- Bitcoin hit a new all-time high of around $61,096 but lost ground toward $50,000.

- India is proposing a complete ban on cryptocurrencies that prohibits even holding the assets.

- Ethereum is seeking support at the 200 SMA to avoid losses toward $1,360.

- Ripple’s former CTO, Jed McCaleb, sells 150 million XRP as overhead pressure intensifies.

Cryptocurrencies across the market have lost some of the gains accrued over the weekend following news regarding India ‘calibrating’ its position on the proposed bill to ban cryptocurrencies in the vast nation. The new report hints at a total ban on trading, owning, and mining digital assets.

Bitcoin rallied above $60,000 and traded a new all-time high at $61,096; however, it has been forced to revisit downstream levels toward $55,000. The instability in the market is not leaving any stoned unturned because other assets such as Ethereum, Ripple, Binance Coin, and Cardano are in the red.

Bitcoin loses over $5,000 in less than 24 hours

Bitcoin has lost a significant amount of its value following the spike to a new all-time high. The volatility has been connected to India’s impending ban on cryptocurrencies. The country has a large population that depends on the trading and mining of digital assets. News on the ban likely to cut their income is bound to lead to panic and market volatility.

Bitcoin is trading at $55,600 at the time of writing. The ongoing losses are likely to extend further, especially with 50 Simple Moving Average (SMA) support giving in. For now, the least resistance path is downwards, as indicated by the Relative Strength Index. Support is highlighted at the 100 SMA near $50,000, whereby buying orders are likely to surge as investors take advantage of the low prices.

BTC/USD 4-hour

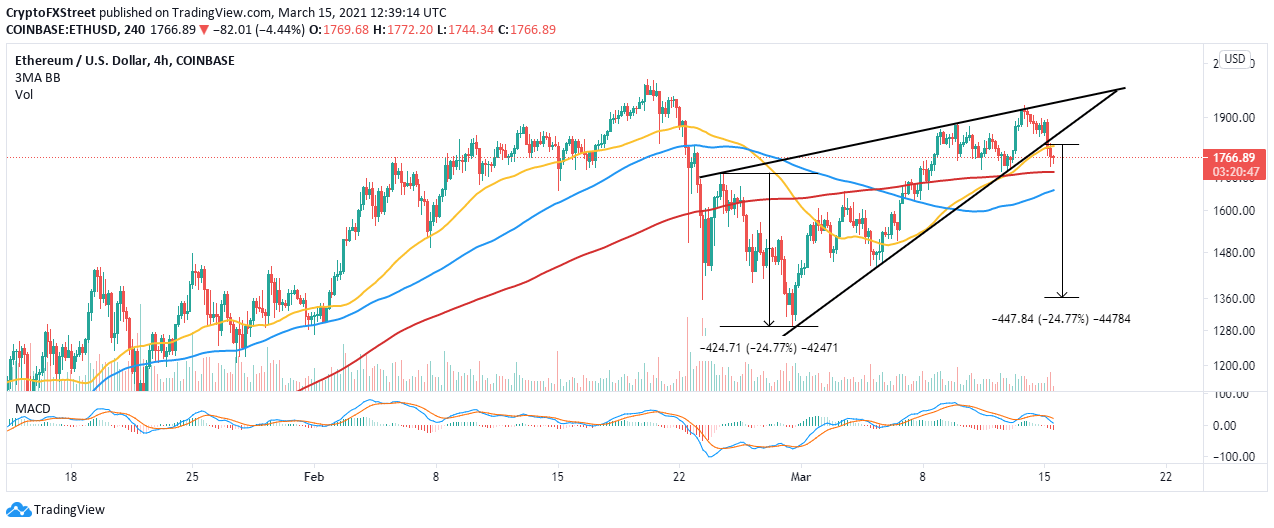

Ethereum eyes downswing to $1,360

Ethereum is in the middle of a correction after slicing through the rising wedge pattern support. Immediate support at the 200 SMA helps to keep the bears in check. However, the wedge has a downward target of $1,360.

The Moving Average Convergence Divergence (MACD) has confirmed the bearish picture. If the situation remains unchanged, Ether will continue with the breakdown under the 200 SMA.

ETH/USD 4-hour chart

Note that action above $1,800 would see ETH abandon the bearish outlook in favor of a bullish upswing toward $2,000. Bulls must focus on overcoming the hurdle at the 50 SMA on the 4-hour chart.

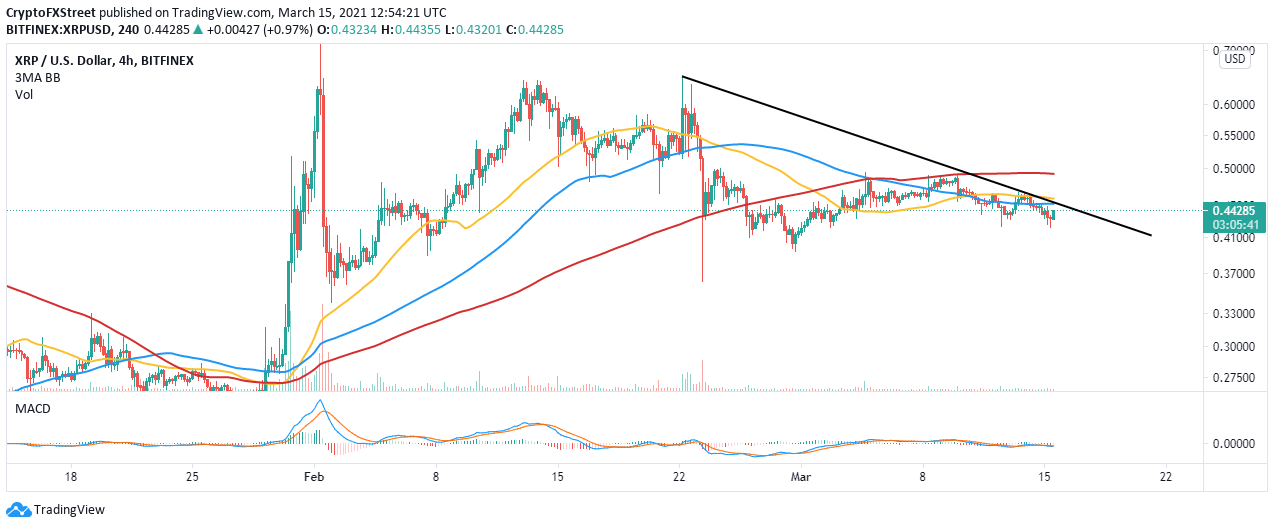

Ripple bleeds as former CTO dumps 150 million XRP

The former Chief Technology Officer at Ripple, Jed McCaleb, is still offloading his XRP stash I to the market. The latest report shows that McCaleb sold 150 million XRP from “tacostand,” his known wallet. The wallet has roughly $450 million XRP that he may continue selling for the rest of 2021.

At the time of writing, XRP is doddering at $0.44 amid a recovery from the intraday low of $0.41. On the upside, XRP will face acute selling pressure at the 100 SMA and the descending trendline. The MACD shows that the trend is likely to flip bullish, allowing buyers to focus on $0.5.

XRP/USD 4-hour chart

Ripple will remain in the woods as long as it is stuck under $0.5. The hurdle at this point hinders bulls from looking toward higher levels such as $0.65 and $0.75. Therefore, price action above $0.5 could jumpstart the uptrend.