In a prior article I focused on how bitcoin(BTC-USD) functions as a complement to gold. Additionally pointed out the limitations of the Grayscale Bitcoin Trust (GBTC), but argued that the benefits of bitcoin outweighed these limitations. In this article I discuss a historical framework for analyzing how the growing mainstream institutional adoption will change the nature of the market, and drive the price of Bitcoin higher.

Perez Model

In Technological Revolutions and Financial Capital, Carlota Perez outlines a model for understanding technological revolutions and economic history. She divided technological revolutions into two main phases: (1)the installation phase when technology is new first coming into the market and infrastructure around it is built, and (2) the deployment phase, when it was adopted by mainstream society, leading to the development of a new ecosystem of businesses.

Source: The Carlota Perez Framework – AVC

The installation phase can be further divided into the Irruption and a frenzy. This phase gives rise to a financial market bubble, the popping of which leads to financial distress, possibly systemic depending on who provided the capital initially. The deployment phase includes both synergy and maturity. During this phase the technology becomes widely familiar, and the benefits spread to the broader society. Perez applied her framework to the first industrial revolution in Britain, steam engines, steel and electricity, oil, and information technology. Venture capitalists have pointed out that this framework can also be used as a model to understand developments in the digital asset space.

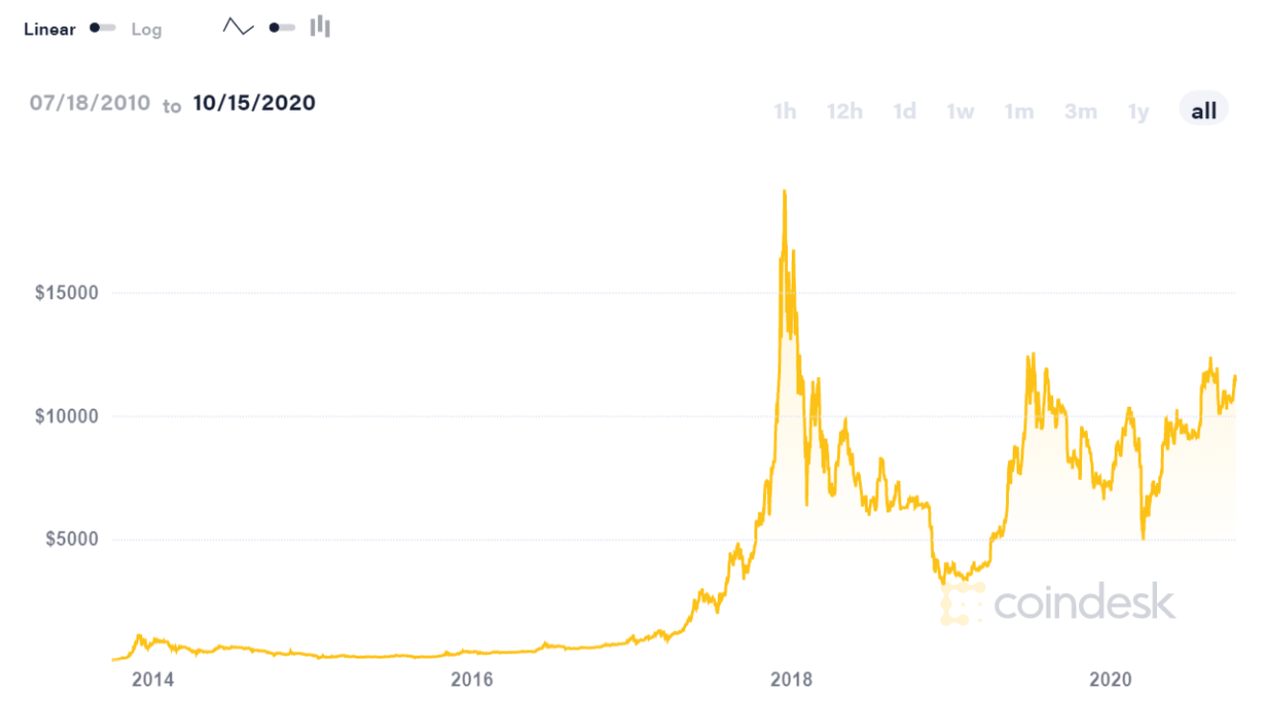

Its likely that the 2017 bitcoin frenzy and subsequent collapse marked the end of the installation phase.

