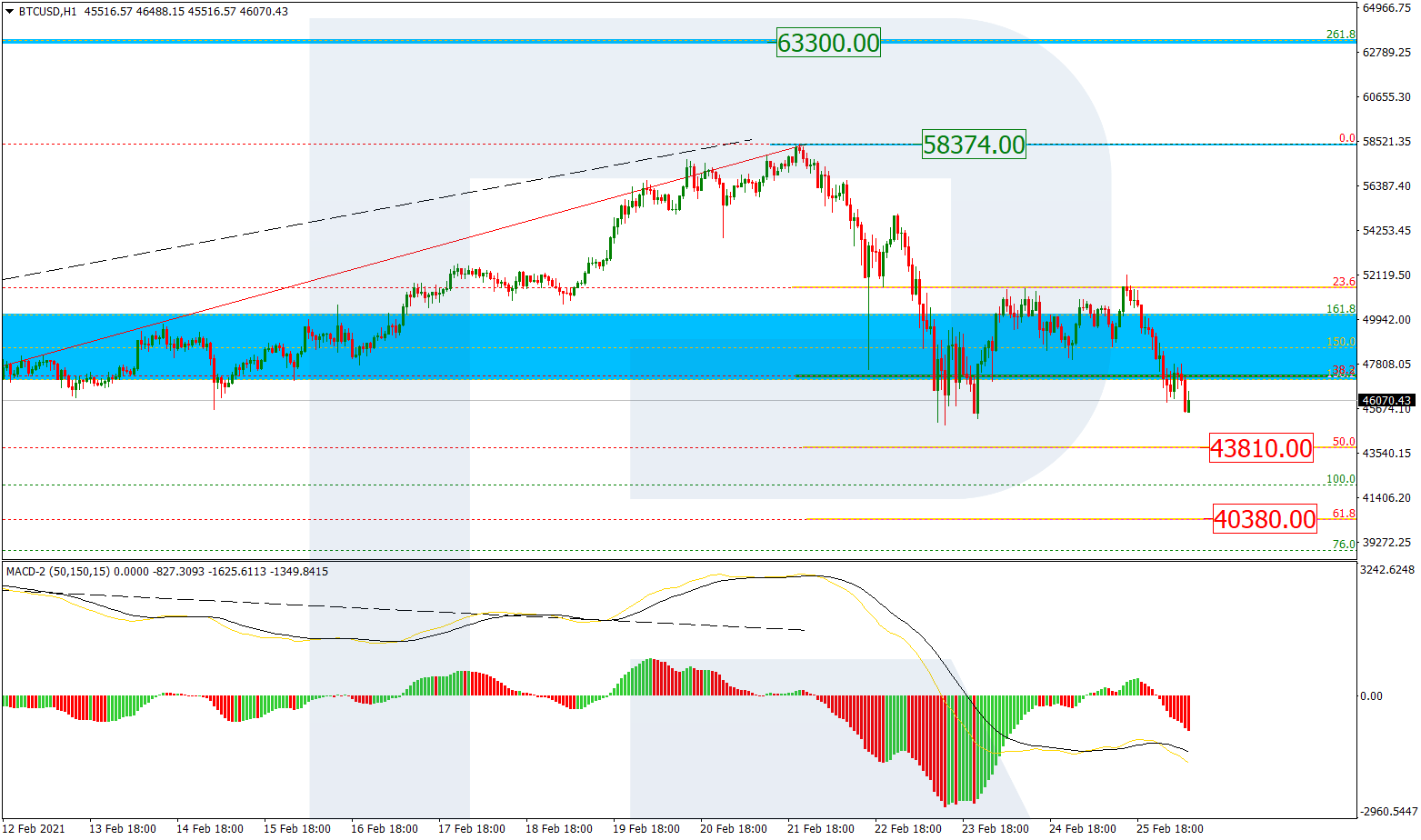

BTCUSD, “Bitcoin vs US Dollar”

As we can see in the H4 chart, after failing to reach 261.8% fibo at 63300.00, BTCUSD started plummeting due to divergence on MACD. The situation may indicate the start of a new mid-term or even long-term correction. The first descending impulse has already reached 23.6% fibo, while the next ones may continue towards 38.2%, 50.0%, and 61.8% fibo at 37530.00, 31165.00, and 24764.52 respectively. The resistance is the high at 58374.00.

