Crypto at a glance

It was the so-called ‘Ethereum killers’ day to shine yesterday, with the likes of Cardano (ADA) and Ethereum Classic (ETC) continuing to soar. ADA hit a new all-time high of $1.70, as the project continues its march towards the long-awaited introduction of smart contracts.

ETC, meanwhile, was up another 40 per cent to $133. It’s now up more than 280 per cent over the last week – astonishing for a project that’s hit so many snags over the last year. Will they really give Ethereum a run for its money, or are they simply basking in its glow at the moment as traders look for growth potential in alternatives with a similar value proposition?

They’ll certainly have a battle on their hands if they do, with Ethereum continuing to see gains. It came within a nose hair of $3,600 yesterday, before falling back again to the $3,450 level. The smart contract giant is currently the 20th largest asset by market capitalisation, having this week flipped Mastercard, Walmart and Bank of America. It’s now got JP Morgan within its sights. Will it manage to overtake the US banking giant and recovering-crypto sceptic this weekend? Is it due a correction, or can it ride a wave to $5,000.

Bitcoin also had a strong day of trading yesterday, despite its market dominance falling again. It currently accounts for just 45 per cent of the total crypto market – a low not seen since July 2018. The leading cryptocurrency’s price hit just over $58,000, before seeing a retrace along with the rest of the crypto markets. It’s currently changing hands for just under $56,000.

There was another boost for Bitcoin as payment giant Square announced a 266 per cent increase in revenue year over year to $5.06 billion. That eye-popping jump in revenue was credited primarily with Square’s decision to let customers buy and sell Bitcoin by means of its Cash App. Its sister company, Twitter yesterday also announced the introduction of a tip jar that allows you to donate to contributors, leading some to speculate a crypto tie-in would be the logical method of payment. What will that mean for the space?

All feedback on Crypto AM Daily in association with Luno is welcome via email to James.Bowater@cityam.com 🙏🏻

In the markets

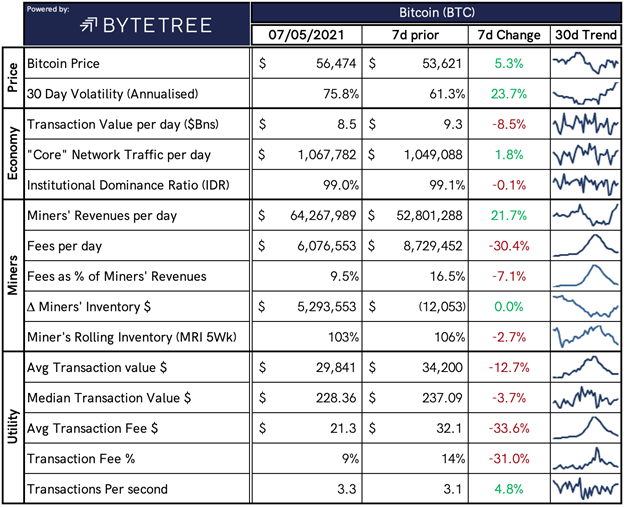

The Bitcoin economy

*Definitions and insights can be found at https://bytetree.com/insights/

Total crypto market cap

The total capitalisation of the entire cryptocurrency market at time of writing is currently $2,374,184,894,765, up from $2,351,040,971,145 at this time yesterday.

What Bitcoin did yesterday

We closed yesterday, May 6 2021, at a price of $56,396.51, down from $57,424.01the day before.

The daily high yesterday was $58,363.31 and the daily low was $55,382.51.

This time last year, the price of bitcoin closed the day at $9,268.76. In 2019, it closed at $5,746.81.

Bitcoin market capitalisation

Bitcoin’s market capitalisation at time of writing is $1.051 trillion, down from $1.062 trillion yesterday. To put that into context, the market cap of gold is $11.559 trillion and Alphabet (Google) is $1.581 trillion.

Bitcoin volume

The total spot trading volume reported by all exchanges over the last 24 hours was $73,161,855,962, up from $67,719,982,282 yesterday. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of Bitcoin over the last 30 days is 58.17%.

Fear and Greed Index

Market sentiment is up to 64, down from 65 yesterday.

Bitcoin’s market dominance

Bitcoin’s market dominance today is 45.25, down from 46.20 yesterday. Its lowest ever recorded dominance was 37.09 on January 8 2018.

Relative Strength Index (RSI)

The daily RSI is currently 50.21, down from 51.41 yesterday. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Convince your Nan: Soundbite of the day

“Our focus, first and foremost, is on enabling … bitcoin to be the native currency. It removes a bunch of friction for our business. And we believe fully that it creates more opportunities for economic empowerment around the world.”

– Jack Dorsey, CEO of Square and Twitter

What they said yesterday

Very interesting thread from our sponsors…

The institutional backing we all needed…

Interesting…

Make sure they know…

Crypto AM Editor writes

Ethereum yet to take off and is on track for $5,200 soon say experts…

Ethereum punches through $3,000 with market cap bigger than Bank of America…

Ethereum closing in on $3,000 as Bitcoin eases off the throttle…

Cardano teams up with Save the Children for humanitarian initiative…

HMRC were not clamping down on crypto…

Binance jumps on the NFT market…

Ethiopia overhauls its educational system with IOHK blockchain partnership…

Crypto AM: Longer Reads

City AM Markets: What is Decentralised Finance (DeFi) by Aave…

Crypto AM: Conversation with James Bowater

Crypto AM: Market View

Crypto AM: Technically Speaking

Crypto AM: A Trader’s View with TMG

Crypto AM: Mixing in the Metaverse with Dr Chris Kacher

Crypto AM: Talking Legal

Crypto AM: Spotlight

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Definitively DeFi

Crypto AM Parliamentary Special

Part one of two – April 2021

Part two of two – April 2021

Five part series – March 2021

Part one…

Part two…

Part three…

Part four…

Part five…

Crypto AM: Recommended Events

Crypto AM DeFi & Digital Inclusion Online Summit powered by Cointelligence Fund

May 20 2021

AIBC World

May 25 to 26 2021 – Dubai

https://aibc.world/events/uae/general-info/

Bitcoin 2021

June 3 to 5 2021 – Miami

Crypto AM City of London Roundtable

Crypto AM DeFi & Digital Inclusion Summit

&

Crypto AM Awards 2021

September 29 and 30 2021

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:30am GMT.