November’s Bitcoin bull run brought about a spectacular surge in trading volumes across spot and derivatives crypto exchanges. Notably, Top-Tier trading venues set an all-time daily high and their monthly volumes skyrocketed to over 114% on average.

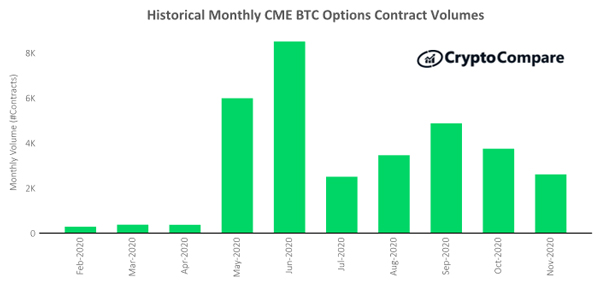

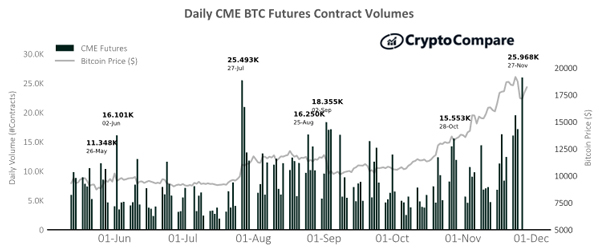

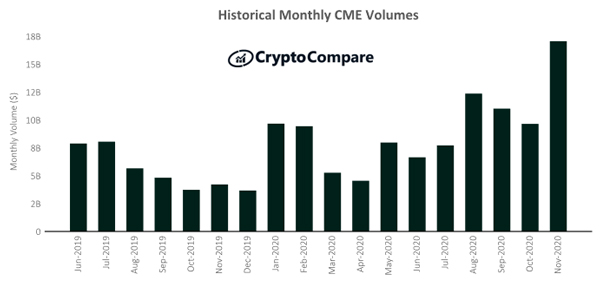

CME had an impressive month hitting a new daily contract volume record for 2020 with roughly 25,900 BTC futures contracts being traded. However, CME options contract volumes declined, experiencing a 30.4% drop since October.

Below are some of the key highlights from CryptoCompare’s November Exchange Review.

Key Highlights

Top tier exchanges gained market share and set all-time daily volume high

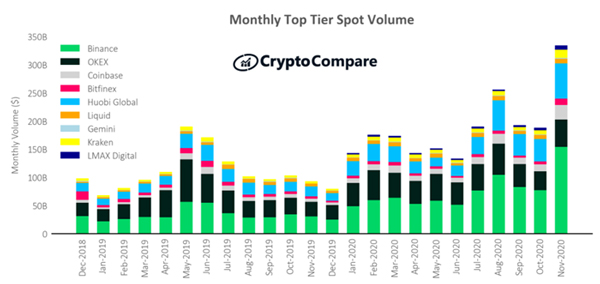

In November, Top-Tier (exchanges graded AA-B) volumes increased 78.2% to $619.0bn while Lower-Tier volumes increased 30.0% to $287.4bn. Top-Tier exchanges now represent 68% of total volume (vs 61% in October). Top Tier exchanges traded a daily maximum of $45bn on the 24th of November almost double the previous record for this year ($23.4bn on the 13th of March).

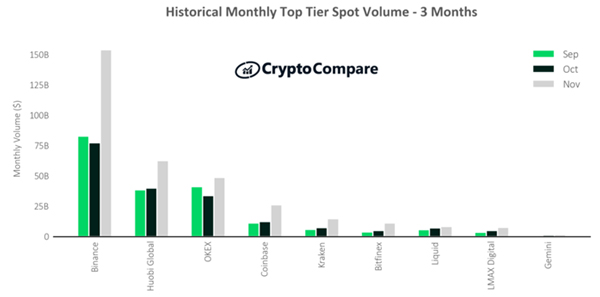

Volume from 15 largest Top-Tier exchanges increased 114% on average

Binance (Grade A) was the largest Top-Tier exchange by volume in November, trading $176.2bn (up 133%). This was followed by Huobi Global (Grade BB) trading $72.1bn (up 73%), and OKEx (Grade BB) trading $45.9bn (up 43%). Exchanges Coinbase (AA), Kraken (A) and Bitfinex (A) followed with $30.0bn (up 166%), $16.6bn (up 156%) and $12.8bn (up 198%).

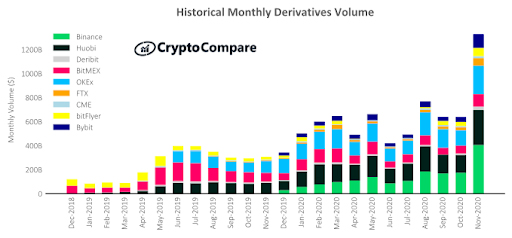

Derivatives volumes doubled in November to an all-time monthly high of $1.32tn

Derivatives exchanges also set a new all-time daily volume record on the 26th of November with $93.36bn. This daily maximum breaks the previous record set on 12th March 2020 ($56.87bn) by an additional 66%.

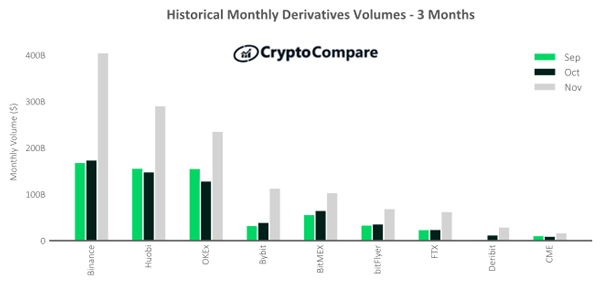

Binance was the largest derivatives exchange in November by monthly trading volume with $405bn [1] (up 132% since October). Huobi (up 96%), OKEx (up 83%) and Bybit (up 187%) followed with $290.8bn, $235.9bn and $113.4bn traded respectively.

|

|

In terms of total USD trading volume, CME’s crypto derivatives volumes have increased by 76.8% to $17.1bn in November.

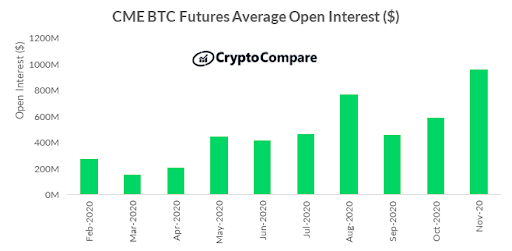

CME’s average open interest figures have also increased substantially by 62% to $962bn in November.

Meanwhile, CME options contract volumes decreased by 30.4% to 2,608 contracts traded in November.