Text Size:

New Delhi: For those of you who have not wrapped your head around what a blockchain is or does, here is a ready reckoner.

Below it, we shall also detail India’s uneasiness with the blockchain and cryptocurrency and why it should be persuaded to embrace it.

What is a blockchain?

A blockchain is a unique database, behind the technology that powers cryptocurrency like Bitcoin.

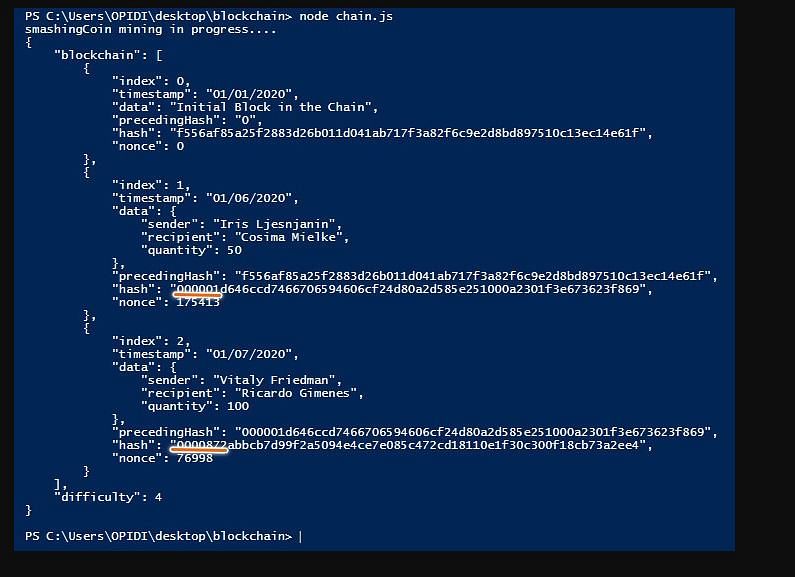

The blockchain database stores information differently from a typical database. As the name suggests, data is stored in groups or blocks which are then chained together. It is called a blockchain because the latest transaction block will contain details of the previous transaction block.

New data enters fresh blocks and once that block is created, it is attached to the chain chronologically.

Different information can be stored in a blockchain, but it is mostly used as a ‘ledger’ for transactions. It is a type of distributed ledger technology (DLT). It is called a ‘ledger’ because it keeps track of everything that is happening, just as a ledger does. It is ‘distributed’ because a copy of the ledger is transmitted and stored with everyone, and is not a centralised network — like in banks.

In Bitcoin’s case, the blockchain allows everyone access to all information and transactions. How does it, therefore, maintain privacy? It links transactions to a recipient ‘Bitcoin address’ — which is a random string of alphanumeric — that changes for each transaction.

Information once stored cannot be changed or tampered with even though everyone has access to the records. This is because they are in a highly coded form.

If blockchains ruled, this is what would happen — a world of no rupees, no credit cards, no digital payment gateways, and no banks!

Also read: A future with bitcoin, block-chain & digitisation looks dystopian, but there’s a positive too

Who conceptualised blockchain?

The blockchain concept was launched by a pseudonymous person or group called ‘Satoshi Nakamoto’ whom no one has ever seen.

Australian entrepreneur-cum-computer scientist Craig Wright has claimed to be Nakamoto, but that is disputed.

Nakamoto released a white paper in October 2008 on Bitcoin (not blockchain) named ‘Bitcoin: A Peer-to-Peer Electronic Cash System‘. It highlighted how blockchain could be the software infrastructure that allowed Bitcoin transactions.

Yet, the paper didn’t use the word ‘blockchain’, but referred to how ‘blocks are chained’ together in holding information.

The word blockchain first appeared around 2010 in a chat forum named ‘Bitcoin Talk’ founded by Nakamoto.

Nakamoto’s seminal paper couldn’t have come at a better time. It was published a month after the 2008 global financial crisis, triggered by banks considered “too big to fail”, filing for bankruptcy. Home-loaners could not pay up.

The 2008 global financial crisis was considered a “powerful demonstration of what happens when the financial world puts too much trust in centralised institutions” like banks.

That is when blockchain proponents felt that a decentralised financial system — not controlled by one entity — would never have allowed the 2008 crisis to happen.

