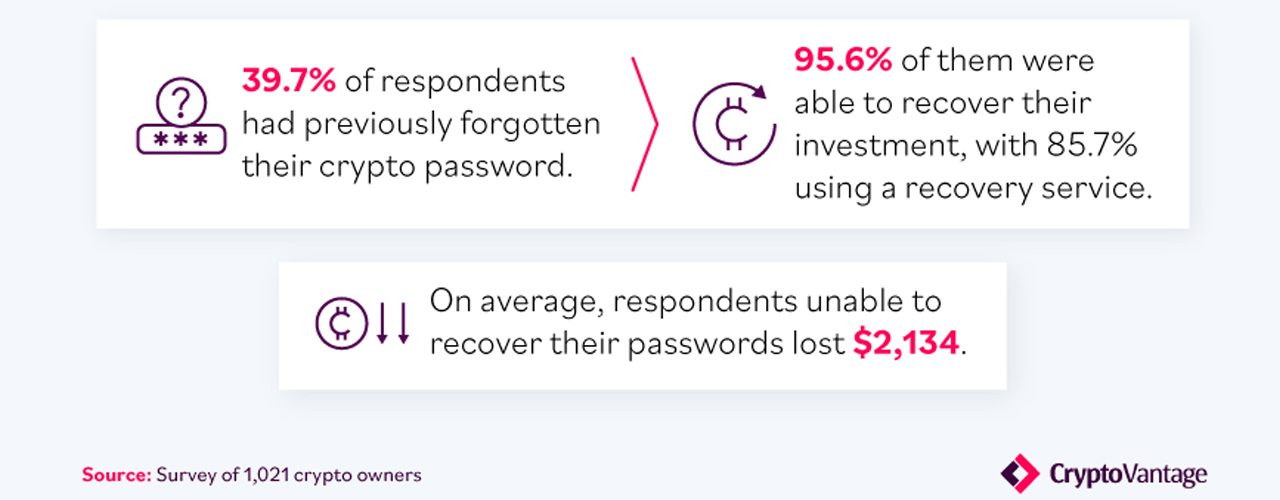

According to a recent study on crypto asset storage and passwords, a survey that polled over 1,000 digital currency owners shows 39.7% have forgotten their passwords. The study produced by cryptovantage.com indicates that users unable to recover their passwords lost an average of $2,134.

Survey Polls 1,000 US Crypto Owners, Respondents Invest $7,245 on Average

Since the inception of Bitcoin in 2009, a number of people have lost coins along the way and this has spread to the myriad of crypto assets in existence today. Just recently, researchers at cryptovantage.com published a study that polled 1,021 cryptocurrency owners residing in the United States.

The study called “Coin Storage Security: A Closer Look at Crypto Storage and Passwords” shows that 39.7% of cryptocurrency owners had lost their password at one time. On the positive side, 95.6%% were able to regain access to their crypto investments, but on average those who could not access their passwords lost over $2K.

“A whopping 95.6% of users who used these services were actually able to recover their money after forgetting a login,” the study highlights. “This success rate bears the potential to seriously alleviate some fears and trust issues among current and potential investors.”

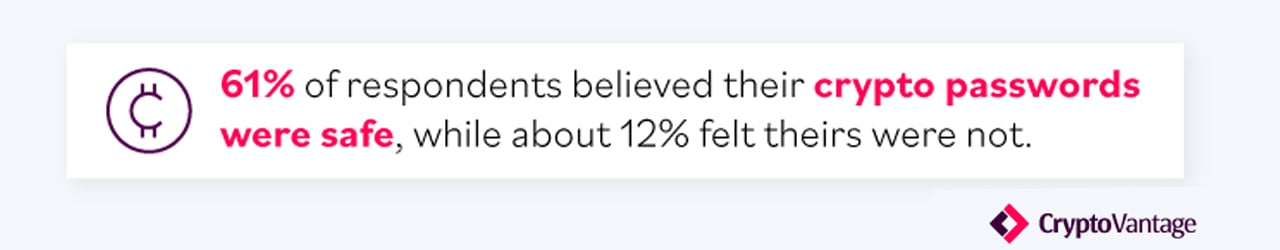

The survey respondents stemmed from the Amazon Mechanical Turk survey platform. The poll findings revealed that 1 out of 10 crypto owners currently believe their passwords are insecure. 20% of the participants use a piece of paper to record their passwords while 27% use a password manager. 61% of the thousand respondents believed they crafted a secure password.

