Bitcoin and the crypto market as a whole pumped shades of Canberra Raiders green through late Friday and into Saturday. Did it Falcon its way over the weekend tryline? Kinda.

At the time of writing, BTC, Ethereum (ETH) and other coins that matter have cooled off a fraction but have sustained most of their early-weekend price exuberance.

Terra ‘Frankenstein’ LUNA

As for Terra Luna… as much as we’ve wanted to after its dreadful crypto-contagion-inducing implosion in May, it’s become hard for us to ignore its ridonculous price action of late.

If you’re a keen observer of anything other than the top 10 cryptos, you might know that LUNA has been performing something of a Frankenstein rise, having surged more than 200% over the past week and closer to about 250% over two weeks.

But that’s not the most staggering stat. The coin (which actually trades as LUNA2 on many exchanges) was trading around US$6 a bit earlier over the past day, which, according to Cointelegraph, represents roughly a 17.59 MILLION% rally since it crashed to basically zero in May.

Wonder if Galaxy Digital’s Mike Novogratz still has his massive LUNA wolf tatt…

LUNA, or LUNA2, or whatever you call it these days has actually pulled back 14% over 24 hours, though – essentially a huge, red flashing warning sign to enter at your own risk. None of this is a pointer to buy LUNA, LUNA2, or LUNC at this point.

Wait… is LUNA/LUNA2 the same as Terra LUNA Classic – LUNC?

No, it isn’t. Although LUNC has been pumping and dumping and pumping periodically, too.

As Cointelegraph explains it, Terra Luna Classic (LUNC) is the original version of the Terra blockchain. Terra LUNA 2.0 is Terraform Labs’ controversial founder Do Kwon’s way of trying to resurrect the project and repay, through occasional airdrops, those worst affected by the original blockchain’s collapse.

So… to reiterate and attempt to be reasonably clear about this… Terra Classic (LUNC), which is up 328% over the past month, is the original LUNA, as the name indicates. And Terra LUNA (which is also trading as LUNA2) is the Terra “regeneration” token, and has pumped crazily since its epic low.

Another thing to note, LUNC has been pumping on the back of news the project has passed a governance proposal that essentially is attempting to turn it into a deflationary token, per the following LUNC community member tweet…

Terra Luna Classic (#LUNC) skyrockets >37,000% since its bottom after the Terra collapse 🤯

This comes after a proposal to implement a 1.2% token burn tax on all transactions that will enable $LUNC to become a deflationary cryptocurrency.#LUNC ✨ #HaileyLUNC ✨ $LUNC ✨ pic.twitter.com/oIxI7tqVkW

