Polygon looks set to break out in July, while Bitcoin and Ethereum continue to stagnate.

Sponsored by eToro Service (ARSN 637 489 466), promoted by eToro AUS Capital Pty Ltd (AFSL 491139). Your capital is at risk. Other fees apply. Invest in stocks with 0% commission, discover ETFs, buy and sell cryptocurrencies and trade CFDs on the world’s leading social trading platform. Find out more.

Sponsored by eToro Service (ARSN 637 489 466), promoted by eToro AUS Capital Pty Ltd (AFSL 491139). Your capital is at risk. Other fees apply. Invest in stocks with 0% commission, discover ETFs, buy and sell cryptocurrencies and trade CFDs on the world’s leading social trading platform. Find out more.July is set to be a bellwether month for cryptocurrency markets, as Bitcoin and Ethereum continue to skirt make-or-break support levels, following the worst quarter for Bitcoin since 2018.

Bitcoin continues to trend downward following a death cross in June – which was its first since March 2020, when global markets crashed under the weight of COVID-19. As such, a successful July is critical to maintain Bitcoin’s bullish narrative into the next half of 2021.

With the correlation between Bitcoin and Ethereum at its highest levels all year, and emerging evidence the recent altcoin season may be over, both assets look poised to carry markets with them, should they break out in either direction.

Let’s explore what major events are on the cards for July and what opportunities they present for traders.

Is altcoin season over?

