Graph Blockchain: Exposure to Altcoin and other DeFi Opportunities

This Graph Blockchain profile is part of a paid investor education campaign.*

Overview:

While Bitcoin and Etherium have long been the major names in the cryptocurrency space, competitors are emerging every day. These new coins, “altcoins”, are creating value by capitalizing on alternative coins after Tesla announced it will suspend Bitcoin payments over environmental concerns. Although Bitcoin’s price is still up by almost 12 percent in the market as of June 2021, altcoins are showing an increase of over 10 percent after investors started diversifying into a total of $27 million in inflows.

While investors may be eager to enter into the altcoin space, one thing that may hold them back is the sheer number of altcoins in existence. In fact, the total number of altcoins in existence sits at somewhere around 7,800, according to data from CoinGecko. With such a large number of coins, it would be extremely difficult for individuals to evaluate each one to determine their value. Factors such as their use case, circulating supply, and the team behind the project can all have an impact on future value.

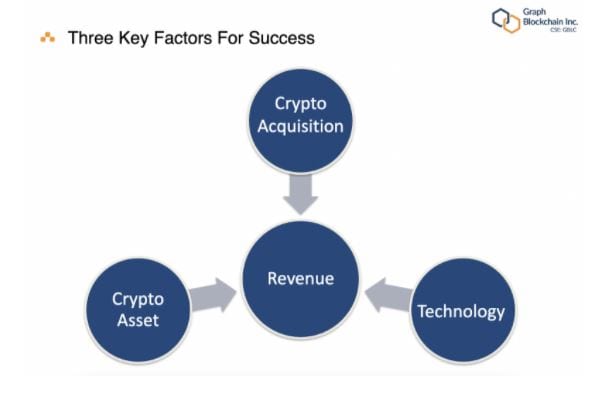

Graph Blockchain (CSE:GBLC) is a Canadian company that operates in the Decentralized Finance (DeFi) space providing investors with the opportunity to gain exposure to the altcoins market. The company is also refocusing blockchain solutions from private blockchains to public blockchains opening significant interest and opportunities in various segments like insurance solutions, lending and borrowing, exchanges (crypto and synthetic assets) and the derivatives markets.

Graph Blockchain is in a unique position as the first mover in public markets building a diversified crypto enterprise. The Company has deployed C$2 million as staking capital. $1,000,000 has been deployed into the Polkadot (“DOT Token”) and $500,000 into the Cardano (“ADA Token”) on April 5, 2021 The remaining C$500,000 was deployed into its third cryptocurrency Chainlink’s token (“LINK Token”) which is the company’s best performing investment increasing over 45 percent since the time it was acquired. The company’s fourth coin XTZ earned an investment increase of over 17 percent on the first day. While ADA is up over 30 percent.

CEO Paul Haber stated in an interview with INN, “some of these altcoins we are looking at are very hard for people to acquire. I think we’ve got a much broader reach than most retail investors. We have an experienced team that’s looking at over 6,000 altcoins. As a retail investor, you can allow us to sift through all that stuff, do the analysis, do the research, kind of like getting that research report from your brokerage firm and participate alongside us.”

The company is well-capitalized, with a C$10 million dollar round of financing led by HC Wainwright & Co. in April of 2021. The raise not only provides the company with capital to deploy into the purchasing of altcoins, but also acts as a signal of confidence. HC Wainwright & Co. is one of the leading investment banks in the cryptocurrency and Bitcoin space. The move is also significant as it represents the first investment into a crypto company by HC Wainwright & Co outside of the United States.

The company’s recent acquisition of Babbage mining is another important step that has allowed Graph Blockchain to provide investors with the only public exposure to altcoins on the market. Outside of altcoins, the company is also actively looking forward and exploring new areas within the DeFi sector. The blockchain technology behind Bitcoin and other coins has proven to have significant value behind cryptocurrencies.

Through a series of acquisitions, the company has positioned itself to not only take advantage of the current DeFi environment, but also plan for the future. An example of this forward-thinking approach is the recent acquisition of New World, a company that is focused on non-fungible tokens (NFTs), which have exploded in popularity as of late.

Graph Blockchain’s Company Highlights:

- Graph Blockchain is a Canadian company that focuses on investing in altcoins that have future growth potential.

- Graph Blockchain allows investors to gain exposure to coins that may not be easily accessible for retail investors.

- The acquisition of Babbage mining has allowed Graph Blockchain to provide investors with the only public exposure to altcoins on the market today.

- The company is well-capitalized, with C$10 million in funding coming from leading investment bank HC Wainwright & Co. in April of 2021.

- Aside from altcoins, the company also actively looks for opportunities to take advantage of other opportunities in the Decentralized Finance (DeFi) space.

