Litecoin – On-chain metrics present the place Litecoin is likely to be heading subsequent

Litecoin, the sixth most respected cryptocurrency within the international market, elevated by 30% previously week. As LTC exhibits robust momentum, on-chain information points exhibit each bear and bull circumstances.

Researchers at Santiment recognized varied on-chain indicators that purchase the case for a pullback and in addition for a continued rally. They wrote:

“The usually ignored and neglected #Litecoin has skilled fairly a month, peaking at practically a +70% achieve earlier than markets skilled a minor pullback on the finish of the weekend.”

The bear case

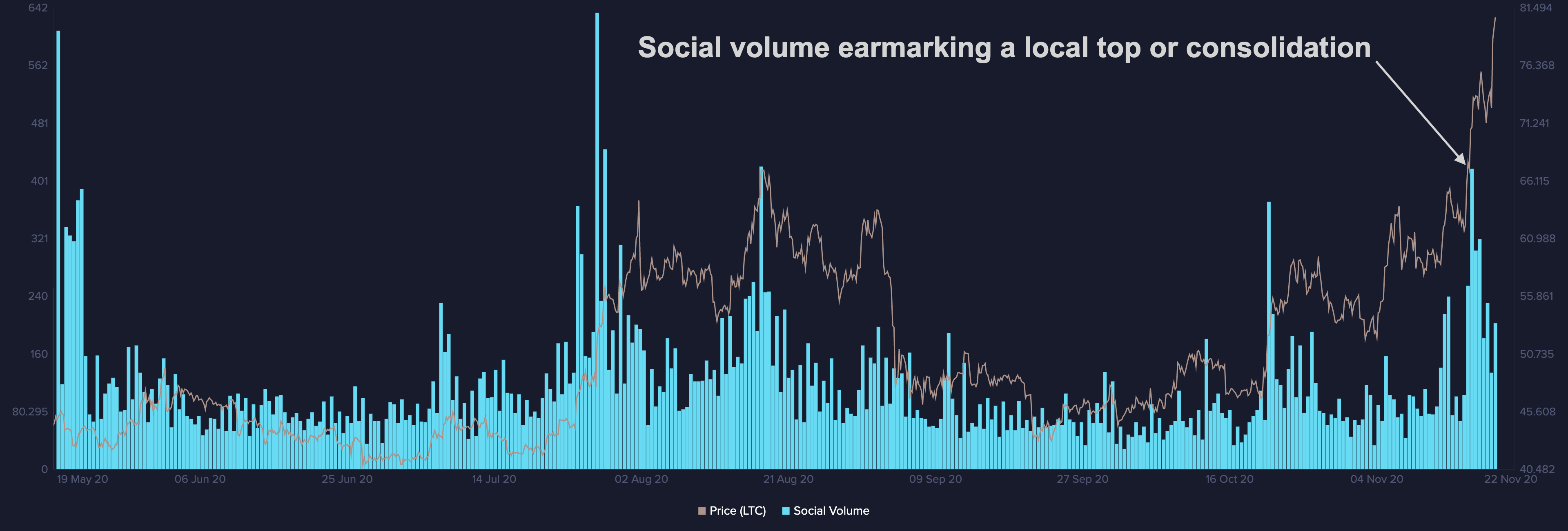

