Cryptocurrency has been making headlines this year due to volatile swings in stock prices, moves and comments by big-name investors, particularly Elon Musk, and news in July that the Federal Reserve is “exploring the implications of fast-evolving technology for digital payments” and plans to issue a report later this year. Visa reported that more than $1 billion was spent on crypto-linked Visa cards in the first half of 2021.

Cryptocurrency has been making headlines this year due to volatile swings in stock prices, moves and comments by big-name investors, particularly Elon Musk, and news in July that the Federal Reserve is “exploring the implications of fast-evolving technology for digital payments” and plans to issue a report later this year. Visa reported that more than $1 billion was spent on crypto-linked Visa cards in the first half of 2021.

In May, Altoona, Pa.-based Sheetz, which operates more than 600 stores in six states, announced it was set to allow digital currency payments using the Flexa network, meaning that customers would be able to purchase items in-store or fill up at the pump using cryptocurrencies, such as Bitcoin, Ethereum, Litecoin, Dogecoin and more.

Sheetz plans to begin accepting cryptocurrency first at select Sheetz Café stores this summer, extending it to fuel pumps later in the year.

CStore Decisions caught up with Perry Kramer, managing partner at Retail Consulting Partners (RCP), to learn more about the opportunity around cryptocurrency for convenience store retailers.

“I give Sheetz credit for its foresight and innovative mentality in pursuing this payment technology,” Kramer said. “Even though cryptocurrency is still in the ‘try and learn’ phase of its life cycle, it’s important to note that alternate payment types have been in the growth phase in retail for the past several years.”

He compared the slow adoption of cryptocurrency to that of Apple Pay, noting that Apple Pay had a similar adoption curve when it was first introduced to the market.

The Flexa solution that Sheetz is using can act as a bridge between merchants and multiple cryptocurrency platforms and could offer a potential avenue for reducing interchange fees, he noted.

“To settle the payments in real time using its own network will give merchants the ability to process payments in either cryptocurrency or traditional currency,” Kramer explained. “There are tens of millions of dollars in potential annual savings for these payment types to reduce the interchange fees that retailers pay in the store and eventually at the pump.”

“This is similar to the early days of Apple Pay where the list of retailers that accept cryptocurrency is actually longer than most people know and includes, in some form, over a dozen major retailers including Lowe’s, Regal Cinemas, Whole Foods, Petco and others,” he added.

RCP anticipates that we’ll see a trend toward retailers accepting cryptocurrency payments at the point of sale, as well as in-app transactions.

“The trend is being driven on multiple fronts: The pandemic has significantly accelerated the use of contactless payments, millennials and Gen Z shoppers are looking to take advantage of cryptocurrencies and, in the future once merchants have matured the implementation, we expect to see merchants experimenting with promotions and membership benefits that encourage the use of cryptocurrencies.”

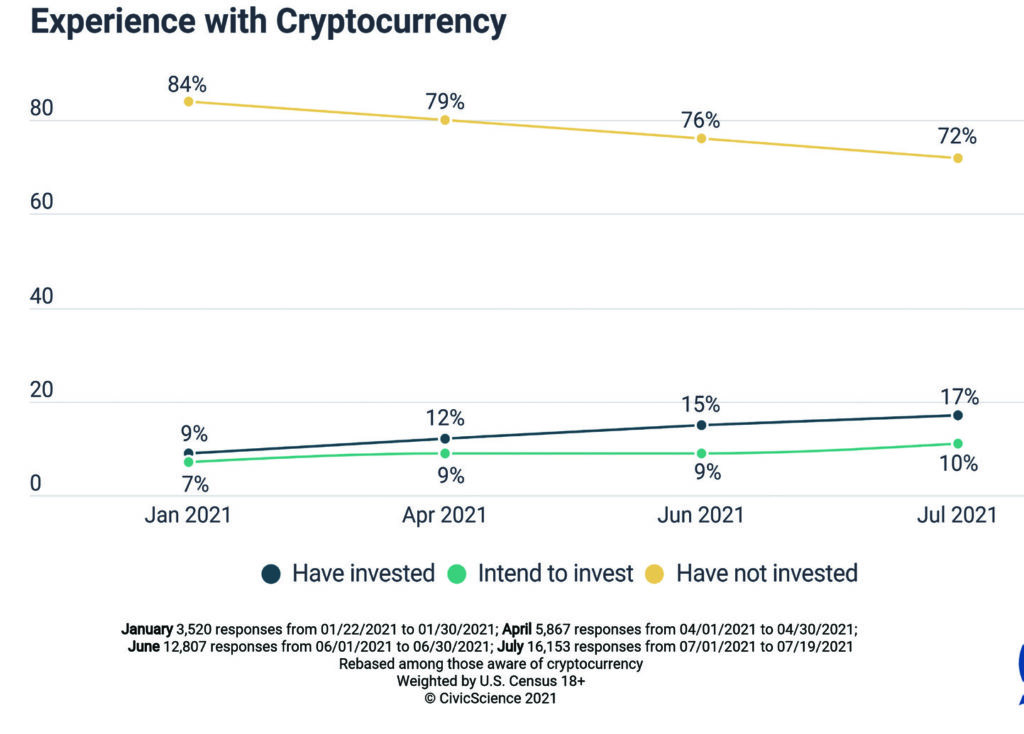

As outlined in the graph above, a CivicScience survey found that from January 2021 to July 2021, the number of people who said they had had NOT invested in the digital currency fell from 84% to 72%, while the number of who claimed they had invested rose from 9% to 17%, with those intending to invest rising from 7% to 10%.

CivicScience also noted that the majority of those who reported having invested or planning to invest in cryptocurrency skewed largely younger — between 18-34 — and slightly more male than female.

As of the week of July 4, CivicScience data showed that of those who reported that they had not invested in cryptocurrency, the most frequent reason was “I don’t understand it” (36%) followed by “I don’t think it’s legitimate” (20%). Those numbers have changed since the week of May 9, when 34% reported “I don’t think it’s legitimate,” and 26% said they didn’t understand it, showing customers’ perception may be rapidly changing.

Retailer Considerations

“The important things for convenience stores to know is that the acceptance of cryptocurrency is still immature and will likely experience some continued market volatility in the coming years,” Kramer noted. “Currently, there are limited options and competitors to the Flexa Network, and RCP expects to see other payment networks offering similar services in the near future.”

It’s also important to understand the different models that exist. “One of the least risky models is to take an approach similar to Starbucks, where Bitcoin is not accepted directly at the register, it is only used to load the customer’s prepaid account that is then accessed at the register,” he said. “In other words, you can add Bitcoin to the Starbucks app and pay that way.”

Kramer advised c-store retailers to keep cryptocurrency on their radar. “Start budgeting time to stay close to this payment trend,” he said, “as the long-term potential to reduce interchange rates may have significant potential in the future. “