PayPal an Avant-Garde: Launch of trading will increase monetisation but enabling retail payments is a game changer for a public-listed fintech

Yesterday, PayPal (NASDAQ:PYPL) announced the launch of a new service facilitating customers to buy, hold, and sell cryptocurrencies directly from their PayPal accounts. Currently, the service is offered to U.S. account holders only via the PayPal platform, with expansion into international markets and its Venmo subsidiary slated for early 2021. Whilst we are excited about the prospect of PayPal’s opportunity to generate additional trading revenues, we are most excited about enabling its digital wallet users to spend the cryptocurrencies at merchant locations. In the near future, PayPal intends on enabling its users to pay with cryptocurrencies by converting the selected cryptocurrency into the merchant’s national currency, ensuring that merchants are always paid on time without being exposed to the constant fluctuations in value of cryptocurrencies.

At the announcement, Dan Schulman, president and CEO of PayPal, said: “The shift to digital forms of currencies is inevitable, bringing with it clear advantages in terms of financial inclusion and access; efficiency, speed and resilience of the payments system; and the ability for governments to disburse funds to citizens quickly. Our global reach, digital payments expertise, two-sided network, and rigorous security and compliance controls provide us with the opportunity, and the responsibility, to help facilitate the understanding, redemption and interoperability of these new instruments of exchange.”

In-app UI of PayPal’s cryptocurrency service

Source: PayPal Newsroom

State of current Bitcoin payments in the US

Newer Merchants are more likely to adopt bitcoin payments

An early 2020 survey by HSB revealed that about 36% of American SMEs accept bitcoin, with 59% of those companies purchasing the currency for their own usage. 21% of bitcoin-accepting companies have been in business for more than 20 years, while 47% have been in business for less than five years. A clear trend is emerging in that newer companies are more willing to adopt cryptocurrencies in their daily transactions.

Several blue-chip companies have attempted to adopt the usage of bitcoin within their ecosystem. However, adoption has not been consistent within the companies as the usage of bitcoin tends to be limited to a certain segment of their ecosystem and processed by third-party cryptocurrency wallet providers.

One of the early notable merchants to first adopt cryptocurrency was Microsoft (NASDAQ:MSFT), which started accepting bitcoin as a form of payment since late 2014. Xbox users can add up to $1,000 in credit to their account in a single day, with a $5,000 credit lifetime limit per account. Despite the enthusiasm and interest in bitcoin of Microsoft founder Bill Gates its adoption has not been consistent on the platform. Microsoft halted the acceptance of bitcoin for a brief period between 2017 and 2018, impinged by high transaction fees and volatile prices.

BitPay is the most prominent bitcoin processor for payments.

BitPay, launched in 2011, is the most prominent third-party transaction processor for bitcoin, partnering with a range of well-known companies from Amazon’s video live streaming service, Twitch, to cosmetics retailer, Lush. BitPay partners can accept bitcoins via their website, e-mail, or in person using a mobile POS device, incurring a 1% transaction fee and receive payments in most of the world’s major currencies.

The pandemic has triggered a seminal point to unlock the Bitcoin and QR-based payments opportunity

Investing in bitcoin and QR code payment opportunity is vital for PayPal, given that it allows to broaden its payments offerings to offline brick-and-mortar businesses which currently constitute ~80% of all retail sales. Given the increased free cash flow windfall from the move to digital payments during the pandemic, management announced an additional $300m of investment in H2 2020.

PayPal sees itself benefiting from a “HALO” effect as consumers using it online are also more likely to use it for offline purchases given the positive brand identity it enjoys. We see PayPal’s QR code and Bitcoin payment offering as a significant driver of growth in the medium to long term, given…

- PayPal is best-positioned of all payment companies to drive QR code and bitcoin adoption in the US given it has c.150-175m digital wallet users on its platform.

- The onset of the pandemic is driving merchants to demand touchless payment solutions.

- Strong consumer value proposition for using digital wallets will fuel user adoption.

