Nine years after Coinbase was founded, it’s all still a bit revolutionary. But there’s a rather rich irony at play: To make the dream a reality, Coinbase first has to thrive in that old world of traditional money and the traditional stock market. Before it can create a new future, the company might have to beat the past at its own game.

So far, so good.

Coinbase filed for a direct listing this week on the Nasdaq, an enormous crossover event between the crypto market and the stock market that could value the company at more than $100 billion. And that’s one of nine things you need to know from the past week:

1. Coin of the realm

Excuse me for the dorm-room philosophy on a Sunday morning, but money is a social construct. In a slightly different reality, no reasonable person would exchange a tasty hamburger and fries for a piece of strangely decorated paper with Alexander Hamilton’s face on it. Fiat currency isn’t intrinsically valuable. But because our society has agreed that strangely decorated piece of paper has a certain value, the trade works. Ever since the abandonment of the gold standard, that’s been the bargain on which our whole economy rests.

On the one hand, it seems kind of ridiculous to try to create that same grand bargain again from scratch, completely digitally, a whole system of payment and trade based on nothing but lines of ones and zeros on a screen. But on the other hand, why not?

I can’t sit here and explain the nitty-gritty details of cryptocurrencies and blockchains, just like I can’t give a detailed breakdown of the many minute processes going on inside my laptop that allow me to push buttons on a keyboard and see these words appear on a screen. I’m not a technologist. But as with other technological breakthroughs, I can certainly see the appeal. The ideal vision of bitcoin and other cryptocurrencies could provide people around the world with a safe way to operate financially without regard to national borders or financial institutions, cutting out middlemen and bankers to create a new sort of economic freedom.

When Coinbase was founded in 2012, that idea was still in its infancy. The overall market cap of all cryptocurrencies was less than $500 million. Slowly but surely, though, it caught on. The first real boom came in 2017 and 2018, when the price of a bitcoin, by far the most popular cryptocurrency, soared from less than $1,000 to more than $19,000. But the boom ended, and for the next two years or so, cryptocurrencies receded from mainstream consciousness.

Then, last year, during the first months of the pandemic, a new, bigger boom began. The price of a bitcoin crept up again past $10,000, past $20,000, past $30,000. The prices of other cryptocurrencies also skyrocketed. By the end of last year, the overall crypto market cap topped three-quarters of a trillion dollars.

And by the time bitcoin rose above $50,000 for the first time earlier this month, a growing chorus of major institutional investors were thinking about cryptocurrencies as a legitimate asset class worthy of their long-term attention.

All of which has been very good for business at Coinbase, which has emerged as the most popular portal for those looking to cash in on the crypto gold rush. Between 2016 and 2018, the company’s valuation grew from $500 million to $8 billion, according to PitchBook data. And earlier this month, Axios reported that private investors recently valued the company at more than $100 billion. That staggering sum could be a rough target valuation for the company’s coming direct listing, which would make the move one of the largest stock-market debuts of all time by a VC-backed company.

There are plenty of other metrics from Coinbase’s new S-1 filing that demonstrate just how swift the company’s recent growth has been. Median quarterly trading volume on its platform increased from $17 billion worth of assets in 2018 to $38 billion in 2020. The value of the assets stored on its platform, meanwhile, has grown from $7 billion to $90 billion over that same span. Total revenue in 2020 was nearly $1.3 billion, up nearly 140% year-over-year.

After that banner year in 2020, the company was sitting on $1.1 billion in cash and equivalents at the end of December, likely a factor in its choice to go public through a direct listing that won’t raise any new capital, rather than opting for an IPO.

But the company’s filing also suggests reasons for wariness. Coinbase readily acknowledges that another cryptocurrency crash could be bad for business, reducing both the value of the assets on its platform and trading volume among its users. And that volume is the key to Coinbase’s model. In 2020, more than 96% of its net revenue came from transaction fees.

In the prospectus, CEO Brian Armstrong says the current good times likely won’t last. “We may earn a profit when revenues are high,” he wrote, “and we may lose money when revenues are low, but our goal is to roughly operate the company at break even, smoothed out over time, for the time being.” Even in an era when profitability is optional for massive startup IPOs, “break even” probably isn’t what most investors are looking for in a $100 billion company.

But then again, Coinbase is not most companies, and the crypto market is not most industries. The segment has its skeptics, to be sure. But it also has a significant population of true believers, people for whom investing in cryptocurrencies is nothing more or less than a bet on trying to create a new, more equitable financial system. It also has a significant population of pure speculators trying to make a quick buck on a highly risky investment with the potential for huge returns. In those two latter respects, some parallels could certainly be drawn to the GameStop saga.

And the timing for the listing couldn’t be better. Another operator of a cryptocurrency exchange, Kraken, is raising new funding that could come at a valuation of more than $10 billion, Bloomberg reported this week, another sign of surging investor interest in the space.