— Hailey LUNC ✳️ (@TheMoonHailey) September 7, 2022

Right, on to other crypto market happenings…

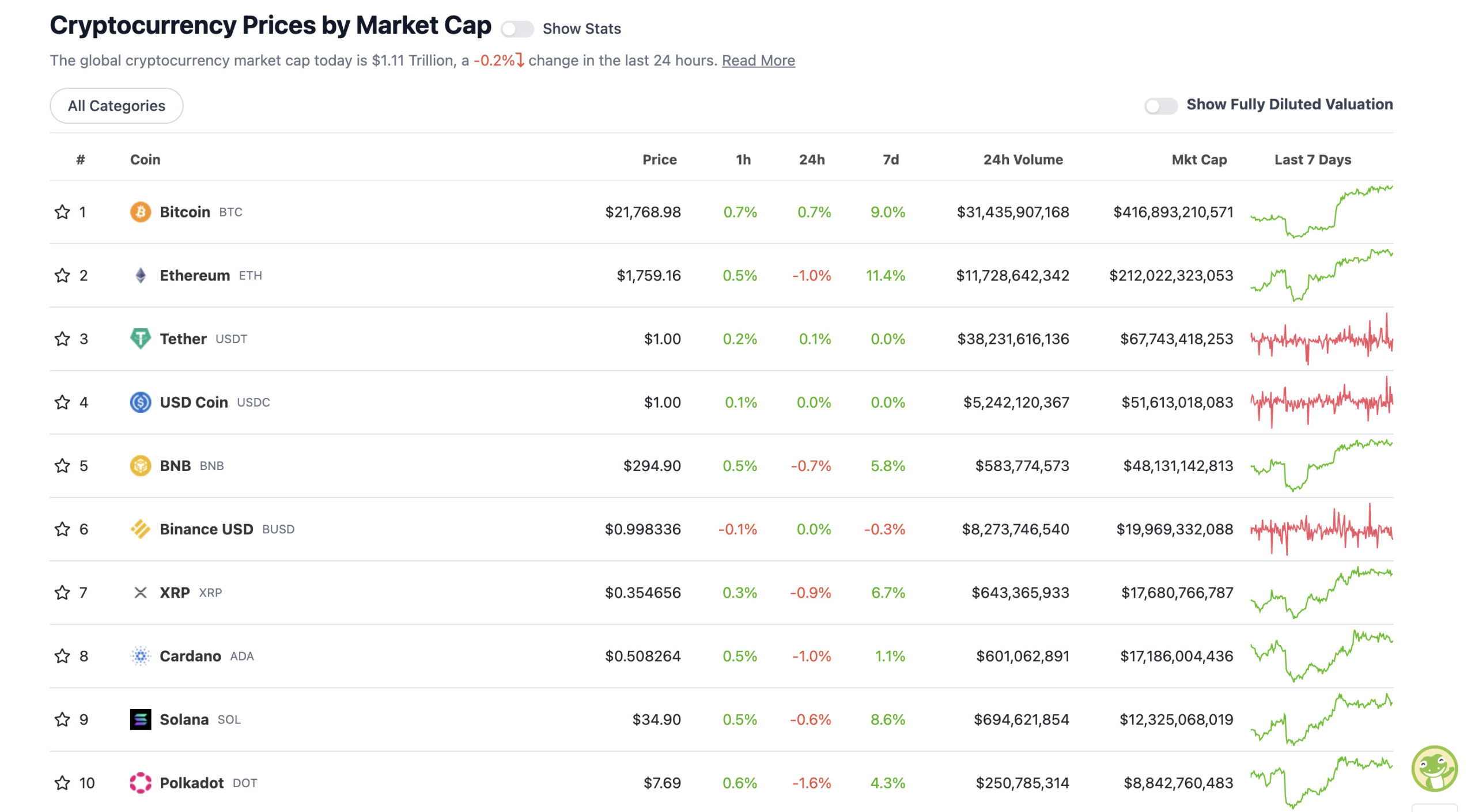

Top 10 overview

With the overall crypto market cap at US$1.11 trillion and up about 0.2% since yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Last time we checked in here in this column, the entire crypto market cap was US$1.03 trillion. It’s found a US$80 billion windfall down the back of the couch since then. Let’s hope it can actually build on that and doesn’t blow it all down at the dog-meme track.

Top guns Bitcoin (Maverick?) and Ethereum (Iceman?) have been wing-manning it out in front for crypto major gains over the past few days. Solana’s doing alright, too. Is there a Goose in that top 10? Hope not.

Will Bitcoin and pals close out the week Stateside with a further little pump to truck things even more into the next seven days? Brainiac American ‘Crypto Quant’ analyst Benjamin Cowen seems to think it could play out that way…

#Bitcoin pump into the weekly close?

— Benjamin Cowen (@intocryptoverse) September 11, 2022

That said, he’s also pointing to what could well be a pretty volatile week in the Cryptoverse, as he calls it.

Ethereum’s much-vaunted Merge to the tree-hugging proof-of-stake protocol is set to complete this week. Around about the same time as that momentous (probably) crypto event, on September 13 at 8am EST the US Bureau of Labor Statistics will release the Consumer Price Index (CPI) report for August.

So we have the #ETH merge and CPI this week, followed by FOMC the week after. Should be some fun times

— Benjamin Cowen (@intocryptoverse) September 11, 2022

This will be a crucial one, which will have significant bearing on US Federal Reserve boss Jerome Powell’s inflation-combatting movements, and the stock markets’ and crypto market’s bowel movements.

Will the data come in lower than July’s very slightly encouraging 8.5%, which was lower than June’s? According to Forbes, it won’t stop the Fed from hiking interest rates in September by around 50 to 75bps at its next FOMC meeting, which happens next week.

If the figures DO come in lower, though, it wouldn’t be unreasonable to imagine a continued stock and crypto rally in the short term this week.

Uppers and downers: 11–100

Sweeping a market-cap range of about US$8.1 billion to about US$429 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Celsius (CEL), (market cap: US$680 million) +15%

• Radix (XRD), (mc: US$647 million) +10%

• ApeCoin (APE), (mc: US$1.74 billion) +9%

• Amp (AMP), (mc: US$502 million) +8%

• Evmos (EVMOS), (mc: US$794 million) +3%

DAILY SLUMPERS

• Terra (LUNA), (market cap: US$918 million) -14%

• EOS (EOS), (mc: US$1.69 billion) -8%

• Helium (HNT), (mc: US$653 million) -7%

• DeFiChain (DFI), (mc: US$569 million) -6%

• Ravencoin (RVN), (mc: US$602 million) -6%

Around the blocks

A selection of randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

#Bitcoin Weekly Close Update 🚨

Potential Bullish Trend Shift?! pic.twitter.com/QwqZy7ycbY

— Kevin Svenson (@KevinSvenson_) September 12, 2022

#Crypto is going to explode. Literally.

— Michaël van de Poppe (@CryptoMichNL) September 11, 2022

Literally, eh? Okay, everybody duck.

Every Dollar you can save now and invest into decent #altcoins / #crypto in the current period can be worth $50-200 per Dollar in a few years.

Remind yourself of that.

— Michaël van de Poppe (@CryptoMichNL) September 11, 2022

And just to pour a bit of cold water on any rising feelings of crypto euphoria… here’s Justin Bennett…

Hope everyone had a great weekend!

Bulls have had their fun, but the entire #crypto market is sitting 5% below a massive resistance area.

Probably one more push higher before the next leg down.

US inflation data on Tuesday and Wednesday, so expect volatility. $BTC $ETH pic.twitter.com/K8niV3xcE8

— Justin Bennett (@JustinBennettFX) September 11, 2022

When physics and intelligence meet… pic.twitter.com/7ds9wniKs5

— Figen (@_TheFigen) September 10, 2022

Scammed again plebs. pic.twitter.com/XDahnid1FT

— Molls (@mollsunminding) September 10, 2022

Hi folks I’m looking forward to talking about how @krakenfx is bringing trust and security to web3 – come grab a coffee and join me at the @AusCryptoCon on Sunday 18th 945am pic.twitter.com/NIY4Rzw9pP

— Jonathon Miller (@jdesmondmiller) September 11, 2022