The U.S. Internal Revenue Service (IRS) has updated its instructions for disclosing crypto activities. The update provides clarification on who must answer “yes” to the IRS’ crypto question and when it is appropriate to select “no” as the answer.

IRS Publishes New Crypto Tax Filing Instructions

The IRS published updated instructions for Form 1040 on Dec. 31. They include additional information on how to answer the cryptocurrency question on the main tax form used by individuals to file U.S. tax returns.

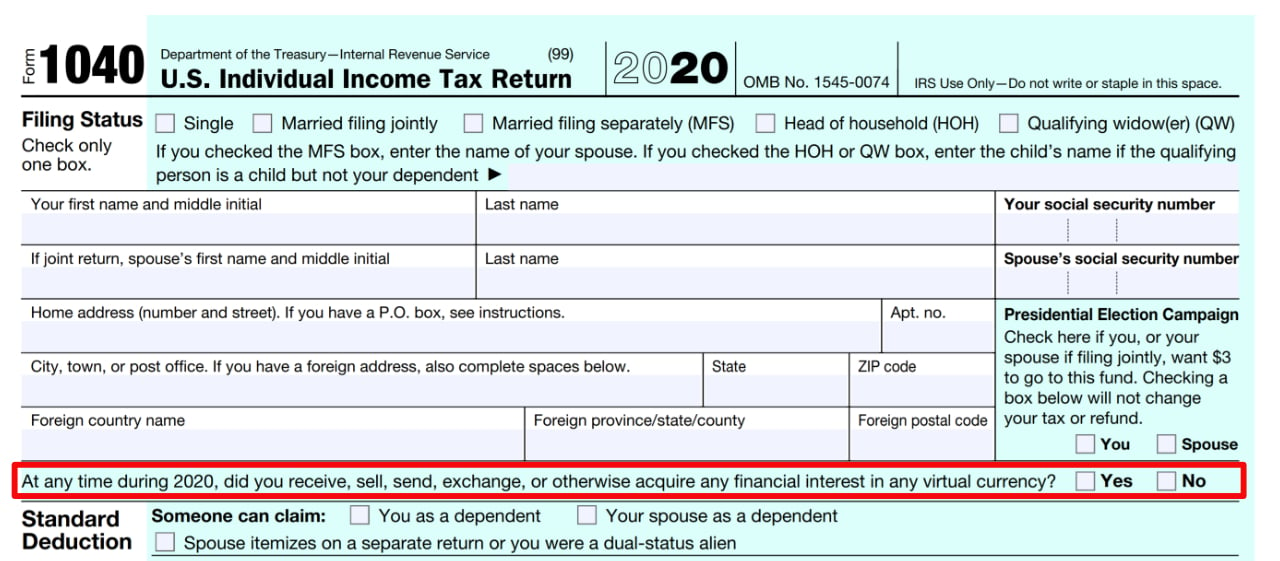

The first question on Form 1040 is about cryptocurrency. It reads: “At any time during 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?” Taxpayers only need to answer “yes” or “no” to this question.

According to Cryptotrader Tax, a crypto tax software company, the IRS now requires taxpayers who purchased cryptocurrency in 2020 to answer “yes” to the crypto question on Form 1040 — not just if they sold, traded, or exchanged cryptocurrency as outlinned the previous instructions. The company detailed:

This language was not present in the prior instructional guidance that was released in October. The IRS will now know everyone who purchased cryptocurrency in 2020 as all taxpayers must answer this question under penalty of perjury.

In summary, taxpayers must answer “yes” to the IRS’ cryptocurrency question in 2020 if they purchased or received (including from an airdrop or a fork) cryptocurrencies. They must also answer “yes” if they sold a cryptocurrency for a fiat currency or exchanged a cryptocurrency for another cryptocurrency. In addition, they need to answer yes if they used cryptocurrency to pay for goods or services.

The new instructions also clarify when taxpayers do not need to answer “yes” to the crypto question. The IRS described:

A transaction involving virtual currency does not include the holding of virtual currency in a wallet or account, or the transfer of virtual currency from one wallet or account you own or control to another that you own or control.

“This is valuable clarification for long-term holders who were unsure if they needed to select yes or no to the question,” Cryptotrader Tax commented.

The IRS also explained that if a taxpayer disposes of any cryptocurrencies that were held as capital assets through a sale, exchange, or transfer, they must use Form 8949 to figure out their capital gain or loss and report it on Schedule D of Form 1040.

What do you think about the IRS’ tax filing requirements? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, IRS

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.