The H1 chart shows a descending correction, which has already broken 38.2% and is currently heading towards 50.0% and 61.8% fibo at 43810.00 and 40380.00 respectively.

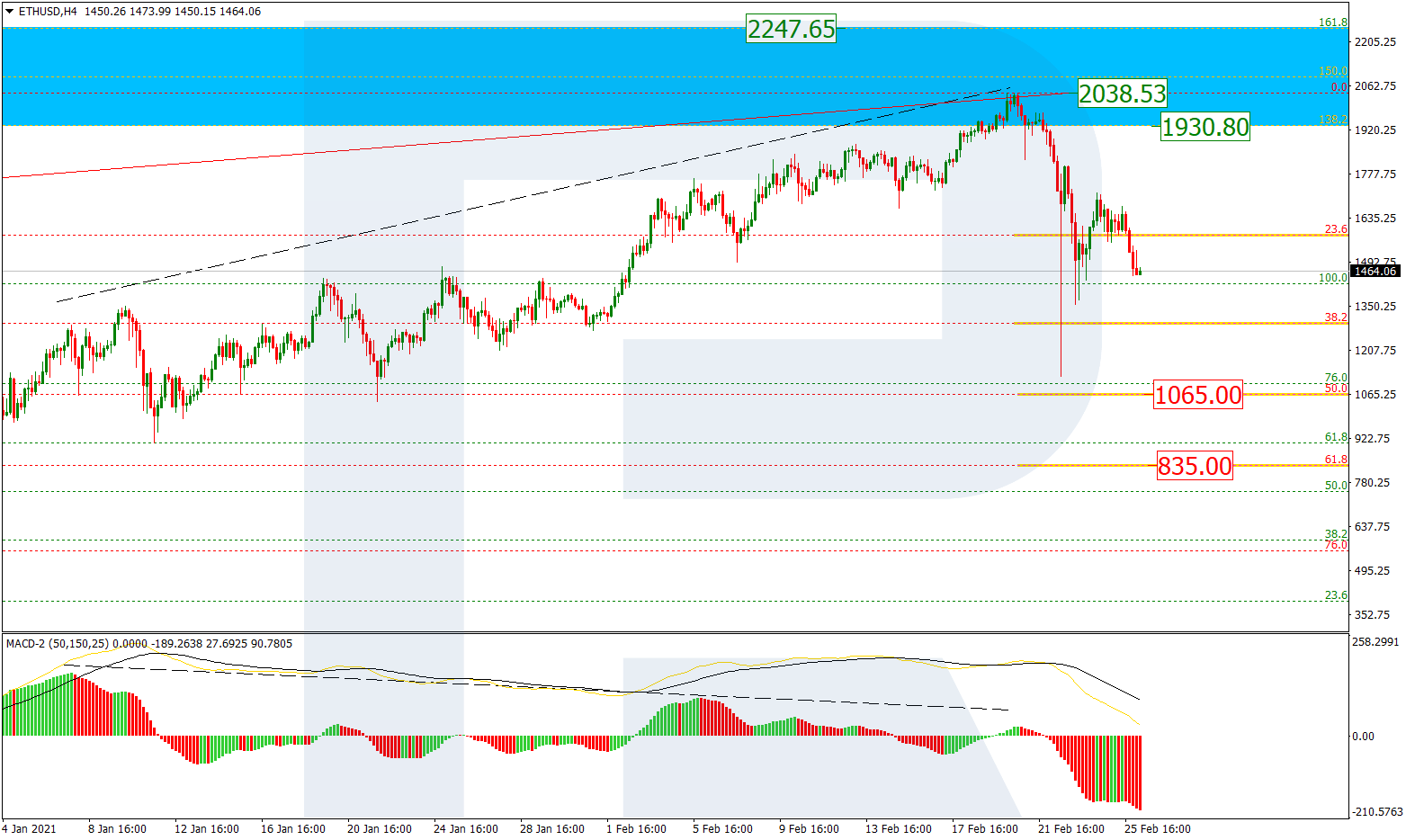

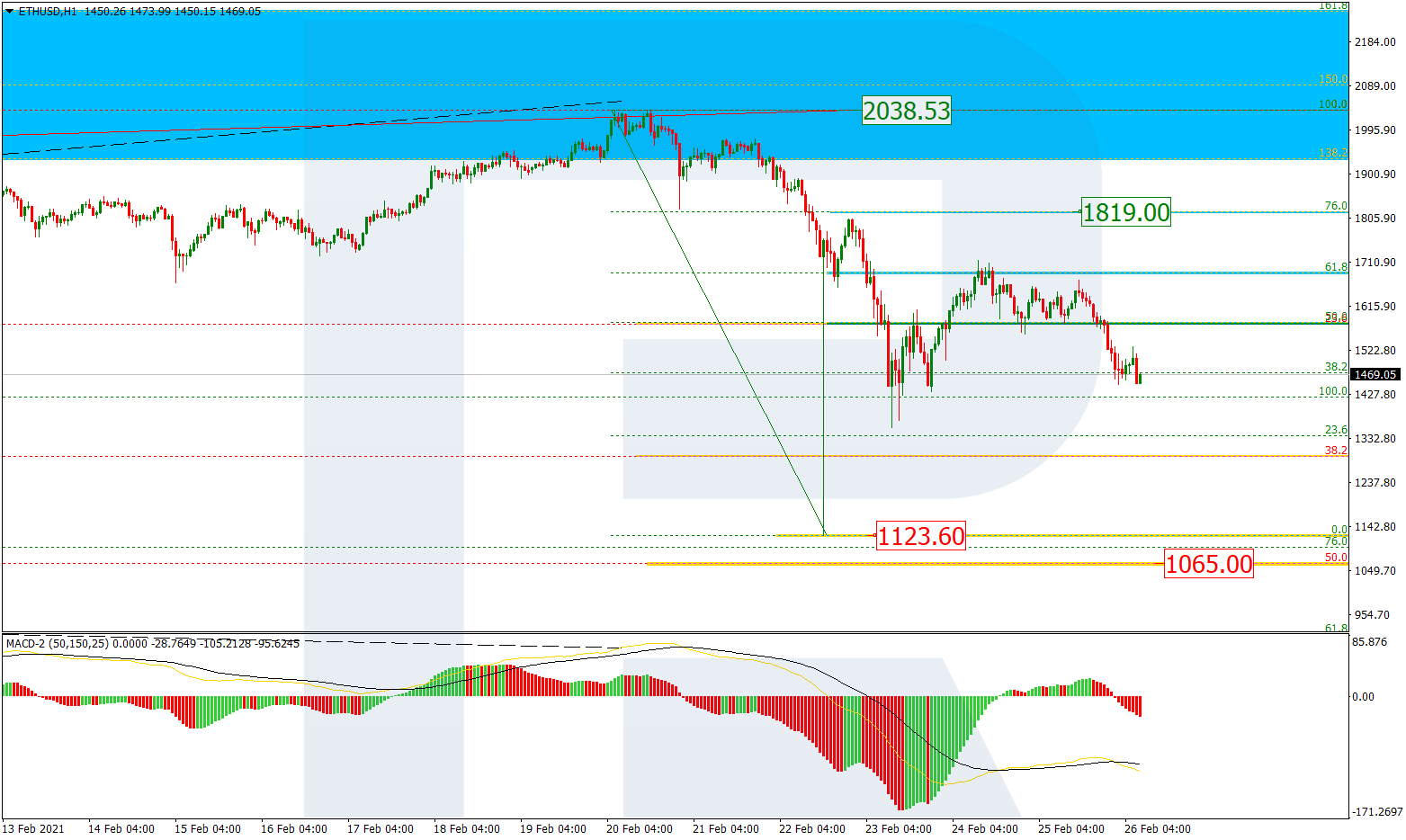

ETHUSD, “Ethereum vs. US Dollar”

In the H4 chart, after testing the post-correctional extension area between 138.2% and 161.8% fibo at 1930.80 and 2247.65 respectively, ETHUSD started plunging due to divergence on MACD. The first descending impulse broke 38.2% fibo but failed to reach 50.0% fibo at 1065.00. the current situation may be described as a correction within a correction. Possibly, the pair may complete the internal correction and resume falling to reach 61.8% fibo at 835.00. The key resistance is the high at 2038.53.

The H1 chart shows a more detailed structure of the current pullback after the descending impulse, which managed to reach 61.8% fibo but failed to get to 76.0% fibo at 1819.00. The next descending impulse may fall to break the low at 1123.60 and then reach 50.0% fibo at 1065.00.