If you’re based in the UK and want to invest in Ripple – all you need to do is find a suitable online broker that offers a market on XRP. You’ll want to select a provider that is regulated, supports your preferred payment method, and offers low fees.

If this is your first time purchasing cryptocurrency online, this guide will show you how to buy Ripple in the UK and which XRP brokers you should consider for the job.

#1 Broker to Buy Ripple (XRP) – eToro

How To Buy Ripple (XRP) – Choose a Broker

If you want to buy Ripple in the UK – you might want to consider one of the brokers listed below. All five have a great reputation in the cryptocurrency trading arena and allow you to invest in XRP in a low-cost manner.

- eToro – Overall Best Broker to Buy Ripple UK

- Coinbase – Best Broker to Buy XRP for Beginners

- OKEx – Best Low-Cost Broker to Buy Ripple UK via a Crypto Deposit

- Binance – Best Broker to Buy Ripple for Asset Diversity

- Coinjar – Best Broker to Buy XRP UK for Those on a Budget

If you want more information on any of the brokers listed above – you’ll find a full review of each provider further down in this guide on how to buy Ripple UK.

How to Buy Ripple in the UK – A Quick Guide For 2021

Based in the UK and looking to buy Ripple instantly with a top-rated brokerage site? If so, the walkthrough below will show you how to buy XRP with FCA-regulated platform eToro.

- Step 1: Open an Account with eToro – You’ll need to first register an account with eToro by entering your personal details.

- Step 2: Upload Your ID – This top-rated trading platform is FCA-regulated – so you’ll need to upload a copy of your driver’s license or passport.

- Step 3: Deposit Funds – Choose your supported payment method (e-wallet, credit/debit card, bank transfer) and proceed to deposit funds.

- Step 4: Buy Ripple – Enter ‘XRP’ into the search box at the top of the page. After clicking on the ‘Trade’ button, enter the amount of XRP tokens you wish to buy. Finally, click on the ‘Open Trade’ button to complete your purchase.

And that’s it – you’ve just bought Ripple at eToro! The tokens will appear in your eToro portfolio instantly. You can sell your Ripple investment day or night by clicking on the ‘Sell’ button.

Cryptoassets are highly volatile unregulated investment products. No EU investor protection. 67% of retail investor accounts lose money when trading CFDs with this provider.

Where to Buy Ripple in the UK

When searching how to buy Ripple in the UK – you will be presented with hundreds of cryptocurrency exchanges and brokers. This can make it super-difficult to know which platform is right for you. For example, you need to look at everything from regulation and payment methods to fees and customer service.

Strapped for time and looking at where to buy Ripple in the UK right now? If so, below you will find a selection of brokers that allow you to buy XRP in the UK.

1. eToro – Overall Best Broker to Buy Ripple UK

We spent countless hours testing the ins and outs of dozens of online cryptocurrency platforms and found that all in all – eToro is the best broker to buy Ripple in the UK. The first thing that stood out for us is that eToro appears to be one of the very few brokerage sites in the UK that is authorized and regulated by the Financial Conduct Authorty (FCA).

Crucially, this means that you can be 100% sure you are using a top-rated and secure broker. After all, this is why eToro has since attracted over 20 million clients and is planning to go public later this year. On top of offering a safe and secure ecosystem, eToro also allows you to buy XRP in a low-cost manner.

This is because you will only need to cover the spread – as opposed to paying a variable commission. The minimum investment threshold is low too – eToro allows you to purchase cryptocurrency from just $25 per trade – which is about £18. When it comes to getting money into and out of your account – eToro supports Visa, MasterCard, Paypal, Skrill, bank transfers, and more. The deposit fee on all supported payment types is just 0.5% – which is arguably the cheapest in the cryptocurrency industry.

A number of passive investment and trading options are also offered by this popular broker. First, you have the CryptoPortfolio – which is managed by the eToro team. This consists of a basket of digital currencies – which is weighted based on market capitalization. This is good for diversification purposes as well as ensuring that you are not overexposed to Ripple. Second, you have the eToro copy trading tool.

This allows you to select a successful eToro trader – of which there are thousands to choose from. Once you have picked an investor, you will then copy all of their future trades like-for-like. If you are also thinking about diversifying into other financial instruments, eToro has you covered. On top of CFD markets that track indices, forex, and commodities – you can also buy shares and ETFs in thousands of companies from multiple UK and international exchanges.

Pros

- Invest in cryptocurrencies on a spread-only basis

- Buy thousands of UK and international stocks at 0% commission

- Minimum investment per trade from just $25

- Supports debit/credit cards, e-wallets, and local bank transfers

- Regulated by the FCA, CySEC, and ASIC

- Used by over 20 million people

- Perfect for beginners

- Social and copy trading tools

Cons

- Perhaps too basic for technical traders

- No support for MT4 or MT5

Cryptoassets are highly volatile unregulated investment products. No EU investor protection. 67% of retail investor accounts lose money when trading CFDs with this provider.

2. Coinbase – Best Broker to Buy XRP for Beginners

Coinbase is a US-based cryptocurrency broker that also has a strong presence in the UK. Launched in 2012 – this makes the platform one of the most established in the UK. As per its latest filing – Coinbase claims to now be home to over 35 million active traders.

In particular, Coinbase is suited for those of you that want to gain exposure to cryptocurrencies – but in a simple and burden-free way. The broker allows you to buy XRP in less than 10-15 minutes from start to finish – which includes the process of opening an account and uploading a copy of your passport or driver’s license. Coinbase also supports debit card payments – meaning that you can buy XRP in the UK instantly.

