With Ether’s technical outlook looking strong, analysts believe that further bullish action may be on the cards.

- On the heels of a new all-time-high above US$1500, the Ethereum options market is currently witnessing a massive surge in buy orders.

- Ether and Bitcoin supply across various exchanges have been dropping at a furious pace, with the most recent dip coming yesterday when the former scaled up beyond the $1,500 threshold.

- While many had been predicting an altcoin boom recently, the market has been somewhat slow to rise.

Ethereum investors have been a happy bunch over the past week or so, especially today saw Ether move from $1,348 to a relative high of $1,557, thus showcasing a profit of around 13% during the last 24-hour trading cycle. It bears mentioning that despite the recent volatility witnessed by the market as a whole, ETH is still exhibiting 30-day gains of more than 56%.

Also, as many investors would have noted, ETH had been flirting with its all-time high value for more than a week now but every time it came close to breaking the $1,420 threshold, it was faced with pullbacks. In fact, it was only after its fourth retest that the digital asset was able to break out completely and now seems to be sitting in a comfortable spot.

In regard to Ether’s fast-growing upward momentum, data released by crypto futures and options exchange Deribit indicates that with the bulls now seemingly in control, the ETH options market seemed to have been swamped with buy orders, which is traditionally used as an indicator of positive future financial movement.

Providing his thoughts on this development, Haohan Xu, CEO of digital asset trading platform Apifiny, told Finder that there is no doubt in his mind that ETH will continue to surge in 2021, alluding to the fact that the currency has become almost synonymous with the DeFi market and as this yet-nascent ecosystem continues to flourish, so will demand for Ether. On a more technical note he added:

“Aside from the obvious reasons of the recent bull run and last year’s DeFi craze, the number of BTC-pegged tokens on Ethereum blockchain such as WBTC, HBTC, renBTC have reached an all time high (ATH), totalling more than 160,000 BTC. This signifies increasing activities on Ethereum and continued strong growth of DeFi.”

Elucidating his thoughts on the matter, crypto analyst and President of spot, futures and options trading platform XREX Inc. Jason Fernandes, told Finder that these new all-time high landmarks should come as no surprise to anyone, especially those individuals who have been following the market closely. “I don’t believe that activity is fully priced-in yet. Bitcoin’s volatility over the past few days has negatively affected the market but the fundamentals of Ethereum remain strong” he added, noting that from a purely macro perspective, it’s been a confluence of factors – such as the launch of Ether 2.0, continual lowering network fees – that are making Ethereum increasingly attractive to investors across the board. Fernandes further opined:

“With the network moving to a proof-of-stake consensus and the fact that the networks can now process transactions at rates comparable to Mastercard/Visa and its easy to see why Ethereum’s price could be headed upward in the short to medium term.”

