Litecoin – LTC dives to essential assist trying to rebound in direction of $200

- Litecoin holds above essential assist as bulls-eye liftoff to $200.

- Help at $145 stays key to the uptrend; in any other case, if damaged, LTC may retreat to $120.

Litecoin has been grinding greater because the current breakdown to $110. Restoration was very constant, however Litecoin failed to carry above $160, not to mention clear the resistance at $170. If its present essential assist at $145 stays intact, Litecoin may spike towards $200.

Litecoin is on the verge of a breakout to $200

LTC/USD price motion is holding inside an ascending parallel channel, as seen on the 4-hour chart. The cryptoasset presently sits on a essential assist at $145, strengthened by the channel’s decrease edge.

Moreover, the 50 Easy Shifting Common is in line to supply anchorage and maybe act as Launchpad for takeoff. A rebound is anticipated to clear the center boundary hurdle, paving the best way for beneficial properties towards $200.

LTC/USD 4-hour chart

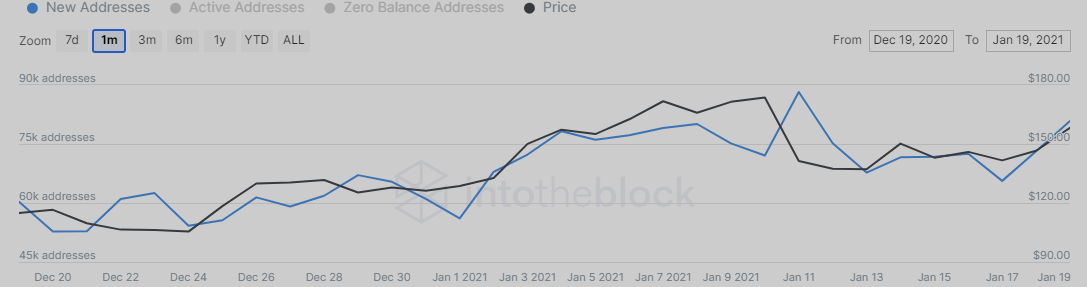

IntoTheBlock’s “Each day Energetic Addresses” model reveals that the variety of new addresses created on the LTC community topped-out on January 11 at a excessive of almost 88,000 addresses per day, calculated one-month trailing common earlier than falling to about 66,000 on January 17.

Since then, Litecoin‘s community progress has recovered by new lively addresses per day. At press time, roughly 81,000 new addresses had been created based mostly on this trailing common, which may be thought of a outstanding bullish signal for Litecoin.

Litecoin newly-created addresses

On the flip aspect, slicing by the $145 assist on the 4-hour assist credence to Michaël van de Poppe, a famend technical analyst’s bearish outlook towards $120.

#Litecoin chart from a couple of weeks again and the degrees are nonetheless legitimate.

The vary at $120 received a check, and $135 flipped since.

Nevertheless, does seem like a weak bounce from the lows right here during which additional consolidation appears seemingly.

Purchaser at $120. pic.twitter.com/XoRl78Qsvy

— Michaël van de Poppe (@CryptoMichNL) January 20, 2021

The assist at $140 may attempt to come in useful however won’t have the facility to flip Litecoin bullish, therefore the opportunity of losses extending to $120 (a possible purchase zone).