Tutorial

The sections below provide a step-by-step guide on how to purchase Tamadoge – one of the best web 3.0 crypto coins to buy in 2022.

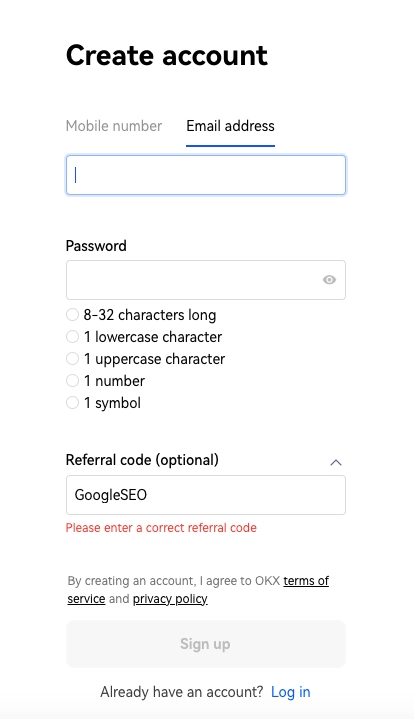

Step 1: Create an OKX Account

Tamadoge can be purchased on OKX – a global cryptocurrency exchange with 20 million + investors. To get started, head to the OKX website, enter your email address, phone number, and create a password for the account.

Confirm the account by entering a code which will be sent to your email or via SMS.

Step 2: Verify Your Identity

To ensure the validity of the user, OKX requires investors to complete a simple KYC (Know Your Customer) process. Verify your account by providing your full name, nationality, and date of birth. Upload a photo ID to verify your identity. For example – a passport copy or driver’s license.

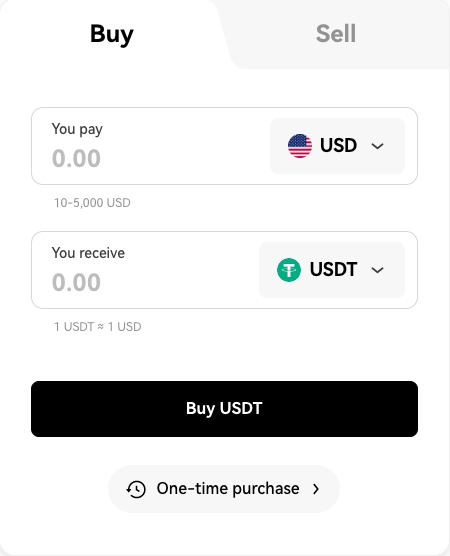

Step 3: Buy USDT

On OKX, Tamadoge can be purchased with the TAMA/USDT trading pair. Therefore, investors must purchase the USDT stablecoin to get started. Choose your preferred payment methods – such as P2P transfer, third-party payment provider or a credit/debit card.

The picture above demonstrates how to purchase USDT with a credit/debit card. Enter the amount of funds you wish to swap to USDT, and click on ‘Buy USDT’ to confirm the purchase.

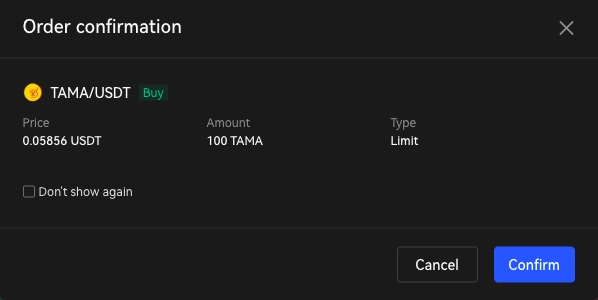

Step 4: Buy TAMA

After the USDT is in your account, you can search for Tamadoge. Click on Buy TAMA and fill in the order box by listing the amount of USDT you wish to swap for TAMA. Confirm the transaction by selecting ‘Confirm’. (Minimum of 100 TAMA must be purchased).

For those that can’t register to the OKX CEX exchange to regulatory restrictions, TAMA is also available to purchase on the OKX DEX.

Conclusion

Web 3.0 cryptocurrencies implement decentralization via blockchain technology – allowing projects to offer various DeFi protocols, decentralized applications while providing more autonomy to users. Among the trending web 3.0 coins, we recommend Tamadoge as the best web 3.0 crypto coin to invest in 2022.

After raising $19 million during its presale, Tamadoge (TAMA) has offered over a 5x price increase since being listed on the OKX centralized and decentralized exchange.

FAQs

What cryptos are Web 3.0?

Some of the popular web 3.0 cryptos include Tamadoge, Battle Infinity and Ethereum. Cryptos like Ethereum deploy smart contracts to allow developers to build decentralised applications and network protocols.

How do you invest in Web 3.0?

Web 3.0 cryptos can be purchased from the top cryptocurrency exchanges. For example, eToro is a popular exchange which offers multiple web 3.0 cryptocurrencies after making a $10 deposit.

What is the best Web 3.0 crypto coin?

We recommend Tamadoge (TAMA) as the best web 3.0 coin. Tamadoge will offer playable NFT avatars, upcoming AR-based apps, and P2E-style arcade games. A deflationary token, the limited supply of 2 billion tokens can help TAMA increase its demand in the long term.