Ether volumes on centralized exchanges continue to plummet

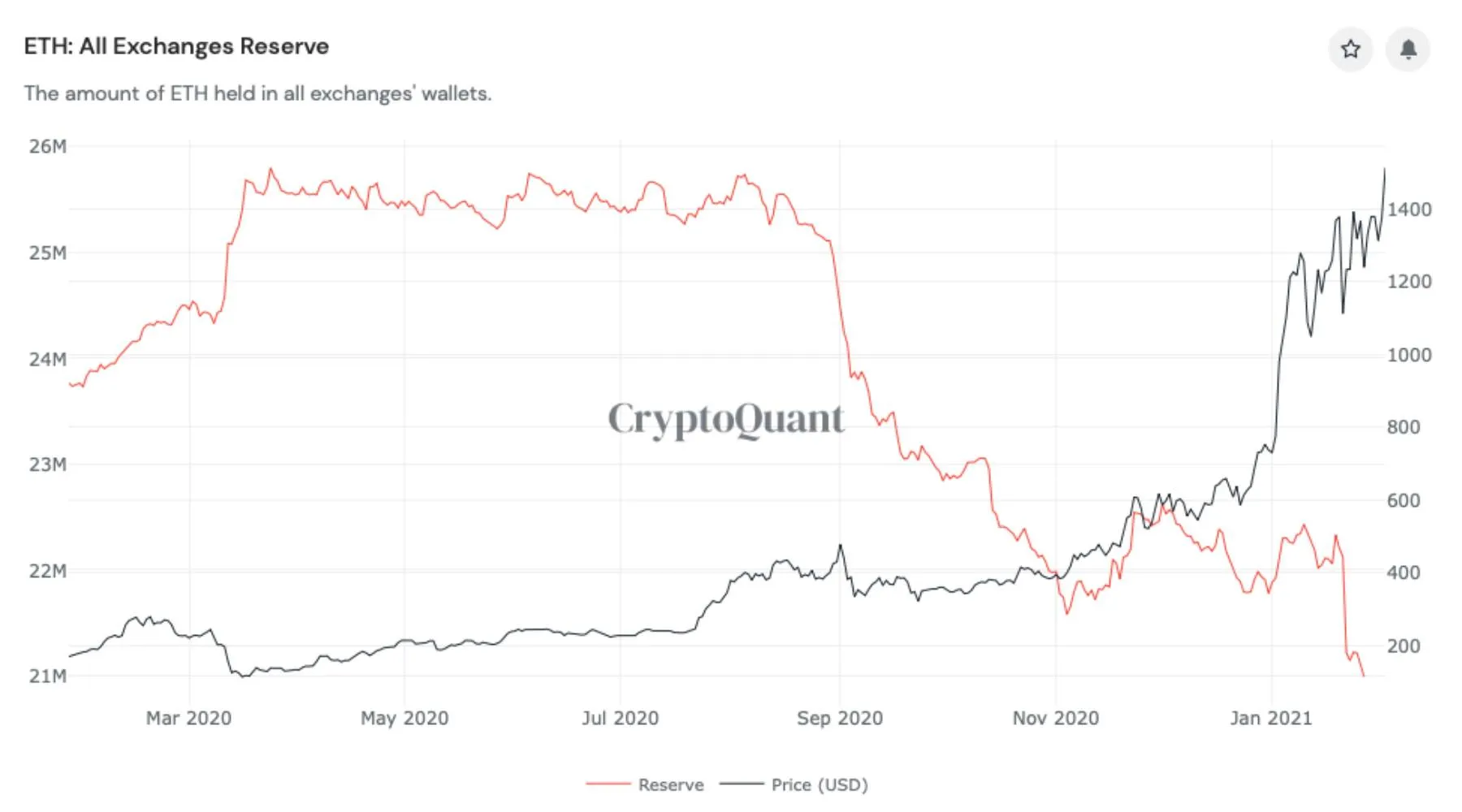

As the ETH market continues to scale to new heights, it is becoming increasingly apparent that more and more people are taking custody of their crypto holdings as opposed to storing their assets on centralized exchanges. In this regard, data made available by crypto analytics firm CryptoQuant, clearly shows that the amount of Ether held across all centralized exchange’s has continued to plunge to all-time lows over the past month or so, with the recent and most drastic dip coming after the currency shot up above the $1,500 mark earlier today.

Ethereum Price vs. Reserve Holdings across CeFi exchanges. Source: CryptoQuant

This trend is most likely being fueled by the rise of DeFi, increasing awareness about ETH2.0 (and its staking options) as well as surging institutional interest in the currency. Furthermore, it bears mentioning that as of Feb. 3, the total value locked (TVL) across all DeFi platforms has reached a staggering $29.71 billion, representing a 95+% growth since January 1. when this value lay at just $15.53 billion.

Altcoins hold on, it’s Ethereum’s time to shine

Recently a whole host of analysts had been claiming that an alt-season may finally be upon us, but upon closer examination, we can see that over the last week or so, only Cardano and XRP have showcased decent gains, with it being public knowledge that the latter’s value is being heavily manipulated by amateur investors at the moment.

In this regard, Xu noted that even though in the future we may see some altcoins competing with BTC and ETH in terms of market dominance, in the near to mid-term, most of these assets are not going to come close to the heights they once scaled up to during the 2017 boom.

Similarly, Fernandes too believes that this is Ether’s time to shine, with an increasing number of individuals now beginning to grasp the immensity of the currency’s technological and monetary proposition, however, he did add:

“In the long term, Ethereum could however see formidable competition from players like Cardano and Polkadot as adoption for these networks grow.”

Interested in cryptocurrency? Learn more about the basics with our beginner’s guide to Bitcoin, keep your crypto safe with a hardware wallet and dive deeper with our simple guide to DeFi.

Disclosure: The author owns a range of cryptocurrencies including at the time of writing

Disclaimer:

This information should not be interpreted as an endorsement of cryptocurrency or any specific provider,

service or offering. It is not a recommendation to trade. Cryptocurrencies are speculative, complex and

involve significant risks – they are highly volatile and sensitive to secondary activity. Performance

is unpredictable and past performance is no guarantee of future performance. Consider your own

circumstances, and obtain your own advice, before relying on this information. You should also verify

the nature of any product or service (including its legal status and relevant regulatory requirements)

and consult the relevant Regulators’ websites before making any decision. Finder, or the author, may

have holdings in the cryptocurrencies discussed.

Picture: Finder