salarko

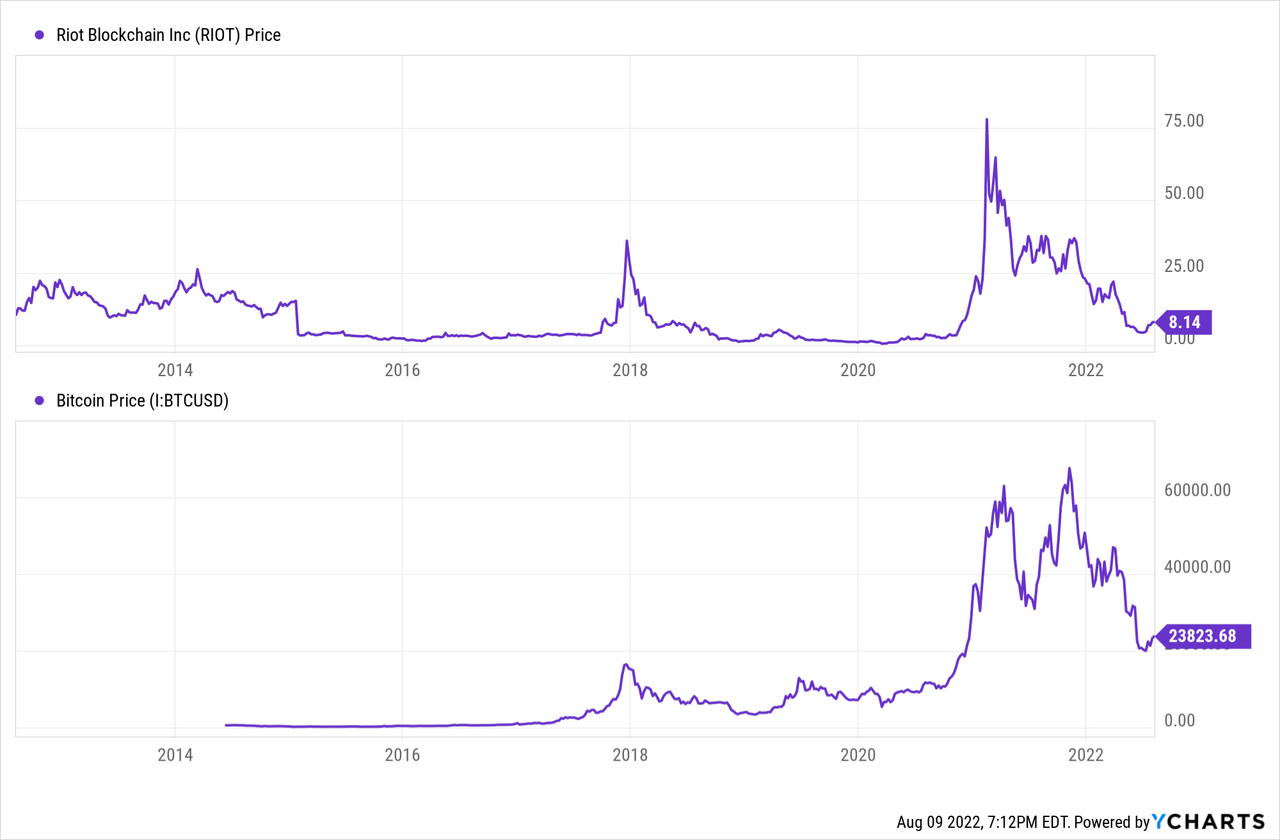

Crypto miners like Riot Blockchain (NASDAQ:RIOT) are finally beginning to capture the attention of investors again. Many of the companies in the space have been brought to their knees due to the aggressive selloff. With the relevantly new adoption of Bitcoin (BTC-USD) and other crypto payment systems, some investors have been coining this as the first crypto bear market, but selloffs like this have happened for Bitcoin at least twice before.

So what has been going on with Riot Blockchain lately? The company has quietly done a great job at Bitcoin production throughout the crypto bear market. I have covered Riot Blockchain multiple times in the past. For a more detailed company profile, complete with historic price targets based on Bitcoin prices, search here. I have also made a crypto ‘cheat sheet’ that documents the important terms for newbie crypto investors. The sheet can be found here.

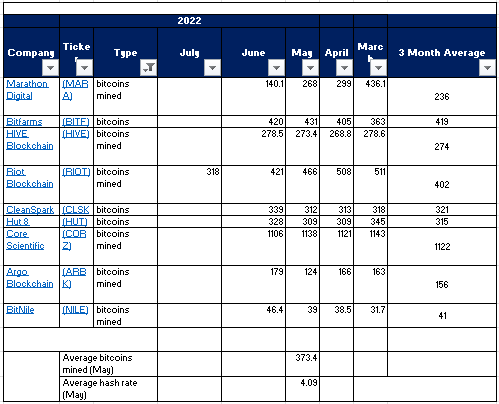

Production figures now average 402 tokens per month for the last three months, with June’s number coming in lower than average at 318 coins. This puts Riot Blockchain towards the top end of producers, which is an impressive feat. In the past, Marathon Digital (MARA) was often looked on as the darling of the Bitcoin mining industry, but Riot Blockchain has been putting in more impressive figures for some time now, and investors should probably stop and take notice.

