Key levels for the weekend for Cardano, Polygon, Litecoin, and OmiseGO.

Cardano (ADAUSD)

Above: Cardano (ADAUSD) Chart

Not a ton of changes to what I am expecting for Cardano here over the weekend. I expect to see some selling pressure again and return to the 0.84 – 9.94 support level. If that were to break, then I’m looking at the next high volume node to hold as support at the 0.68 value area. If I were to be uber greedy and bearish, I’d also look at 0.41 as a level to test before resuming any further upside momentum. However, if we get a series of daily closes above 1.80, then I might enter some orders in at those levels if the daily volume is appropriate.

Polygon (MATICUSD)

Above: Polygon (MATICUSD) Chart

Polygon has certainly bucked a lot of the trend of some continued selling that many cryptocurrencies have experienced in the latter half of this week. This means that MATIC is either going to buck the trend and diverge from the broader market – or it is just a laggard and we haven’t seen a corrective move yet. I’m definitely in the camp of it’s a laggard and under threat for downside pressure. I also project that Polygon’s retracement is going to be more violent than other cryptocurrencies because it has remained near its all-time highs for most of the week. Hell, Polygon hasn’t even tested the 50% Fibonacci Retracement when so many other popular and high market cap cryptocurrencies have done so. The two most important levels I see on Polygons chart are the 38.2% level at 0.7990 and the 50% level at 0.5366. Both of those Fibonacci Retracement levels have a correspondingly high volume node in the same value area. We may even see a flash crash if Polygon moves to the 38.2% Fibonacci Retracement because a move below the 38.2% level would also mean a move below a high volume node. The profile is very, very thin between 0.7990 and 0.5366.

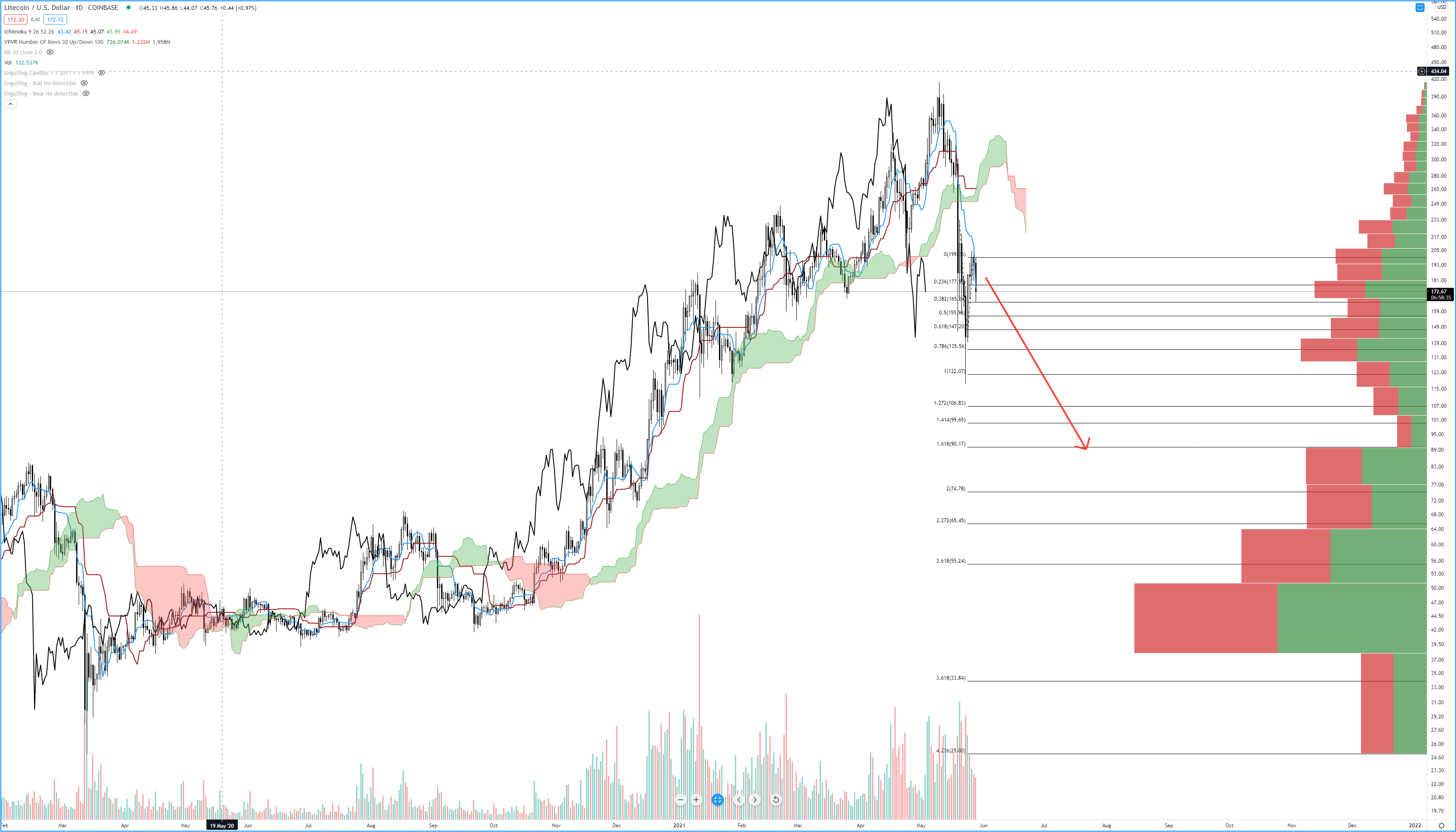

Litecoin (LTCUSD)

Above: Litecoin (LTCUSD) Chart

Litecoin has a bucket full of ugly in its near term price action for anyone remaining bullish right now. In a nutshell, I think we’ll see a very fasts trip to the 161.8% Fibonacci Extension at 90.17. 90.17 is just a hair above a high volume node at 80.50. The key level that Litecoin would need to break is a shared value area at 122 – 125 where a high volume node and the 100% Fibonacci Extension level exist. The volume profile is thin, but not to thin between 122 and 90.

OmiseGO (OMGUSD)

Above: OmiseGO (OMGUSD) Chart

I haven’t done a review on OMG for a while, but when I was doing some analysis this morning, I thought it looked good enough for all of us to take a peek at. The key level I’m looking at putting in a limit buy order at is between 1.744 and 1.5650. The VPOC (Volume Point Of Control) is in the same value area as 1.560 and 1.744. However, I think we may see OMG find some support against the 0.618 Fibonacci Retracement at 3.78 and the 50% Fibonacci Extension at 3.80.

Advertisement

Save money on your currency transfers with TorFX, voted International Money Transfer Provider of the Year 2016 – 2020. Their goal is to connect clients with ultra competitive exchange rates and a uniquely dedicated service whether they choose to trade online or over the telephone.

Find out more here.