The key problem with Coinbase is that it does charge hefty fees – at least in comparison to other brokers in this space. For example, you will pay a standard commission of 3.99% to buy Ripple with a debit card. If you deposit funds via a UK bank transfer, you won’t pay a transaction fee. You will, however, need to pay a trading commission of 1.49% when you buy Ripple and again when you cash out.

On the flip side, whilst Coinbase is a bit pricey, the broker does ensure that your investment funds remain safe at all times. For example, it is mandatory to set up two-factor authentication. This means that on each login attempt – you will need to confirm a code that is sent to your mobile device. You then have device whitelisting – which requires an additional security step should you try to sign in with a different laptop or phone.

Coinbase also keeps at least 98% of client-owned digital assets in cold storage – meaning the funds are kept offline and away from servers. You might also be interested in the Coinbase debit card – which is issued by Visa. This allows you to spend your cryptocurrency holdings in the real world – online, in-person, or at an ATM. Finally, Coinbase also offers a trusted mobile wallet – which allows you to store your XRP tokens securely.

Pros

- One of the most popular cryptocurrency exchanges

- More than 35 million users

- Supports instant debit card purchases

- Dozens of digital currencies to choose from

- Institutional-grade security practices

Cons

- Debit card deposits are expensive at 3.99%

- You will pay a standard trading commission of 1.49%

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

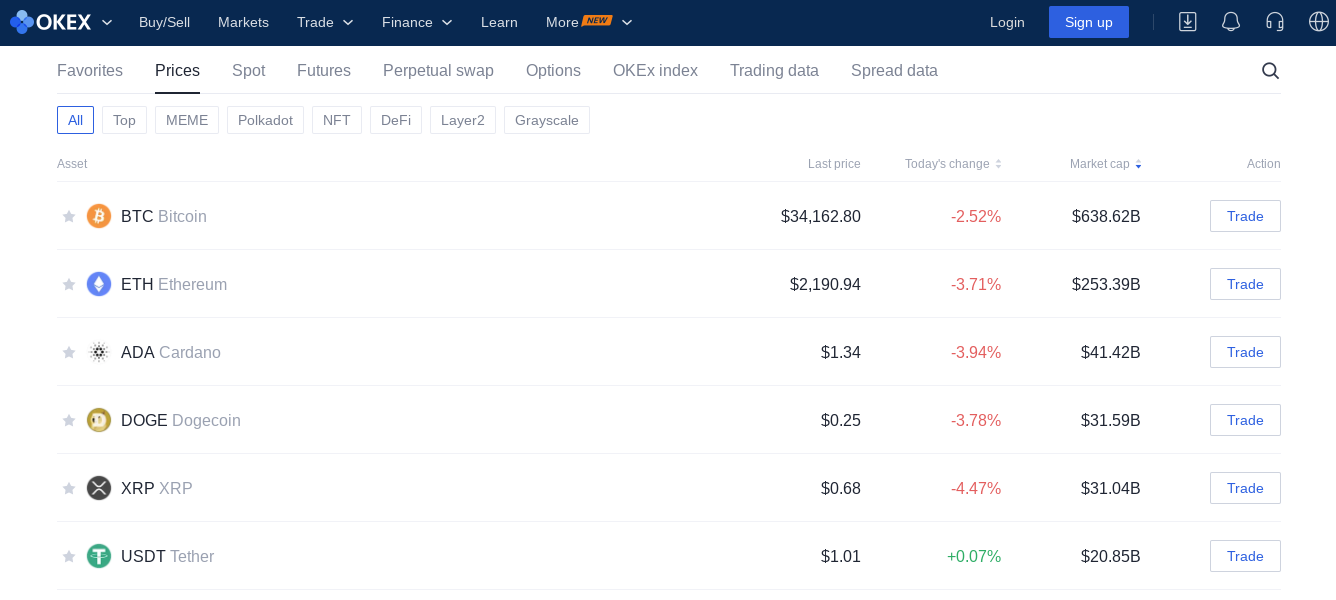

3. OKEx – Best Low-Cost Broker to Buy Ripple UK via a Crypto Deposit

Next up is OKEx – which is one of the best brokers to buy Ripple in the UK in exchange for another digital asset. For example, if you are currently holding Bitcoin or Ethereum, there is no need to deposit funds with a debit/credit card to buy XRP. Instead, you can simply head over to OKEx, transfer the digital currency into your account, and then exchange the coin for Ripple.

This option offers a number of benefits – such as extremely low trading fees. In fact, other than the small blockchain fee that you need to pay when depositing coins into OKEx, you will only pay a commission of 0.10%. This is even lower if you trade large volumes. In terms of what digital currencies you can swap for XRP at OKEx – this includes Bitcoin, Ethereum, Tether, and more. OKEx is used by over 20 million traders – so there will no issues finding sufficient liquidity.

Although OKEx is one of the best platforms for crypto-to-crypto exchanges, the provider also has the legal remit to accept fiat currency deposits. This includes debit and credit cards issued by Visa and MasterCard. Additionally, you can also transfer funds from your UK bank account. In addition to its core trading and brokerage services, OKEx is involved in a number of innovative products that might interest you.

For example, the OKEx Earn feature allows you to earn passive income on cryptocurrencies you currently own. This is because OKEx will lend the funds to margin traders – which in turn, comes with interest for as long as the position remains open. In this sense, the risk of loss on your crypto assets is minimal. Finally, OKEx is also a good option if you want to improve your knowledge of cryptocurrency investing – as the platform is home to an extensive education suite.