33% of US Crypto Owners Fall Victim to Scams, Digital Currency Investors Show ‘High Propensity’ to Stay Involved After Issues

Out of the thousand respondents, the most used wallet was on the Coinbase platform (34.7%) followed by the wallet users access via their Robinhood accounts (26.4%). Binance users accounted for 24.4% of cryptovantage.com’s poll. All three of these wallets are custodial and they do not give access to private keys.

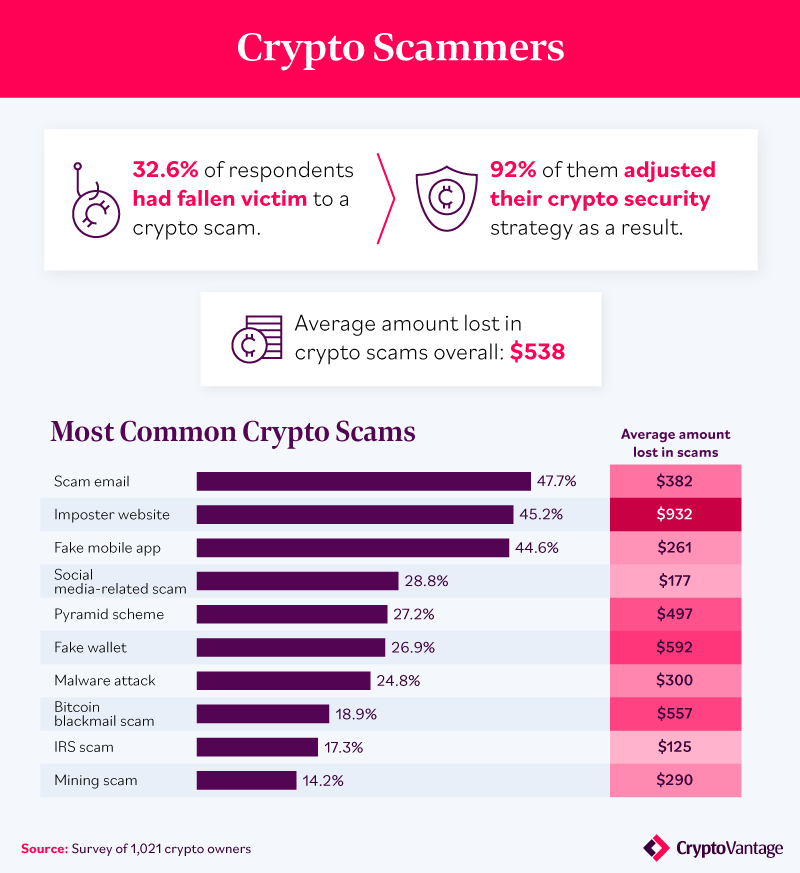

The study also covers crypto scams and noted that 32.6% of crypto owners in the U.S. have fallen victim to a crypto scam. The average loss for an individual getting duped by a crypto scam according to cryptovantage.com’s researchers is around $538.

The most expensive scam cryptocurrency users fall for is the imposter website, which is a web page that aims to imitate a trusted crypto service but steals people’s money. Respondents also said that they fell victim to email scams but the most common scam is the fake mobile application. Despite some of the initial drawbacks, digital currency investors continue to press forward even when mistakes are made, the cryptovantage.com survey concludes.

“Digital investors demonstrated a high propensity to get involved with cryptocurrency even in the face of some major trust issues and bad experiences,” the researchers opined. “Even after forgetting passwords or perhaps investing too much, their biggest regret was selling. Doing proper research and trying to take the emotion out of it will be key in any investor’s future.”

What do you think about the study that shows how 39.7% of American crypto holders have lost their passwords? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, cryptovantage.com,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.