Crypto at a Glance

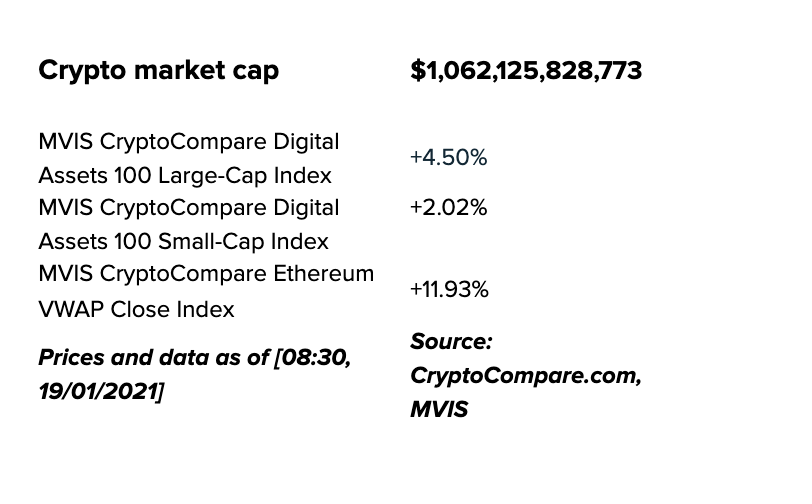

It’s been a relatively quiet week so far for Bitcoin, which seems happy to coast along between $35,000 and $37,000 for the time being. The really big-and-mega-exciting news today is Ethereum, which finally looks to be charging, head-down and horns out, towards that long-awaited new all-time high (set in the heady days of January 2018). Is today finally the day it breaks the seal? If it does break it, where does it go from here?

The move comes just days after Grayscale CEO, Michael Sonnenshein tweeted that institutional investors are increasingly showing an interest in diversifying their investments into other crypto assets as well. Could this be part of the cause and what could it mean for other alts?

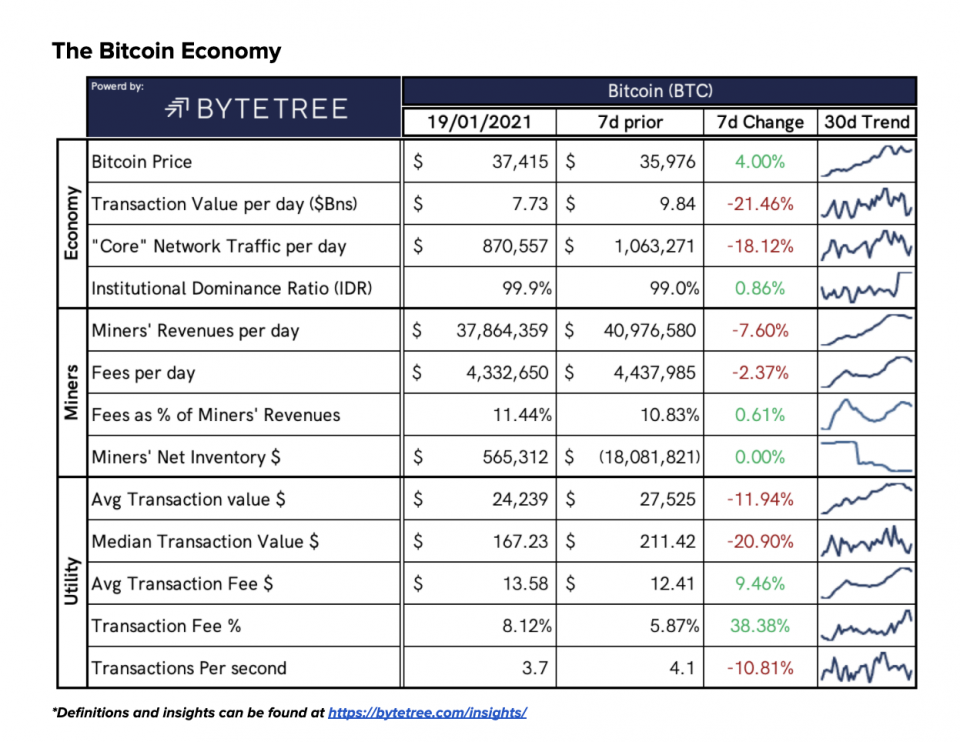

There was generally a lot of talk in the lead up to Christmas of institutional money finally arriving for crypto, but the numbers we’re seeing this year are making even that seem like small fry. Yesterday saw Grayscale buy some $590 million of bitcoin, while last week the digital asset manager spent a massive $700 million in a single day – the majority of which it says is on behalf of institutional investors. That’s up from an average of roughly $250 million a week in Q4 of last year. Meanwhile, CoinShares, which claims to be the largest digital asset manager in Europe, launched their new Physical Bitcoin ETP (BTC) yesterday and has already attracted $200 million of assets. Is this just the start? What does institutional investment mean for the traditional market cycles we’ve seen over the past 13 years?