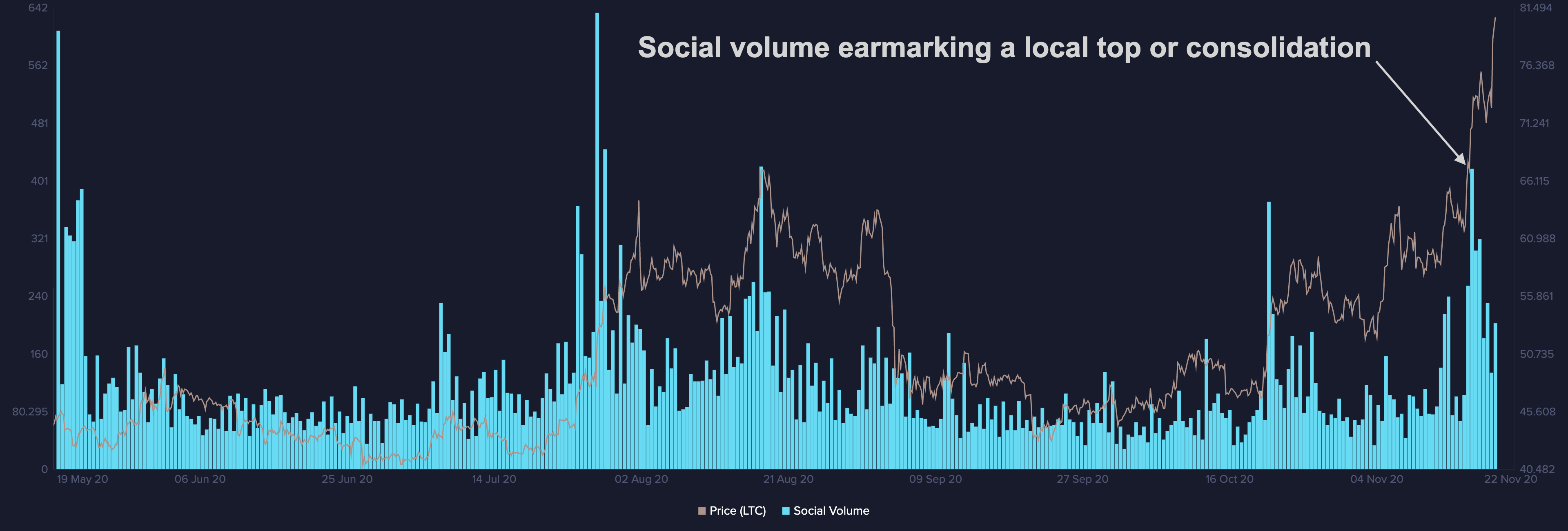

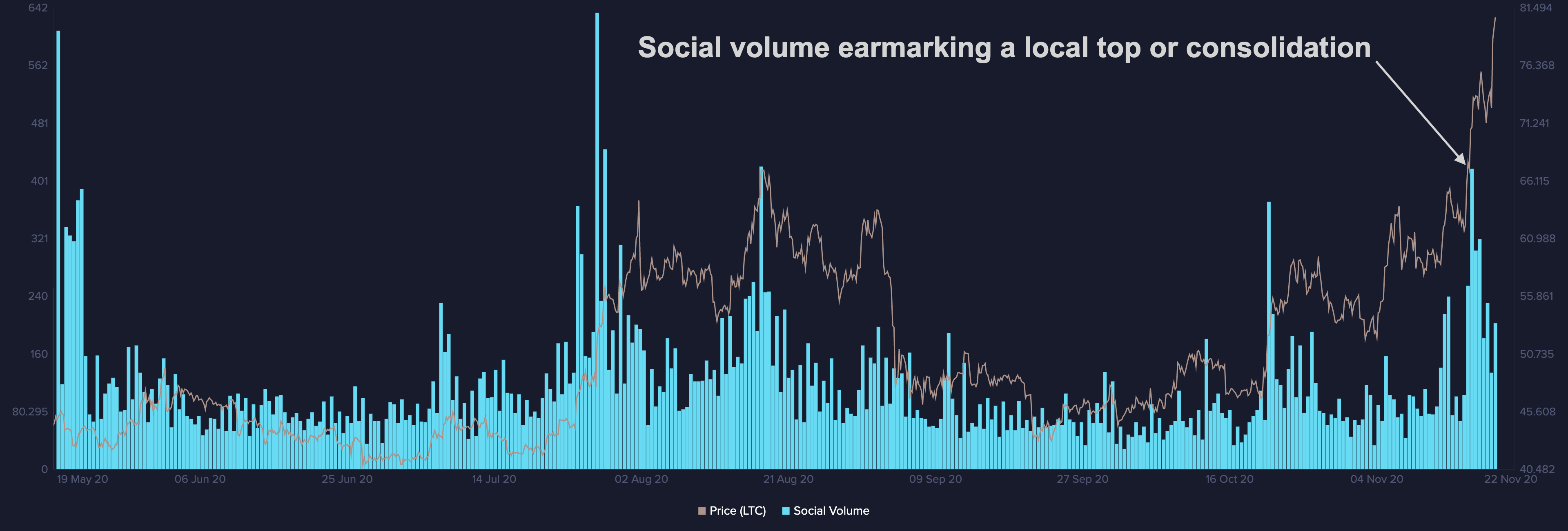

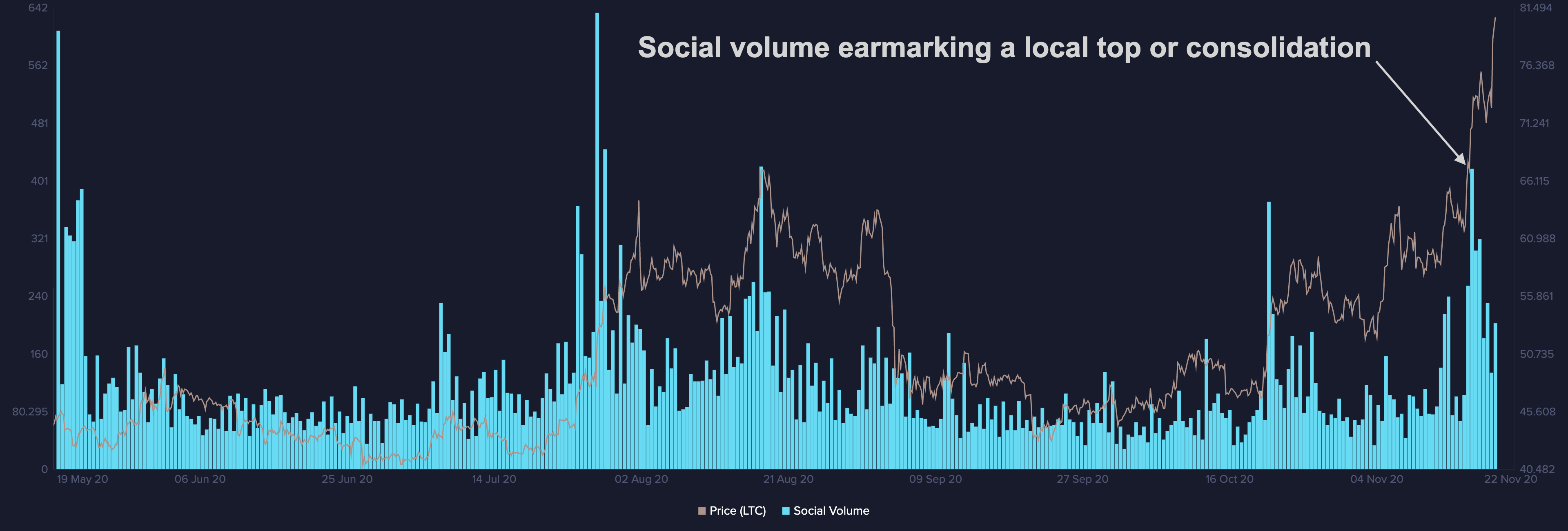

In keeping with Santiment, three on-chain metrics point out an area high or the potential for consolidation.

The metrics are age consumed, day by day energetic addresses, social quantity, MVRV, and Imply Greenback Invested Age.