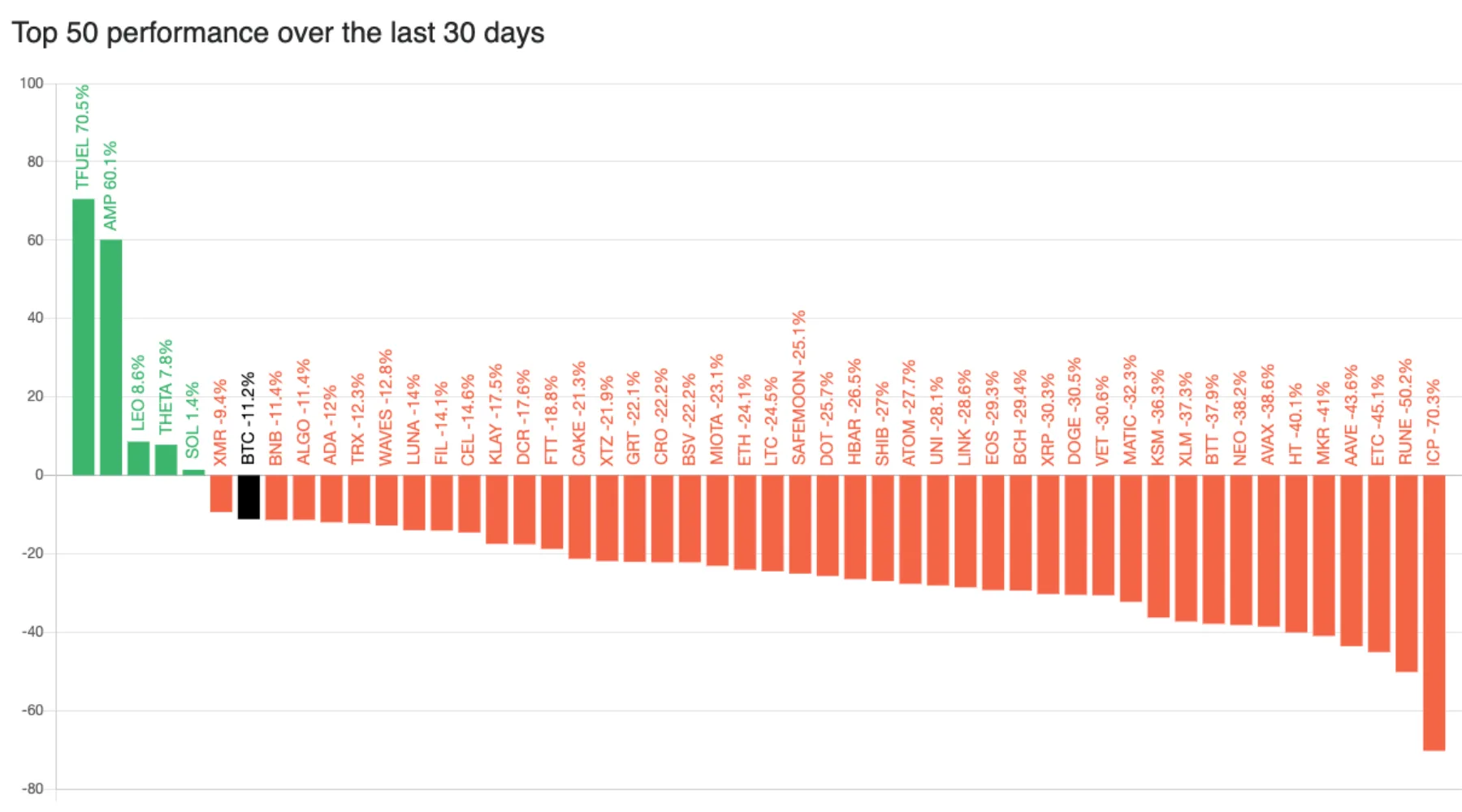

According to the Altcoin Season Index (ASI), which tracks the performance of the top 50 altcoins against Bitcoin, altcoin season may be coming to a close. This occurs when the price of Bitcoin begins to outperform the collective price movement of the top 50 altcoins by market capitalisation. Current data indicates that altcoins are losing value faster than Bitcoin.

47 of the top 50 altcoins by market capitalisation have lost more value than Bitcoin over the past 30 days. Source. Blockchaincentre.net

Data from CoinMarketCap supports this idea, with Bitcoin dominance increasing gradually over the past month, now accounting for 46% of the total market value of cryptocurrencies, up from 40% at the start of June.

On its own this increase in Bitcoin dominance looks relatively minor, but when the correlation between Bitcoin and Ethereum is taken into account, against the backdrop of a bear market, it starts to spell out warning signs for altcoins.

Bitcoin and Ethereum are currently at 0.78 correlation according to CoinMetrics, up from 0.55 at the start of the year.

This is important because Ethereum is commonly perceived as a leading indicator for the altcoin market (when Ethereum begins to decouple from Bitcoin in a bull market, then alts tend to follow). So a relatively high correlation right now suggests that if Bitcoin falls – so too will Ethereum and the altcoin market.

So what are the key levels to look out for throughout July? According to Josh Gilbert, analyst at eToro Australia (where crypto trades are CFDs), Bitcoin needs to move back above US$40,000 to recapture bullish sentiment.

“Looking at the technical levels as of the end of June, the bears seem to be in control. Bitcoin is trading below its 50 and 200 day moving average and would need to break through US$42,000 and US$43,000 for us to test the US$50,000 mark once again.”

Much of Bitcoin’s recent narrative has been based on macroeconomic factors, primarily the ability of Bitcoin to serve as a hedge against inflation, in particular the US dollar.

On that note, Gilbert identifies recent posturing by the US Federal Reserve as playing into Bitcoin’s macro case in the short term.

“I’m also keeping an eye on the inflation picture and the Fed’s dovish stance. Low rates continue to drive investors towards crypto assets, and the discussion of Bitcoin as an inflation hedge gets stronger. The challenge is to try and change the narrative and investors’ perception of Bitcoin. Whilst some argue that Bitcoin is a better store of value or inflation hedge, it is yet to be tested as a real inflation hedge given that inflation has been relatively low for many years.”

Fortunately, Bitcoin doesn’t have to break upward for altcoins to benefit.

While Bitcoin is likely to take altcoins down with it if it breaks a leg lower, its current sideways trend still gives enough room for altcoins and the DeFi space to breathe. As for Ethereum, the upcoming London hard fork looks set to give users even more breathing space – in the form of lower fees.

https://www.youtube.com/watch?v=RwiIFJ7FZXo?feature=oembed&enablejsapi=1

Ethereum packs its bags for London

Ethereum is considered a leading indicator for the rest of the altcoin market. This may be due to its status as the premier “altcoin” and home of DeFi, or because most altcoins operate as tokens on the Ethereum blockchain and thus their success is bound to Ethereum’s. Regardless of the reason, positive price action for ETH tends to have a flow-on effect to alts.