1. PayPal is best-positioned in the payments sector to drive QR code and Bitcoin-based payments in the US

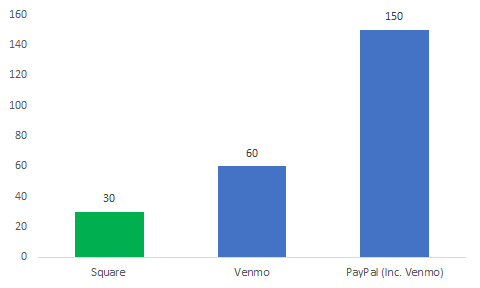

Unlike any other payment company, PayPal is best-positioned to drive QR code and bitcoin-based payments given its scale of 150-175m US users. The scale makes it impossible for merchants of any size to ignore PayPal enabled mobile payments. Versus competitors, Square (NYSE:SQ) comes closest with a digital wallet which had 30m users at the end of H1 2020. Visa (NYSE:V) and Mastercard (NYSE:MA) do not have digital wallets serving customers directly. Zelle, another P2P payments platform backed by banks and credit unions in the US, is another big player in the digital wallets space which had forecasted to overtake the number of Venmo users (40m in 2018 versus 60m in Q2 2020) back in 2018.

2. The onset of the pandemic is driving merchants to demand touchless payment solutions

Furthermore, with the onset of the pandemic, users are more likely to use touchless payments such as QR codes and bitcoin, driving merchants to reach out to PayPal and demand touchless payment solutions. Currently, PayPal is working with more than 100 large retailers across the US and Europe, including the likes of pharmacy giant CVS (NYSE:CVS) to provide QR code-based payments. We don’t see any reason why PayPal cannot also provide bitcoin payment solutions along with its QR-code based payment solutions to the same merchants.

3. Strong value proposition for using digital wallets will fuel user adoption

The ability to add reward points for customers every time they pull out a PayPal or a Venmo digital wallet will be a key driver of adoption. Acquisition of Honey will provide further impetus for users to use the Venmo and PayPal apps to make offline purchases as it allows merchants to integrate some of Honey’s discount offerings. Merchants could also use proximity messaging features to provide customers with offers to increase sales.

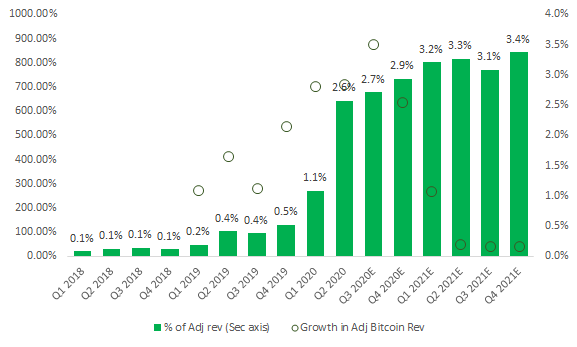

Square’s Bitcoin business makes for a good read across for PayPal

In early 2018, Square allowed almost all its cash app users to buy and sell bitcoins. The business now accounts for 2.6% of overall net revenues, up from only 0.4% in Q2 2019 as “Stay at Home” measures saw Cash App users increasingly engage in trading Bitcoins.

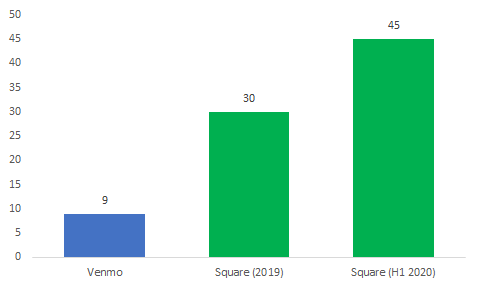

Adj. Bitcoin Rev growth accounted for 2.6% of Square’s Q2 adj Rev

Source: Square’s quarterly reports and AlphaTech Equities

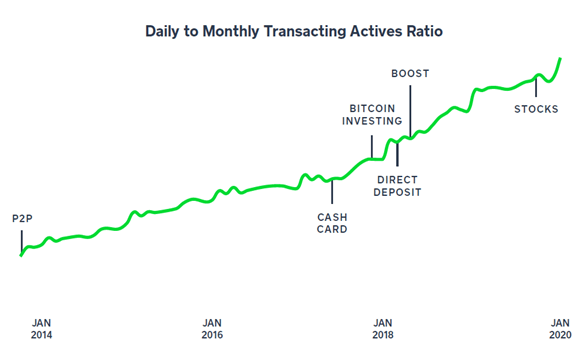

With the aim of monetising its digital wallets, Square has been adding multiple revenue engines to its Cash App over the years with bitcoin becoming an important avenue of growth during the pandemic.