Pros

- Trusted crypto exchange with over 20 million users

- More than 400+ digital currency pairs

- Buy and sell cryptocurrencies with a debit/credit card or bank transfer

- Low commissions that start from 0.1%

- Fully-fledged mobile app on Android and iOS

- Great reputation and highly secure

Cons

- Debit/credit card fees could be more competitive

- Derivative products too complex for beginners

via eToro, UK’s #1 Broker

Cryptoassets are highly volatile unregulated investment products. No EU investor protection

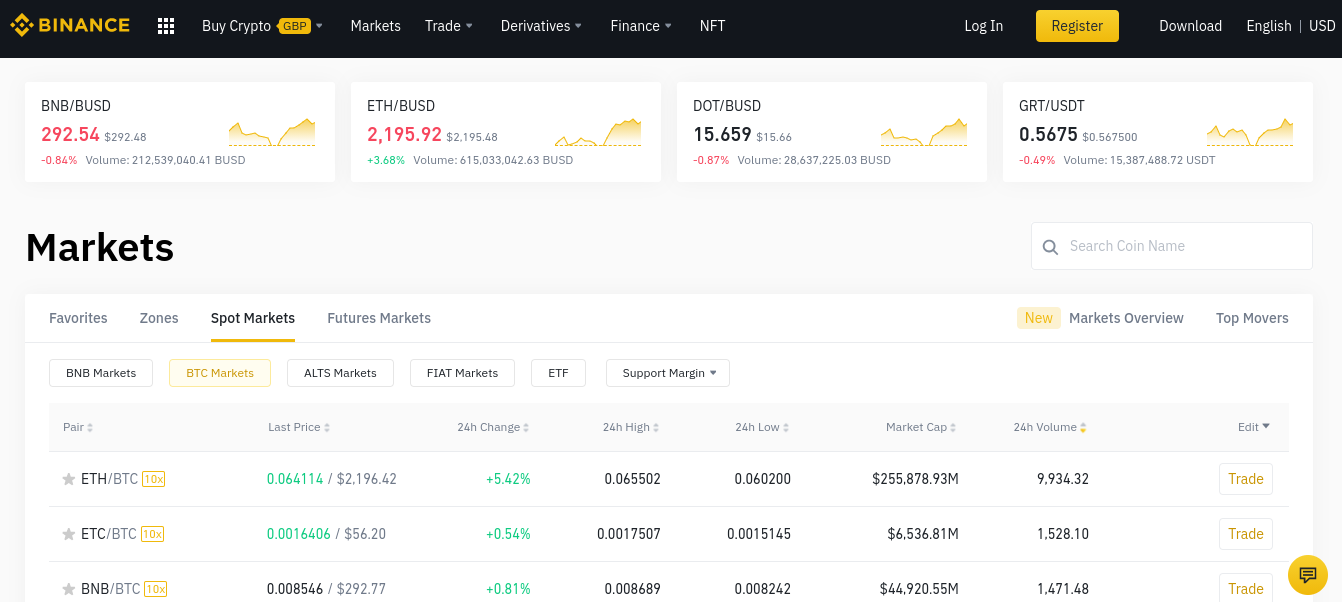

4. Binance – Best Broker to Buy Ripple for Asset Diversity

Binance is now the largest cryptocurrency exchange globally – with billions of dollars changing hands on this platform each and every day. According to the exchange itself, Binance is now home to over 100 million active trading accounts. This top-rated provider allows you to buy XRP in the UK instantly with a debit or credit card.

First, you will need to open an account and upload your government-issued ID. In the vast majority of cases, Binance will be able to verify your document instantly. Then, you can proceed to enter your card details, select XRP from the drop-down list, and choose the amount you wish to buy.

This will cost you 1.8% of the total transaction amount – which is reasonable. With that said, eToro offers the same service at just 0.5% – which is much cheaper. Nevertheless, Binance also supports payments via the Faster Payments Network – which are both free and near-instant. Then, you would simply need to find the GBP/XRP market to complete the purchase. This would result in a super-low commission of just 0.10%.

Binance offers hundreds of other digital currencies of all shapes and sizes – including a significant number of ERC-20 tokens. As such, this platform is ideal if you want to build a highly diverse cryptocurrency portfolio in a low-cost manner. Binance also offers savings accounts, which allow you to earn interest on your crypto assets. You can choose between a flexible or locked account, with the latter offering higher rates of interest.

Pros

- Facilitates billions of dollars in daily trading volume

- Supports hundreds of digital asset pairs

- Near-instant deposits via debit/credit cards and local bank transfers

- Trading commission starts at just 0.1% per slide

- Offers crypto savings accounts

- Ideal for both beginners and experienced traders alike

Cons

- Not all supported cryptocurrencies can be purchased with a debit/credit card

- No e-wallet deposits or withdrawals

via eToro, UK’s #1 Broker

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

5. Coinjar – Best Broker to Buy XRP UK for Those on a Budget

If you’re looking to buy Ripple in the UK but you don’t want to risk a lot of money – you’ll need to find a broker that accepts small deposits. At the forefront of this is Coinjar – which allows you to get started with an inconsequential investment of just £5. You can get money into your Coinjar account by transferring funds from your UK bank account.

Much like Binance, this is processed via the Faster Payments Network – so there are no fees involved and the funds should arrive in a few minutes. Once the money does land in your Coinjar account, you can buy Ripple at a commission rate of 1%. The other option you have is to do an instant purchase via your UK debit/credit card.

