Text Size:

Thank you dear subscribers, we are overwhelmed with your response.

Your Turn is a unique section from ThePrint featuring points of view from its subscribers. If you are a subscriber, have a point of view, please send it to us. If not, do subscribe here: https://theprint.in/

Central Bank Digital Currencies (CBDCs) have been a topic of discussion for most central banks (for more than 86%, as per the BIS); but have recently been classed as a ‘priority project’ (as per Powell) after China’s official launch of e-CNY (a CBDC) whitepaper in July.

Has e-CNY jolted the Fed? Will e-CNY result in the fall of a seven-decade long USD dominance? Let’s take a moment to understand this issue in its totality

CBDC’s and their inevitability, first

CBDCs – sovereign issued digital currencies which are a legal tender and allow the bearers to lay claim on public money (just like any other currency issued by a Central Bank). Unlike cryptocurrencies they are centralized, and account based (i.e., require verifying the identity of the payer instead of the token itself).

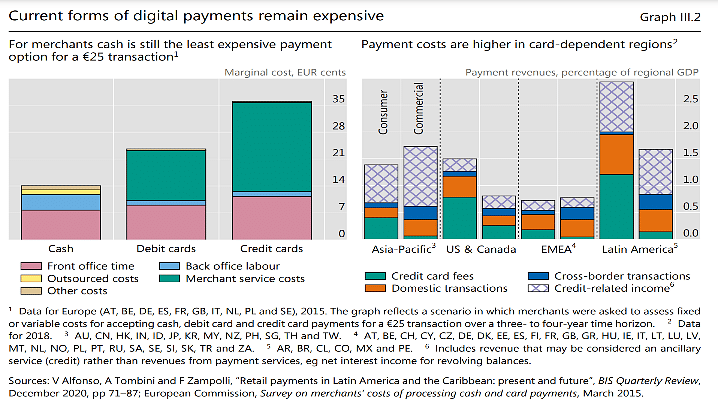

The possibility of bringing unbanked citizens under the umbrella of the country’s financial system (for direct transfers, subsidies etc.), having visibility (and control) into the citizens transactions and stopping private cryptocurrencies (e.g. Bitcoin) from becoming serious competition to the state’s monopoly over money – are the main reasons behind the popularity of CBDC’s. Then there are the immediate gains of real time 24×7 transfers and settlements and elimination of inefficiencies like float (ranges between 3 days to a week for international remittances), intermediary exchange fees (average of 3%) etc.

Most governments are still debating the ideal structure of CBDCs e.g., Direct implementation through mobile phones or through financial intermediaries, interoperability standards for cross border transactions etc. However, China is the only large economy with a pilot launch (e-CNY) in 2020 and has now released its findings and whitepaper on the topic.

Next, Digital Dollar is late

Fed would now have a direct channel to currency holders (instead of the 24 primary market dealers) – and commercial bank deposits get substituted by CBDC deposits with the Fed.

From a monetary policy perspective, the breaking down of the centuries old fractional reserve banking system would change the empirical constructs for money multiplier, which would (in turn) adjust over the long run.

Both these factors will help ensure faster and predictable impact of monetary policy changes. However, the elimination of intermediaries (e.g., clearing houses, settlement institutions, payment systems operators, etc.) would decrease industry revenues (1.5% of US GDP for US banks alone) and incentivize them to lobby for a delay in Digital Dollar implementation.

This is the exact reason for the lag in Fed’s CBDC decisions. One party, autocratic political systems have some advantages over that of a democratic, free market capitalistic (prone to lobbying) society!

