Blockchain — the system of decentralizing a database and distributing it across an entire network of computers — brought us Bitcoin and other cryptocurrencies. It’s been used to make supply chains more transparent and create secure records that cannot be altered unilaterally.

Now the technology is being used in the COVID-19 immunization program of Britain’s state-owned National Health Service.

The vaccines need to be stored at frigid temperatures to be effective. In the case of the Pfizer shot, the required range is minus 60 to minus 80 Celsius.

“Storing the drugs in the correct way is absolutely critical,” said Tom Screen, technical director of the British technology company Everyware.

The company is using sensors and cloud computing to remotely monitor the temperature of NHS refrigeration units.

“If a fridge does go out of the temperature range, the hospital gets an automated alert,” Screen said, adding that without such notification the hospital could be forced to discard precious vaccine supplies.

Data security is a crucial part of Everyware’s modus operandi, especially when it comes to NHS facilities. The health service suffered a serious cyberattack in 2017 and was subsequently criticized in a parliamentary report for being unprepared for hackers.

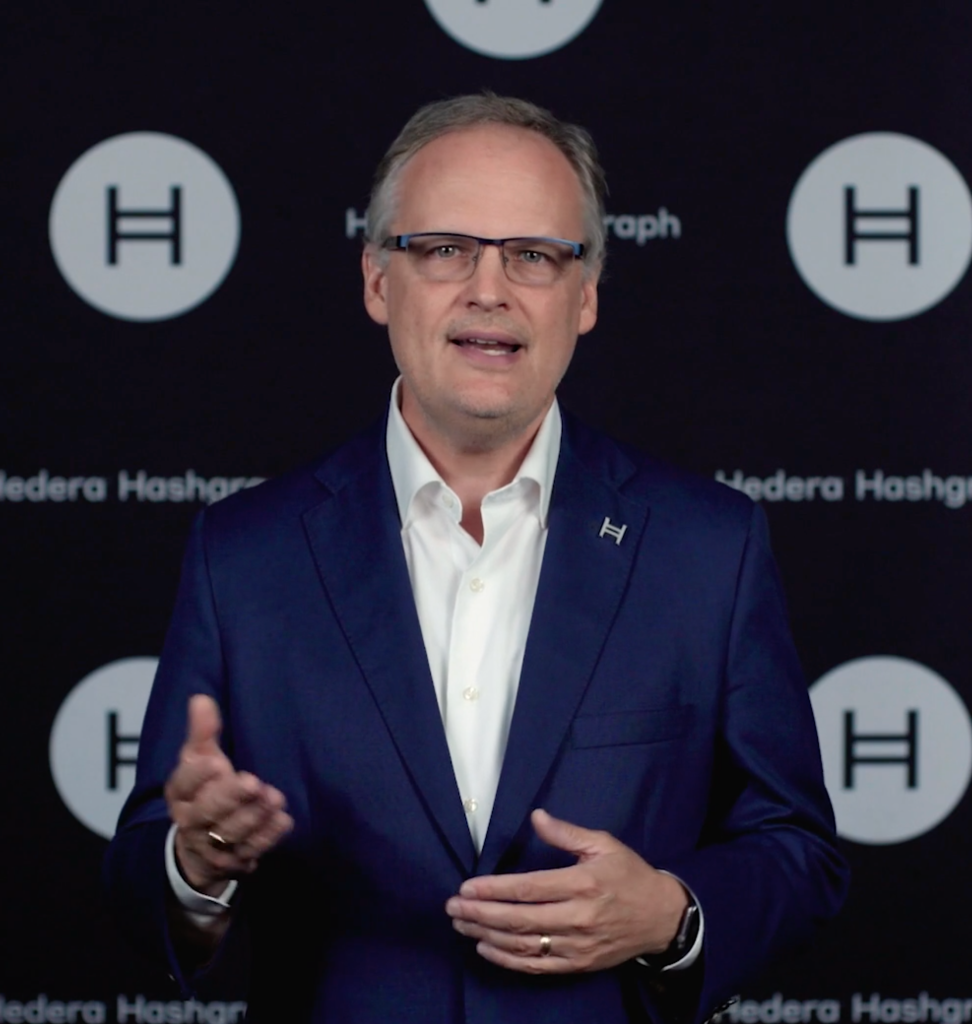

To help with cybersecurity, Everyware has turned to Hedera, a U.S.-based platform that offers a distributed ledger technology like blockchain, which gave birth to Bitcoin. Hedera CEO Mance Harmon said it’s ideal for a COVID-19 immunization program.

“Having a tamper-proof record-keeping system that can be shared across the vaccine supply chain is always important, but critically so here for the COVID vaccines,” Harmon said.

Hedera’s chief executive believes that decentralized computer networks with hundreds or even thousands of participants can play an important role in other aspects of pandemic management — to combat vaccine counterfeiting, for example, and create unforgeable vaccination certificates.

Trust is the key, according to Jillian Godsil, an author who’s written extensively about blockchain. She said that as the pandemic has spread insecurity, distributed ledgers have come into their own.

“People can lie. Institutions can lie. Governments can lie. But blockchain cannot lie,” she said.

As a result, Godsil said, more and more people are entrusting their health — and not just their wealth — to this technology.

Are more direct payments for COVID relief finally here?

Those “stimulus checks,” as they’re commonly referred to, are hitting bank accounts now. The IRS says a “vast majority” of people will get their payments through direct deposit. But it’s going to take a while to get to everyone who is eligible. Additional batches of payments go out in the coming weeks, either via direct deposit, by mailed check or debit card. And over that time, brands will be competing to capture consumer spending. Deals and other offers are likely to appear online, where people have already been shopping during the pandemic.

I’m hearing a lot about interest rates. Is it getting more expensive to borrow money?

Expectations of higher inflation as the economy rebounds have investors demanding higher yields to compensate. In turn, the recent surge in bond yields is pushing up the interest rates consumers pay on mortgages and other loans. Economist Scott Hoyt with Moody’s Analytics said rising rates could dampen demand for housing a little and refinancing a little more. Other kinds of consumer spending are less likely to be affected. Interest on auto loans and credit cards are pegged to shorter-term rates, which haven’t been rising as much.

How will the latest round of pandemic relief from the federal government help women?

More than 2 million women have left the workforce since 2020. Many of them did so initially to care for children. The American Rescue Plan, poised to be passed this week, is offering an expanded child tax credit that could give up to $300 a month per child under the age of 6. It also includes nearly $15 billion to help support child care facilities. Even so, experts say child care is still the primary stumbling block for many women who want and need to get back to work.