Monero is a cryptocurrency based on the open-source CryptoNote protocol, designed to protect the anonymity of its users. As a cryptocurrency, Monero (XMR) has focused on making its wallets and transactions completely anonymous. With the goal of making private transactions accessible worldwide, Monero goes into direct competition with Bitcoin and other cryptocurrencies.

Monero Means Money

Private, decentralized cryptocurrency that keeps your finances confidential and secure. — getmonero.org

The cryptocurrency has implemented a whole bunch of different privacy features, including ring signatures, confidential ring transactions (RingCT), shadow addresses, also called stealth addresses, and the Kovri program. Together, they ensure that both senders and recipients, their locations, and transaction amounts are disguised.

Accordingly, Monero is often used as a payment method on the darknet because of its high degree of anonymity. According to Chainalysis, there has been an increase in ransomware in connection with Monero. The accusations of a cryptocurrency being used exclusively for criminal purposes are offset by the benefits of the privacy coin: Anonymity, censorship-resistant money transfer, and privacy protection.

The goal of Monero is to enable private and fast transactions between individuals without the need for a central financial institution. To do so, several technical solutions are in use.

In addition to its sophisticated privacy features, Monero uses the CryptoNight consensus mechanism, which is based on proof-of-work (PoW) consensus and enables network mining. Unlike bitcoin, XMR mining favors classical CPUs. That means anyone can mine Monero coins and contribute to the validity of the network. You can mine XMR with almost any standard laptop or computer and it even comes with an “all-inclusive” package, which makes mining especially easy.

Monero was launched in April 2014. It was a fair, pre-announced launch of the CryptoNote reference code. There was no premine or instamine, and no portion of the block reward goes to development. See the original Bitcointalk thread here. The founder, thankful_for_today, proposed some controversial changes that the community disagreed with. A fallout ensued, and the Monero Core Team forked the project with the community following this new Core Team. This Core Team has provided oversight since. — getmonero.org

This Is How It Works

Users’ transactions are mixed into a single pool. It is not possible to see details about individual transactions including the sender, receiver, or wallet balances from the outside—exactly the opposite of many other solutions.

To do so, Monero leverages to following mechanisms to grant anonymity:

- Ring Address: A group of cryptographic signatures is created to prevent the participating senders from being identified. This contains at least one real participant. However, the remaining signature actors are also validated, making it impossible to determine from the outside who in the group actually placed the order for the transaction. At the same time, key identities are used to ensure that no transactions can be issued twice.

- RingCT: Ring Confidential Transactions is the feature that allows hiding transaction amounts in the Monero network. It was implemented at the beginning of 2017 and is mandatory for all transactions. They ensure that the transaction amount is hidden. Imagine a wallet with a total of 60 XMR. Now, one would like to buy an item in the amount of 7 XMR with it. To do this, the wallet must put the 60 XMR on the table, but receives 53 XMR back, while the remaining 7 go to the new owner.

- Stealth Addresses: They allow and require the sender to create random addresses for each transaction on behalf of the recipient. This is achieved by generating a one-time public key for each transaction. The receiving person simultaneously receives a one-time usable private key to “search” and retrieve the sent money in the blockchain.

- Ring Signatures: Monero uses ring signatures to mix the digital signatures of users with other users on the network before adding the information to the blockchain. Each transaction group contains a total of 11 different signatures that are mixed together.

- Transactions over Tor/12P: To disguise the IP addresses of the users in the network, it is possible to use an overlay network such as Tor or I2P. This way, hackers can no longer trace the origin of the transactions.

Also, new blocks are created in the network every two minutes to enable fast transaction times and low costs. Another special feature is that there is no maximum block size as with other cryptocurrencies.

Use Monero

To use Monero, the first thing you are going to need is a wallet. Especially with the Monero GUI, they tried to simplify the accepting/sending of the coins as far as possible. Just share a QR code to send/receive payments. More details.

