Welcome to part three of our series of articles designed to help you understand alt seasons, a stage in the crypto price cycle when altcoins outperform Bitcoin. It’s an exciting time for the crypto investor, and given the amount of evidence suggesting that an alt season may be incoming, getting up to speed will place you in good stead to make the most of it.

In part one, we discussed the fact that alt coins now account for $1.3 trillion worth of the total crypto market cap of $2.2 trillion. We examined how entire ecosystems of software and applications have been developed on top of the key altcoin technologies like Ethereum, Solana and BNB and we promised to show you some key indicators to look out for when trying to decide if an alt season is on the cards.

Part two looked at some key metrics to keep an eye on when trying to predict the dawn of an alt season. We saw how Bitcoin dominance has been on a sharp downward trend since the beginning of the 2021. We looked at the influence of Bitcoin investor sentiment as indicated by the Bitcoin fear and greed index and we looked at how the ETH price chart suggested an incoming breakout.

Now that you’re equipped with some tools to understand and predict the arrival of an alt season, let’s look at how to invest when one does occur.

Consolidate or diversify?

Alt season presents a far wider range of investment opportunities than a focussed Bitcoin rally, simply because this is an area of the crypto market that is still in its infancy. From smart contract technologies to Web 3.0 and everything in between, these cryptocurrencies are fighting for dominance in their respective sectors. This is a double-edged sword for investors though, as the process of deciding where to invest suddenly becomes a lot more complicated.

For many, a winning strategy is simply going all-in on the one blockchain technology that they believe has the most potential, or the one currently leading the technological space they are most interested in. Making that decision requires a substantial amount of research and a deep understanding that extends beyond just Bitcoin and Ethereum.

Why it’s hard to pick a winner

Predicting which cryptos will outshine the rest in an alt season is no simple task. The difference in returns can be extreme. For example, between August and November 2021, Solana’s price shot up 574%. Meanwhile, rival in the smart contract space and fellow member of the top 10 cryptocurrencies by market cap, Cardano, grew just 52%. While investors who bought into Solana before its epic price rally are no doubt overjoyed by their returns, they would invariably have had to buy in without any real certainty that Solana would outperform a close competitor like Cardano so resolutely.

Every alt season has seen a small number of altcoins set price growth records, while others see more moderate gains. The fact is, even for seasoned analysts and market researchers, predicting which altcoin is going to outperform all others involves some element of luck.

The table above shows the top 10 cryptos by market cap from 2014 to present day. The cryptos highlighted in blue represent the newcomers to the Top10 when compared to the previous year. It’s remarkable to see how significantly this list has changed year on year. This table shows a clear demonstration of just how difficult it is to accurately predict which crypto will succeed or which will become a fly-by-night coin.

So how do we pick the winners? We don’t have to.

Diversification is easier than you think

In the world of cryptos, diversifying simply means investing in several different cryptos. By doing this, you are spreading your risk across multiple investments with exposure to various sectors rather than putting everything you have into a single crypto.

The idea is that by exposing your portfolio to multiple cryptos, you’ll stand to benefit from uncorrelated returns.

Sure, you won’t realise the same returns as you would have if you went all-in on the highest performing crypto, but on the flip side, you won’t risk having all your eggs in one basket. Instead, via diversification, you spread the risk and benefit from a far less volatile ride along the way.

Building a diversified crypto portfolio still requires that investors do their own comprehensive research, decide which cryptos are best to hold for exposure to certain market sectors, and constantly reweighting their portfolio to keep in line with the fast-paced nature of the crypto market. This is clearly neither a simple task nor a time-efficient task.

Revix, a crypto investment platform based in Cape Town, was founded to solve that very problem. In addition to making it easy and safe to buy individual cryptos, Revix’s claim to fame is its crypto Bundle offerings.

In the same way, you would buy into the JSE Top40, Revix bundles allow you to invest in a group of cryptocurrencies seamlessly.

Revix’s empowers users to invest in 3 different theme-based bundles:

The Top 10 Bundle is like the JSE Top 40 or S&P 500 for crypto and provides equally weighted exposure to the top 10 cryptocurrencies making up more than 75% of the crypto market. This bundle includes all the cryptocurrencies mentioned in this article and has significantly outperformed Bitcoin over the last 12 months.

The Smart Contract Bundle provides equally weighted exposure to the top 5 smart contract focused cryptocurrencies like Ethereum, Solana and Polkadot that enable developers to build applications on top of their blockchains, similar to how Apple builds apps on top of its OS operating system.

The Payment Bundle provides equally weighted exposure to the top 5 payment focused cryptocurrencies looking to make payments cheaper, faster and more global. These cryptos include the likes of Bitcoin, Ripple, Stellar and Litecoin.

Revix’s bundles have outperformed an investment in Bitcoin alone over a one-, three- and five-year time period.

What’s more, if a new crypto manages to meet the criteria that Revix’s bundles are based on, Revix will automatically reweight the bundle, keeping your portfolio bang up to date with the fast-moving world of cryptocurrencies.

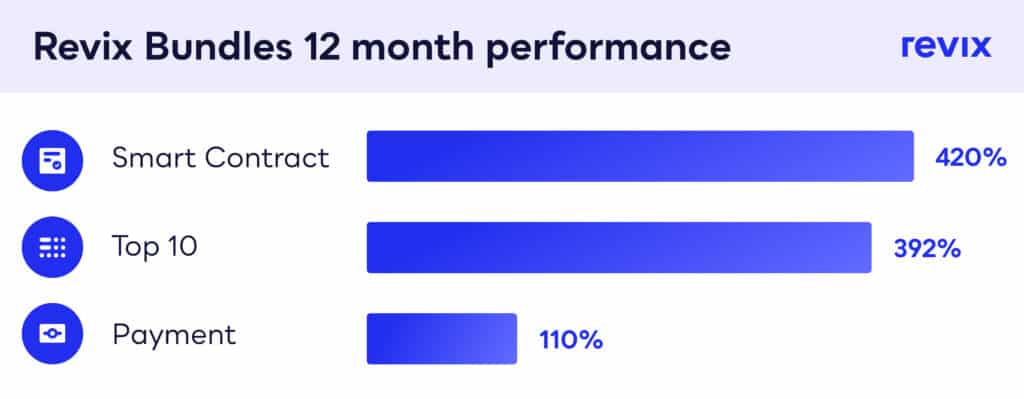

This graph shows the performance of Revix’s bundles over the last year.

The Smart contract bundle (+420%) and the Top10 Bundle (+392%) have both massively outperformed Bitcoin (+165%) over the past year without the investor having to do any research or rely on any guesswork.

And It gets even better!

Revix Bundles are built on a direct indexing model, which means, unlike an ETF, Revix purchases and holds the underlying assets on your behalf. It was also the first crypto platform in South Africa to opt into and pass a third-party audit of these assets, conducted by Mazars.

So not only do you gain diversified exposure to alt season at the click of a button, but you also get the security that an audited company is looking after your assets.

Wear your Bitcoin on your sleeve!

Whether you’re brand new to crypto investing or someone who has paid for a pizza with Bitcoin, the original cryptocurrency’s legendary status won’t be lost on you. So you’ll be excited to discover that Revix, a Cape Town-based crypto investment platform, is running a competition to win a prize that will make it easy to show the world that you’ve taken the crypto revolution seriously.

Predict what you think the Bitcoin price will be on the 3rd of January 2022 at 12:00 PM, and make an investment of R500 or more in Bitcoin via Revix’s platform, and you could win one of three exclusive pairs of Tateossian® Blockchain Cufflinks. Follow the instructions on

this link to enter.