Ripple released its Q1 2021 report showing a solid performance during the first quarter of the year.

This includes XRP sales that were up by almost 100% compared to the previous quarter and data showing accumulation from “whale” (holders of a large number of tokens) wallets, despite the ongoing US Securities and Exchange Commission (SEC) lawsuit.

XRP advocates have grown in confidence as the lawsuit has gone on. In part, this is thanks to reports of the questionable events surrounding the case.

The New York Times recently posted an article on the “revolving door” appointment of former SEC Chair Jay Clayton at One River. This hedge fund is reported as a big buyer of Bitcoin and Ethereum, sparking concerns of a conflict of interest.

Ripple is off to a flying start in 2021

As reported by Ripple, Q1 2021 for the cryptocurrency space as a whole has been a groundbreaking period. The total crypto market cap started the year at $776 billion, forming a steady uptrend to end the quarter at its highest point in the period, at $2.5 trillion.

Ripple’s XRP sales hit $150 million in Q1 2021 versus $76 million in Q4 2020, an increase of 97%. The firm said its On-Demand Liquidity (ODL) service contributed to the jump. ODL refers to the cross-border payment solution using XRP without the need to pre-fund accounts.

Ripple attributes sales growth to “deeper engagement from key ODL customers.” It also mentioned a drive to expand ODL corridors in the APAC region, focusing on Southeast Asia in the first instance.

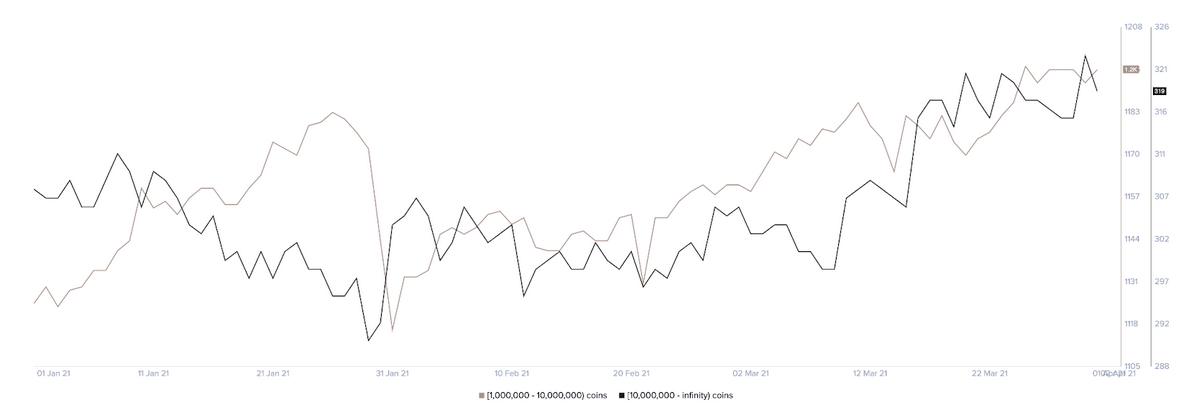

As well as that, data shows Q1 2021 was a period of XRP accumulation by whales. The number of “whale” wallets, defined as wallets holding at least 10 million XRP, increased from 308 to 319.

Likewise, the number of wallets holding between 1 million and 10 million XRP also went up from 1,125 to 1,196.

Source: ripple.com

Former SEC Chair under the spotlight

In late December, the SEC filed charges against Ripple over allegations that it, along with two key executives, sold $1.3 billion of unregistered securities over a seven-year period.

One of the oddities that soon emerged was the resignation of Jay Clayton, as SEC Chair, the day after bringing charges. The circumstances triggered some to consider whether ulterior motives for bringing the case were at play.

A critical component of Ripple’s defense is its assumption that XRP is the same, from a securities point of view, like Bitcoin and Ethereum, which the SEC deems non-securities. However, the SEC says Ripple was wrong to make that assumption.

In March, Jay Clayton joined One River Digital Asset Management as a paid advisor. This firm invests hundreds of millions into Bitcoin and Ethereum.

While this information is nothing new, The New York Times piece details the scale of “revolving door” appointments which sees many former public officials, not just Clayton, end up landing senior industry posts.

The question is, are these former politicians and civil servants doing what they do, or is something more insidious at play?

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

Like what you see? Subscribe for updates.