3 main features of blockchain Nakamoto proposed

Nakamoto’s paper proposed a payment system which had three main features. All could be implemented without a central financial institution.

One, it would be a system where trust can be obviated. There is no need for a third-party financial institution to provide an element of trust between buyer and seller who usually don’t know each other, especially in e-commerce.

In blockchain transactions, entities may not necessarily know each other yet they transact with surety due to secure cryptography techniques.

Two, unlike in cash, there is always a danger of ‘double spending’ of digital money. Technically, one could duplicate the digital money like a word file and spend it at two or more places. Nakamoto suggested a mechanism that would secure past transactions and also identify and stop double spending.

Three, it would be a system for new money to be generated. Those who generate blocks for transaction — also known as ‘miners’ — get a part of the transacted amount as fee. In addition, a miner also gets a designated number of bitcoins that the software is designed to send — a sort of reward for adding a block. This is how the blockchain software generates and releases new bitcoins into the system’s money supply.

How does Nakamoto’s blockchain implement these features?

Nakamoto’s proposed payment system depends heavily on cryptography or intricate coding. That is why digital currency like Bitcoin is referred to as ‘cryptocurrency’.

Cryptography ensured secure transmission and storing of information by converting information into a random string of alphanumeric.

Cryptography is implemented through a method called ‘hashing’ — which is a way to apply cryptography to information.

This algorithm converts plain text to a unique string of alphanumeric.

For example, hashing the word ‘Hi’ gives you this:

3639efcd08abb273b1619e82e78c29a7df02c1051b1820e99fc395dcaa3326b8

Hashing the sentence: ‘This blockchain explainer is the bane of my existence’, is this:

e48ed0d791a1fe581b02663516d870e8587f14e6bf5c30b73724088e1624c289

You will notice that the result is always a fixed length irrespective of the length of the original message.

Another way cryptography is applied to information is called encryption, and at times, confused with hashing.

Encryption is used when bitcoins are sent to others.

The main difference between hashing and encryption is the former will always produce fixed length results, whereas that of encryptions may vary. You also cannot reverse a hash to see what the original message was. But with a password, encryptions allow you to decrypt the original message.

Also read: Why Tesla’s big Bitcoin splash isn’t exciting news for Indians investing in cryptocurrencies

Who are participants in a blockchain?

There are four sets of stakeholders: full nodes, super nodes, light nodes, and mining nodes.

Node means the device connected to the blockchain system — desktops, laptops, mobiles etc.

Full nodes are computers which provide computing power to keep alive and available the full list of transactions on the blockchain. In the normal banking system, transaction records are made available 24×7 to customers by banks. But in the absence of banks, people must volunteer their computers to maintain the blockchain system. Volunteers should ideally have their computers connected to the blockchain for at least 6 hours a day.

Super nodes or listening nodes are usually those working 24×7 and ensure full nodes are connected to each other to make transactions faster.

Light nodes are devices with less computing power to maintain fewer transactions and include regular users of bitcoin like you and I. Light nodes only store records that are relevant to them.

Mining nodes perform two essential tasks. One is to verify transactions and create a block for each transaction. This is similar to how banks clear transactions. The other task is to generate new bitcoins similar to how RBI mints new rupee coins. Mining requires a lot of computing power which means high electricity consumption.

This WSJ video says to generate (or ‘mine’) one new bitcoin, 100 MWh (mega- watt hours) of electricity is consumed. It’s the same amount of electricity used to watch TV continuously for 98 years!

How do these nodes join the blockchain network?

To join the blockchain for bitcoin transactions, one must download on the computer a free-of-charge, open-source software program called Bitcoin Core.

The software program will download the full history of transactions on the blockchain network. One needs about 400GB of free space on the computer and another 5-10GB a month. This is similar to a full node.

If you don’t want to download the Bitcoin Core software, you can just download only a software program that acts as a ‘wallet’ to store only your transaction details and bitcoin balance. This is similar to being a light node.

Also read: The future of money is digital, but it will be more than just Bitcoin

How do blocks transact?

Block details are in two sections — the block header, and a list of previous transactions.

The block header has the date and time a block was created; a hash of the previous block (therefore, the word ‘chain’); and a hash of previous transactions related to this block.

