For some months now, the explosiveness of cryptocurrency has hinged on the inflation hedging capability of Bitcoin. More investors and companies are coming to terms with the benefits of adopting Bitcoin as a store of value. While this is a great development, it raises questions concerning the original and perhaps the now-forgotten purpose of Bitcoin.

[soros]

Q2 2021 hedge fund letters, conferences and more

Warren Buffett, Diversified Retailing And Capital Allocation

In 1966, Warren Buffett, Charlie Munger, and their partner, Sandy Gottesman, formed a holding company, Diversified Retailing Company, Inc., to “acquire diversified businesses, especially in the retail field.” According to Alice Schroeder in The Snowball, soon after the deal was agreed, Buffett, who owned 80% of the company, went over to his bank to try Read More

In its early years of existence, Bitcoin was strongly marketed as a digital form of money designed for everyday use. The goal was to deliver a seamless payment process such that you could use Bitcoin to make purchases from your favorite coffee shop. However, judging by the recurring scalability issues resulting in network congestion, this lofty goal no longer seems attainable. And understandably, many have shifted their gaze to the “store of value” use case of Bitcoin.

However, this does not necessarily put a dent in the prospect of crypto as a payment solution. Several companies have dedicated their time, expertise, and resources to developing payment-focused infrastructures that do away with the pitfalls of legacy cryptocurrencies like Bitcoin. As highlighted by Forbes, crypto payment is currently attracting the interest of traditional financial institutions mainly because of its optimized cross-border transactional features. Hence, it is looking ever more likely that the mainstream adoption of cryptocurrency hinges on the success of crypto as a payment solution.

With this general context in mind, it is easy to see why previously inconsequential factors are fast becoming the major talking points in the crypto payment sector. For instance, KYC is now an essential factor that could determine the mainstream acceptance of cryptocurrency. The other is the compatibility of the crypto payment network with enterprise-based systems.

In light of this, I have decided to explore the top cryptocurrency networks conditioned for mass payment functions. Here, I will rank them based on their capacity to meet the requirements for mainstream adoption. In essence, these rankings will be based on their preparedness to appeal to a broader audience.

