Shares of Coinbase Global, Inc. ( NASDAQ:COIN ) have trended lower ever since the company’s IPO in April this year. This isn’t surprising as the prices of Bitcoin and most other cryptocurrencies have also trended lower since April. It seems that the share price is being driven by sentiment rather than fundamentals, which often leads to a stock becoming either over or undervalued.

By comparing Coinbase’s PE ratio to the market and industry we can get a sense of how optimistic the market is. We can then look at the outlook for the company to get an idea of whether or not there may be an investment opportunity.

Coinbase earns most of its revenue from transaction fees from cryptocurrency trading. This means its revenue depends on both the prices and trading volumes of crypto assets. Trading volumes and crypto prices are both falling which is bad news for Coinbase.

But it’s not all bad news if Coinbase can grow revenue despite the lower crypto prices. The company’s CEO, Brian Armstrong, recently indicated that the exchange plans to list every legal crypto asset . This will give it a competitive advantage versus PayPal and Square, which are limiting their crypto wallets to Bitcoin and possibly Ethereum.

What can we Learn from Coinbase’s PE ratio?

Coinbase is currently trading on a PE of 38.6. This is more than twice the broader equity market’s PE of 18.6 and nearly three times the PE of the US Capital Markets industry which is 13.9. This implies that that market still expects Coinbase to grow its earnings at a much higher rate than both its industry and the broader market.

View our latest analysis for Coinbase Global

NasdaqGS:COIN Price Based on Past Earnings July 20th 2021

Is There Enough Growth for Coinbase Global?

Coinbase Global’s P/E ratio would be typical for a company that’s expected to deliver very strong growth, and importantly, perform much better than the market.

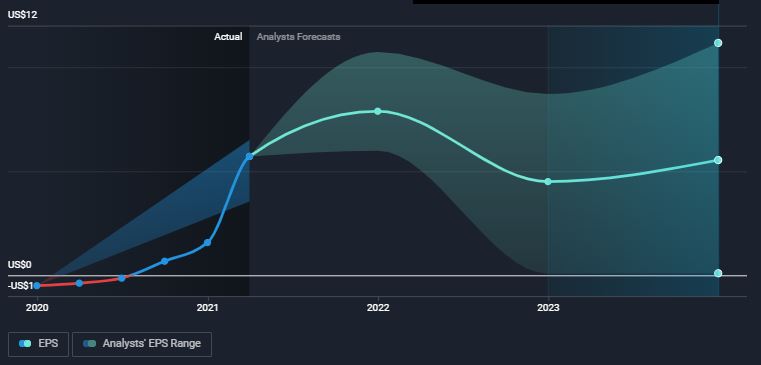

If we look at the historical and expected EPS growth, we can make two observations. Firstly, earnings growth is expected to slow dramatically in the next six months and earnings are forecast to fall next year. Secondly, there is a very wide gap between the highest and lowest forecast, even for December which is just five months away. This indicates that there is very little certainty about earnings, which isn’t surprising given the volatility of crypto assets.

NasdaqGS:COIN Earnings per Share Growth Forecasts

What Can We Learn From Coinbase Global’s P/E?

We’d say the price-to-earnings ratio’s power isn’t primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations. You can also see an estimate of the fair value based on analyst forecasts here , but as mentioned these estimates have a very wide range.

The high PE ratio for Coinbase does suggest the market is still very optimistic when we compare it to growth forecasts. Of course, if crypto prices rise again those forecasts will rise – and if crypto prices fall further, forecasts will fall. We have also identified 2 other warning signs for Coinbase Global that you may want to be aware of.

We would suggest checking Coinbase’s quarterly earnings releases to see if the company’s revenue is falling at a slower rate than crypto prices are falling. This would indicate that Coinbase is growing its customer base or that trading volumes are rising.

The stock may well continue to trade based on sentiment with little regard to fundamentals. Remember though, if earnings fall and the stock price rises or remains around $220, the PE will rise even more. This will imply even more growth is needed to justify the valuation, and there will be more risk for investors.

If P/E ratios interest you , you may wish to see this free collection of other companies that have grown earnings strongly and trade on P/E’s below 20x.

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned . This article is general in nature. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Promoted

When trading Coinbase Global or any other investment, use the platform considered by many to be the Professional’s Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com