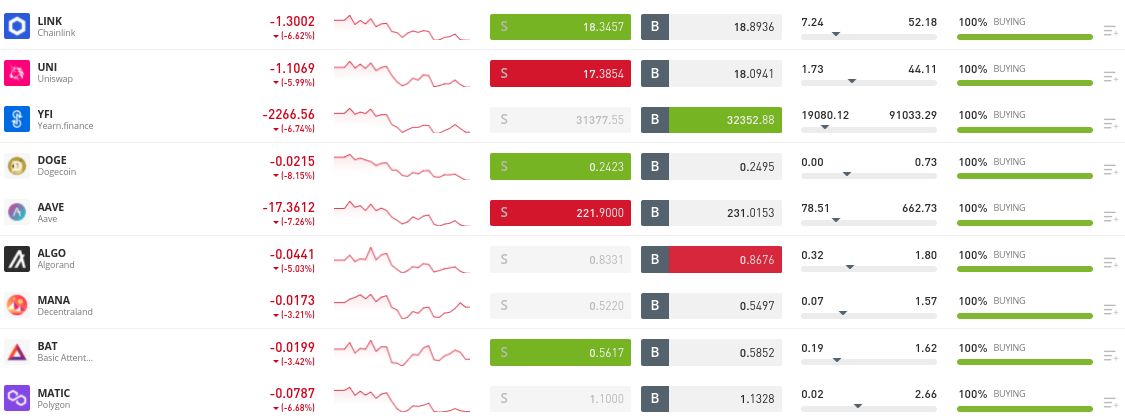

This will attract a higher commission of 2%. Much like the other platforms we have reviewed today, Coinjar gives you access to a great selection of other digital assets. This includes everything from Bitcoin, Stellar, and Ethereum to EOS, Litecoin, and Tether. In fact, you also buy a number of promising DeFi coins – such as Uniswap, Yearn.finance, and Balancer. Coinjar also offers a mobile app – which allows you to buy and sell, set up price alerts, and store your digital tokens.

Pros

- Has been active in the crypto brokerage arena since 2013

- Very user-friendly platform – so is perfect for beginners

- Mininmum deposit of just £5

- No fees to deposit funds via Faster Payments

- Debit/credit cards also supported

- Top-rated mobile app

Cons

- Too basic for experienced cryptocurrency traders

via eToro, UK’s #1 Broker

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

How to Buy Ripple (XRP) in the UK – Detailed & Explained in Full

If you are looking to buy Ripple in the UK – but this is your first time investing in the crypto arena, we are now going to walk you through the process. For our detailed tutorial, we explain the required steps with eToro. Not only is this because eToro is authorized and regulated by the FCA – but it offers some of the lowest trading fees in the cryptocurrency space.

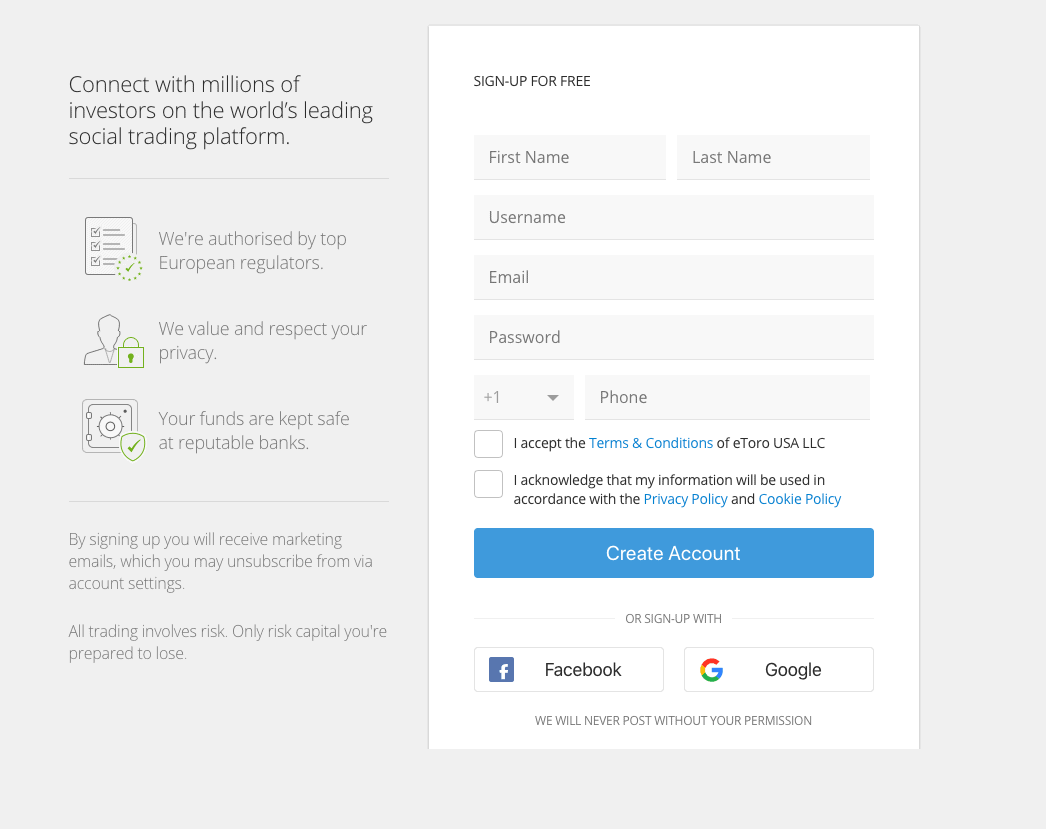

Step 1: Open a Crypto Broker Account

To get started with eToro, you will first need to register. This should only take a few minutes and the broker simply needs to collect some personal information from you. Think along the lines of your first and last name, date of birth, and home address.

