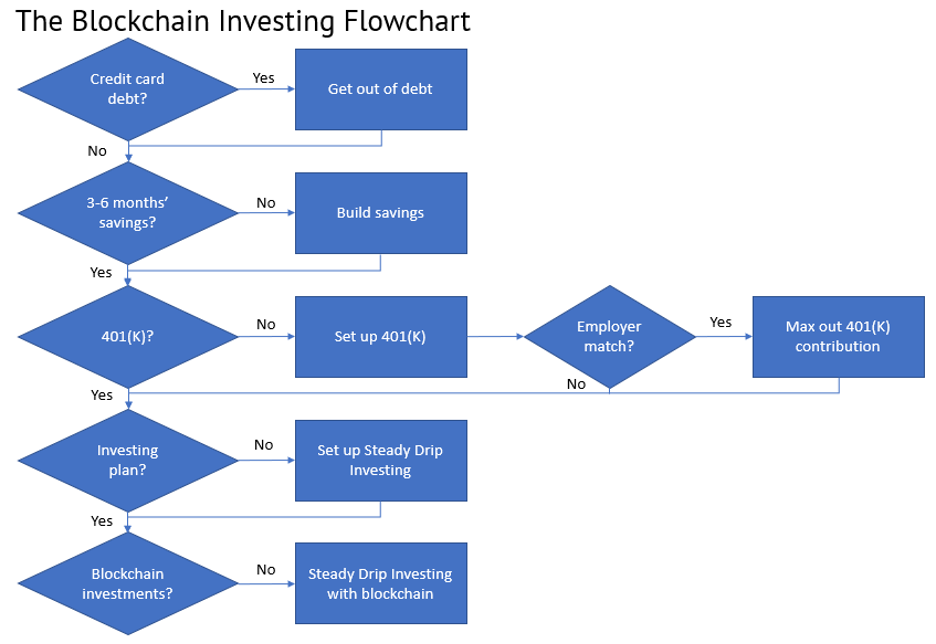

To build long-term wealth, we use a concept called steady-drip investing.

Each month, we tuck away a little bit of money, and invest it into a blend of traditional and digital investments (the stock market and the block market).

Also called dollar cost averaging, the advantage to this method of investing is that you can set it and forget it. Every month, like clockwork, it’s an auto-withdrawal from your bank account, where your money will go to work for you, building wealth.

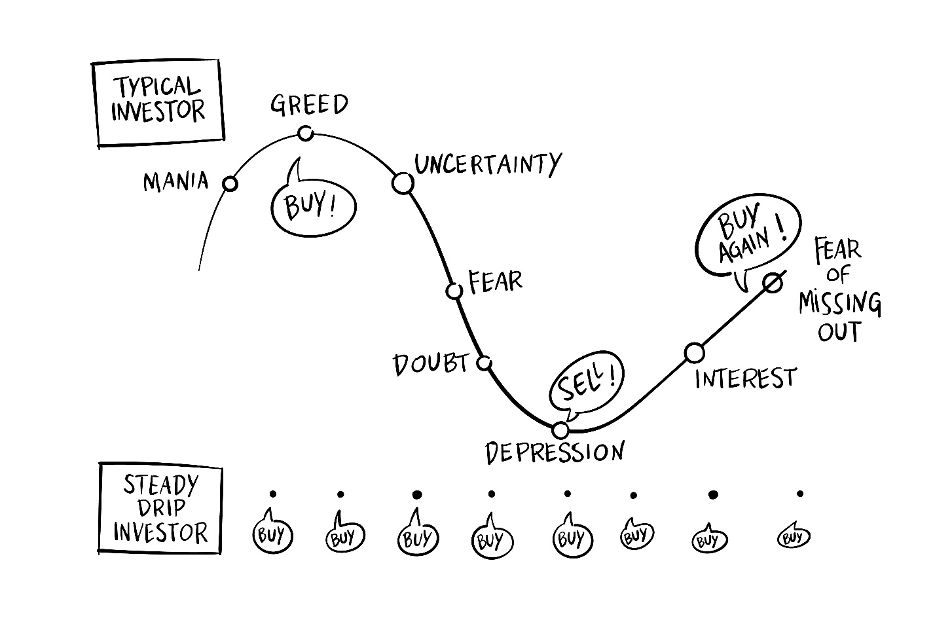

Steady-drip investing comes with another advantage: it protects you from yourself. In the world of investing (especially blockchain investing), it is easy to get caught up in the hype cycle. Too many blockchain investors put in a ton of money because “bitcoin’s going through the roof,” only to see the price of bitcoin plummet the next week. Instead of “buy low, sell high,” they “buy high, sell low.”

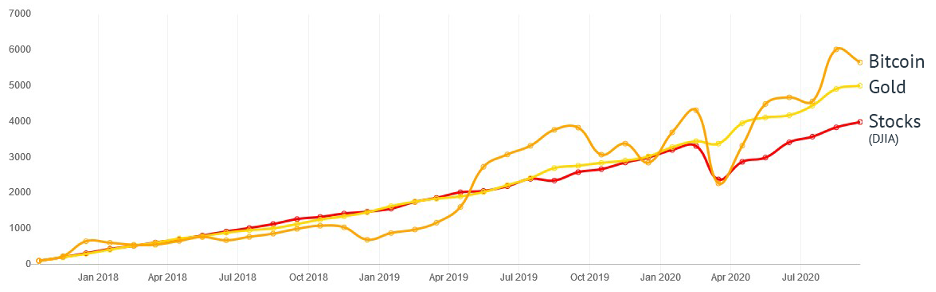

Here’s an example of steady-drip investing $100 per month over the last three years:

Whether you invested in bitcoin (orange line) or the stock market (red line), you would have much more money than you put in: your wealth would have worked for you.