Monetisation of Square’s Cash App

Source: Square’s Unit Economics presentation March 2020

However, there are significant differences between Square and PayPal regarding the Bitcoin opportunity, including

The power of scale: Square’s Cash App has 30m versus PayPal and Venmo combined 150-175m users in the US. The scale difference is a key differentiator for PayPal as it allows the company more power to build out a nationwide merchant acceptance network to enable bitcoins and QR code payments.

Q2 2020 # of users in million: PayPal has 5x the users vs. Square

Source: PayPal and Square Q2 2020 transcripts

Spending with bitcoin: Square’s Cash App only allows users to buy and sell bitcoins versus PayPal, which in addition to allowing its users to trade bitcoins will also enable them to spend cryptocurrencies at merchant locations.

Multiple currencies: Unlike Square which only allows trading of bitcoin, PayPal will allow users to deal in multiple digital currencies, including Ethereum and Litecoin. According to coinmarketcap.com, the current global cryptocurrency market capitalisation is at $393bn, with bitcoin accounting for 60.8%, Ethereum 11.9%, bitcoin cash at 1.28% and Litecoin a 0.92% of the total market share.

Online presence: Given PayPal’s flagship product of online wallets, it makes it much easier for the company to enable customers to spend bitcoin via digital channels versus Square which operates mostly as a tech-enabled acquirer for SMBs.

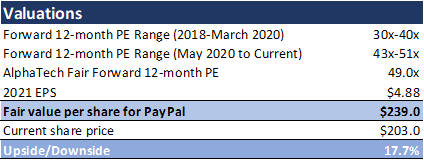

Valuations are rich but offer an attractive entry point to the long-term investor

We see management increasing its execution pace on monetising its digital wallets with the launch of bitcoin services. PayPal’s rev per user at c. $9 is significantly lower than that of rival Square at $45 per user. Whilst bitcoin trading should give a significant monetisation boost in the short to medium term, we are particularly excited about PayPal enabling payments at retailers via bitcoins in the US.

Rev per user for Cash App is significantly higher than PayPal’s Venmo

Source: Square and PayPal’s Q2 earnings transcripts

Source: Square and PayPal’s Q2 earnings transcripts

Since we published our initiation coverage report on PayPal earlier this month (link here), shares have outperformed the broader S&P 500 index by c.5%. We continue to see PayPal as the best-positioned payment company in the sector driven by its pure play exposure to digital commerce. We upgrade our price target to $239 and are now “Very Bullish” on the stock.

PayPal’s valuations are rich but for a good reason

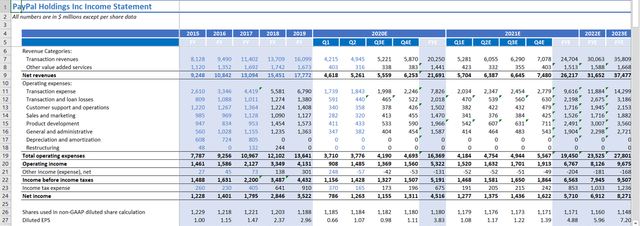

Financials remain unchanged for the moment

Our short-term financials remain unchanged for the time being but we will monitor the bitcoin trading launch closely to see how it impacts monetisation of its digital wallets for 2021 and beyond.

Source: AlphaTech Equities

Investment thesis: PayPal is best-positioned to unlock the opportunity in the pivot to mobile payments

We see PayPal as the best-in-class digital payments company, well-positioned to benefit from the move to e-commerce during the pandemic. We see the recent growth in e-commerce sales as sustainable, driven by the 1. Stickier new customer cohort of older aged people, coined by management as “Silver Tech” and 2. Merchants launching not only new use cases for online businesses but also adopting a digital-first strategy.

We are most excited about the potential for mobile payments in the US. We see PayPal as best-positioned to capture the biggest market share in the form factor pivot of payments to mobile payments, given its scale both on the side of consumers (150 to 175m US consumers) and merchants. We are most excited about its recent announcement to launch its QR code and bitcoin payments network.

Tech savvy CEO Daniel Schulman took the helm in July 2015 and has been instrumental in transforming the business from a product (PayPal Checkout) company to a complete digital platform company, boasting of some of the leading fintech products in the industry such as Venmo, Xoom and Honey, among others. First out of the blocks on the launch of bitcoin and QR code payments, he has proved to be a visionary once again.

We upgrade the stock to “Very Bullish” with a price target of $239, imputing an upside of 18%.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.