(Photo illustration by Chesnot)

Getty Images

Obviously crypto crashed, is crashing, will crash some more.

To most investors this is the time to focus on preserving capital and that is not a bad thing. However, it’s not a time to embrace remorse for losses, grief for not taking those juicy profits or anger that it must be someone else’s fault for making the market crash when you still believe it’s going to the moon.

Instead now is the time to plan the next campaign like a crypto Napoleon on Elba.

It is fine to just think this is just another short-term bump in the road for crypto, it’s fine to hodl, too. It’s okay if you are horribly wrong—that’s just how investing works, you can’t always be right—but what you also need to be doing is thinking about what to do next.

Planning for the worst can also be planning for the best. For me this is a lesson learned in 2000-2002 as I made colossal paper profits in the dotcom and put them all back and then didn’t buy a pile of Amazon

AMZN

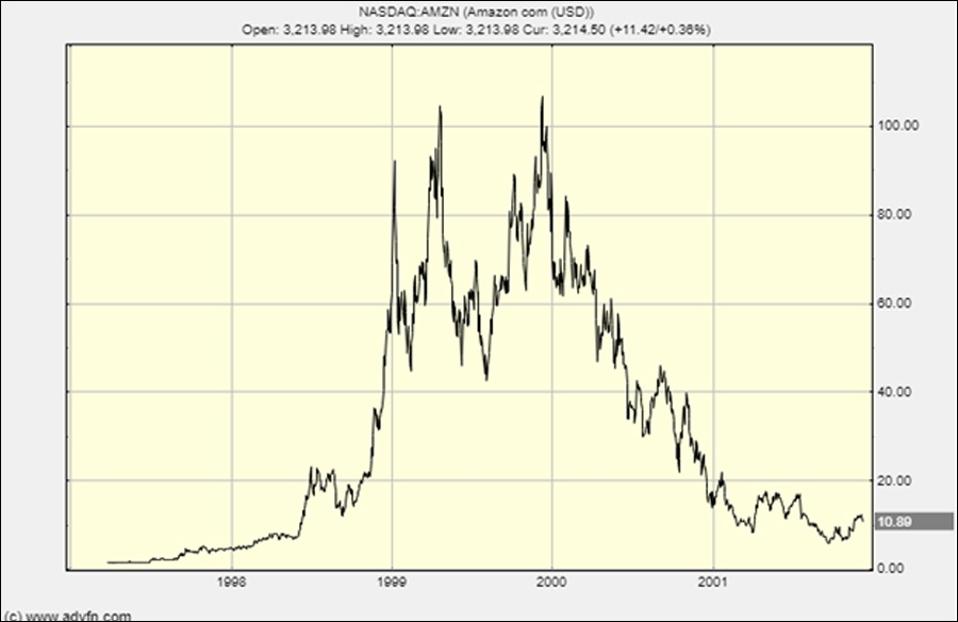

This is what I missed:

The Amazon chart: shame I didn’t buy back in 2007/8

Credit: ADVFN

If I had been looking this is what I would have seen:

The early days of the Amazon chart – that’s my kind of chart

Credit: ADVFN

Now most people couldn’t stomach buying that chart, but actually I would have probably wanted to buy because I’m a contrarian and I love charts like this. But I wasn’t looking, I was fighting to keep my business from imploding along with most other dotcoms. That is a reason but not an excuse. (I would have probably sold it at $20 too but that’s an entirely different lesson worth learning.)

The idea is this. You have to buy the aftermath of any crash. You have to go looking for gems in the rubble. There are great returns to be had at huge discounts because most other participants are paralyzed, in shock and awe. Find and buy the good stuff after a crash.

Coinbase is going to be one such gem amongst the ruins. It’s a great site and business.

In my mind I was going to go in big on the Coinbase IPO but when it came to it, the price was way too high for my value investor psychology and the market way too hot for my contrarian soul. Turns out that was a good call and now that situation is over and Coinbase has slumped.

The Coinbase chart shows the price crashing

Credit: ADVFN

Once this crypto crash is over, I will be accumulating Coinbase. To me, Coinbase is the Amazon of crypto, and I mean by that a near-term survivor of this crypto crash and a long term equity giant.

I could almost start acquiring today but somehow, I remember just how bad things can get and how low prices can fall in a crash, and I should actually just get on a boat and sail to America single-handed seeing as how cruises are kind of on hold, to burn up the time between now and when it may be the right time to actually start acquiring bombed-out crypto plays. It could be as long as six months to a year away, so maybe I should think about rowing.

From this weekend’s action it would appear a lot of crypto investors have bailed but I suspect there are hordes more taking a pounding.

Now is not the time to go into a cycle of grief; now is the time to mark out your contenders for the next winter/boom/bubble cycle. Armed with the exorbitantly expensive education of how a bubble plays out while acquiring great crypto assets at fire sale prices in the post-crash crypto winter, there is a tremendous opportunity to be sat on a hill of profits near the next crypto high.

It’s coming.

———

Clem Chambers is the CEO of private investors website ADVFN.com and author of 101 Ways to Pick Stock Market Winners and Trading Cryptocurrencies: A Beginner’s Guide.

Chambers won Journalist of the Year in the Business Market Commentary category in the State Street U.K. Institutional Press Awards in 2018.