The market capitalization of all 10,722 cryptocurrencies in existence is around $1.42 trillion on Wednesday and during the last 24 hours, all of these crypto-assets combined lost 3.92%. Meanwhile, bitcoin captures 45.73% of the entire $1.42 trillion capitalization and ethereum commands 17.8%. As both of these leading assets have improved this week, seven-day changes against the U.S. dollar show a great number of other crypto-assets have seen much bigger double-digit gains.

Steemit Coins, 51% Attacked Tokens, and Forgotten Crypto Assets

An interesting assortment of crypto assets have seen double-digit gains as larger competitors like bitcoin (BTC) and ethereum (ETH) have seen weaker improvements. For instance, BTC has gained 2.74% against the U.S. dollar during the last seven days.

ETH has jumped close to 10%, but not quite, with an 8.89% rise over the last week. While they are at the very least weekly improvements against the dollar, a number of unconventional crypto assets have jumped much higher.

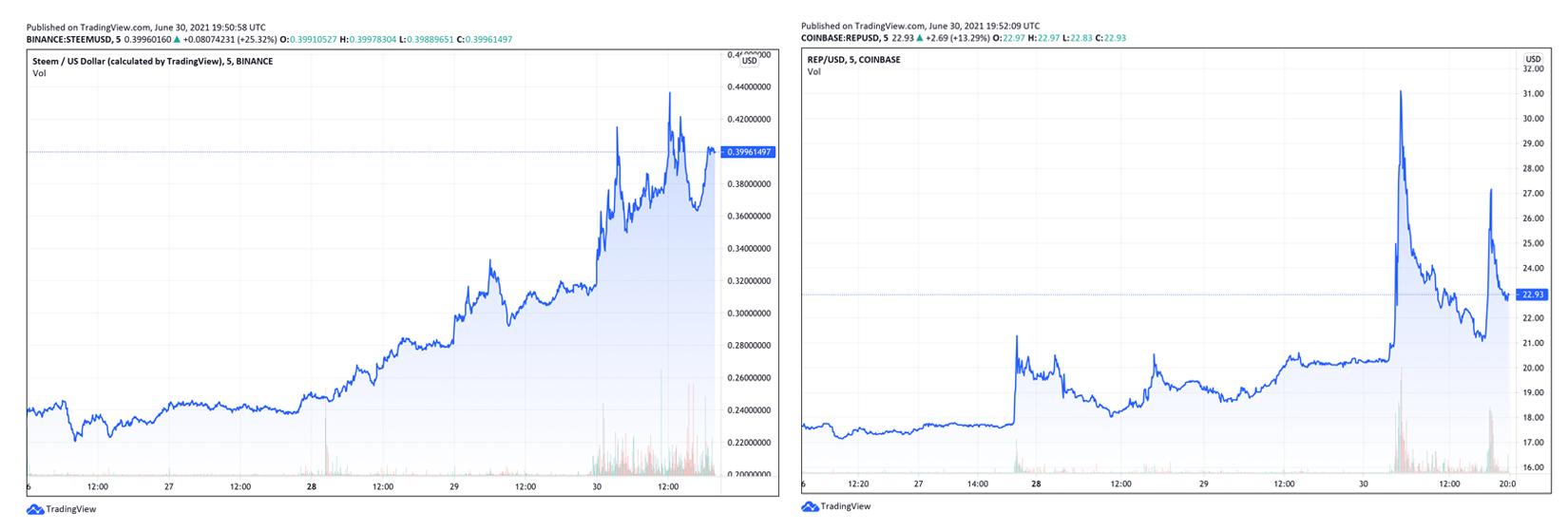

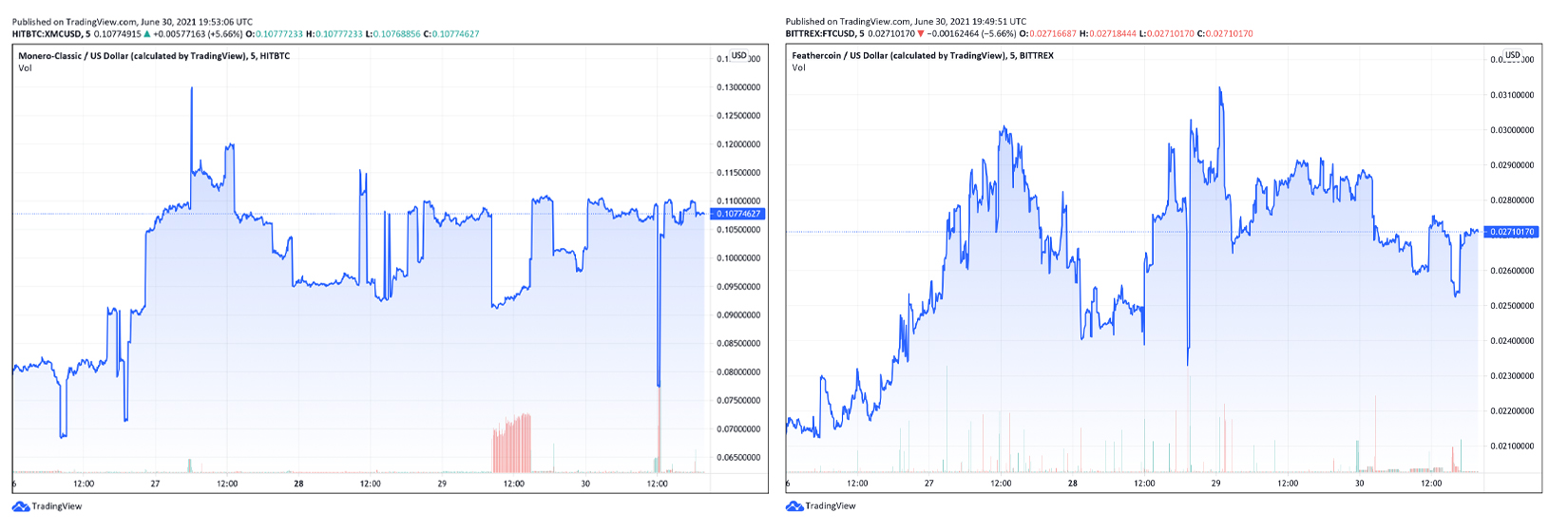

Steem (STEEM) has gained 54% this week and the crypto asset’s cousin steem dollars (SBD) spiked over 31% during the last seven days. The two digital currencies are leveraged for upvoting and tips on the Steemit blogging platform.

