Bitcoin and Ethereum already made new all-time highs in 2021. Meanwhile, there are lots of projects which are exploding and have provided 5x to 10x returns within a year. Therefore, we have examined some lesser-known gem coins that have great growth potential which we think are undervalued right now. Further, we have also shared some of the compelling reasons why you should look into these altcoins.

1- PlasmaPay

Plasma is an application infrastructure that aims to decentralize the centralized financial services industry (CeFi). Further, developers can use Plasma’s building blocks to create new DeFi protocols, as well as manage assets and dApps on top of PlasmaPay.

Plasma provides solutions to a lot of organizations that are utilizing its tools, such as online businesses, mobile/web developers, e-commerce companies, and many more. Additionally, Plasma Finance offers lots of benefits such as auto-calculations, the option to choose ROI, invest, store, and manage any DeFi token with ease.

PlasmaPay Features

Impressively, Plasma offers new generation benefits to users, such as payment processing, sending and receiving payments despite the need for a card provider or bank, cross-border transactions with zero commissions, and instant liquidity.

Due to the high gas cost, low transaction speed, and network congestion issues on Ethereum, smart contract transactions are very expensive and take a lot of time to get confirmed. Hence, the Plasma community solves issues such as high fees, low transaction speed, bad user onboarding, and more. Besides this, the Plasma chain also supports stablecoins which are fully backed by fiat in distributed bank accounts and EMI companies.

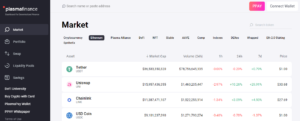

Additionally, its user-friendly dashboard has all the DeFi features in one place, such as portfolio management, fiat on/off ramp, liquidity pools, DEX and SWAP aggregator, lending and borrowing, and cross-chain asset swap.

Source: plasma.finance

Recent Developments

The PlasmaSwap team is building the first DEX of its kind, which allows native support for Limit Orders and the Stop Loss functions for trades. Impressively, this will be backed with Plasma Gas Station, which will allow users to pay for gas fees with other major ERC-20 tokens like USDT or native PPAY.

This year, the Plasma team plans to integrate new advanced features to its platform. For example, the token holders can order bank cards and use them to withdraw cash at ATMs or pay at some online stores. The project will also launch HyperLoop cross-chain support for Polkadot, Cosmos, EOS, and Binance Chain.

PlasmaPay Partnerships

Recently, PlasmaPay partnered with Casper Labs, the world’s most advanced proof-of-stake smart contracts platform. This partnership came around at a very interesting point as PlasmaPay is about to release its PlasmaSwap DEX and Casper labs is close to its mainnet launch.

PlasmaPay teamed up with Bondly Finance to expand the decentralized payments systems in 2021 and beyond to attract new users in the DeFi space.

Impressively, PlasmaPay taps partnerships with diversified crypto companies such as DIA, Geek, Bridge Mutual, Ren Protocol, and SushiSwap for integration.

PPAY Token

The native token of PlasmaPay and Plasma Finance is PPAY, which is an ERC-20 token. Users can utilize this token in enabling swaps, rewards, liquidity mining, borrowing/lending, staking, and governance. Hence, it is designed to be an all-in-one DeFi service token.

Price – $0.243490

Market Cap (March 8, 2021) – $31,658,932

CoinGecko Ranking (March 8, 2021) – #490

2- e-Money

e-Money is a blockchain-based peer-to-peer payments platform that transfers money at a low cost. Moreover, it eliminates the intermediaries present in traditional financial services by introducing currency-backed stablecoins.

The team aims to provide a low cost, transparent financial service globally. Moreover, e-Money intends to offer a range of interest-bearing currency-backed stablecoins where each token is backed by a reserve of assets denominated in its underlying currency. e-Money offers a variety of Euro-centric stablecoins, including eEUR, eCHF, eSEK, eNOK, and eDKK, with plans for a range of other tokens planned for release in 2021.

e-Money Features

Notably, e-Money is designed as the Layer 2 solution for traditional finance with features such as accessibility for all, near-zero fees, instant settlements, and immediate finality. Impressively, the quarterly reserve audits of this project are performed by Ernst & Young, which boosts its transparency.

In addition, the value of e-Money’s currency-backed tokens regularly changes, which makes it distinct from existing stablecoins. It also aims to maintain a static 1:1 peg with its underlying assets. Besides this, the e-Money DEX offers easy conversion between currencies with instant payment support.

Recent Developments

e-Money is enhancing their decentralized exchange (DEX), which has a lot of user-friendly features such as:

It does not require any coin execution fees on trades.

