gguy44/iStock via Getty Images

Thesis Summary

Coinbase Global, Inc. (NASDAQ:NASDAQ:COIN) has recently rallied strongly, following positive news and a strong Bitcoin (BTC-USD) recovery. Looking at analyst forecasts, it seems clear that Coinbase is undervalued, which is why I expect it to rally strongly, especially as we enter a new crypto bull market. Even with the regulatory uncertainty surrounding crypto, I am bullish on COIN and calculate its fair value of at least $260.

Quick Overview

Coinbase is one of the largest exchanges in the world. It was founded in 2012 by Brian Armstrong, and it started trading publicly on the Nasdaq in April 2021. This was at the height of stock market valuations, and Coinbase shares began trading at $250, with a valuation of $86 billion.

COIN Price Chart (TradingView)

As we can see in the chart above, Coinbase traded as high as $360 in November but has since fallen considerably together with most Nasdaq stocks. At its lowest, COIN was trading at just over $40. However, we have seen a significant rally in the past month, with Coinbase making headlines for good and bad reasons.

On the unfortunate news side, Coinbase was accused by the SEC of trading unregistered securities. Of course, this debate spills into that of what cryptocurrency is. On top of that, a former Coinbase manager has been accused of insider trading. Allegedly, different wallets were used to purchase tokens before public listings in Coinbase.

While these headlines put a dampener on Coinbase’s price, the stock rallied on news that it was partnering with BlackRock to provide institutional investors access to crypto. Needless to say, this is huge for Coinbase.

In the last few weeks, COIN has rallied strongly as we approach the Ethereum (ETH-USD) merge, which many see as positive news for Coinbase. The company could stand to profit from the staking of Ethereum.

How Does Coinbase Make Money?

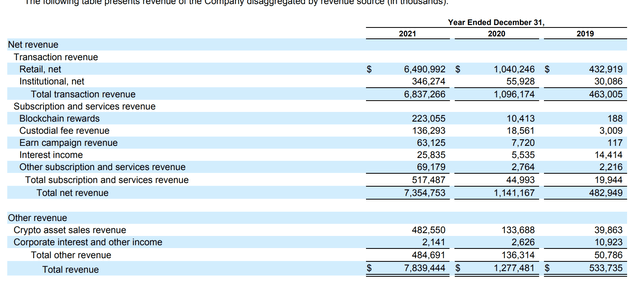

As we can see in this extract from Coinbase’s annual report, around 90% of revenues come from transaction revenues, and in turn, most of this comes from retail. Every time you make a transaction, Coinbase takes a small fee, much like a stockbroker or a payment processor. Coinbase also makes some revenue from subscriptions and services like custody.

Coinbase has enjoyed significant revenue growth since 2019, going from $533,735 million to nearly $8 billion in 2021. Granted, this has been during an epic crypto bull run and growth for 2022 will likely be much smaller.

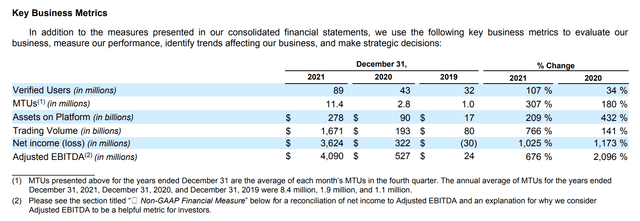

Another important metric for Coinbase is users, which have also grown at a healthy rate:

Monthly transacting users increased by 307%, almost three times as many verified users. This shows the dynamic of retail traders becoming more active during the height of the bull market.

The not-so-secret formula for Coinbase to increase revenues is simple. More transaction users and higher crypto prices go hand in hand.

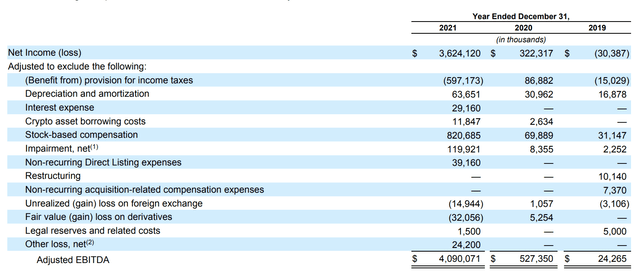

What About Profitability?

The next natural question to ask is what about profitability?

