As EIP-1559 launched on August 5, there were concerns that the miners would not be happy about making less due to the upgrade, but so far, not an issue.

While fees will still remain high depending on network congestion until ETH 2.0 (PoS) is launched, EIP-1559 will reduce Ethereum’s inflation from four per cent to roughly three per cent. Notably, Vitalik Buterin recently moved up the launch date of ETH 2.0 from January 2022 to December 2021. There have also been deflationary spikes since the launch when the amount of ETH burned well exceeds the number of ETH minted.

Decentralised computer technologies such as Ethereum and Cardano are in competition with each other, not with Bitcoin. Over time, such technologies should continue to co-exist with Bitcoin.

Some have suggested that once Bitcoin’s scaling issues are solved, companies may easily port over to Bitcoin since it is the most secure network. But Ethereum leads in network effect when it comes to providing a platform that enables companies on which to build. Both can co-exist, serving different purposes.

Ethereum (ETH) has one of the top development teams. They have come out with Berlin which helps increase transaction times while slightly reducing fees and now EIP-1559 which is making Ethereum less inflationary and even at times, deflationary, when the amount of ETH burned exceeds the amount minted, thus making its supply even more scarce.

Ethereum already has a supply shortage based on the migration of Ethereum out of exchanges into long term storage. Two of its primary technologies, DeFi and NFTs, continue to lock up a substantial amount of ETH. Institutions are starting to recognise Ethereum in addition to Bitcoin, while German funds can now allocate 20 per cent of their capital into Ethereum. The launch of Ethereum ETFs further push demand even higher for ETH.

Meanwhile, direct layer 1 competitors such as Cardano (ADA) and Binance (BNB) may co-exist if their fees and transaction times remain well ahead of Ethereum’s. Ethereum is expensive but offers the greatest network effect thus its level of security would appeal to larger companies that can afford the high fees. Smaller companies may opt for Cardano and Binance even though security and decentralisation are not as robust.

Layer 2 companies such as Fantom (FTM), Solana (SOL), Polygon (MATIC), and Harmony (ONE) which co-exist alongside ETH offer superior scalability thus their transaction times are a huge help to ETH as both platforms can be used together. A multi-chain world is likely.

All of the above are a few of the reasons why ETH has outperformed BTC and many alt coins since the recent lows. Exceptions include my favorites such as SOL, SAND, AXS, and CHR.

Replacing the functions of the IMF

Governing bodies such as the IMF are running scared when it comes to Bitcoin and crypto because this technology will largely replace the functions of the IMF rendering it obsolete in time.

The IMF just published a report saying crypto assets require an enormous amount of electricity – a statement that has been completely debunked. The IMF of course raised the old broken record that they are used for cyberattacks, ransomware, etc. They also said internet access and technology needed to transfer crypto assets remains scarce in many countries.

If the IMF has ever been in the deepest tropical rainforest in the Amazon or desert in the Sahara, virtually everyone has a mobile phone. The ignorance of the IMF is nothing short of shocking. They went on to say cryptocurrencies are “unlikely to catch on”. Tell that to the doubling of users that occurs each year.

Two per cent of the world now uses cryptocurrencies in some form. Up to 16 per cent of the US population is using crypto. Then they brought up some questionable study that claims 75 per cent of El Salvadorans think their country’s adoption of Bitcoin is “not very wise”. This study has not ever been validated so it seems the IMF is creating intentional FUD of their own.

Then US Senator Elizabeth Warren went on the attack saying crypto is a risk to hedge funds and banks. She never cared about hedge funds before and in fact tried to take them down. She wants to regulate banks to death. She also finds stable coins a threat and that DeFi brings huge risks. The over-regulated EU agrees with her. Both refer to people behind Bitcoin as “shadowy players”. But what about the professionals in high finance who have been manipulating markets for ages?

And if any of the above were true, why would Goldman Sachs go all-in and file for a DeFi ETF? The banks are going in because they know crypto is the future and want to be behind it. Even Bank of America that once denounced crypto is now allowing some of its clients to trade BTC futures.

Hyperinflation here we come?

Meanwhile, the value of hard assets continues to jump. Real estate marked the fastest month-to-month growth in more than 30 years. From April to May, prices skyrocketed 17 per cent – all due to QE money printing. This pace should slow or expect a resumption of the sharp uptrends in crypto as well.

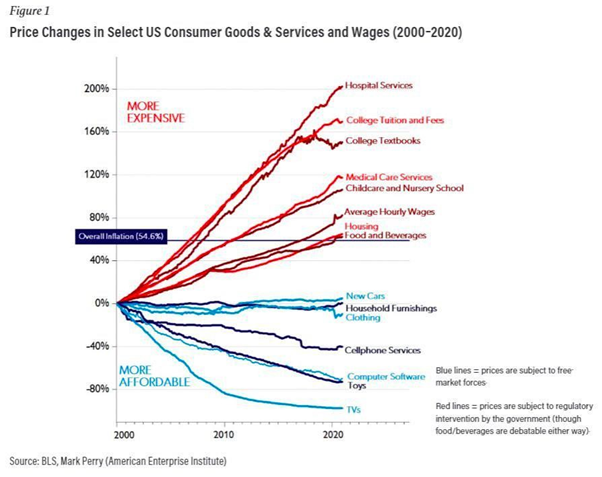

Further, the cost of two essentials, medical/health care and education, continue to soar, not to mention food and energy which are excluded from the CPI calculations due allegedly to their volatility. Yet anyone who grocery shops knows the cost of basics (dairy, meat, etc) have moved considerably higher in price over the last few years.

Make way for the era of Bitcoin, Ethereum, and other transformational crypto technologies.

(͡:B ͜ʖ ͡:B)

Dr Chris Kacher, bestselling author/top 40 charted musician/PhD nuclear physics UC Berkeley/Record breaking audited accts: stocks+crypto/blockchain fintech specialist. Co-founder of Virtue of Selfish Investing, TriQuantum Technologies, and Hanse Digital Access. Dr Kacher bought his first Bitcoin at just over $10 in January-2013 and participated in early Ethereum dev meetings in London hosted by Vitalik Buterin. His metrics have called every major top & bottom in bitcoin since 2011. He was up in 2018 vs the median performing crypto hedge fund at -46% (PwC) and is up quadruple digit percentages since 2019 as capital is force fed into the top performing alt coins while weaker ones are sold.

https://hansecoin.medium.com/subscribe

Virtue of Selfish Investing Crypto Reports

TriQuantum Technologies: Hanse Digital Access

https://twitter.com/VSInvesting/ & https://twitter.com/HanseCoin

https://www.linkedin.com/in/chriskacher/