Source: Reuters

Bitcoin is the talk of the global financial markets as the digital currency is seeing a huge trading frenzy. With Tesla acquiring $1.5 billion of the cryptocurrency, Bitcoin’s price has zoomed into the stratosphere. One Bitcoin is now worth about $45,500, higher by 57% in 2021; even more than 25 ounces of gold. Just before the pandemic struck in March last year, the digital currency was trading even below $5,000.

Now an important debate raging globally is what is in store for Bitcoin, and where lie the risks? For instance, is the demand for a digital currency as an alternative asset class here to stay? Are digital currencies substitutes for traditional asset classes like gold, and can one easily and quickly shift between assets? Or is this just a speculative bubble gripping global investors?

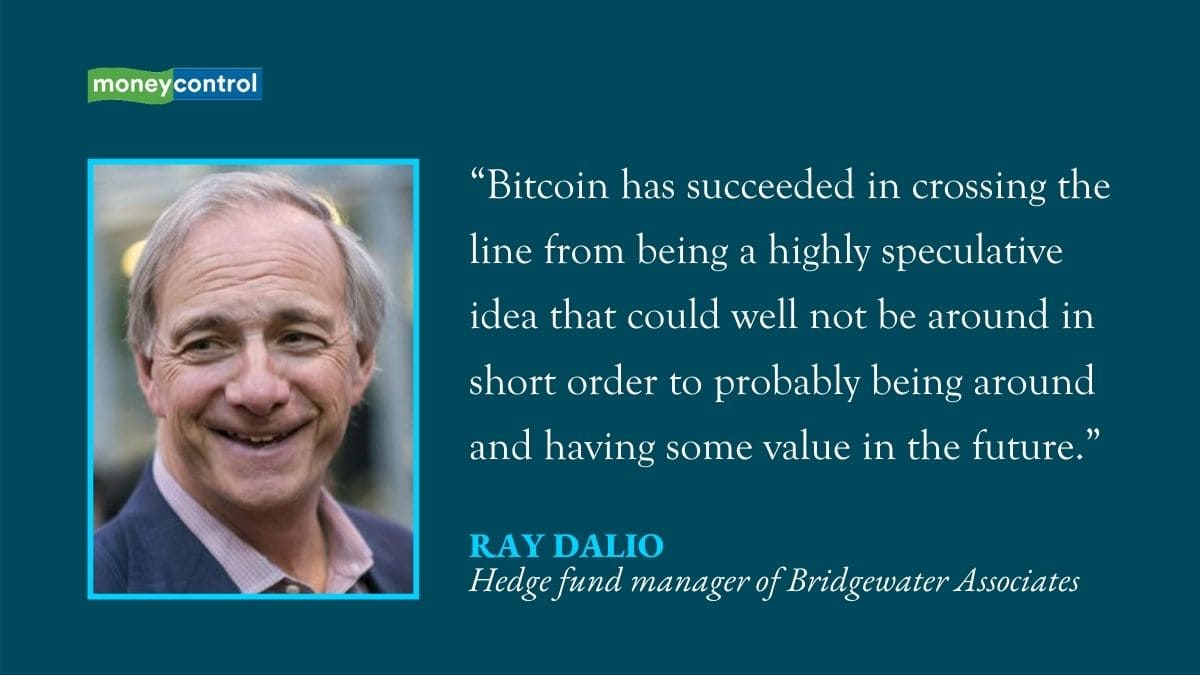

No doubt, the digital currency has come a long way, and it is being seen more than just an alternative investment fad. Ray Dalio, the billionaire hedge fund manager of Bridgewater Associates, puts it succinctly in a recent client note: “It seems to me that Bitcoin has succeeded in crossing the line from being a highly speculative idea that could well not be around in short order to probably being around and having some value in the future.”

The Gold ‘Similarities’

Folks at Bridgewater Associates note that “Bitcoin offers stable and limited issuance that cannot be devalued by central bank printing”.

While about 90 percent of the Bitcoin supply is already mined, new issuance will slow even every few years. In fact, the currency will never be fully mined. That’s one feature that seems to be encouraging digital cryptocurrency collectors and speculators. While there is a ‘limited’ supply of Bitcoins, digital currencies are mushrooming at a rapid pace. There are more than 4,000 cryptocurrencies, which means that there is ‘unlimited’ supply of these currencies.

Bitcoin’s advantage is that it has a more widespread acceptance over other digital currencies. Bitcoin commands a lion’s share of more than 75 percent of the total cryptocurrency market-cap. Even with other cryptocurrencies such Bitcoin Cash, Litecoin which have features similarly to Bitcoin such as limited supply, the latter has been more in demand. In fact, many Bitcoin enthusiasts are seeing Bitcoin as a form of digital gold.

On the other hand, government bonds hardly offer high returns in this zero-to-low interest rate environment even as currencies across the globe are depreciating. Although, Bitcoins don’t offer any yield as such much like gold, that has not been a disadvantage in this low rate environment.

Nevertheless, Bitcoins price movements have been sharp and volatile compared to assets like gold, real-estate or other safe-haven currencies, diminishing its appeal as an alternative asset class.

Other Disadvantages

There are some other evident drawbacks. Dalio notes that it is unclear whether Bitcoin can provide diversification when portfolios need it most, or act as an adequate hedge against inflation. Bitcoin is also a relative newcomer among assets, and so it does not have a history to determine whether the asset class can indeed protect and enhance returns on a portfolio.

“Bitcoin has generally appreciated alongside rising inflation expectations, but its longer-term historical relationships with inflation and gold have been relatively weak,” said the Bridgewater note. The vast majority of people and governments are not still using it as a reserve asset like gold in their balance sheets, which also include large global institutional fund allocators.

Bitcoin’s large trading frenzy and high turnover is due to the rise in high-frequency traders, and the rise of derivatives on them. High-profile buyers such as Tesla are further fuelling investor interest. Its also driving Bitcoin’s higher turnover with trading volumes increasing more than gold. But this is due to asset-churning and speculation over long-term risk-raking, points Bridgewater.

This could also be a classic bubble-like behaviour. Leverages on Bitcoins have increased phenomenally which has pushed prices higher, further heightening risks.

The digital asset also faces major regulatory risk. While institutional investors may increase allocation if it is regulated, governments could also stymie its growth if the alternative proves to be more successful, or emerge as a big threat to fiat currency. Authorities have already been hollering that Bitcoin is also a conduit for money laundering.

“Future challenges may still come from quantum computing, regulatory backlash, or issues we haven’t even determined yet. Even if none of these materializes, Bitcoin, for now, feels more to us like an option on a potential storehold of wealth,” pointed out the note.