The long run price chart of BTC-USD tells this story:

The deployment phase will lead to widespread adoption of bitcoin as an asset class, and an ecosystem of business necessary to allow institutions to invest in it. Recent developments support the idea that we are moving into an era for bitcoin that will resemble the deployment phase in Perez’s model. This will bring a surge in demand into an asset class with a small market cap, creating a lot more upside for Bitcoin.

Institutional Deployment

Custody and execution services are key parts of the ecosystem of businesses that will define the deployment phase for bitcoin. Without these services, allocating to bitcoin is more trouble than its worth for most institutions. Additionally, institutions need a clear regulatory framework to avoid compliance problems.

Stone Ridge Asset Management and the New York Digital Asset Group (NYDIG) in 2019 published a paper outlining the challenges faced by institutions seeking to get bitcoin exposure:

….Thus, when implementing a Bitcoin position, fiduciary agents find themselves in a new and often uncomfortable position. In addition to weighing the dollar cost of various approaches, they must also understand the operational challenges and risks of those approaches as well. Practitioners face this unusual melding of investment and operational due diligence in a rapidly evolving regulatory landscape without clear, well-documented best practices.

NYDIG then proceeded to develop solutions to these problems, both for themselves and the wider industry. They developed custody and execution services that they needed to launch a series of bitcoin funds. Additionally, they built anti-money laundering and know your customer systems and acquired regulatory licenses necessary to transact in a way that pleases client compliance departments. NYDIG earns most of their money from banks, RIAs, and institutional allocators, but also has some foundations and university endowments as customers. They’ve noted a dramatic increase in the number of institutional investors investing in bitcoin since the beginning of this year.

Similarly, Fidelity operated a digital assets division for five years before launching publicly in 2018. These efforts are just now beginning to yield results. They recently announced a $13 billion sub custody deal for digital assets held by clients of Kingdom Trust, an alternative investments custodian.

In early 2020, Brian Brooks, a former Coinbase executive took over as acting head of the Office of the Comptroller of the Currency (OCC). Shortly thereafter, the OCC announced that U.S. Banks can provide custody services for bitcoin. This means institutional investors seeking bitcoin exposure will soon have a wide variety of solutions to meet their operational needs.