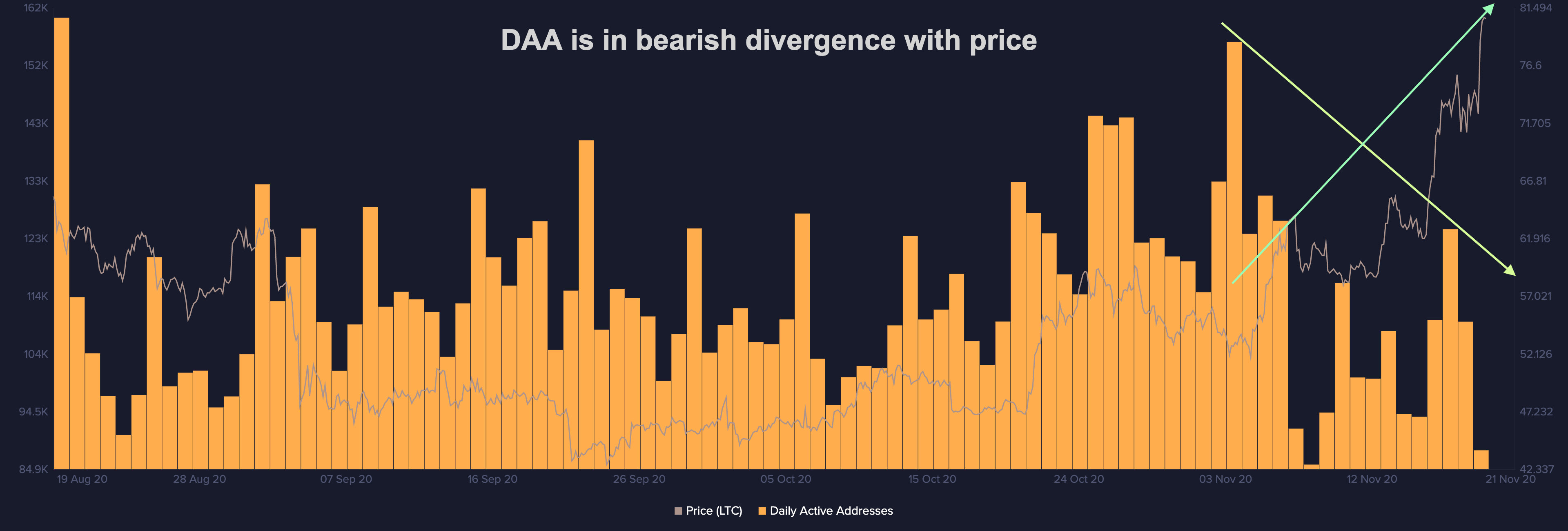

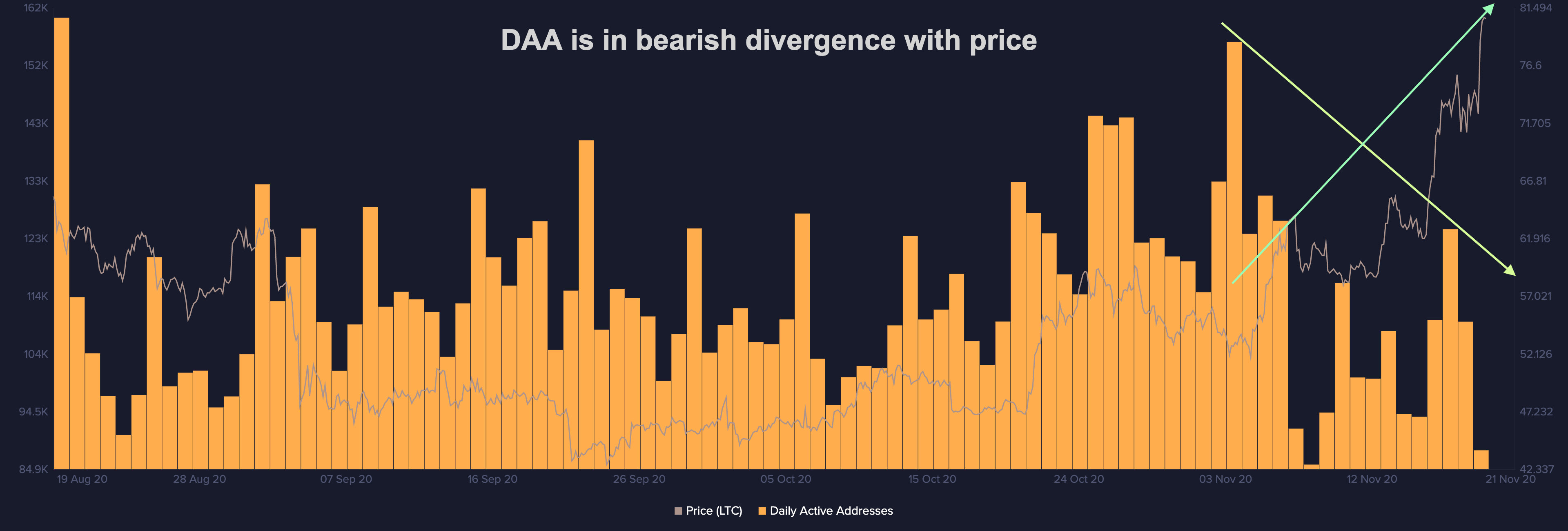

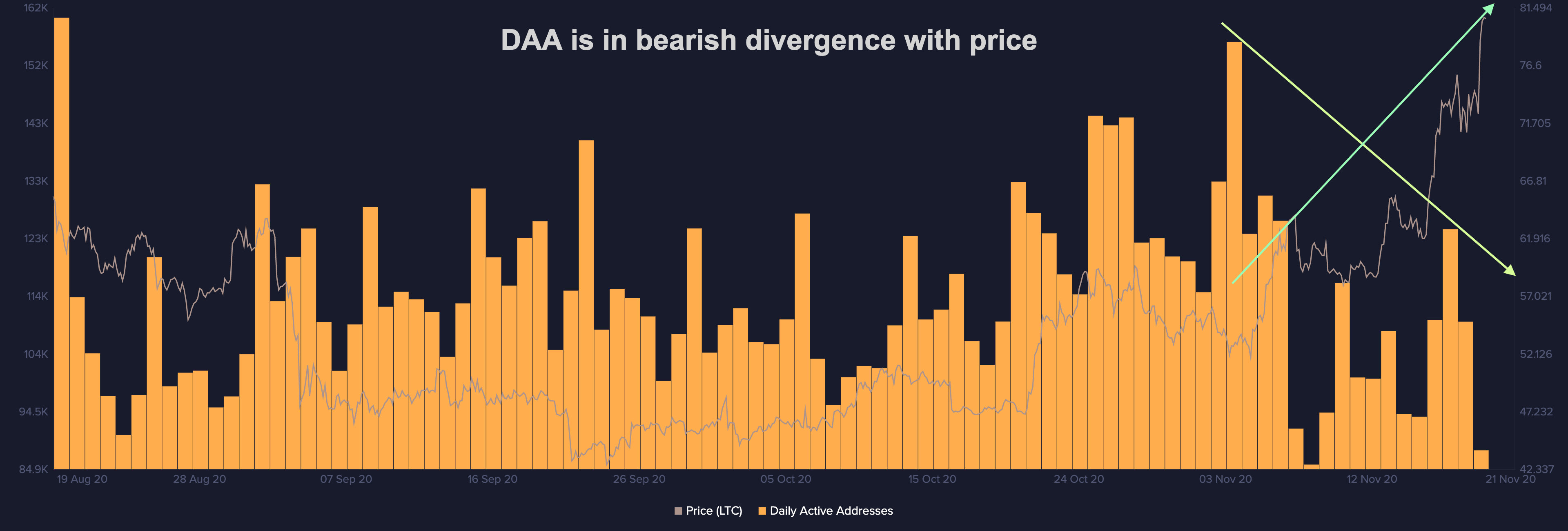

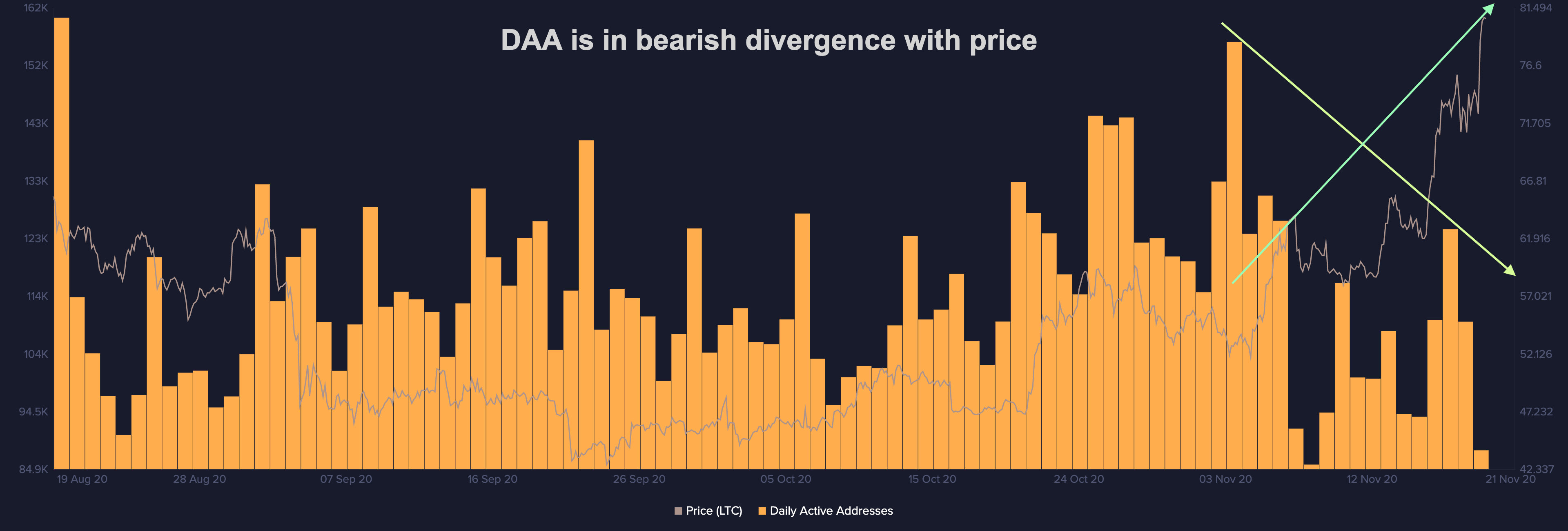

The day by day energetic addresses and social quantity, particularly, present an uptrend that isn’t being backed by stable fundamentals.