On top of choosing a username and strong password, you’ll need to confirm your UK mobile number. This can be achieved by entering the unique code that eToro sends to your phone via SMS.

Cryptoassets are highly volatile unregulated investment products. No EU investor protection. 67% of retail investor accounts lose money when trading CFDs with this provider.

Step 2: Upload ID

You will be buying XRP at eToro with pounds and pence -so the broker will first need to verify your identity. This is also a burden-free process, as you simply need to upload some ID and a proof of address.

- ID: This can be a passport or driver’s license

- Proof of Address: This can be a utility bill or bank account statement (issued within the last three months)

In most cases, your document will be verified automatically. With that said, eToro allows you to buy XRP in the UK up to a value of $2,250 (about £1,600) without completing the verification process. You will need to do this to make a withdrawal though – so it’s best to get this out of the way now.

Step 3: Deposit Fund

eToro will now guide you through the deposit process. First, you need to select the payment type that you wish to use. To recap, supported payment methods at eToro include debit and credit cards, e-wallets (including Paypal), and a bank transfer.

The deposit fee amounts to just 0.5% and the minimum stands at $200 – or about £160.

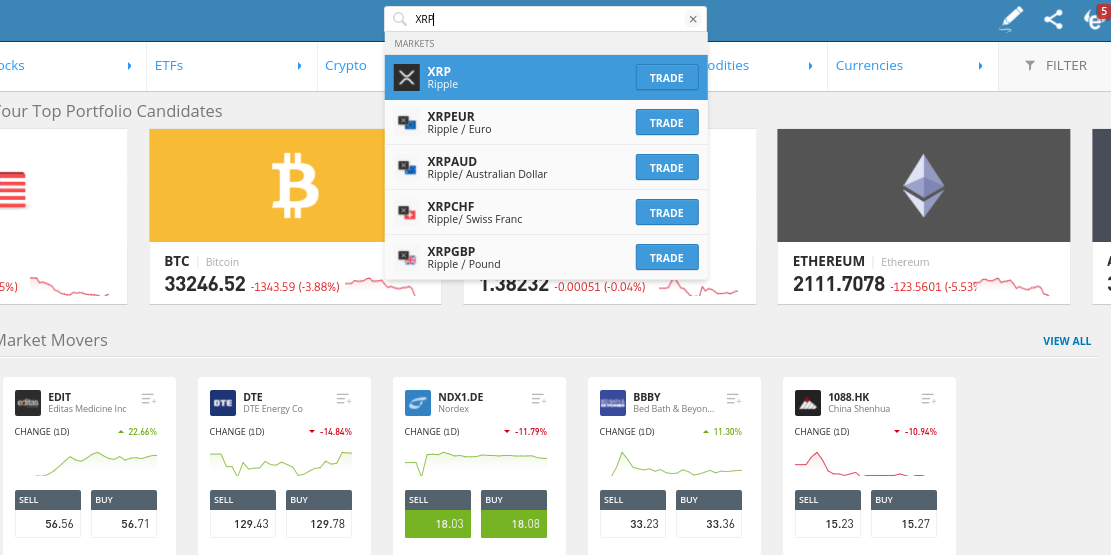

Step 4: Search for XRP

On top of cryptocurrencies, eToro is home to thousands of other financial instruments. As such, the easiest way to buy Ripple on the platform is to search for ‘XRP’ and click on the result that loads.

In doing so, you will then need to click on the blue ‘Trade’ button – which you will find on the next page.

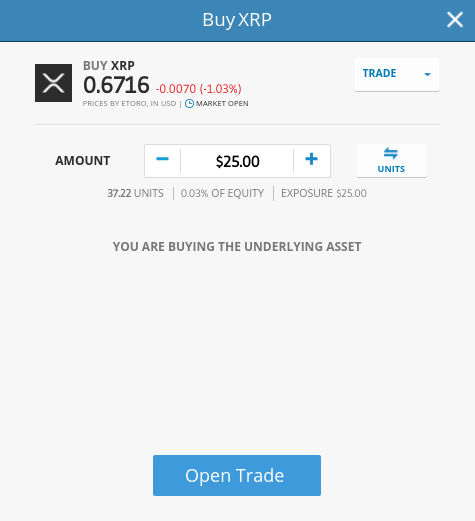

Step 5: Buy Ripple UK

The final step is to create a buy order – which lets eToro know that you wish to invest in Ripple. By default, you will be placing a market order, which ensures that your investment is processed instantly. If, however, you want to buy XRP at a specific entry price, you can do this via a limit order.

Either way, you also need to enter your stake into the ‘Amount’ box. Much like the global cryptocurrency market – eToro operates exclusively in US dollars. As such, enter your investment amount in USD – ensuring you meet the minimum trade size of $25.

Once you are happy with the specifics you have entered – click on the ‘Open Trade’ button to complete your XRP investment!

Buy Ripple – Best Place to Buy XRP in the UK

Ripple has held its status as a multi-billion dollar crypto asset for many years. With this in mind, there are hundreds of platforms that allow you to buy Ripple from the comfort of your home. Other options exist too – such as cryptocurrency ATMs.

To help you choose the right method for you, below we discuss the best place to buy XRP in the UK.

Online Cryptocurrency Broker

Cryptocurrency brokers are not too dissimilar to a conventional stock trading site. This is because the broker must hold a regulatory license with the relevant financial authorities.

- For example, eToro is not only licensed in the UK by the FCA, but with bodies in Australia and Cyprus.

- This means that you can be sure you are using a credible platform that takes investor protection and client fund segregation seriously.

- Additionally, by using a regulated online broker, you will likely have the option of being able to buy Ripple in the UK with a debit or credit card.