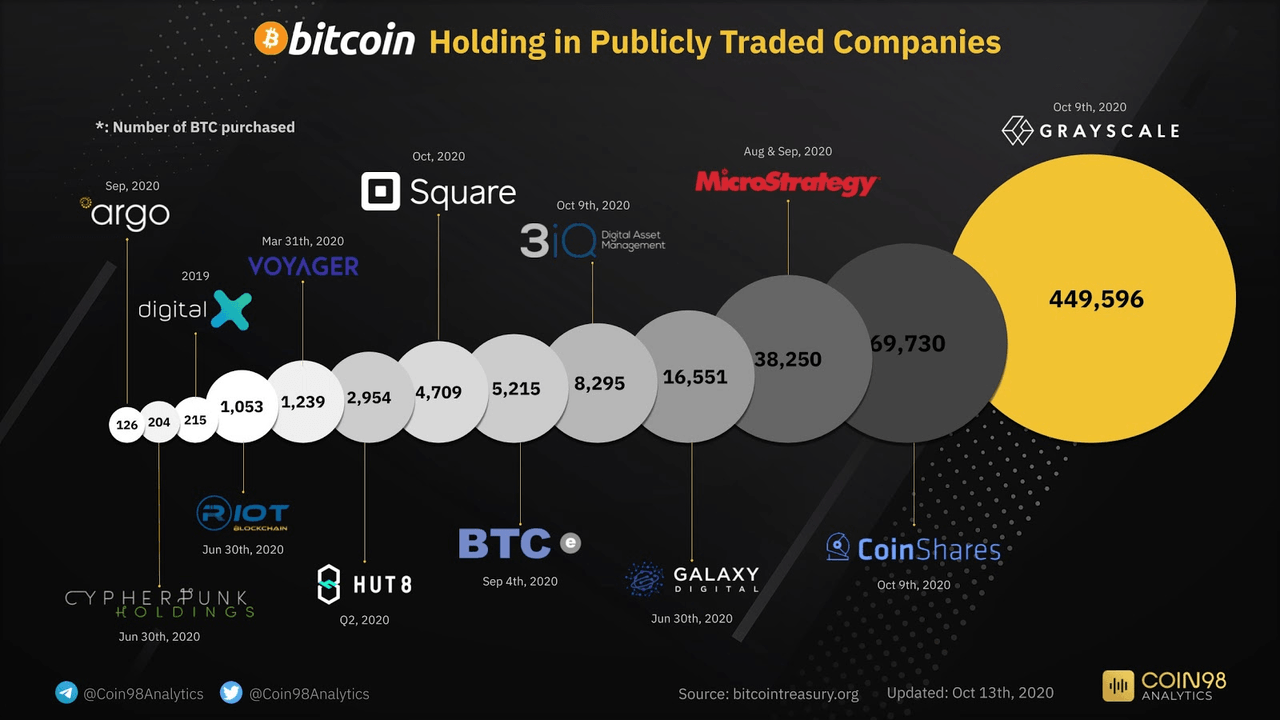

Public companies investing in Bitcoin

During the installation phase, the bitcoin market was dominated by small time speculators and retail investors. However a major shift is happening as we enter the deployment phase. At least 13 public entities have invested in bitcoin.

Some of these companies are focused on digital assets. Others such as Square(SQ) and Microstrategy(MSTR) merely view bitcoin as a way of diversifying their cash. These actions are harbingers of things to come.

Reversal of Career Risk

In earlier years, career risk was a major issue that prevented mainstream institutional investors from investing in Bitcoin. Here is how NYDIG described the problem:

Agents are further incentivized to avoid unnecessary risks because they are likely to be “institutionally second-guessed” by operational diligence teams and an independent auditor that will examine the books and test a sample of (or in some cases all) positions and transactions for existence and proof of control.

Yet with the improvement of custody, execution and compliance solutions this is starting to change.

Its worth recalling that commodities were at one time considered a risque asset class. Once Wall Street built structured products tracking them, however, they became mainstream. In fact commodities are now considered essential in many asset allocation frameworks. John Street Capital argued that with burgeoning crypto derivatives markets, structured products can’t be far behind.

Emerging and frontier markets followed a similar path. Prior to the 1980s they were considered too volatile and illiquid. But over time, investors realized that the high growth rates and low correlations with developing markets made emerging markets an essential portfolio component.

With more mainstream institutional investors adding a small allocation to bitcoin, an allocator no longer needs to risk being wrong alone. In fact, its possible in the near future there will be more career risk to having zero bitcoin exposure than there is to buying bitcoin.

Conclusion

Fidelity said in a recent whitepaper that“ Bitcoin is a drop in the bucket compared with markets bitcoin could disrupt”. In fact Bitcoin’s market cap is approximately $200 billion, but a large portion of that is locked up in long term holdings or lost accounts so only a small fraction of that is available for purchase. Moreover the pace of bitcoin mining is slowing down and becoming more difficult over time. As institutions enter the market and bitcoin moves from the installation to the deployment phase, the price is likely to move dramatically higher.

Disclosure: I am/we are long GBTC, BTC-USD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.