Below, steem’s 54% rise, the prediction market crypto-asset augur (REP) jumped 51%. REP tokens are used in the Augur system to give users the ability to create a prediction market on any topic. Another unconventional rise this week was monero classic’s (XMC) 45% jump. XMC is a fork of the privacy coin monero (XMR).

Then crypto assets that have seen 51% attacks, also saw double-digit gains this week. For example, below XMC’s rise, the digital currency vertcoin (VTC) rose 40% during the last seven days. And the coin below VTC, which has also been 51% attacked, is bitcoin gold (BTG) rising 38% this week.

Seven-day changes against the U.S. dollar also show the 51% attacked ethereum classic (ETC) saw a 31% rise during the trailing seven-day week. Interestingly, a forgotten digital currency launched on April 16, 2013, feathercoin (FTC) has gained 29% this week.

FTC is an ancient coin that used to be a top ten crypto market cap contender, but today feathercoin holds the 100th position. Market aggregators also show that Vinny Lingham’s civic (CVC) token has jumped 26% over seven days.

The newer meme-based ERC20 token, that shares the concept of dogecoin (DOGE), shiba inu (SHIB) rose 22% during the course of the week. While seven-day gains have been higher for these crypto coins, 24-hour statistics have been different. For example, ETC is down -1.57% on Monday, VTC -4.12%, and FTC is down -8.29%.

What do you think about the double-digit gains seen by this unique bunch of crypto assets? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, tradingview,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.