Unlike many growth companies that rely on a high stock based on compensation or have low margins because of high marketing expenses, Coinbase is very profitable. Net income 10-fold from 2020 to 2021. The company had over $4 billion in EBITDA in the last reported year. That puts COIN’s EBITDA margin at 42.45%

This kind of profitability is quite remarkable for a company that is growing so fast, and I would expect such a margin to be sustainable in the long term.

Forecast and Valuation

Those who bought COIN when it IPO’d have faced severe losses, but so has the market. The poor performance in the stock price is not indicative of Coinbase’s future potential and valuation.

Coinbase is the go-to exchange for retailers, and it has so many potential avenues for growth. Institutional trading will surely be a big source of revenue, especially after the BlackRock deal.

On top of that, crypto is an expanding market with many other areas of interest. DeFi, NFTs, synthetic assets. Coinbase is merely scratching the surface.

Now, let’s take a look at the analyst forecasts for Coinbase.

Revenue Estimates (SA)

As we can see, 2022 is expected to be a bad year, with revenues slashed in half. This is possible, given that crypto prices are much lower, and they could still take a few months to recover and even longer to surpass previous highs. However, as we enter a more favourable crypto environment, Coinbase will flourish. Even Wall Street analysts believe that by 2025 Coinbase will have close to $7 billion in yearly revenue. Based on the dynamics of previous Bitcoin cycles, 2025/26 could be the peak of the next bull run, so I’m going to make a valuation for these years.

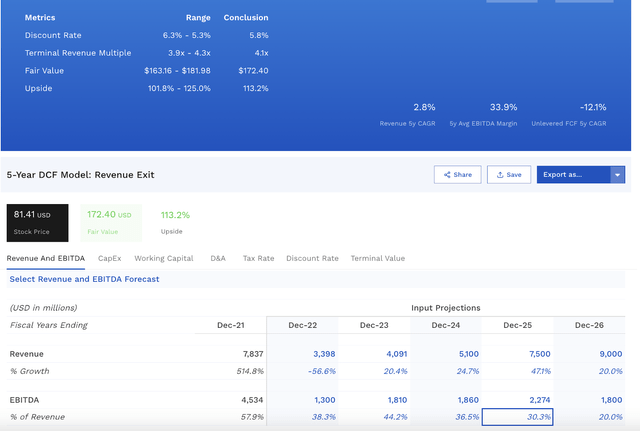

Below, we can see a 5-year DCF model provided by Finbox.

I have used analyst estimates as a reference point, though I have been slightly more bullish in my forecast, which has COIN achieving $9 billion in revenues by 2026. This aligns with my belief that crypto prices should surpass previous highs by at least a multiple of 2-3. This is a very conservative estimate, given that Coinbase achieved almost $8 billion in 2021. Once Bitcoin regains new all-time highs and interest picks up, Coinbase should easily exceed its 2021 revenues. Now, I have forecast a substantial margin contraction in terms of EBITDA margin, assuming that competition will intensify.

Even with what I consider to be a moderate forecast, the fair value achieved in this model is $172.4, which implies a juicy +100% upside potential.

Risks

Of course, even with a bullish crypto market, Coinbase faces multiple risks, the most significant of which is regulation. While individual crypto holders can escape regulation to an extent, Coinbase is a listed crypto exchange and is in many ways at the mercy of regulators. We have already seen this with the recent SEC investigation. While there’s no real risk of Coinbase being shut down, the company will likely have to face increased regulatory scrutiny, and compliance with new rules will strain profitability.

On top of that, profitability and growth will also be affected by competition. As crypto enters a new bull run, interest will once again pick up, and with money on the table, new companies and exchanges will be quick to try to offer similar services to Coinbase. One could even argue that decentralized exchanges will likely take over COIN’s market share, but this misses an important point.

Indeed, DEXs are superior to centralized exchanges but are flawed in one fundamental way; onboarding. Crypto veterans assume retailers prefer a decentralized exchange, where you control your keys and may benefit from lower fees. However, for the average crypto newbie, the ease of use that Coinbase provides far exceeds the possible benefits of having your own wallet and controlling your keys, which is a moderately complex process.

This, combined with the fact that Coinbase is already a household name, will be key to the company’s success. People want to invest in crypto but are still very uneasy about it. Investing through a well-known, publicly listed, and regulated company provides the assurance they need to take the leap.

Takeaway

Coinbase is showing solid signs of reversal, and with what I believe to be an upcoming crypto bull market, it could prove to be an excellent investment. It won’t necessarily outperform cryptos, but it is, in my opinion, a great addition to a well-diversified crypto portfolio.