But note how that orange line is all over the place. In a word, bitcoin is more volatile.

This is why we recommend a mix of bitcoin and traditional stocks – the stock market and the block market – and steady-drip investing into both.

Our Blockchain Believers Portfolio has a mix of both: click here for more info.

As of this writing, there are no investment apps that will let you set up both a balanced investment portfolio and a blockchain portfolio, so you’ll have to build the app stack yourself. Fortunately, you can set it up in about an hour.

How to Dollar Cost Average Bitcoin and Stocks

Time: about an hour

Apps needed: We’ll use Betterment and Coinbase.

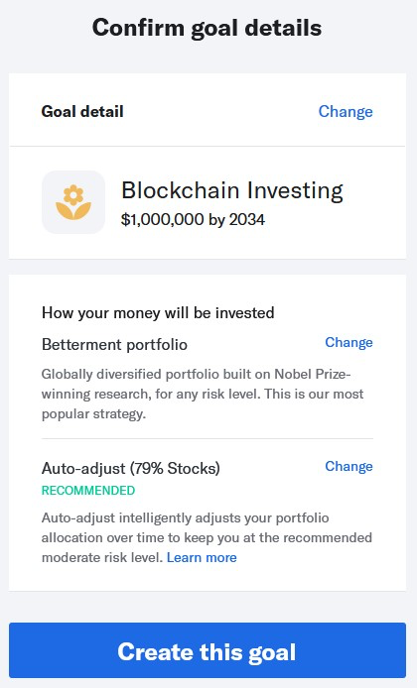

Step 1: Install Betterment. Betterment is a financial services app that allows you to save and invest using automatic steady-drip withdrawals from your checking account. (Alternately, you can set up a checking account directly within Betterment.) Betterment will also let you set up savings and retirement plans if you haven’t done that yet – but here we’ll focus on setting up our blockchain investing.

Then you’ll set up a new investment account, which will look something like this:

(Note this screenshot shows an ambitious goal – you can lower this to whatever you can afford to put away each month.)

Then set up auto-withdrawals from your linked checking account (or directly from your Betterment checking account), to set up your monthly steady-drip investing.

That’s the stock market. Now on to the block market.

Step 2: Install Coinbase. This is probably the easiest app for blockchain investing, as well as one of the most trusted: Coinbase has been in business since 2012, and has annual revenue of over $1 billion. Most important, they support steady-drip investing into digital assets.

You’ll set up Coinbase to auto-withdraw from your Betterment account, at no more than 10% of your total monthly investment. Let’s say that you’re investing $1,000 per month into your Betterment “stock portfolio”: no more than $100 will go into your Coinbase “block portfolio.” (Detailed instructions here.)

Your Coinbase investment can simply be held in bitcoin, or you can do a mix of top digital assets. (See our Blockchain Believers Portfolio for examples.) If you’re investing $100 per month, you might put $50 into BTC, $25 into ETH, and $25 into XRP. This will go into your account monthly, like clockwork.

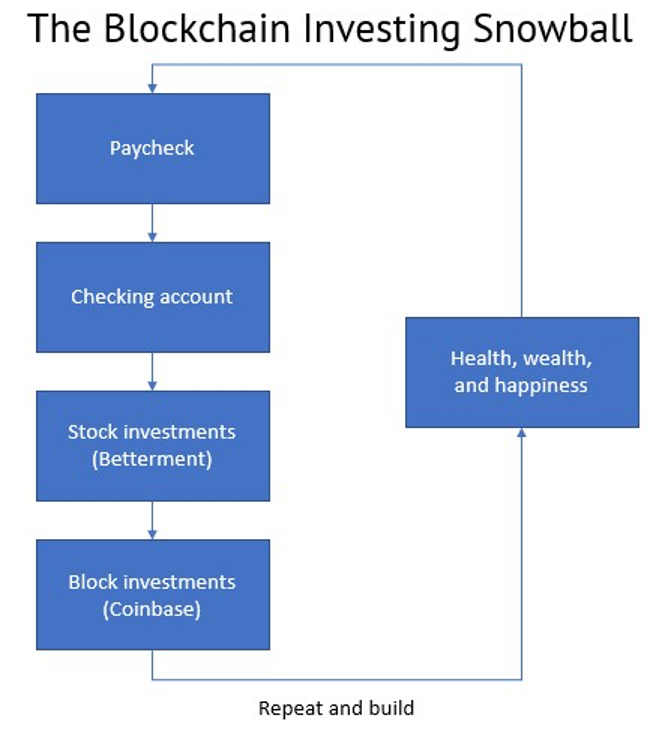

Your final setup will look something like this: a “snowball” of gradually increasing wealth:

Creating Wealth with the Blockchain Snowball

In summary, this method allows you to do dollar cost averaging across both the stock market and the block market; this combination has performed better than the stock market alone.

At the same time, this limits our risk to the volatile blockchain markets, which can otherwise wipe out a lifetime of wealth for people who make badly-timed bets on bitcoin.

By combining traditional stock investing with a little bit of blockchain exposure, we enjoy the benefits of blockchain without betting the farm.

Drip by drip, the water feeds the soil. Drip by drip, the plants grow. Drip by drip, may your investments do the same.

P.S. Don’t forget to sign up for our free weekly blockchain investing newsletter.