In the Markets

What bitcoin did yesterday

We closed yesterday, 18 January, 2020, at a price of $36,630.08 – down from $35,791.28 the day before. It’s now 17 days since the price of bitcoin was last below $30,000 and 33 since it was below $20,000.

The daily high yesterday was $37,299.29 and the daily low was $34,883.84.

This time last year, the price of bitcoin closed the day at $8,942.81. In 2019, it was $3,657.84.

As of today, buying bitcoin has been profitable for…

99.9% of all days since 2013-04-28.

Bitcoin market capitalisation

Bitcoin’s market capitalisation is currently $695,369,116,592, up from $670,715,099,323 yesterday. That means Bitcoin is still outside the top 10 assets by market cap, which is sad but we suppose we’ll live. Gold’s market cap is currently $11.703 trillion. Slowly but surely.

Bitcoin volume

The volume traded over the last 24 hours was $56,296,149,855, up from $52,911,226,655 yesterday. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of bitcoin over the last 30 days is 90.7%.

Fear and Greed Index

The Fear and Greed Index remains in Extreme Greed at 80. That may be up on yesterday and still in Extreme Greed, but it now seems we’re in a period of sustained cooling off. This is possibly a good thing after the Winter hot streak, as the index doesn’t usually stay this high for very long before a correction. The last time we were outside of Extreme Greed was 5 November 2020.

Bitcoin’s market dominance

Despite Ethereum’s pump, Bitcoin’s market dominance still stands tall at 66.17. Its lowest ever recorded dominance was 37.09 on 8 January, 2018.

Relative Strength Index (RSI)

The daily RSI is currently 62.26. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

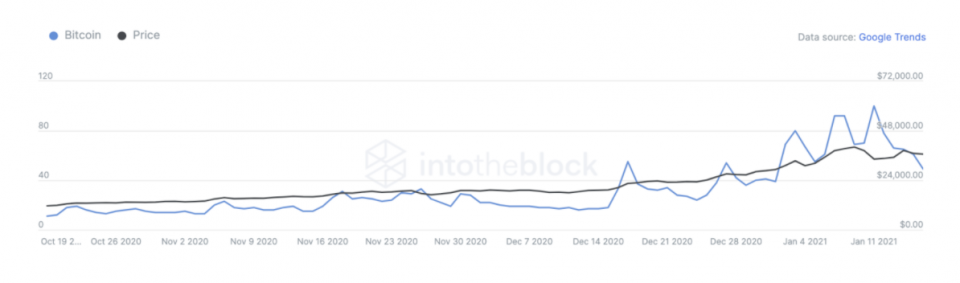

Google trends

The trend in Google searches over the last 90 days. Google shows this chart on a relative basis with a max score of 100 on the day that had the most Google searches for that keyword. The latest score is 49 – taken from 16 January.

Convince your Nan: Soundbite of the day

“Bitcoin is the dominant digital monetary network. The next billion members will pay trillions to join. You might want to join first.”

- Michael Saylor, MicroStrategy CEO and bitcoin quote machine

What they said yesterday…

Want to know what was embedded on the 666,666th dollar bill? What about the 666,666th bar of gold? Nothing. Because they’re boring.

Don’t let Grayscale take it all for themselves

The road may be long…

…but happening it could well be

Crypto AM: Longer Reads

Crypto AM: Market View in association with Ziglu

Crypto AM: Technically Speaking in association with with Zumo

Crypto AM: Talking Legal in association with INX

Crypto AM shines its Spotlight on Trade the Chain

Crypto AM: Focusing on Regulation

Crypto AM: Deeper Dives with Liam Roche

Crypto AM: A Trader’s View with TMG

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Definitively DeFi

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:30am GMT.

Crypto AM Daily in association with Luno