China as the destabilizer

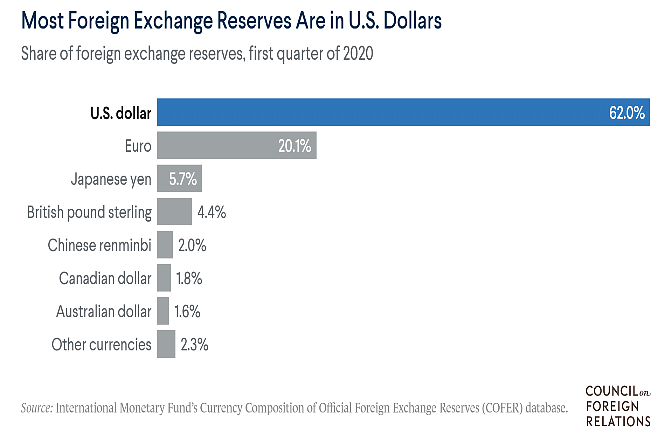

USD is doubtlessly the world’s dominant currency accounting for more than 88% of all forex transactions and is classed as the world’s reserve currency.

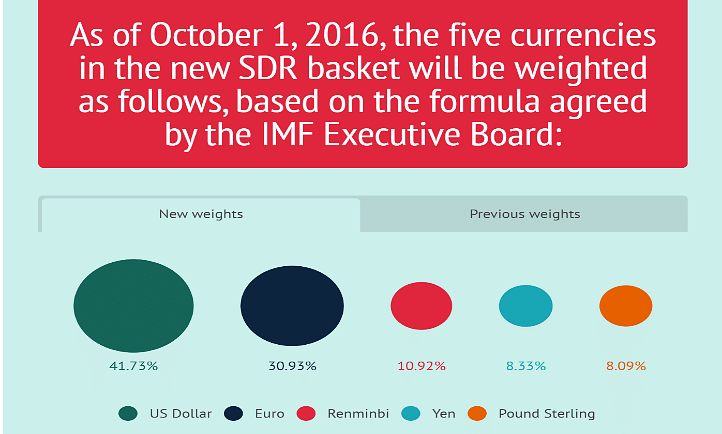

However, China’s ambitions to dethrone USD is well known; and announced by Xi in various Party speeches. It has been persistently building a framework to support CNY – inclusion in IMF’s SDR basket, swap agreements, setting up yuan-clearing banks around the world, and using the ‘Belt and Road Initiative’ to drive further adoption of the currency by recipient countries etc.

Despite these initiatives, CNY only accounts for 4% of forex transactions. China’s relatively closed capital markets, financial markets and the economy erode investor confidence. Its global reputation has also taken a hit over COVID, authoritarianism (e.g., the recent crackdown of its internet giants across industries like retail, payments, education etc.) etc. All these factors make the currency unattractive.

It is thus improbable that CNY will replace USD – but e-CNY is a definite disruptor. It will give a first mover advantage and increase CNYs share of forex transactions. However, the larger gain is for the society and world economy – as it is a meaningful push for leading economies to move from researching to piloting CBDCs.

In Conclusion

USD will change and evolve into a Digital Dollar (CBDCs are inevitable). On the other hand, China will get a first mover advantage for e-CNY – a disruptive launch and a Tsunami for sure.

e-CNY alone will not displace USD, it will instead help the world formalize and accept this innovation. We are moving towards a multicurrency and a more equitable currency market.

USD hegemony is threatened by the resultant structural changes in the financial and money markets. Govts, markets and societies alike will have to adjust and transform – this is the onset of the real fintech disruption.

Also read: CoinDCX becomes India’s first cryptocurrency unicorn, sees another 100+ in coming years

These pieces are being published as they have been received – they have not been edited/fact-checked by ThePrint.

Subscribe to our channels on YouTube & Telegram

Why news media is in crisis & How you can fix it

India needs free, fair, non-hyphenated and questioning journalism even more as it faces multiple crises.

But the news media is in a crisis of its own. There have been brutal layoffs and pay-cuts. The best of journalism is shrinking, yielding to crude prime-time spectacle.

ThePrint has the finest young reporters, columnists and editors working for it. Sustaining journalism of this quality needs smart and thinking people like you to pay for it. Whether you live in India or overseas, you can do it here.