For the past nine years, Coinbase’s value has been determined solely by a relatively small group of venture capitalists. What will happen when the company’s shares are at last available to a much broader base? We’re about to find out.

2. Plugged-in SPACs

For what seems like the umpteenth week in a row, we saw multiple major mergers lined up between SPACs and companies operating in some part of the electric vehicle market. EV manufacturer Lucid Motors agreed to merge with Churchill Capital Corp. IV in a deal that values Lucid’s existing business at $11.75 billion. Xos, which is developing electric delivery trucks, agreed to merge with a SPAC that values the combined entity at $2 billion. And Enovix, which makes lithium-ion batteries for EVs, struck a SPAC deal of its own that comes at an enterprise value of just over $1.1 billion.

3. Giant unicorns

Coinbase had company from other high-profile unicorns making headlines this week. SpaceX reported $850 million in new funding in an SEC filing, confirming an earlier report from CNBC. Other reports emerged indicating that point-of-sale loan provider Klarna is in talks to raise $1 billion in new funding at a $31 billion valuation. Finally, Roblox revealed an anticipated March 10 date for its coming direct listing after clearing up an issue with the SEC that was reportedly related to how the social gaming company reports revenue from its proprietary digital currency.

4. Politicos

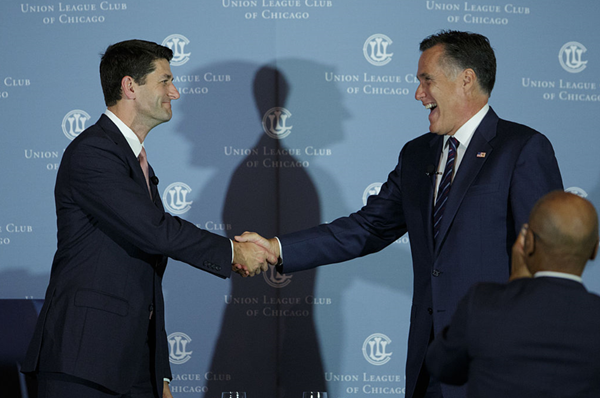

In 2012, Mitt Romney picked Paul Ryan as his running mate in the Utah senator’s bid for the White House. Now, the two are reuniting, as Ryan (who was later speaker of the House) has agreed to become a partner at Solamere Capital, a private equity firm founded by Romney. Meanwhile, The Washington Post reported that former Treasury Secretary Steven Mnuchin, a former Goldman Sachs executive, is starting a new investment fund that will seek to raise capital from sovereign wealth funds in the Persian Gulf to invest in sectors such as fintech and entertainment.

5. Next big things

Nostalgia is hitting the Instagram generation. A red-hot startup called Dispo raised $20 million at a $200 million valuation to fund its retro photo-sharing platform, which attempts to recreate the disposable camera for our virtual age—users can’t look at the photos they take until the next day. The rising trend of non-fungible tokens also continued to accelerate, as Benchmark reportedly led a $50 million investment in Sorare, the creator of a blockchain-based platform for virtual soccer cards, building on the boom of NBA Top Shot.

6. Telecom transactions

AT&T struck a deal to spin out its DirecTV, AT&T TV and U-Verse units, with TPG Capital paying $1.8 billion for a 30% interest in the new entity. The deal implies an enterprise value for the businesses of $16.25 billion, compared to the $48.5 billion AT&T paid for DirecTV in 2015. Another major name in PE was active on the other side of the equator, as KKR struck a $1 billion deal to take control of Telefonica Chile’s fiber network in the country.

7. Family trees

Last year, Blackstone made a bet on genealogy when it acquired Ancestry for $4.7 billion. Now, Francisco Partners is getting in on the act: The tech investor agreed this week to buy Israel-based genealogy company MyHeritage, with TechCrunch reporting a price tag of $600 million.

8. Bessemer’s billions

Bessemer Venture Partners became the latest VC firm to bring in a huge new haul of funding, closing its latest flagship fund on nearly $2.5 billion and raising another $825 million for its second opportunity fund. Bessemer also promoted four current investors to partner, and it brought on former Amazon executive Jeff Blackburn as another new partner after he recently ended a 22-year stint at the ecommerce powerhouse.

9. Benchtop blood testing

A California-based startup is developing a novel blood-testing platform that, in the span of just a few minutes, could conduct a wide array of lab-accurate tests from just a few drops of blood. And no, we’re not talking about Theranos. This week, San Diego’s Truvian Sciences closed a $105 million Series C to continue funding its pursuit of a game-changing diagnostic tool, one that could very well accomplish what Theranos once promised. And Truvian seems eager to avoid the sort of pitfalls that befell Theranos: It said the new funding paves the way for the company to submit its device for Food and Drug Administration approval.