Platforms like eToro also support bank transfers and e-wallets. This makes the investment process simple and convenient – especially if you are looking to buy XRP for the first time.

Cryptocurrency Exchange

There are hundreds of cryptocurrency exchanges active in the online arena – most of which are unlicensed. This is because they do not support fiat currency deposits or withdrawals. On the contrary, these platforms can only accept payments in the form of digital currency.

With that said, some unregulated cryptocurrency exchanges get around this by processing fiat deposits via a third party. Although perhaps not illegal, this still means that you will be entrusting your hard-earned money with an unregulated entity. Proceed at your own risk when using an unlicensed cryptocurrency exchange – as you can never truly be sure you are using a legitimate provider.

Ripple ATMs

There are several hundred Ripple ATMs scattered around the world – but only 10 are currently situated in the UK.

Nevertheless, if you do have a crypto ATM nearby that supports XRP – the process works as follows:

- Enter the amount of Ripple you want to buy

- The ATM will tell you how much you will get for your stated amount

- Insert the cash into the machine

- Collect the receipt that is printed

The receipt will give you instructions on how to claim your XRP coins via cryptocurrency wallets.

Ways to Buy Ripple UK

As we have briefly covered throughout this guide – there are many ways to buy Ripple in the UK. More specifically, you have a variety of options when it comes to choosing your preferred payment method.

This includes the following:

Buy Ripple With Debit Card

The best way to buy XRP in the UK is to use your everyday debit card. Whether that’s issued by Visa or MasterCard – the best cryptocurrency brokers allow you to invest in Ripple in this manner. You will first need to open an account with your chosen provider and then go through a quick Know Your Customer (KYC) process.

This is because you are using fiat currency and thus -the broker is legally required to verify your identity. Once this is done, you can proceed to buy Ripple in the UK instantly. As we cover in more detail later, just be sure that you know how much the broker charges in fees. This is because we have come across platforms that charge in excess of 5%.

Buy Ripple via Debit Card with 0% Commission >

Buy Ripple With Credit Card

Several platforms also allow you to buy Ripple with a credit card. The process works much the same as using a debit card, albeit, you need to check whether additional fees apply. For example, you might need to pay a cash advance fee if your credit card issuer viewed brokerage payments as a cash advance.

Buy Ripple via Credit Card with 0% Commission >

Buy Ripple With Paypal

A select number of online brokers allow you to buy Ripple with Paypal. eToro, for example, will charge you just 0.5% to deposit funds with this payment method. The same broker supports other e-wallets too – such as Skrill and Neteller.

Buy Ripple via Paypal with 0% Commission >

Buy Ripple With Bitcoin

If you want to buy Ripple with Bitcoin, you are best advised to use a cryptocurrency exchange. First, you will need to quickly register with the exchange provider – which should only take you 30 seconds.

This is because you are conducting a crypto-to-crypto transfer – so the exchange doesn’t need to collect any personal information from you – other than an email address. Then, you will need to search for XRP/BTC – before completing the exchange.

Buy Ripple via Bitcoin with 0% Commission >

Why Buy Ripple UK?

So now that you know where to buy XRP in the UK and which brokers are worth considering – it’s now time to do a bit of research on Ripple itself. After all, you will be risking money by investing in this digital asset – so it’s best to spend some time assessing what the future holds for XRP.

Ripple is Looking to Revolutionize Cross-Border Payments

Unlike a lot of cryptocurrency projects in this industry – Ripple is behind technology that has the potential to revolutionize a major industry – cross-border payments. More specifically, the Ripple framework allows banks and large financial institutions to transfer funds in a fast and low-cost manner.

At present, the vast majority of interbank transactions are facilitated by SWIFT. For those unaware, SWIFT is a third-party intermediary that sits between the sender and receiver. In most cases, SWIFT requires several stakeholders to process the transaction when it is being conducted in competing currencies – which includes corresponding banks.

As a result, it often takes days for the funds to arrive and fees are often costly for both parties involved. This is where Ripple and its XRP come in. Put simply, the Ripple protocol can facilitate near-instant cross-border transactions that cost just a fraction of a penny.

The XRP token itself forms the crucial bridge between the sender and recipient, meaning that there are always sufficient levels of liquidity available – irrespective of which currencies are involved in the transaction. Ultimately, this gives XRP real-world usage, which is vital for the digital currency to grow over the course of time.