Author’s figures adapted from Seeking Alpha

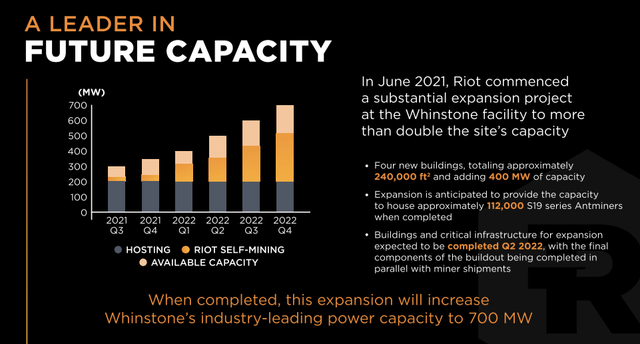

Crypto miners tend to produce only one or two products at a time, and for Riot Blockchain, that product is Bitcoin. The company also provides other Bitcoin-related offerings, but mining production is by far its main revenue driver, which is why investors should pay special attention to any disruptions to its core business. Riot recently announced that it was attempting to control electricity costs, which would result in a drop in production during the month of July. This was what accounted for the 24.5% drop in sequential monthly Bitcoin production for that month. This is particularly concerning as the company can do precious little to control the price of electricity, and it is one of the significant direct costs associated with production. Furthermore, as more bitcoins are produced, the overall difficulty of mining each token on average will increase substantially, which implies more electric cost per token, assuming that the efficiency of the mining fleet does not change significantly. For Bitcoin miners, electricity is literally revenue over time. Bitcoin miners use a fleet of sophisticated computers to solve complex cryptographic formulas with the hope of earning a reward. The process is commonly referred to as solving a block. As the overall computing power (commonly referred to as the hash rate) of the fleet increases, the likelihood of earning Bitcoin increases. This is where the high electric costs that miners are currently experiencing can become quite problematic, as many of them have communicated plans to increase overall production capacity significantly with the hope of increasing Bitcoin production for the next major move upward. Riot was no exception to this rule, as the company had long communicated its ambitious growth plans to shareholders.

That now looks under threat as companies are being forced to consider the decreased profitability of mining at high electric costs and the effects it could have on cash reserves as Bitcoin price continues to remain at depressed levels, making it prohibitive to sell tokens on the market.

So What Should Investors Look For?

While Bitcoin could certainly sell off further from here, the token is enjoying notable stability in the $20,000 to $25,000 area. It is important to note that this is not a profitable region for Bitcoin mining companies. Many of them see direct costs closer to $10,000 per token, with total costs reaching as high as $30,000 per coin. The good thing with top-tier miners like Riot Blockchain is that they manage to maintain suitable liquidity to navigate downturns to a degree. What would be problematic is Bitcoin remaining at depressed levels for a very extended period of time, as this would almost certainly make mining an unprofitable endeavor. The average recession lasts roughly 17 months in the US, and there are signs that Bitcoin is more heavily correlated to stock prices than it is inversely proportional to inflation. Put another way, as the US emerges from recession, the rising tie that tends to lift all boats will likely lift Bitcoin as well.

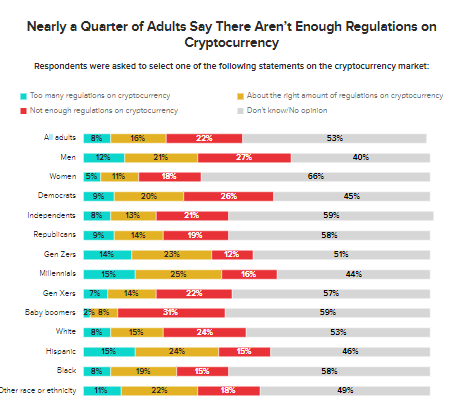

On a more negative note, the risk of regulation for Bitcoin miners seems to be becoming more and more prominent. The government recently investigated the impact of crypto mining on the environment, which brought a wave of unwanted negative media attention to companies like Riot Blockchain. The good news is that crypto regulation is still fairly unpopular among Americans. A recent poll suggested that roughly 3 out of 10 Americans believed that crypto should be regulated compared to one out of five who believed that it should not.

Morning Consult

Any sort of meaningful environmental regulation surrounding crypto mining would likely be devastating to the industry, but for now, with the relatively positive view from voters towards decentralized currency, it looks unlikely. Investors should pay attention to headlines surrounding mining regulation, particularly with respect to the environment and electrical grids, very closely.

The other major item for investors to pay attention to is any forced selling from mining companies. Companies have recently started liquidating portions of their crypto treasuries to fund operations. This is, of course, standard practice, but at depressed levels, there is a tendency for mining companies to hold on to the tokens they produce until crypto prices reach attractive levels. A prolonged depression in Bitcoin prices could force miners to sell at unattractive prices, which would significantly hamper profitability but, more importantly, signal liquidity concerns if done in a haphazard manner.

The Takeaway

While the production story is up in the air with the recent curtailments, Riot is still one of the premier Bitcoin mining companies and will likely make it to the other side of a recession just fine. I am a long-term Bitcoin bull, and for this reason, I am also bullish on Riot Blockchain. The company is executing responsibly, but Bitcoin prices are out of its control. I rate blockchain as a long-term buy.