Implementing droplet optimization for liquidity.

Receipt sophisticated order matching charts.

e-Money Partnerships

Recently, e-Money partnered with Elrond to circulate European stablecoins eEUR, eCHF, eSEK, eNOK, and eDKK that were issued by e-Money on the Elrond mainnet.

e-Money, in collaboration with Avalanche, launched its stablecoins on Avalanche’s Contract Chain (C-Chain). Additionally, it has tapped a lot of other partners to expand its stablecoins, such as Royal Finance, RAMP, and Mantra Dao.

NGM Token

The native token of e-Money is NGM, which stands for Next Generation of Money. Moreover, the NGM token offers staking and rewards tokens to secure the e-Money network. Like other proof-of-stake chains, such as Cosmos Hub and IRISnet, the inflated NGM supply is also distributed on pro-rata for staking rewards.

Price – $1.28

Market Cap (March 8, 2021) – $14,752,944

CoinGecko Ranking (March 8, 2021) – #684

3- Fuse Network

The Fuse Network is a borderless public ledger that is designed for permissionless and smooth day-to-day payments. Moreover, Fuse Network connects with Ethereum through a bridge that allows any token to move freely between Ethereum and the Fuse chain.

Fuse Features

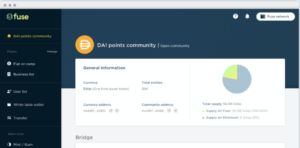

Fuse makes it suitable for companies and enterprises to integrate digital payments on their platforms through its simple user interface. In addition, the Fuse Studio empowers users to easily launch and explore new communities. It has an in-built contract store that has various innovative features and integrated services, such as fiat on-ramps, business management plugins, community management functionality, and much more.

Notably, the Fuse Studio permits users to build their own wallet and mint their own custom-branded currency for companies and communities. Further, its plug-and-play solutions streamline the complex payment solution and allow frictionless mobile payments with ease.

Source: fuse.io

Fuse Wallet

The team has introduced an innovative Fuse wallet for community members where they can store a wide range of different currencies and tokens – both crypto and traditional fiat currencies. Moreover, Fuse Studio connects with a wallet to process real-world transactions into the blockchain. The Fuse wallet supports any ERC-20 token and has features such as secure onboarding, a fast verification process, merchant support, and other functions. Besides this, users can process transactions in Fuse with a maximum fee of 1 cent.

Recent Developments

Recently, Fuse introduced FuseDollar (fUSD), which is a USDC-backed stablecoin to empower the Fuse ecosystem. Additionally, Fuse Network integrated Mintgate to leverage a token-gating system for content access management. This allows Mintgate users to choose Fuse Network as a platform to manage their content. In the near future, Fuse users can also access Mintgate for the studio plugin.

The Fuse team has introduced a new program to reward FUSE/ETH liquidity providers (LPs) and swappers on Loopring. With this, a total of 50,000 FUSE and 1,180 LRC will be allotted as part of a dual reward program over 14 days.

Fuse Partnerships

Fuse partnered with Pocket Network to streamline the Fuse-Ethereum bridge and make it more efficient and less expensive for users. Besides this, this enables Fuse applications to access Pocket Network’s services through staking POKT. Impressively, the Fuse Network achieved a huge milestone by processing over 5,200,000 transactions.

Fuse is using the Chainlink Proof of Reserve to bring secure, reliable, and efficient minting and auditing of Fuse Network’s collateralized FuseDollar (fUSD) stablecoin.

Fuse collaborated with MANTRADAO to launch the OM/USDC pool on FuseSwap. Additionally, Fuse has a lot of other partnerships, which include Uniswap, Orion Protocol, Dapp.com, Transak, and more.

FUSE Token

The native FUSE token is an ERC-20 token that offers staking, voting on protocol changes, and rewards tokens to secure the network.

Price – $0.193808

Market Cap (March 8, 2021) – $11,262,165

CoinGecko Ranking (March 8, 2021) – #770

4- Fractal Network

Fractal is an open-source protocol that serves the user information in a fairly open way. As a result, a high-quality version of the free internet is assured. Moreover, it creates a new privacy-enabled equilibrium for users to share and monetize their data as well as protect advertisers from fraud.

The CEO of Fractal is Julian Leitloff. His name was listed in one of the Forbes 30 Under 30 in 2016. Julian started his career in banking and co-founded Fractal at the age of 22. Impressively, he generated over $1 million in revenue with his business and founded Fractal in 2017.

