With ETH currently trading at around US$1,000, it seems the market can expect more volatility in the coming few days.

- Analysts believe that the ongoing dip had been on the cards for quite some time now, especially with ETH and BTC showcasing historic price runs in recent weeks.

- As per Coin Metrics’ latest newsletter, an increasing number of institutions are looking to buy Ether as an alternative to Bitcoin.

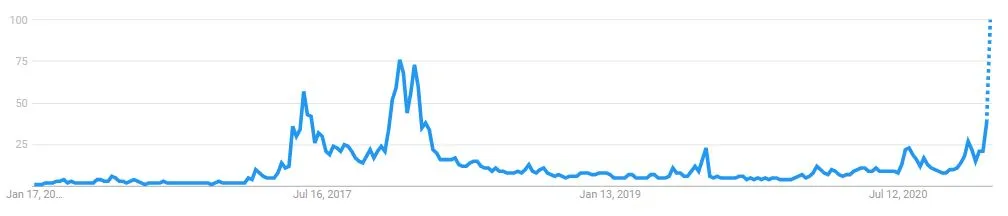

- Google Trends data indicates that search interest for the term “Ethereum” is currently growing.

Ethereum, the second-largest cryptocurrency by total market capitalisation, has witnessed a sharp dip of around 15%, as a result of which the premier digital asset’s value is currently hovering around the US$1,100 region. Despite the correction, Ether is still showcasing a healthy 7-day gain of over 16%. This latest slide comes in the wake of Bitcoin experiencing a 24-hour slip of 10.4%, its largest in over a week.

Over the course of the last 12 months, Ethereum’s rise has been nothing short of meteoric, with the altcoin incurring gains of 700+%. Thus, price corrections of 10-20% – which have become a staple of the cryptocurrency industry – stand to provide a whole host of investors the opportunity to accumulate assets. Also, technically speaking, analysts had predicted that ETH would meet heavy resistance following its breach of the US$1,350 threshold which when coupled with BTC’s aforementioned decline, seems to explain this current downtrend.

Despite the volatility, Tron CEO Justin Sun told Finder that Ether’s value is likely to continue increasing in the future for a number of reasons. Firstly, he pointed out that the industry had been in a bear season over the course of 2018-19 but despite the slumps, a massive section of investors had continued to accumulate ETH (as well as other premier cryptocurrencies). The secondary, and much more obvious narrative as per Sun, is the inflow of capital from institutions, adding:

“Eth’s value was meant to increase… because of the positive correlation in price analysis of BTC, LTC. Once BTC moves, it consolidates and when that happens, capital flows to the next major [digital asset]. BTC has broken its ATH by a huge margin – ETH has not yet done that thus the next legit alt season could see ETH breaking past its ATH.”

Adding to his aforementioned point of capital – be it institutional or retail – flowing in a sequence, i.e. large caps to mid-caps to low caps, Sun is confident that many major altcoins (including ETH) will witness a massive surge in interest in the coming months.

Ethereum searches grow sharply on Google

On the heels of its recent upward ascent, data as per Google Trends indicates that a growing number of people have been looking up the term “Ethereum”. In this regard, the currency’s previous such peak came all the way back on 13 January 2018, the day when the premium altcoin hit its all-time high value of $1,448.

Furthermore, Google analytics indicates that most of ETH’s current interest seems to be coming from a slew of unexpected regions, particularly Eastern European nations such as Kosovo, North Macedonia and Slovenia. Other countries where people are aggressively stocking up on their Ether knowledge include Nigeria and China.

By contrast, despite Bitcoin seemingly breaking new ground (price-wise) each passing day, the cryptocurrency’s Google search results have stayed at just 65% of its peak popularity, last seen on 23 December 2017.

Commenting on this development, John Squires CEO of Currency.com, a regulated digital asset trading platform, told Finder that with each passing day institutional investors are becoming more and more interested, albeit slowly, in Ethereum, adding:

“We can see that with the growing interest in the Grayscale Ethereum Trust. In fact, there are some who are solely investing in ETH and not Bitcoin. This was noted by Michael Sonnenshein, managing director at Grayscale Investments LLC.”

In terms of its future value action, Squires believes that the premier altcoin could well be on its way to pushing past its historical high, especially as interest in DeFi continues to surge. In this regard, Google’s search data has suggested that interest in the term “DeFi” too has remained at 90% of its peak, despite the boom being witnessed quite some time back.

Lastly, on the subject of whether ETH can reach the $10,000 mark, Squires opined: “It’s too early to say whether it will hit $10k. Let’s wait and see when the system upgrades and addresses the [existing] problems with its blockchain.”

Ethereum next in line for major institutional interest?

While Bitcoin has effectively been given the green light – as has Ethereum to a certain degree – from institutional investors, it still remains to be seen whether players from the realm of traditional finance really do go all-in when it comes to buying the altcoin like they have done with BTC over the course of the last couple of months.

In this regard, one can see that during December 2020, the trading volume of Ethereum options rose across the board to a whopping $2.24 billion, showcasing a 22.4% rise since touching its November all-time high of $1.83 billion. Similarly, as per issue #84 of Coin Metrics’ State of the Network newsletter, an increasing number of institutions are beginning to look at ETH as a legitimate alternative investment to BTC, with the currency well positioned to “benefit from growing institutional interest in cryptocurrencies”.

Sun believes that the DeFi boom – that has thrived, in large part, thanks to the developmental capabilities afforded by the Ethereum ecosystem – can be viewed as a positive mark for the crypto space given the fact that high potential projects (like Polkadot, Chainlink) have come into the limelight while the number of scams associated with the industry have decreased greatly. He added: “DeFi social experiments are being watched closely by traditional institutions just like BTC was being watched by them for the past 5 years.”

Interested in cryptocurrency? Learn more about the basics with our beginner’s guide to Bitcoin, see how to keep your crypto safe with our end to end guide to cryptocurrency security and dive deeper with our simple guide to DeFi.

Disclosure: The author owns a range of cryptocurrencies including at the time of writing

Disclaimer:

This information should not be interpreted as an endorsement of cryptocurrency or any specific provider,

service or offering. It is not a recommendation to trade. Cryptocurrencies are speculative, complex and

involve significant risks – they are highly volatile and sensitive to secondary activity. Performance

is unpredictable and past performance is no guarantee of future performance. Consider your own

circumstances, and obtain your own advice, before relying on this information. You should also verify

the nature of any product or service (including its legal status and relevant regulatory requirements)

and consult the relevant Regulators’ websites before making any decision. Finder, or the author, may

have holdings in the cryptocurrencies discussed.