Bitcoin (BTCUSD)

Above: Bitcoin

I’m using a Point & Figure chart setup for this article. I’m an avid Point and Figure trader and advocate. I use candlesticks as my primary chart form, but I use Point & Figure to execute my trades. Point and Figure also records only one thing: price. It is the price action traders chart form. I love how it filters out all the noise and little swings that occur on time based charts like Japanese candlesticks. I’ve left out the Fibonacci retracements and extensions on this chart on purpose because, well, it looks to messy. The short setup involves a Point & Figure pattern known as bull trap. Bull traps occur when a buy signal is generated, but then the next column of O’s generates a sell signal. The entry of a short at $30,000 would confirm a bull trap and provide a conservative profit target at $28,000. For the long side of the market, I’ve identified a great zone for a Buy Limit order at $22,319.39. The highlighted blue zone represents two key Fibonacci levels: a 161.8% extensions and a 61.8% retracement. That price level also fulfills what we want to see for Bitcoin when it comes to a retracement, which is a >40% drop (in this case, it would be a -46% drop).

Short Entry: $30,000 – cover at $28,000

Long Entry: Buy Limit at $22,319.39

Ethereum (ETHUSD)

Above: Ethereum

Similar to Bitcoin, but with out the short idea, Ethereum’s buy limit orders exist where there is a confluence of Fibonacci extension and Fibonacci retracement levels. The two buy levels each contain strong Fibonacci levels. The first level at $774.44 is a confluence of the 50% Fibonacci retracement and the 161.8% Fibonacci extension. The second buy level at $622.34 is a confluence of the 61.8% retracement and the 200% extension.

Similar to Bitcoin, but with out the short idea, Ethereum’s buy limit orders exist where there is a confluence of Fibonacci extension and Fibonacci retracement levels. The two buy levels each contain strong Fibonacci levels. The first level at $774.44 is a confluence of the 50% Fibonacci retracement and the 161.8% Fibonacci extension. The second buy level at $622.34 is a confluence of the 61.8% retracement and the 200% extension.

First Buy Entry: Buy Limit at $774.44

Second Buy Entry: Buy Limit at $622.34

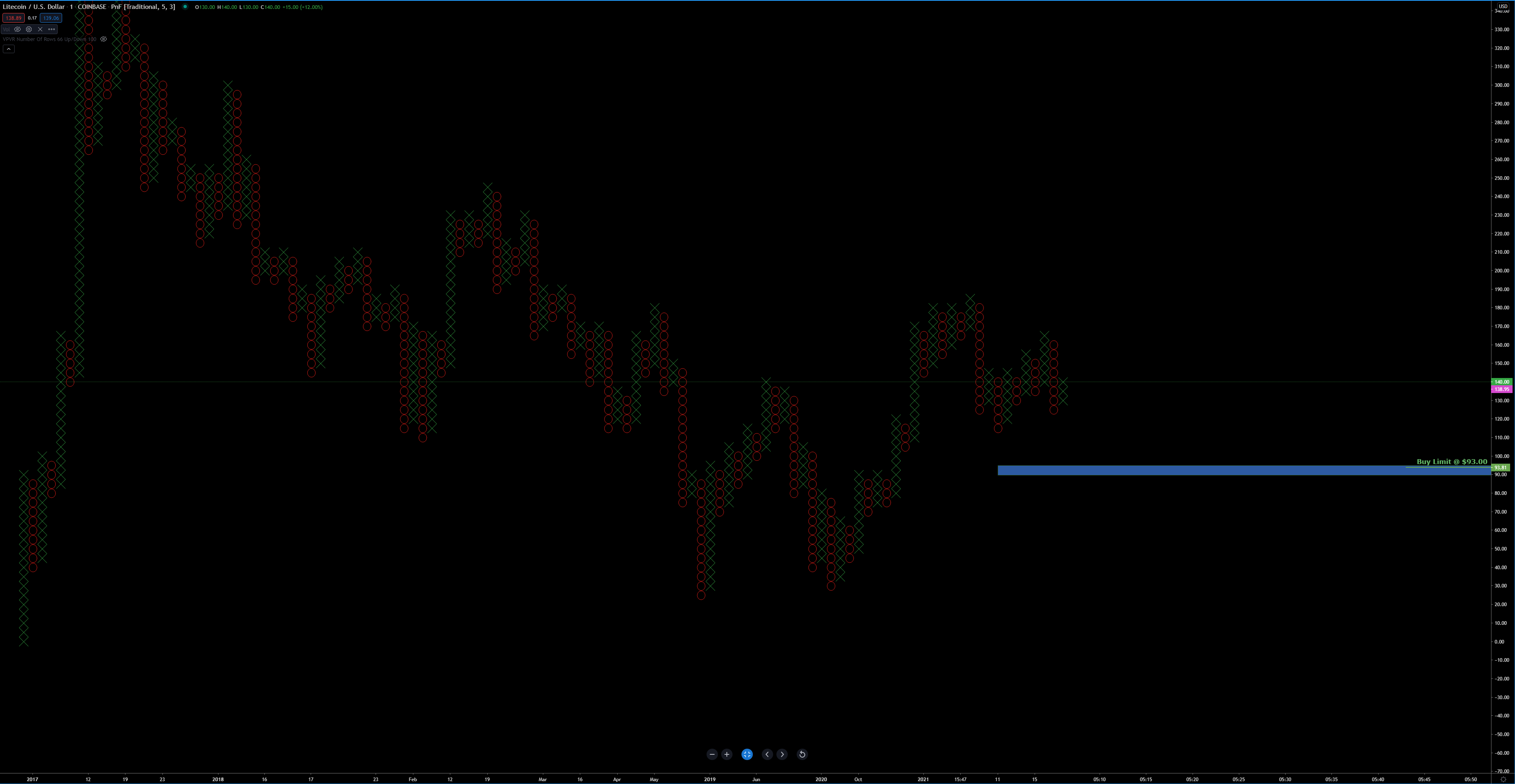

Litecoin (LTCUSD)

Above: Litecoin

I’m honestly surprised that Litecoin didn’t accomplish what both Bitcoin and Ethereum did in this latest bull run: create new all-time highs. The buy limit zone I’ve identified has three important confluence price levels. The first is the Fibonacci retracement of 61.8%, the second is the 100% Fibonacci extension, and the third is the -50% drop from the prior swing high. That -50% drop falls into line with Litecoin’s normal retracement amount during an expansion phase.

Buy Entry: Buy Limit at $93.00

Cardano (ADA/USD)

Above: Cardano

Cardano represents one of my biggest hodl positions in cryptocurrencies. It’s also a fun one to accumulate and swing trade. Like the rest of the cryptocurrency market, Cardano has a normal retracement of 40% to 50% during an expansion phase. The buy limit zone I’ve identified at $0.22 has three important Fibonacci confluence zones. The first is the 23.6% retracement from the swing low of 0.03 to the major swing high all the way up at $0.85 (January 2018). The zone includes the Fibonacci 141.4% Fibonacci extension and the 50% Fibonacci retracement. The buy entry at $0.22 is -44.43% below the Point and Figure high of $0.39. I am expecting a strong support zone here.

Buy Entry: But Limit at $0.22

Advertisement

Save money on your currency transfers with TorFX, voted International Money Transfer Provider of the Year 2016, 2017 and 2018. Their goal is to connect clients with ultra competitive exchange rates and a uniquely dedicated service whether they choose to trade online or over the telephone.

Find out more here.