What Happened: A new report from Coinbase Global Inc (NASDAQ:COIN) revealed that Ethereum (CRYPTO: ETH) outperformed all other benchmark assets, including Bitcoin (CRYPTO: BTC) during the first half of 2021.

“The second most valuable crypto asset appreciated 895% over the 12-month period and 210% over the 6-month period ending June 30,” read the report.

Coinbase attributed Ethereum’s performance to a handful of factors like the increasing usage of DeFi protocols built on Ethereum and investor optimism around the network’s transition to a proof-of-stake consensus mechanism with ETH 2.0.

The report also found that the anticipated rollout of EIP-1559, which will burn ETH gas fees as the network is used, thereby decreasing the supply of ETH and the rise of scaling solutions like Polygon (CRYPTO: MATIC), improving the network’s throughput, also played a part in the asset’s price appreciation.

“Many of our largest institutional clients, including hedge funds, endowments, and corporates, increased or added first-time exposure to ETH in H1, believing the asset has long-term staying power tantamount to BTC’s while playing a differentiated role in their portfolios,” stated Coinbase.

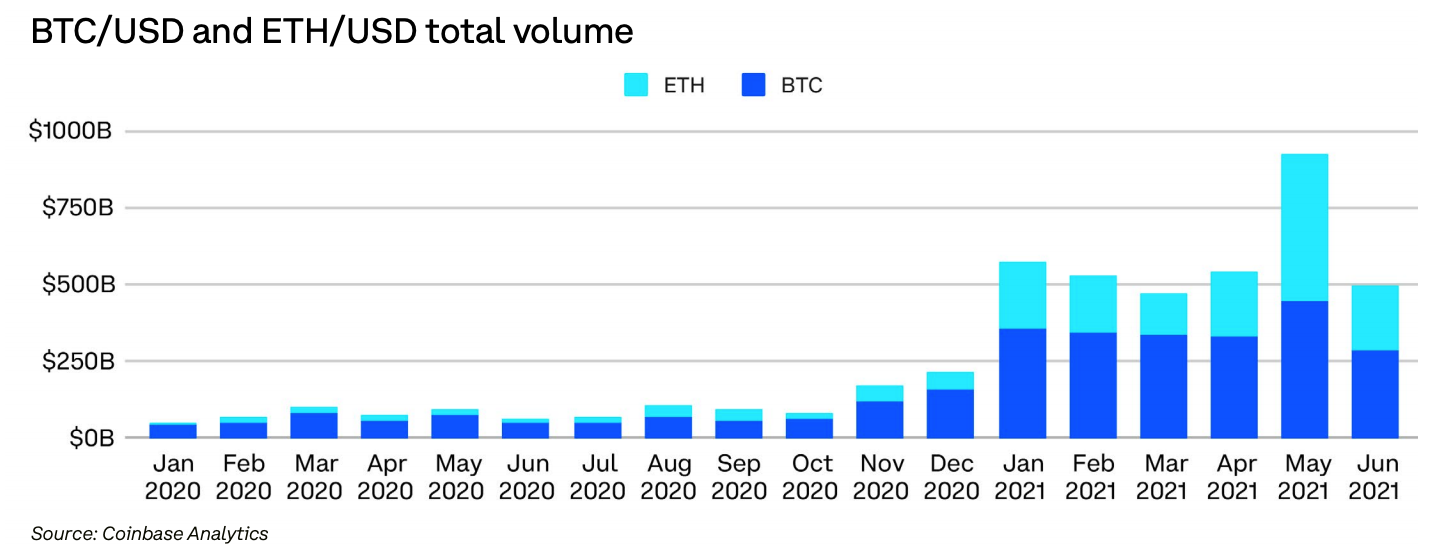

Ethereum’s trading volume across major exchanges also grew more significantly than Bitcoin’s over the past six months. According to the report, total BTC volume for the period reached $2.1 trillion, up 489% from $356 billion over the same period in 2020. Total ETH volume, on the other hand, reached $1.4 trillion, up 1,461% from $92 billion in H1 2020.

Price Action: At press time, Bitcoin was trading at $39,481, gaining 4.34% over the past 24-hours.

Ethereum was up 2.21% over the same period, trading at a price of $2,282 at the time of writing.

Read also: Crypto Exchanges Binance And FTX Reduce Max Leverage From 100x To 20x