Ethereum’s Achilles heel is its inability to scale, which has resulted in a sky-high fee market with users paying up to $80 for a standard transaction in periods of peak congestion. Given that DeFi is Ethereum’s current killer application and that DeFi transactions tend to consist of multiple transactions at once, the fee market is by far Ethereum’s biggest problem right now.

Fortunately a solution is coming, in the form of the London hard fork, which is expected to provide a degree of relief to gas fees, while other upgrades like Optimism are still being worked on.

According to Gilbert, “The London Update [hard fork] will remove the function for users to select the gas fee they pay when making Ethereum Transactions. You will instead pay a base fee, an option to tip the miner. Users can also set up a fee cap to ensure that they don’t pay more than they wish. This upgrade will be significant for how users interact with Ethereum. The London hard fork is set to be temporary until Ethereum transitions to Ethereum 2.0, expected in 2022.”

The London hard fork doesn’t have a set release date yet, but will go live on Ethereum’s 3 main testnets between 24 June and 7 July, with a release on the mainnet expected to follow in the weeks after.

Despite this upgrade, Ethereum’s scaling issues are still likely to persist until it makes the full migration to Ethereum 2.0. This presents several opportunities in the meantime as Layer-2 technologies like Optimism and Polygon are relied upon to keep Ethereum functioning efficiently.

Polygon (MATIC): The start of a new economy?

Altcoin season might appear to be over, but a certain corner of the market is thriving.

Polygon is an Ethereum-compatible sidechain that supports an Ethereum-based DeFi economy for a fraction of the fees. Using Polygon for DeFi is about 100x cheaper than using Ethereum, which has caused the amount of assets deposited on Polygon – known as total value locked (TVL) – to skyrocket from US$4 billion in May to over US$8.44 billion by the end of June.