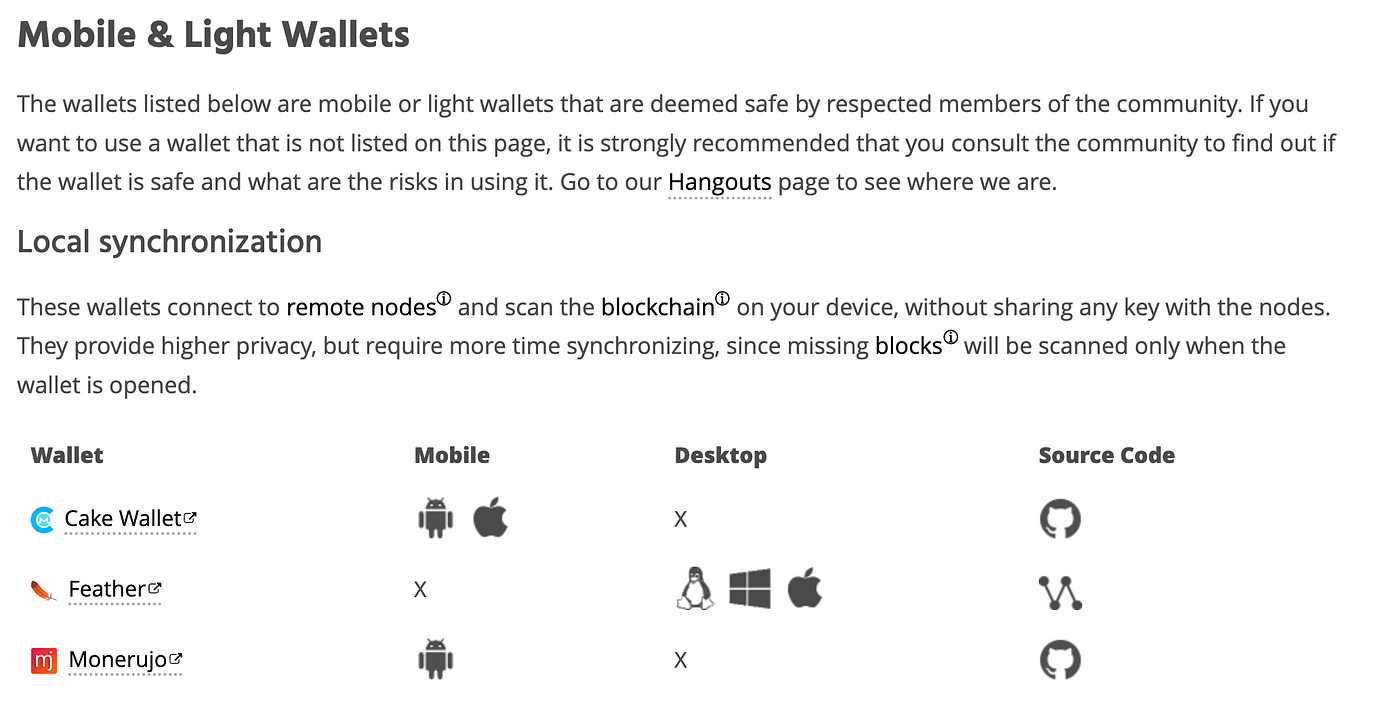

Also, you can use a number of third-party mobile or light wallets to start using Monero.

Probably the biggest advantage of Monero is its strive for privacy and complete anonymity. This makes it particularly attractive for privacy enthusiasts to use the network for transactions. Unfortunately, this anonymity is somewhat compromised by the software CipherTrace, which was commissioned by Homeland Security. Since it is always assumed that criminal organizations finance themselves in the shadow of cryptocurrencies, the software is supposed to enable transparency in the Monero network.

Nevertheless, with its ease of use and simple integration Monero has gained many fans and partners who support the project. It is also made especially easy for miners who want to support the network by having their own mining wallets. In addition, updates to the network take place every 6 months on a regular basis, following a clearly structured roadmap. While it is often unclear with other crypto projects when changes and updates will be implemented, Monero offers additional planning security and continuously improves its network functions

As these anonymous features suggest, neither government nor regulatory authorities have found much interest in this digital currency so far. There have already been several attempts by the American and European authorities to take action against it.

Based on some statistics, Monero is indeed the most widely used currency on the dark web and in a variety of illegal operations, including cyber ransomware. One example can also be found in Russia’s war actions in early 2022. As soon as the EU decided to exclude Russia from the SWIFT system, the price of the privacy coin Monero (XMR) skyrocketed.

Check the Moneropedia

Another currency, that is focused on fast payments and privacy, including anonymous transactions, is DASH. DASH, standing for “Digital Cash”, is a cryptocurrency created in 2014 as an alternative to Bitcoin with a focus on security and data protection. Just as with real cash, no one should be able to trace from whom the money comes and to whom it is sent. The Dash protocol also uses elaborate procedures to disguise the sender and recipient and thus protect the anonymity of the players.

The coin is supposed to be used to pay for products and services — just like fiat currencies. However, like any other cryptocurrency, the coin can also be bought, traded, and exchanged as a speculative object with the aim of generating income. In the network itself, the XMR coin serves as a means of payment for transaction fees and an incentive for miners, who supply the network with computing power and thus ensure security and stability.

The current circulating supply is about 18.1 million and it does not have a maximum supply. Although there is no cap, the release of new Monero Coins is so slow that it does not produce significant inflationary pressure.

The issuance plan includes two phases:

- Main curve: until May 2022, about 0.8 XMR per block. Just over 210,000 per year: issuing a block takes two minutes.

- Tail curve: from May 2022 onward, 0.6 Monero/block. Less than 158,000 new XMRs per year.

Tail issuance is one of the key differences between Monero and Bitcoin. While there will only be around 21 million Bitcoins, Monero has no cap. Instead, miners will continue to be subsidized and receive 0.6 XMR per block in addition to transaction fees. The tail issuance phase will lead to insignificant annual inflation of less than 1 percent.

This is because, in theory, it is assumed that the transaction fees would not be sufficient to provide a permanent incentive to the miners.

The platform Cake DeFi provides an easy and user-friendly way to generate passive cash flow on your crypto portfolio. This is done in three different ways, called lending, staking, and liquidity mining. All you have to do is to sign up for the platform, top-up money via credit card or transfer cryptocurrencies, and put your assets to work. Read more.

You receive a 30$ signup bonus upon your first top-up with the following referral code:

Another way to earn passive income with crypto is Curve in combination with Crypto.com Cashback. Take a look at This Is How You Can Add Every Card To Google/Apple Pay

The future of Monero depends on many external factors such as regulations and acceptance. If the coin manages to assert itself in the market, similar to Bitcoin, nothing stands in the way of further growth.

Nevertheless, there is also a lot of criticism and regulatory concerns, as cryptocurrencies are repeatedly linked to terrorism and money laundering. For this reason and also due to fear of regulations, a few crypto exchanges have already stopped trading Monero.

So far, Monero can be proud of being the gold standard for anonymous transactions. Away from the current happenings in the market, which are impacting the short to medium term, Monero thus has a unique selling proposition. This circumstance creates both opportunities and risks in the long term. After all, from the perspective of supervisory and law enforcement authorities, radical data protection is undesirable. However, if “privacy coins” experience a renaissance, there will be no getting around Monero.