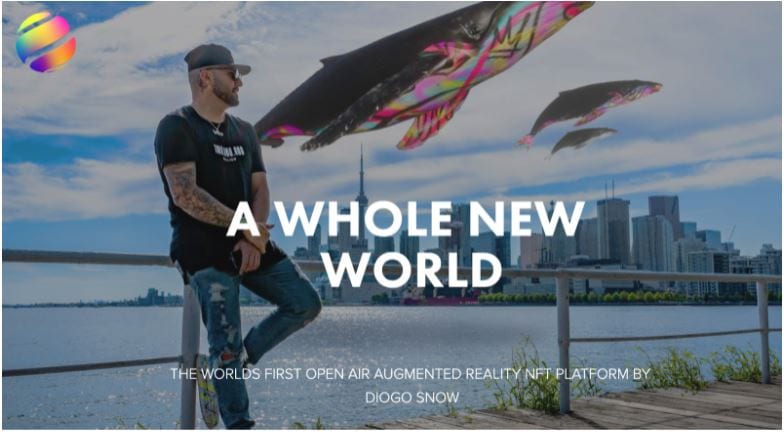

- Recently, the company acquired New World, an augmented reality non-fungible token (NFT) company that is well-positioned to take advantage of the newfound popularity of NFTs.

Graph Blockchain’s Key Acquisitions:

New World

In June of 2021, Graph Blockchain announced the signing of a letter of intent to acquire New World Inc, an augmented reality art-focused non-fungible token (NFT) company that allows creators, musicians, and celebrities to have access to an NFT distribution canvas to create and sell digital art.

The NFT market has exploded in popularity, with sales of NFTs in the first quarter of 2021 estimated to be around US$2 billion. The sale of NFTs is completed on the blockchain, allowing creators, musicians, and celebrities to distribute unique digital art.

New World has built this platform and has already signed such notable artists as Diogo Snow, who has produced numerous pieces for celebrity clients including Drake, and Fetty Wap, an American rapper, singer and songwriter, who has over 6.5 million Instagram Followers, as well as many others.

Beyond the Moon

In May of 2021, Graph Blockchain announced that they had entered into a letter of intent to acquire Beyond the Moon Inc., a Crypto Launchpads service provider. Launchpads, which are crypto projects designed to promote and introduce upcoming projects to the crypto market,

are one of the most exciting opportunities in the crypto space today. By helping early stage cryptocurrencies Beyond the Moon gains access to the first public investment round, called an Initial DEX Offering (IDO). Early access to crypto projects is difficult to access but provides the highest potential return on investment in the space.

Graph Blockchain’s Management Team

Paul Haber — Chief Executive Officer

Paul Haber has been involved in corporate finance and capital markets for over 25 years as an banker, investor and entrepreneur. He has served as the CFO and Audit Committee Chair of many public and private companies. Haber started his career with Coopers& Lybrand, now PwC LLP. He is both a Chartered Accountant and a Certified Public Accountant, with an Honours Bachelors of Arts Degree in Management from the University of Toronto. Haber was awarded his Chartered Director designation from the DeGroote School of Business in partnership with the Conference Board of Canada.

Andrew Ryu — Chairman

Andrew Ryu is a seasoned and experienced entrepreneur and operator in public and private companies with over 20 years of experience. As a graduate of McMaster University and University of Toronto, he became the founder and CEO of TLA Inc., president of business development of Archer Education Group and founder and former CEO of Loyalist Group Limited (TSXV:LOY), which was nominated as the top TSXV company in 2013, ranked fourth in 2014 and was the top pick of the street in 2014. He was nominated as EY Entrepreneur of the Year in 2014. He served as interim CEO and Chairman of Graph Blockchain Inc. (CSE: GBLC). As a founder of the Company, he served as CEO from 2016 until recent.

Don Shim — Chief Financial Officer

Don Shim has led a successful accounting and finance career in both the US and Canada. He brings a wealth of knowledge to the team with his expertise in auditing publicly traded junior mining companies and high tech industries. Shim is a member of theChartered Professional Accountants of British Columbia and a Certified Public Accountant registered in the State of Illinois, United States. In addition, Shim is an audit partner on numerous audit engagements for various publicly traded companies, primarily focusing on junior mining, oil and gas, pharmaceutical, and high tech industries. Shim also assisted various start up companies in achieving public listings on the TSX Venture Exchange, Canadian Securities Exchange and the OTC Market. In addition, Shim teaches accounting at a local college in Vancouver and acts as a facilitator at CPA Western School of Business, mentoring CPA candidates enrolled in the CPA Professional Education Program.

*Disclaimer: This profile is sponsored by Graph Blockchain (CSE:GBLC). This profile provides information that was sourced by the Investing News Network (INN) and approved by Graph Blockchain, in order to help investors learn more about the company. Graph Blockchain is a client of INN. The company’s campaign fees pay for INN to create and update this profile.

INN does not provide investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. INN does not endorse or recommend the business, products, services or securities of any company profiled.

The information contained here is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Readers should conduct their own research for all information publicly available concerning the company. Prior to making any investment decision, it is recommended that readers consult directly with Graph Blockchain and seek advice from a qualified investment advisor.