This information is added in hash form for security and convenience. Remember a blockchain is decentralised. In the absence of a central authority to maintain records, all transactions and blocks are broadcast to the entire network. Every node will have a copy of everyone else’s transactions. But hash is the secure code that does not allow people to read others’ transactions.

A hash is also convenient because of its fixed length. In a decentralised system, nodes instead of banks will have to check that transactions were in order and were not tampered with. It is easier to check something of fixed length.

Finally, it is a hash. That means it cannot be reversed, and the record cannot be tampered with.

Also read: Why Modi govt’s plan to ban Bitcoin is a terrible idea

India’s problem with cryptocurrencies and blockchain

It is now important for Indians to thoroughly understand the concept of Bitcoin, blockchain and cryptocurrency.

Bitcoin is not a payment method the government has issued. How does it track transactions or tax it? What if criminals use it to buy illegal goods? What if unwitting civilians trying to buy bitcoin are duped?

How can law enforcement help these people when government does not know whom to contact and investigate? What happens to traditional banks and their business if people start paying through Bitcoin?

The Indian government’s response was to propose a bill to ‘prohibit all private cryptocurrencies’ like bitcoin while allowing an RBI-issued ‘official digital currency’ and technologies like blockchain and DLT to be used in unspecified ‘certain exceptions’.

An RBI digital currency — a kind of digital rupee — is different from a private cryptocurrency. When someone says ‘digital currency’, they usually mean a digital version of a currency issued by a country’s central bank.

A cryptocurrency like Bitcoin is also a type of digital currency, but is more specifically known as a cryptocurrency because cryptography is used to make transactions secure.

The announcement of a bill to ban private cryptocurrencies caused a lot of heartburn to Indian businesses that had invested in them. A bill will shut down cryptocurrency platforms, people will lose jobs and investments.

Amid the industry’s pleas not to pass the bill, the government is holding it for now with the finance minister saying there would be a ‘window’ to experiment with blockchain and cryptocurrencies.

India’s decision to not ban the crypto may well be a wise one.

Countries like Russia are trying to integrate blockchain and cryptocurrencies in their economy, to undermine the US dollar’s power in international trade and to avoid US sanctions according to a 2019 Vice video.

One of Russia’s leading state banks was hit by the Obama administration’s sanctions in 2014 and during his tenure as its chairman between 2016 and 2019, Sergey Gorkov, set up a blockchain research institute in 2017.

Gorkov said in the Vice report, “commercial banks realise that traditional banking activity might not stay as it is forever”.

Gorkov likened countries that don’t embrace blockchain to countries that didn’t embrace the Internet in the 90s.

“Those who don’t deal with blockchain today will end up in the Stone Age in 20-30 years,” he said.

The other uses of blockchain:

The sooner people are ‘disappointed’ in blockchain because it doesn’t make you rich, the sooner blockchain can become a part of everyday infrastructure in a significant way, said Finn Brunton, New York University Associate Professor who has written books on the internet, privacy, and digital cash. Watch the 2017 Wired video here.

For example, integrity of elections maybe maintained using blockchain.

Recently it was reported The Election Commission is working with IIT-Madras on using blockchain in the poll process.

England’s Plymouth University explained in a paper how blockchain may be used. When a person registers to vote, he goes to a government portal to create a transaction with information like a national identity number, postal and email address, and a password.

This transaction is then analysed by a miner node set up by the government. Once the miner node approves the transaction as valid, it is added to the blockchain of registered voters. When election starts, polling stations can consult this blockchain to ensure a person votes only once.

Also read: Govt can ban Bitcoin but for ‘digital rupee’ to succeed, India has to do a lot

Subscribe to our channels on YouTube & Telegram

Why news media is in crisis & How you can fix it

India needs free, fair, non-hyphenated and questioning journalism even more as it faces multiple crises.

But the news media is in a crisis of its own. There have been brutal layoffs and pay-cuts. The best of journalism is shrinking, yielding to crude prime-time spectacle.

ThePrint has the finest young reporters, columnists and editors working for it. Sustaining journalism of this quality needs smart and thinking people like you to pay for it. Whether you live in India or overseas, you can do it here.