Overview Of Top Crypto Payment Networks

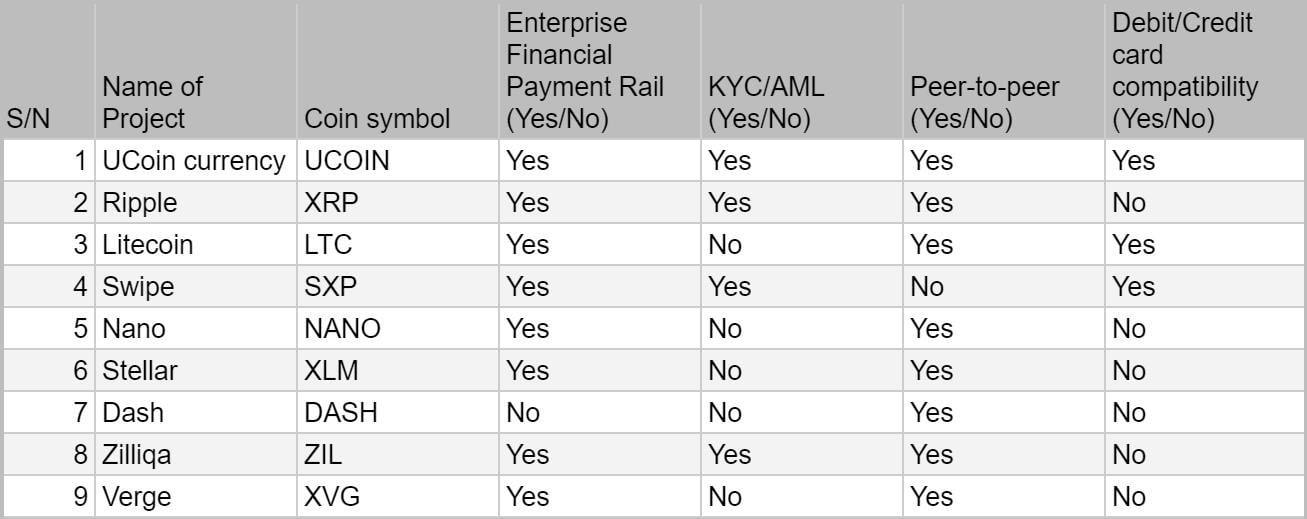

Author’s chart

As you must have noticed from the table above, the list borders on the added functionalities that could propel the mainstream adoption of each project’s cryptocurrency. As a crypto payment-focused solution, it is expected for these projects to look for ways of bettering the transactional performance of Bitcoin. Therefore, it made more sense to explore those simple details other than speed and cheap transaction fees. Here, I have based the rankings on the KYC and AML support of the project, the enterprise integrations, credit/debit card implementations, and peer-to-peer performance.

After the thorough consideration of these factors, I came up with 9 crypto payment networks purpose-built to spur mass adoption. The first on the list is UCoin Currency, which seems to have combined the elements of a conventional payment system and blockchain infrastructure to great effects. This is followed by XRP, a formidable option for processing cross-border payments. The third project on the list is Litecoin which has shown time and again that it is serious about establishing itself as the ideal crypto payment network. Below is an overview of the top 3 crypto payment networks based on mainstream appeal.

UCoin

Although it is one of the late bloomers in the crypto payment sector, UCoin, an ERC-20 token, seems to be rightly positioned to make a splash in the global financial terrain. This project focuses on enabling a crypto payment infrastructure for everyday use. As such, it does not compromise on speed and affordability. It has even gone a step further to incorporate functionalities that would appeal to enterprises.

One of such functionality is its decision to take on KYC and AML compliance requirements. There is also the added benefit of debit and credit card integrations and other advanced institutional features like the provision of a regulated crypto custodial solution. On the flip side, Ucoin is a relatively new project. Hence, it has a long way to go to catch up and overtake other crypto projects focusing on payment in terms of market visibility.

Ripple (XRP)

Despite its current woes, Ripple remains one of the highly-rated crypto payment solutions. The project looks to democratize cross-border payments by enabling instantaneous transactions between two or more financial institutions. All this is made possible by the unique design of its crypto network and native digital asset, XRP. Truth be told, Ripple is less concerned about the everyday use by individuals. The goal is to onboard as many financial organizations as possible and provide them with an instant cross-border and interbank payment solution.

This is why it has set up an array of Enterprise-based features and partnered with several banks and gateways. Understandably, the project provides compliance systems. However, this has not stopped the US Security and Exchange Commission (SEC) from targeting the company for breaching securities laws. It goes without saying that the future of XRP rests on the outcome of its ongoing lawsuit in the US.

Litecoin

Those familiar with the crypto industry will know that the growth of Litecoin is firmly rooted in innovation. The development team is constantly looking for ways to establish Litecoin as a potent payment network. At one point, the project launched an official Visa virtual debit card solution in the US to improve the seamlessness of using Litecoin to pay for goods and services.

There have also been instances where Litecoin secured strategic partnerships to expose the network to more users. One of them is its partnership with MeconCash that allows users to withdraw LTC as Korean Won on 13,000 ATMs across South Korea. That said, the cryptocurrency is working on incorporating privacy features. Although this decision has not had a major impact on the adoption of the coin, it will be interesting to see how regulators respond to it.

Other Notable Discoveries

From my research, it is clear that mainstream adoption comes with the added pressure of setting up compliant mechanisms to ensure that the payment network remains on the good side of regulators. Hence, KYC and AML integrations are increasingly becoming core requirements for crypto payment solutions. Out of all the platforms considered, only UCoin, Ripple, Nano, and Zilliqa have shown a positive level of flexibility towards compliance. In contrast, Litecoin, Verge, and Dash are privacy-focused.

Final thoughts

As discussed in this article, the crypto payment sector is still alive and well despite the declining prospect of Bitcoin as an efficient payment infrastructure. For what it is worth, solutions like UCoin, XRP, Litecoin, and Nano have taken up the mantle, and they have shown that the mass adoption of crypto payment is achievable.