Ripple Tokens are Cheap

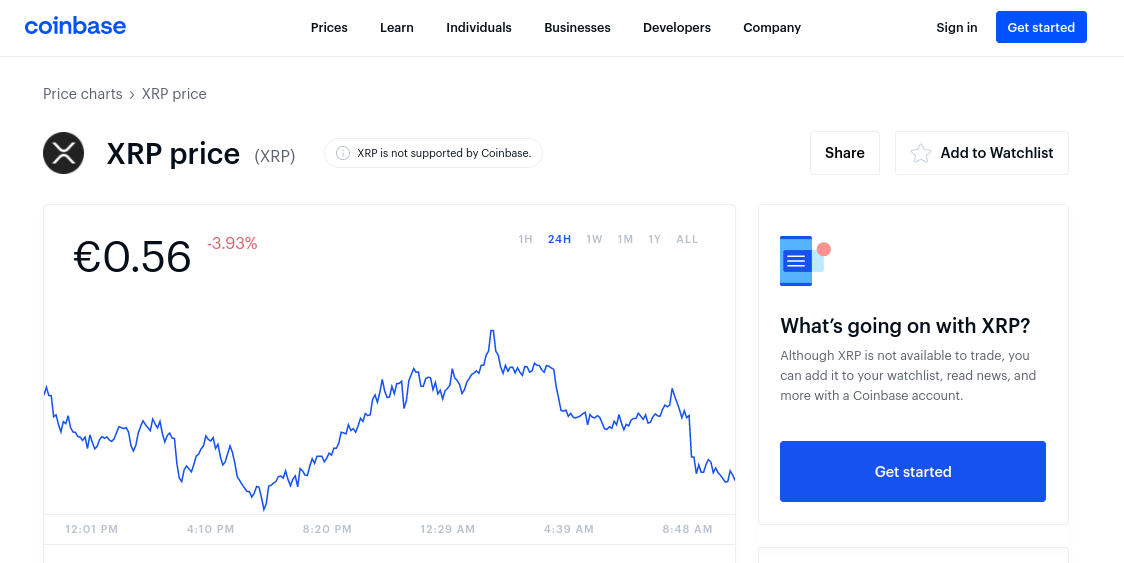

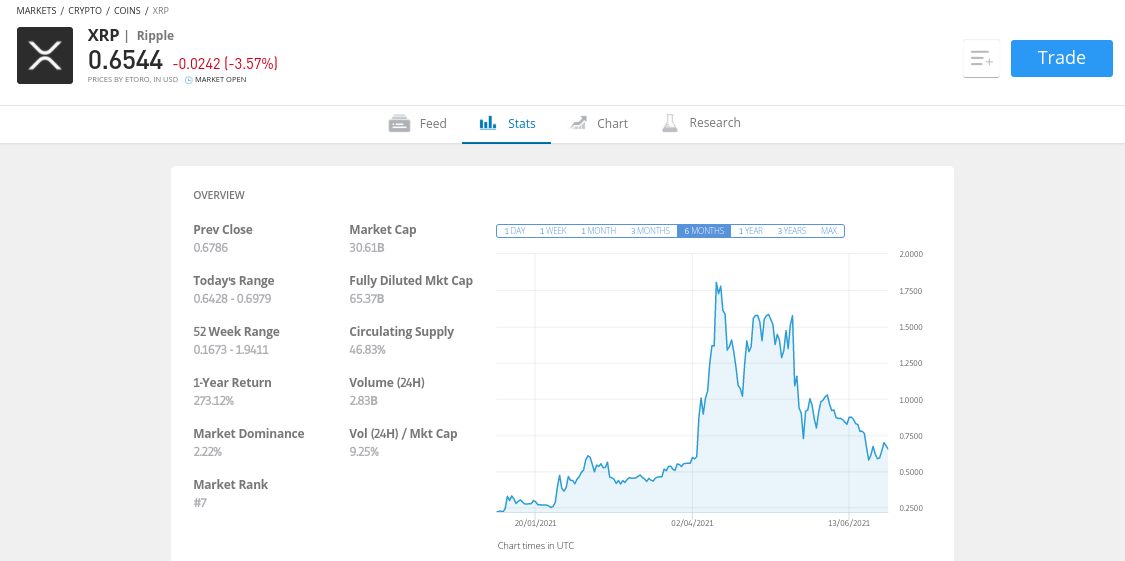

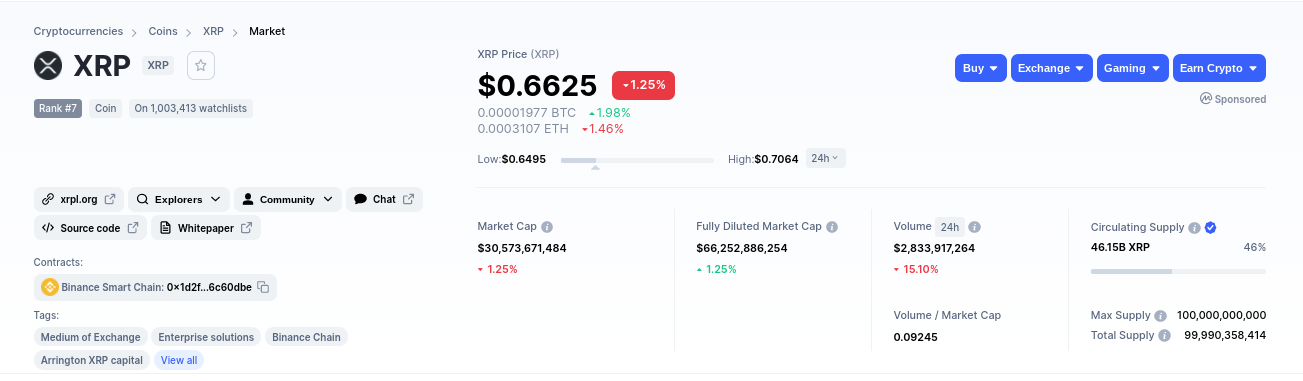

Another reason why people in the UK are interested in Ripple is that its XRP token is considered cheap. This is because, at the time of writing, you will pay just $0.66 per token – which is about £0.48. This means that for an investment of just £48 – you would get 100 XRP tokens. This allows you to build a sizable position with a small capital outlay.

Past Performance

Like a lot of digital currencies, Ripple has experienced a significant valuation increase since the token was launched in 2013. According to CoinMarketCap, XRP was priced at just $0.005 per token back then. Fast forward to early 2018 and the same crypto-asset breached a price of $3.40.

Although the cryptocurrency has since retreated, at current levels of $0.66 per token this still represents a huge amount of profit for those investing back in 2013. In fact, this translates into gains of over 13,000%.

