Hello traders,

XRPUSD unfolded a five-wave overlapping move from the 0.329 highs, which is in Elliott wave theory known as a leading diagonal.

When diagonal triangles occur in the fifth or C wave position, they take the 3-3-3-3-3 shape that Elliott described. However, it has recently come to light that a variation on this pattern occasionally appears in the first wave position of impulses and in the A wave position of zigzags. The characteristic overlapping of waves one and four and the convergence of boundary lines into a wedge shape remain as in the ending diagonal triangle. However, the subdivisions are different, tracing out a 5-3-5-3-5 pattern.

On the XRPUSD we can see this kind of pattern, as desribed above, completed in the wave A, which means, latest turn up from September lows can be part of a three-wave correction in wave B. We specifically see a three-wave a-b-c move, where wave c of B can retrace towards the Fib. ratio of 38.2 and 0.618 (0.260/0.290 area), where resistance and a new turn lower can be seen. However, in case of a deeper pullback in wave B, be aware of possible resistance at the 0.30 level.

Invalidation level is at 0.329.

XRPUSD, 4h

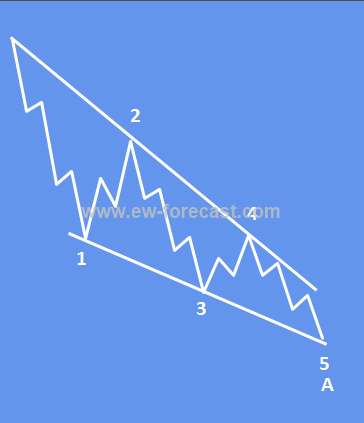

Example of the Elliott wave leading diagonal:

- Structure is 5-3-5-3-5.

- A wedge shape within two converging lines.

- Wave 4 must trade into a territory of a wave 1.

- Appears in the wave one position in an impulse, in the A wave position of A-B-C.