- Ethereum price had a breakdown from a crucial pattern on the 12-hour chart.

- The number of whales holding ETH has significantly shrunk.

- If ETH bulls can’t hold a key support level, the digital asset could drop towards $1,000.

Ethereum price suffered a major blow right after climbing above $2,000 for the first time ever. The smart-contracts giant fell to a low of $1,355 and is on the verge of another leg down.

Ethereum price could dive towards $1,000

On the 12-hour chart, the most significant pattern was the ascending wedge formed since the beginning of 2021. This pattern had a breakdown below the critical support level of $1,750 while the bears target a low of $1,000 in the long-term.

ETH/USD 12-hour chart

The breakdown of the ascending wedge pattern has a bearish price target of $1,000 in the long-term. In addition to this, on-chain metrics are also in favor of the bears.

ETH Holders Distribution

The number of whales holding between 100,000 and 1,000,000 ETH coins ($150,000,000 and $1,500,000,000) has significantly decreased from 161 on February 12 to only 153 currently. This indicates that large holders expect Ethereum price to fall even more.

However, despite the past price action of Ethereum, the number of coins locked inside the Eth2 deposit contract has reached 3.3 million while the total sum of Ethereum locked in DeFi protocols touched 7.95 million. This means that a total of 11.25 million Ethereum are locked away from exchanges decreasing its selling pressure.

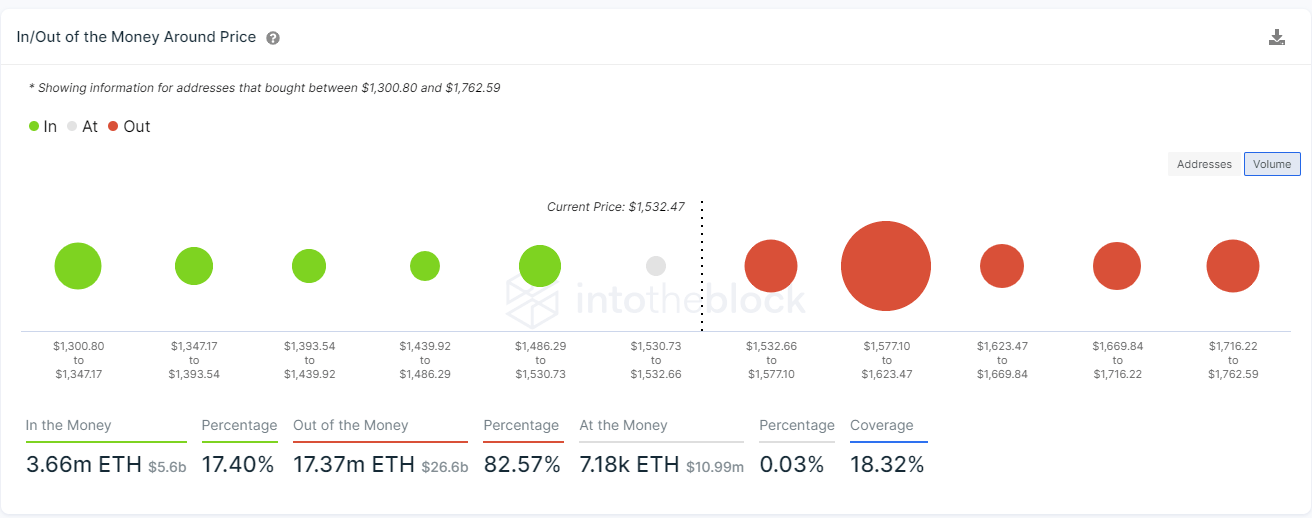

ETH IOMAP chart

According to the In/Out of the Money Around Price (IOMAP) chart, there is one crucial resistance barrier located between $1,577 and $1,623. A breakout above this point should push Ethereum price towards $1,762.

%20[16.51.32,%2026%20Feb,%202021]-637499518225771940.png)