Two years ago the cryptocurrency firm Circle announced the launch of USDC, a stablecoin pegged to the U.S. dollar. This week, Circle revealed the launch of high yield digital dollar business accounts with APY up to 10.75%.

- On September 26, 2018, Circle and the Centre open-source consortium launched an ERC20 token called USD Coin or USDC.

- At the time of publication, USDC is the 12th largest blockchain in terms of market capitalization with $2.8 billion circulating today. Under tether (USDT), USDC is the second-most popular stablecoin.

- “USDC is the first of several fiat tokens Centre expects to deliver, and Circle is the first of several forthcoming,” Circle stated at launch.

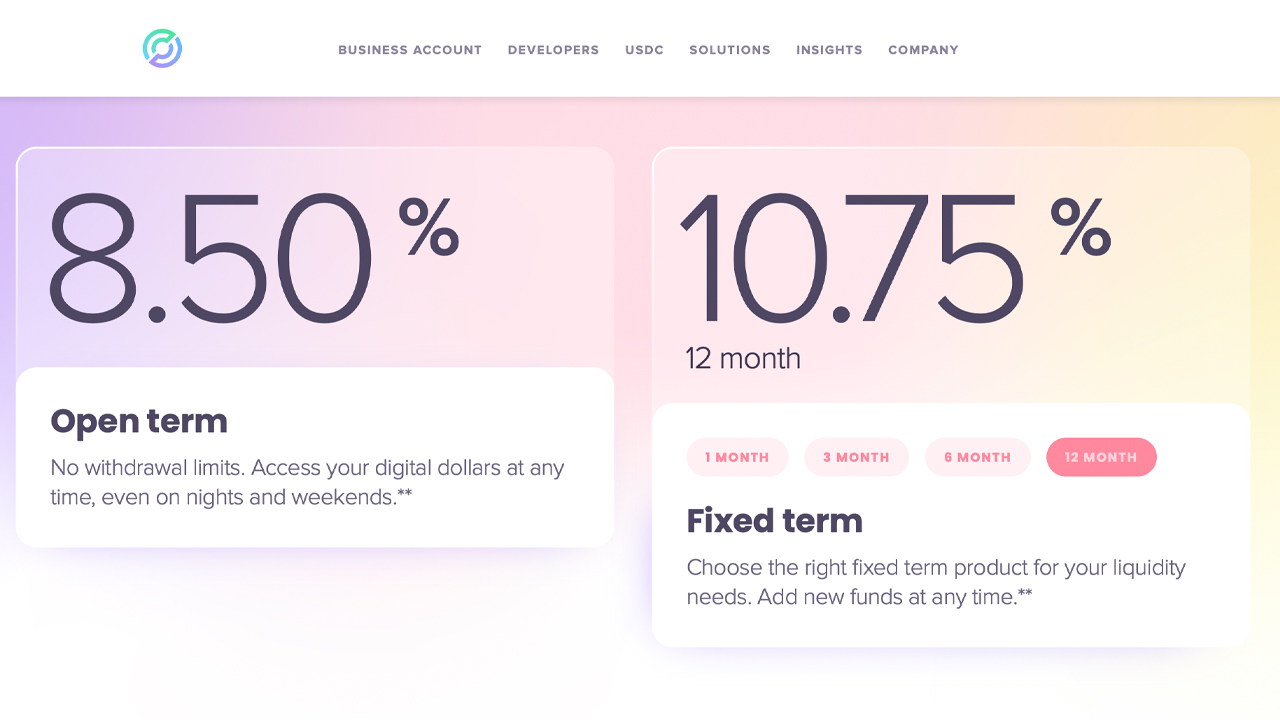

- On November 5, 2020, Circle’s official Twitter account tweeted about USDC business accounts that offer high yield returns. “Circle is planning to introduce short and medium-term high yield interest rate business accounts built entirely on USDC. Starting at 8% APY, make sure to secure a spot on the waitlist today. Restrictions will apply,” the firm tweeted.

- The waitlist web page states: “Secure a spot on the waitlist for high yield digital dollar business accounts. Talk with us to explore short and medium-term high yield interest rate accounts built entirely on USDC so you are first in line when the service becomes available.”

- The open term APY offer of 8.50% says that it offers no withdrawal limits and account holders can access their digital dollars at any time. A fixed term of 12-months can accrue 10.75% and six months can get 10.25%.

- “Interest payments are paid out weekly and accrue daily” and the process is “natively integrated into your Circle Account and customizable through Circle APIs,” the company’s website details.

- Most all cryptocurrencies like bitcoin (BTC), bitcoin cash (BCH), and ethereum (ETH) can be leveraged in high yield interest-bearing accounts through various outlets. Yet stablecoins, no matter the flavor, typically accrue much higher interest rates.

What do you think about Circle introducing high yield digital dollar business accounts with USDC? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Circle,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.