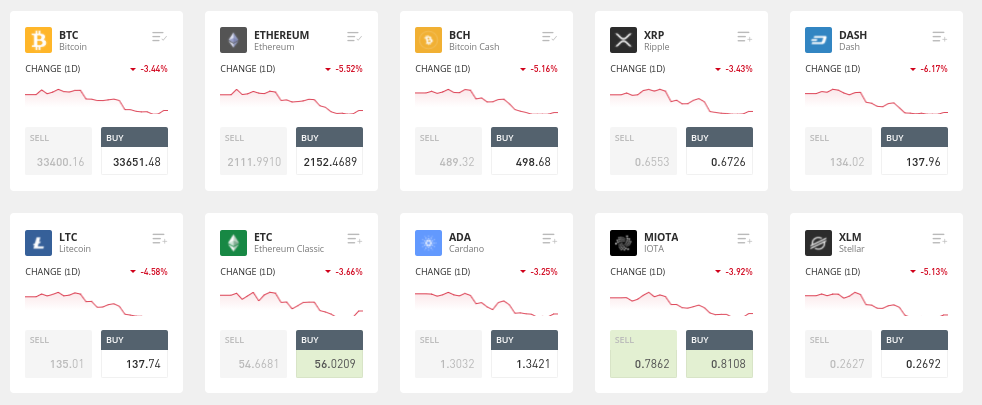

Less Volatile Than Many Other Cryptocurrencies

Based on current prices, Ripple and its XRP token are carrying a market capitalization of over $30 billion. Such a large valuation ensures that unlike many other digital currencies in this industry, XRP is a lot less volatile. This means that wild pricing swings won’t be as frequent when investing in Ripple – at least in comparison to the wider market.

Buy the Dip

Just over two months prior to writing this guide on how to buy Ripple – XRP was trading at $1.93. As noted just a moment ago, XRP has since fallen back to the $0.66 level.

While this does represent a rapid decline, if you believe in the long-term potential of Ripple then this does allow you to buy the digital asset at a reduced price. If XRP is able to recover its previous 2021 highs of $1.93 – this would require an upswing of over 190%.

The Cost of Buying Ripple

If you want to buy Ripple online in the UK – you will need to check what fees your chosen broker charges. The main fees to consider are discussed below.

Deposit Fees

When using fiat currency to deposit funds into the cryptocurrency broker – fees usually apply. For example, debit/credit card deposits are usually the most expensive – with Coinbase and Binance charging 3.99% and 1.8% respectively. Bank transfers via the Faster Payments Network are usually free.

We found that eToro is the most competitive in the payment fee department – as the platform charges 0.5% across all of the supported deposit types.

XRP Trading Fees

You often need to pay a commission to buy XRP in the UK. This will be charged against the value of your trade. For example, Coinjar charges a commission of 1% – so a £1,000 trade would cost you £10.

Then, if you sell your XRP tokens back to cash when they are worth £1,500 – your 1% commission will amount to £15. eToro, on the other hand, will only charge you the difference between the buy and sell price – otherwise known as the spread.

Ripple Wallet Fees

When storing your tokens in a private Ripple wallet – you need to lock away 20 XRP. This is to prevent the Ripple network from a global spam attack. You won’t be able to touch that 20 XRP for as long as you wish to keep the wallet active.

Risks of Buying Ripple in the UK

Before buying XRP in the UK – make sure you consider the risks involved.

The three main risks that we identified are discussed below:

Success is not Guaranteed

Although Ripple has formed partnerships with a significant number of banks and financial institutions, there is no guarantee that the underlying technology will revolutionize the cross-border payments industry.

In fact, there is every reason to believe that SWIFT – which currently holds the monopoly in this space, will eventually bring out a framework that operates in a similar nature to Ripple.

XRP Liquidity is Only Needed for a Few Seconds

When XRP is used as a liquidity bridge to facilitate cross-border payments for competing currencies – it is only needed for a few seconds. This means that the upside potential on XRP could be somewhat limited.

Furthermore, the team at Ripple might be keen on the value of XRP modest – otherwise, this will result in transactions being too expensive for financial institutions using the technology.

54% of XRP Supply Held by Ripple

The total supply of XRP tokens is 100 billion. Of this figure, approximately 46 billion – or 46%, is already in circulation. This does, however, mean that the team at Ripple is in possession of 54% of the total supply of XRP. Many would argue that this means Ripple isn’t decentralized at all – not least because the majority of tokens are held by a centralized entity.

Selling Ripple: A Quick Overview

If you’re wondering how to sell Ripple – the process depends on where you are storing your XRP tokens. For example, if the tokens are currently being held in a Ripple wallet, you will need to transfer them to a cryptocurrency exchange that supports your preferred market. In other words, if you want to sell Ripple back to pounds and pence – the exchange needs to support XRP/GBP.

On the other hand, if you bought Ripple from a regulated online broker and decided to keep the tokens there – cashing out could not be easiesr. For instance, at eToro, you simply need to sell the XRP tokens from within your portfolio. The funds will then be added to your eToro account – ready to be withdrawn.

How to Buy Ripple UK – Conclusion

In summary, you should now know how to buy Ripple in the UK with your preferred payment method. The most important thing is that you only use a regulated broker that has a great reputation for safety and client protection.

We found that the best way to invest in XRP in the UK is through eToro – which is regulated by the FCA. Getting started with an account takes minutes and you can then buy Ripple instantly with a debit/credit card or e-wallet.

eToro – Best FCA Broker Buy Ripple (XRP) UK

Cryptoassets are highly volatile unregulated investment products. No EU investor protection. 67% of retail investor accounts lose money when trading CFDs with this provider.