When the consumer exercise of a blockchain will increase in tandem with the underlying cryptocurrency, it suggests a bullish development. However, if the consumer exercise stagnates amid an ongoing rally, it usually means that the rally may not be an natural uptrend.

The sudden spike in social quantity additionally suggests euphoric ranges of market sentiment, which traditionally marked native peaks.

The bull case for Litecoin and basic elements

The bull case for Litecoin within the quick to medium time period is based totally on basic elements.

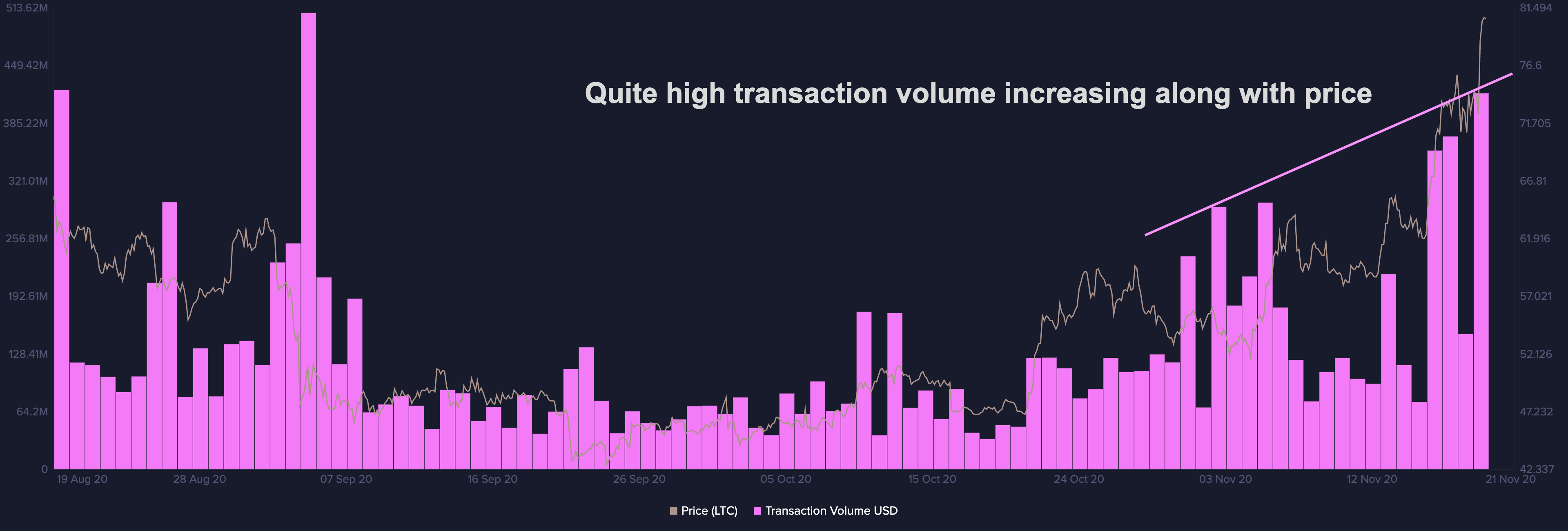

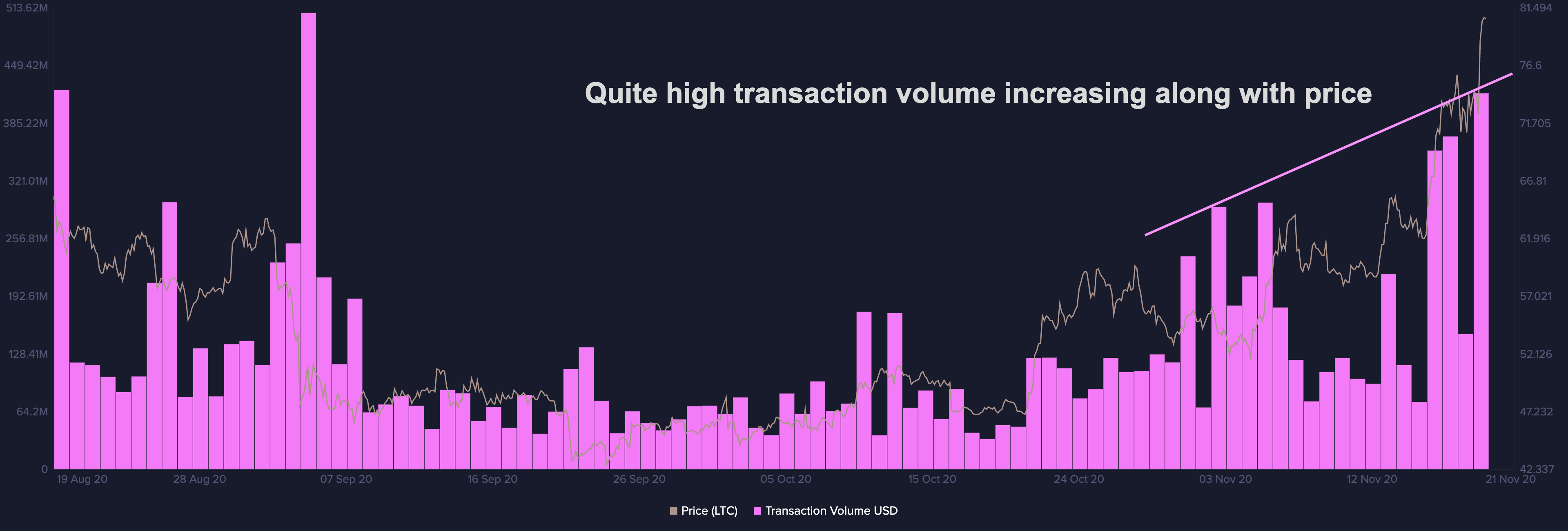

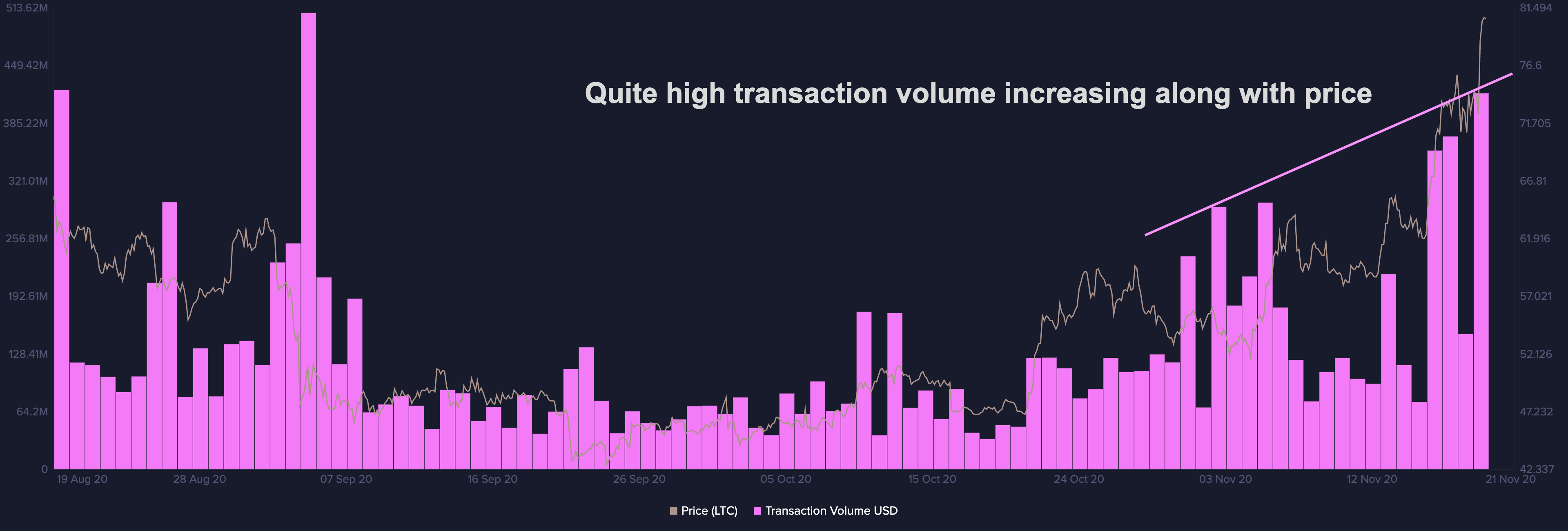

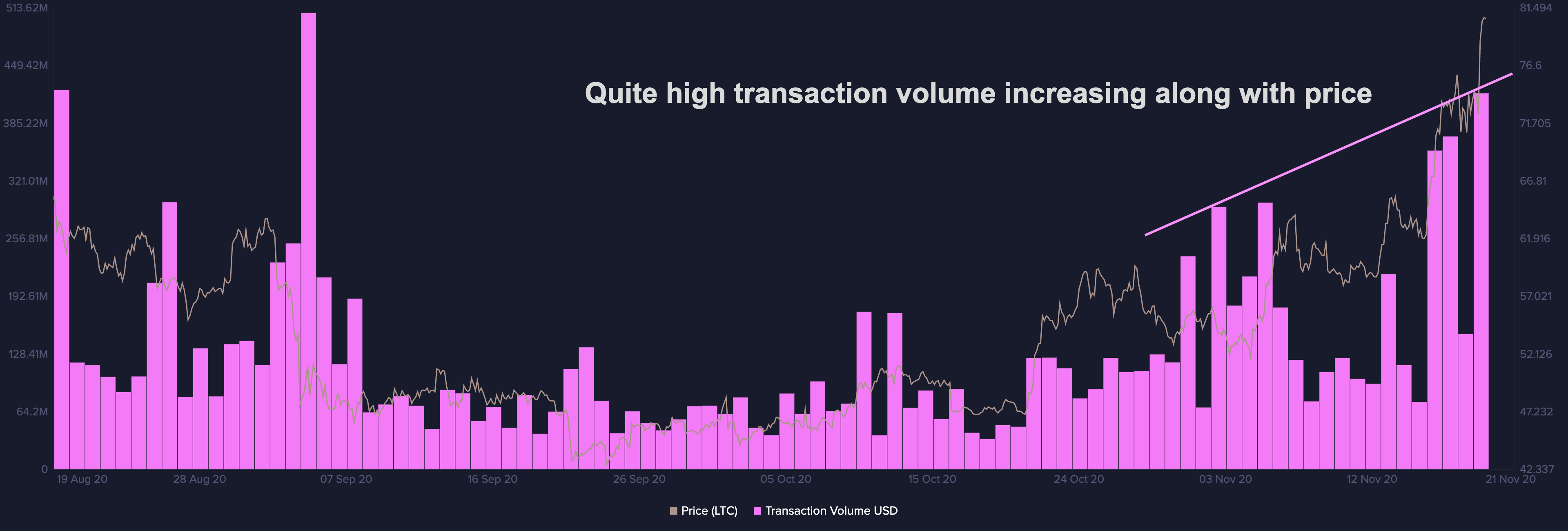

The transaction quantity of Litecoin has been persistently growing since early November. It exhibits that the customers are seemingly sending and receiving extra on-chain transactions, which could signify two issues.

