The strenghtening US dollar and technical issues at major crypto exchange Coinbase might be partially blamed for the bitcoin (BTC) crash seen yesterday, according to analysts.

There’s something behind every crash of the world’s number one crypto, and many become determined to find who and what is to blame. Some believe that one of the factors behind yesterday’s price drop to c. USD 30,700 per bitcoin could be the USD.

If “we’re really looking for a more cause-and-effect driver to explain [Monday’s] pullback, other than the obvious “what goes up must come down” element, it would be [Monday’s] uncanny apparent correlation to the US dollar, which bounced hard off her own lows [on Monday],” Mati Greenspan, founder of Quantum Economics, wrote in his newsletter yesterday, adding that stocks and commodities are also softening on the greenback’s strength.

Greenspan further added that there is nobody who could “say exactly where it will turn around, or when the pain will end,” but to him, this price action seemed “oddly reminiscent of the early 2017 bull market pullbacks.”

Meanwhile, Vijay Ayyar, Head of Business Development with crypto exchange Luno, was quoted by Bloomberg as saying that if the US dollar index “powers through” the level of 92 (currently sitting at nearly 90.5), “then we may have seen a bitcoin top at [USD] 40,000.”

At the same time, others are pointing at another possible cause behind the crash, and one criticized before. Crypto researcher and analyst Willy Woo tweeted that spot market sell-off started around USD 38,000, “then Coinbase partially failed, not registering buys, causing its price to go [USD] 350 lower than others, this pulled down the index price that futures exchanges use to calculate leverage funding, wrecking bearish havoc on speculative markets.”

He further argued whether futures exchanges should have “removed Coinbase from their index during the incident to firewall the situation.”

Unlike previous crashes in the past 2 years, where over-leveraged markets lead by trader liquidation, this one started on spot markets, then was greatly amplified by a single exchange partially failing, yet did not turn itself off for the good of the ecosystem,

— Willy Woo (@woonomic) January 11, 2021

Alistair Milne, Chief Investment Officer at the Altana Digital Currency Fund, commented that Coinbase traded “at least 1000 lower” than its competitors Bitfinex and Binance.

Which market?

CNN Business argued that bitcoin is now in a bear market, but Naeem Aslam, chief market analyst at AvaTrade, was quoted as saying that “the bull run is not over yet, and it is still likely to make its journey to the upside.” Meanwhile, MicroStrategy CEO Michael Saylor tweeted that the events of the day confirm that BTC “will probably not go up at the rate of 1500% per year for more than a month at a time.”

Furthermore, some have pointed out that bitcoin has seen larger corrections before at times of massive gains.

Fun fact: #bitcoin had 6 pullbacks bigger than our recent -28% in the record setting 1000%+ growth year of 2017.… https://t.co/R9dGQuNIdj

Additionally, per on-chain analysis firm Glassnode, as on-chain fundamentals remained strong despite the value dip, pointing to a healthy network, that dip “caused a clear bounce off the bear/bull threshold on the Bitcoin dormancy flow chart.”

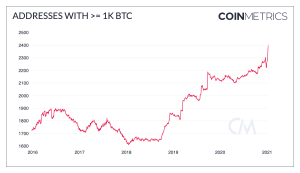

“Active addresses for both BTC and ETH are also both near all-time highs,” researchers at Coin Metrics noted today, adding that this increase signals that on-chain activity is increasing.

Also, they stressed that the amount of addresses holding at least BTC 1,000 has increased significantly since the start of 2021, which is “potentially further evidence that institutions are here to stay.”

Finally, as is always the case, there are rumours of a possible ‘whale‘ influence, as well as talks of conspiracies and manipulations – as well as comments criticising the inevitable resurgence of these discussions.

At pixel time (14:21 UTC), BTC trades at USD 34,029 and is up by 6% in a day and 8% in a week. The price rallied by 82% in a month and 336% in a year.

__

bitcoin is the real v-shaped recovery

— Matthew Graham (@mattysino) January 12, 2021

__

Definitely the level. https://t.co/PHYQvtOghS

— Pierre (@pierre_crypt0) January 12, 2021

__

1. people who bought at the top in 2017 who are shitting their pants 2. instos balancing the month who have doubled their profit and therefore selling 50%. 3. bots programmed to sell when top Bollinger is breached and other conditions apply

— David Hilcher (@david_hilcher) January 10, 2021

__

what happened in the last 48 hours is wild

here’s my speculative likely incorrect narrative – high time frame levels got chopped as fk because oi was huge, funding was massive, and too many apes were giga long and over leveraged

a bunch of people lost everything, now only up 🤝

— CryptoGainz (@CryptoGainz1) January 12, 2021

____

Learn more:

Ruffer Reveals Why They Poured GBP 550M in ‘Non-Sensical’ ‘Beast’ Bitcoin

Crypto in 2021: Bitcoin To Ride The Same Wave Of Macroeconomic Problems