ETH’s bi-weekly losses currently lay north of the 20% mark.

- Due to a lack of certainty surrounding the upcoming London Hardfork’s launch date, experts believe ETH can be faced with even more volatility in the near term.

- Technical indicators suggest that Ether may dip as low as AU $1,880 in the days to come.

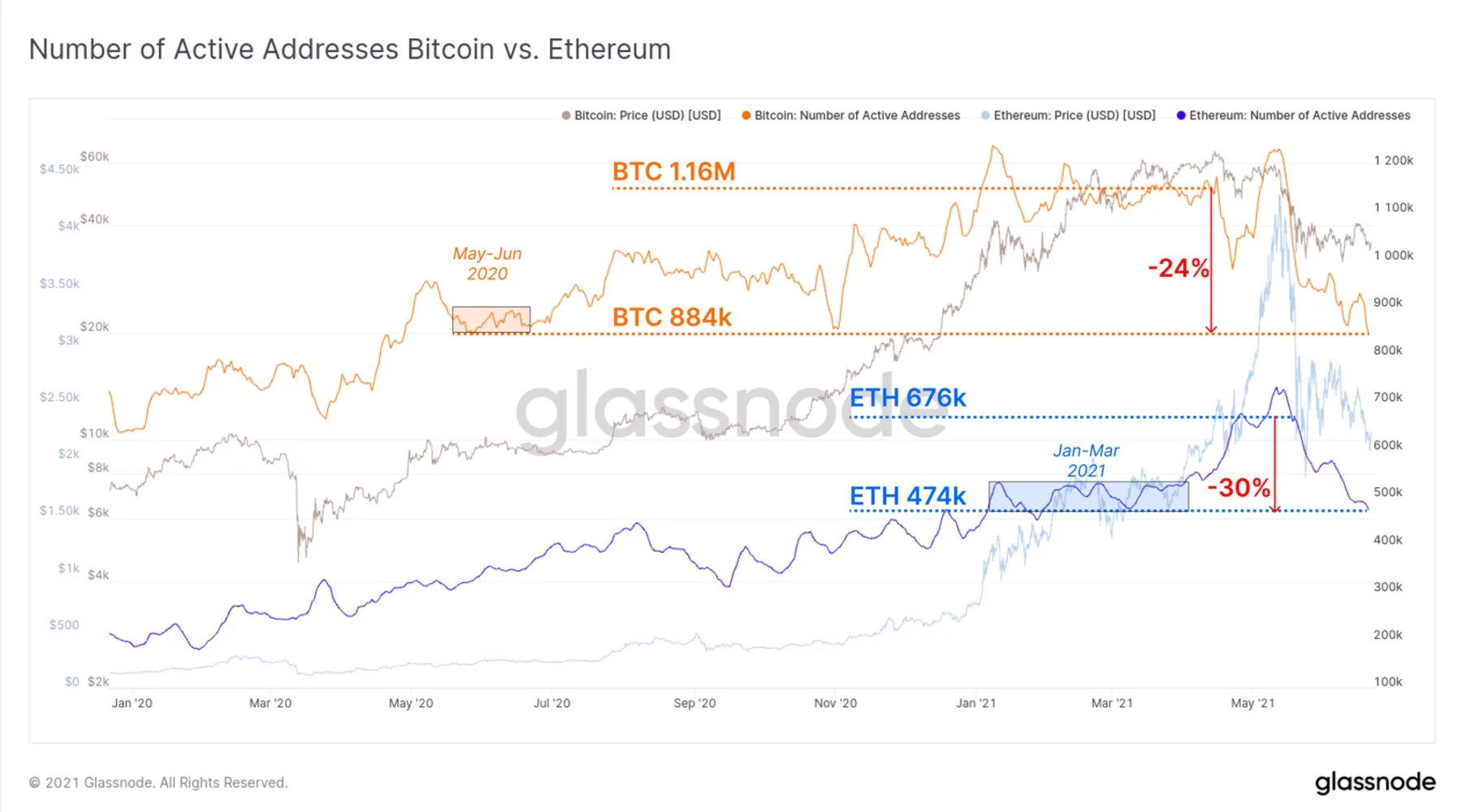

- The total number of active Ether wallet addresses have dropped by over 30% since May.

As the crypto market continues to struggle, Ethereum in particular seems to have been on the receiving end of a lot of negative market action that has seen the value of ETH crumble from it’s all time high of around AU $5,500 to under AU$2,650 — representing a loss of over 53%. At press time, the altcoin is trading at $1993.

To get an idea of what may be in store for Ether in the near to mid term, Finder reached out to Victor Kochetov, CEO of Malta-based cryptocurrency exchange Kyrrex. In his estimation, the coming months will most likely see the altcoin follow a “downward impulse”, potentially taking the currency all the way down to a target level of AU $2,640. He further added:

“With a greater degree of probability, this target will be broken, followed by a move to 100% of the 4th point of the downward impulse, namely to a price level of around AU $1,880.”

Similarly, Gregory Klumov, CEO of stablecoin platform Stasis, is of the view that because of the uncertainty surrounding the upcoming London Hardfork — which contains the highly awaited EIP 1559 — ETH will most likely be faced with even wilder levels of turbulence in the near term.

As a quick refresher, the aforementioned London Hardfork was scheduled to go live next month, however, as of now there is no exact date as to when its implementation will take place. Furthermore, it should be pointed out that the upgrade contains certain EIPs that seek to mitigate Ethereum’s existing gas-fee related woes (which reached their peak earlier this year during February and April).

Technical indicators seem to be unfavorable for Ether

While ETH’s intense negative price action over the past 72 hours may have come as a surprise to many, a number of indicators seemed to have already been hinting in the direction for some time now. For starters, data released by crypto analytics provider Glassnode shows that since May, the total number of active addresses in relation to Ethereum have dipped by an insane 30%.

Total number of active ETH and BTC wallet addresses (source: Glassnode)

Not only that, even the total volume of USD-based transactions being settled on the Ethereum ecosystem have dropped by a whopping 65% over the above stated time window. And while such dips in network activity can be construed as being general drops in investor enthusiasm, it is worth noting that most people who accrued heavy sums of ETH earlier this year may now be looking to sell their holdings, so as to avoid going into heavy losses.

Interested in cryptocurrency? Learn more about the basics with our beginner’s guide to Bitcoin, dive deeper by learning about Ethereum and see what blockchain can do with our simple guide to DeFi.

Disclosure: The author owns a range of cryptocurrencies at the time of writing

Disclaimer:

This information should not be interpreted as an endorsement of cryptocurrency or any specific provider,

service or offering. It is not a recommendation to trade. Cryptocurrencies are speculative, complex and

involve significant risks – they are highly volatile and sensitive to secondary activity. Performance

is unpredictable and past performance is no guarantee of future performance. Consider your own

circumstances, and obtain your own advice, before relying on this information. You should also verify

the nature of any product or service (including its legal status and relevant regulatory requirements)

and consult the relevant Regulators’ websites before making any decision. Finder, or the author, may

have holdings in the cryptocurrencies discussed.