First, it may present that extra customers are accumulating LTC and presumably sending them from exchanges to non-public wallets. This implies an accumulation development is likely to be within the works, as the choice cryptocurrency (altcoin) market recovers as an entire.

Second, there could possibly be extra customers participating in LTC transactions following varied basic developments.

On October 6, the open-source developer group of the Litecoin blockchain launched a testnet for Mimblewimble.

Mimblewimble is a privateness resolution designed for the Bitcoin blockchain. Since Litecoin and Bitcoin share similarities in construction, the answer may be carried out onto the Litecoin blockchain.

It comes a month after CryptoSlate reported {that a} new Litecoin replace confirmed the Mimblewimble implementation is on observe.

Charlie Lee, the creator of Litecoin, first introduced the mixing of Mimblewimble in January 2019. He wrote on the time:

“Fungibility is the one property of sound cash that’s lacking from Bitcoin & Litecoin. Now that the scaling debate is behind us, the following battleground will likely be on fungibility and privateness. I’m now centered on making Litecoin extra fungible by including Confidential Transactions.”

The confluence of main community developments, rising transaction quantity, and the start of an altcoin season buoyed LTC in latest weeks. Within the quick to medium time period, LTC may see sustained momentum if the day by day energetic addresses start to extend and social volumes stay steady.

Like what you see? Subscribe for day by day updates.