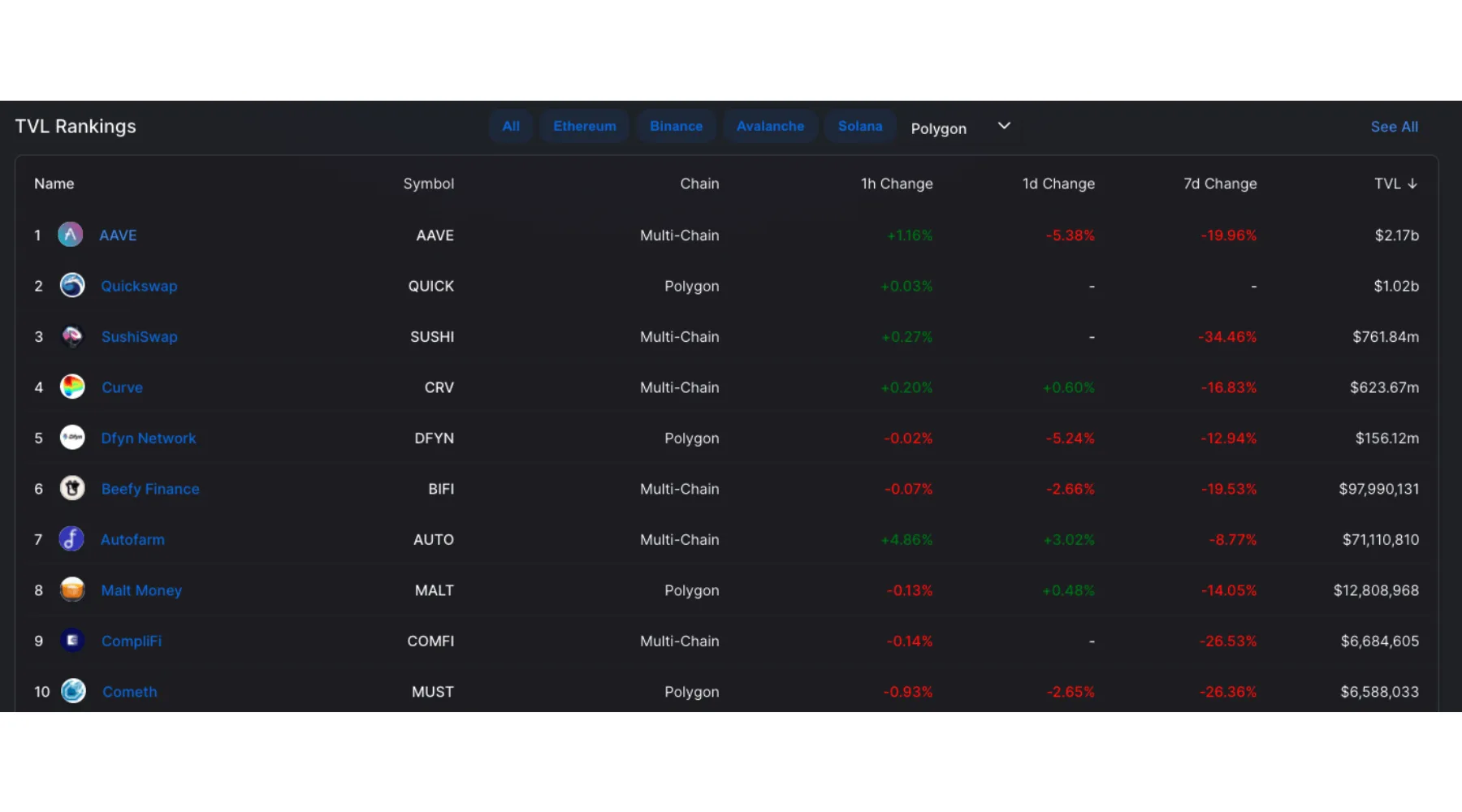

For comparison, the largest 3 DeFi protocols by TVL are AAVE (US$9.78 billion), Curve (US$8.83 billion) and Compound (US$6.07 billion) – with US$2.17 billion (21%) of AAVE’s total TVL already hosted on Polygon. Given that Ethereum’s scaling issues are likely to continue for the rest of the year, despite the upcoming London hard fork, growth of the Polygon network is likely to continue.

The total value of assets deposited on Polygon by various protocols. Source: DeFiLlama.

The catch is that existing DeFi protocols need to create a version of their platform that is compatible with Polygon as well as Ethereum. This is because assets first need to be transferred from Ethereum onto the Polygon sidechain to be traded. As a result, a new token economy has erupted on Polygon, spurred by a series of new and existing DeFi protocols.

Let’s take a look at some of the most prominent protocols and their associated tokens that have begun capturing market share on Polygon.

MATIC – MATIC is the native token of the Polygon network and is used to pay for gas fees, much the same way as ETH is used on Ethereum. As such every Polygon user must have some MATIC in their wallet in order to use the network.

AAVE – AAVE is by far the most prominent DeFi platform on both Polygon and Ethereum, with over US$2 billion of its US$9.78 billion TVL now migrated over to Polygon.

SushiSwap (SUSHI) – SushiSwap was one of the first DEXs to adopt Polygon and has quickly become one of the leading protocols on the network with roughly a third of its total TVL now on Polygon.

QuickSwap (QUICK) – Quickswap is essentially a Uniswap clone tailored for Polygon and similarly offers users the chance to earn revenue by being a liquidity provider.

Polycat Finance (FISH) – Polycat finance is an ambitious-looking project that could be described as a version of Yearn Finance for Polygon. It offers automated yield farming as well as farms and vaults.

Given the amount of protocols announcing their intention to support Polygon, and with Ethereum’s scaling issues far from over, it seems likely that Polygon’s capture of the Ethereum market is set to continue.

Disclaimer:

This information should not be interpreted as an endorsement of cryptocurrency or any specific provider,

service or offering. It is not a recommendation to trade. Cryptocurrencies are speculative, complex and

involve significant risks – they are highly volatile and sensitive to secondary activity. Performance

is unpredictable and past performance is no guarantee of future performance. Consider your own

circumstances, and obtain your own advice, before relying on this information. You should also verify

the nature of any product or service (including its legal status and relevant regulatory requirements)

and consult the relevant Regulators’ websites before making any decision. Finder, or the author, may

have holdings in the cryptocurrencies discussed.

Disclosure: The author holds cryptocurrencies including LINK at the time of writing

Picture: Getty

Trade with eToro

Compare other cryptocurrency exchanges here