Fractal Features

In this social distancing environment today, everyone is using the internet and is searching different websites to obtain information. Notably, these websites ask the user to confirm third-party cookies. These cookies are small files installed on the device which track user activity and share this information with advertisers. Fractal aims to solve this problem through its open-source protocol designed to replace the ad cookie and to give the control of user data back in the hands of users.

Fractal Protocol empowers users by allowing them to manage, curate, and verify their private data themselves. Additionally, by replacing ad cookies, it gives users full control over their data, and they can share anything they want, which results in the production of relevant and high-quality content.

Recent Developments

Recently, Fractal tokens were launched on the Polkastarter platform. Upon launch, both the POLS Pool and the Regular Pool were completely sold out and raised a total of $400,000 within minutes.

The team is working diligently to enhance the ad markets and create a free and fair internet. In addition, to encourage users, new incentive programs and competitions are coming in the near future.

Fractal Partnerships

Fractal collaborated with Polymath to provide Fractal’s ID verification software to its institutional-grade blockchain network. In addition, Fractal ID will integrate a KYC/AML process to verify the users of Polymesh. This integration also enables the swift onboarding of users and expedites the compliant-enabled infrastructure.

Fractal teamed up with Uniswap and was listed on its DEX as a trading pair. Impressively, within 24 hours, $36,388,141 in volume was traded with over 2,000 holders of FCL.

FCL Token

The Fractal utility token – FCL – combines all stakeholders around the Fractal Open Advertising Economy. It adheres to no profit, no dividend, no ownership, and no voting rights via the token. Further, the team intends that the token functions as the protocol’s native currency, fueling the incentives mechanism embedded in the protocol.

Price – $0.660626

Market Cap (March 8, 2021) – NA

CoinGecko Ranking (March 8, 2021) – #NA

5- DAO Maker

DAO Maker provides advanced solutions in a safe, decentralized, and free environment to raise funds. It also assists startups who are facing challenges in the initial stages of their development and helps them in fundraising.

DAO Maker Features

Venture Bond

Interestingly, DAO Maker offers Venture Bond, which allows startups to issue bonds. Startups use the principal sum generated by bond purchases to generate interest. Further, when the Venture Bond matures, the principal sum is returned to the buyer, so they are left with both their initial funding and also any newly acquired tokens or equity.

Dynamic Coin Offering (DYCO)

DYCO participants can buy tokens from the market and refund them to generate risk-free profits, no matter if they held them or sold them at a profit. Besides this, for the first 16 months, the circulating supply is 100% backed by USDC.

Social Mining

It allows any tokenized project to generate token-based incentives. This encourages community members who offer value to the ecosystem. Social Mining-powered Hubs or DAOs organize and ease user assessment for other members of the community. Additionally, these Hubs or DAO capture data, such as the addition of secondary market value through liquidity, expansion of the project, and more. Further, it will make these factors accessible for others to view.

DAO Maker introduced the new Strong Holder Offering (SHO), which is designed to analyze the creation of investment strategies for yield farming, trading, and lending on the Ethereum DeFi ecosystem. Furthermore, it provides the easy automation of investment strategies while maintaining full custody of the funds by the end-user.

Recent Developments

DAO’s Social Mining platform is integrated with Polkadot to provide governance solutions and to boost the on-chain developments. Recently, DAO was listed on SushiSwap, allowing DAO holders to provide liquidity and earn SUSHI tokens.

Additionally, it has also integrated with wallets, such as Enjin, TokenPocket, Polygon, SafePal, and many more.

DAO Maker Partnerships

DAO Maker partnered and integrated DAO token as a preferred payment method on Travala.com. This partnership will allow DAO token holders to access over 600 airlines and 2,200,000 hotels via Travala.com.

DAO Maker teamed up with PAID Network to gain exposure to launches on PAID’s Ignition launchpad.

DAO Token

The governance token of the DAO Maker ecosystem is DAO, which is built on Ethereum. It allows staking, voting on protocol changes, and rewards tokens to secure the network.

Price – $3.58

Market Cap (March 8, 2021) – $67,412,168

CoinGecko Ranking (March 8, 2021) – #334

Conclusion

These low market cap altcoins have given a remarkable performance in the last couple of months. Moreover, this price surge is backed by the development of these altcoins, their partnerships, upgrades, and market acquisitions. These projects have a low market cap. Thus, it can be a great choice for new investors who just entered the crypto space and want to invest for the long term.

Join us on Telegram to receive free trading signals.

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided.

Do your own due diligence and rating before making any investments and consult your financial advisor. The researched information presented we believe to be correct and accurate however there is no guarantee or warranty as to the accuracy, timeliness, completeness. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. Copyright Altcoin Buzz Pte Ltd. All rights reserved.