In brief

- Ethereum transaction fees are falling.

- This could mean there’s less activity on the blockchain.

- And that this summer’s hype around DeFi is coming to an end.

The average price of an Ethereum transaction has hit its lowest price since the middle of July, when this summer’s decentralized finance boom was just getting started. Lower fees could mean that there’s less activity on the Ethereum blockchain; fees skyrocketed this summer when miners strained under the weight of this summer’s DeFi play. Does this mean the hype is over?

On Saturday, the average price of an Ethereum transaction hit $0.905, creeping up to $1.029 on Sunday, according to data from metrics site BitInfoCharts. This is a sharp decline from highs of up to $14.583 for a single Ethereum transaction at the start of September.

Fees paid for Ethereum transactions go to Ethereum’s miners, who expend computational power to process transactions. Ethereum transaction fees rise when there is more demand for miners’ computational power than supply.

This occurs when the network strains under the surge of activity. When a lot of people process transactions at once, miners give priority to the highest bidders.

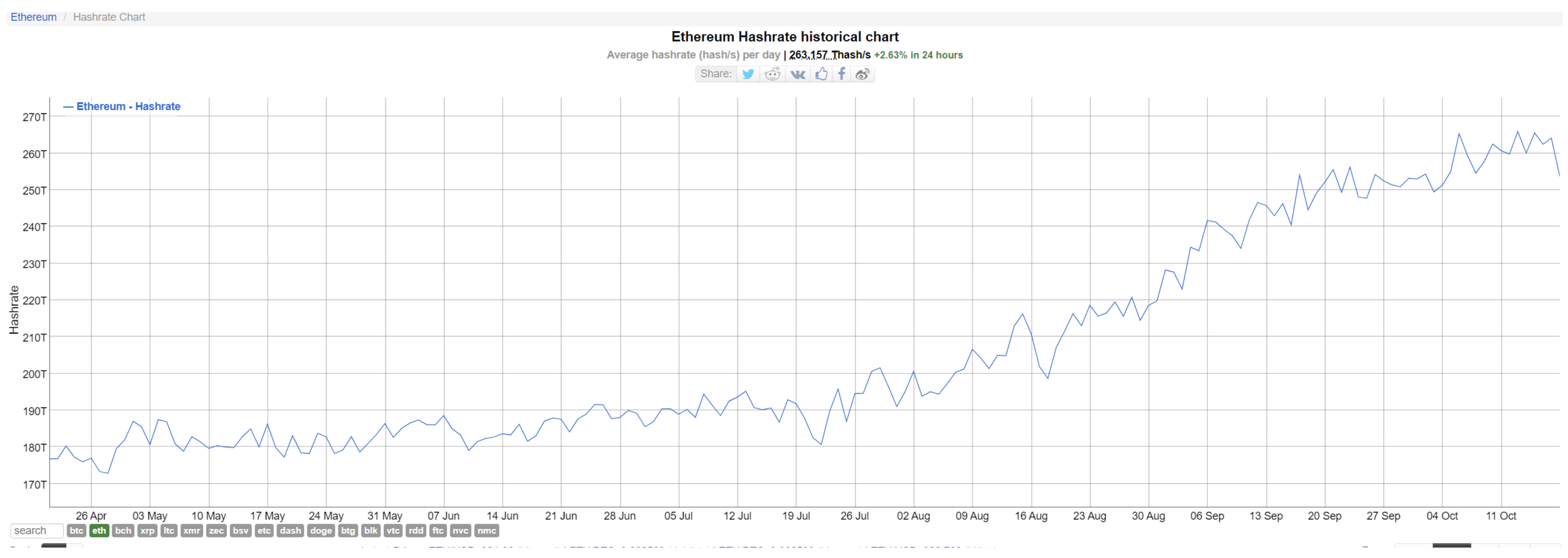

Accordingly, fees decline when the network is less busy, or when there are adequate miners to deal with the supply. Hash rate has increased on the Ethereum blockchain since July, but its rise has been steady; the fees paid on the Ethereum blockchain are far more volatile.

That the average fee for an Ethereum transaction has declined to levels unseen since July could signify that this summer’s hype around decentralized finance has subsided. Decentralized finance, or DeFi, refers to non-custodial smart contracts, lending protocols and synthetic stocks.

Starting at the tail-end of June, these protocols started offering additional incentives to those who used the platforms, sometimes of up to 1000% APY. This brought money flooding into the market—and fees spikes accordingly.

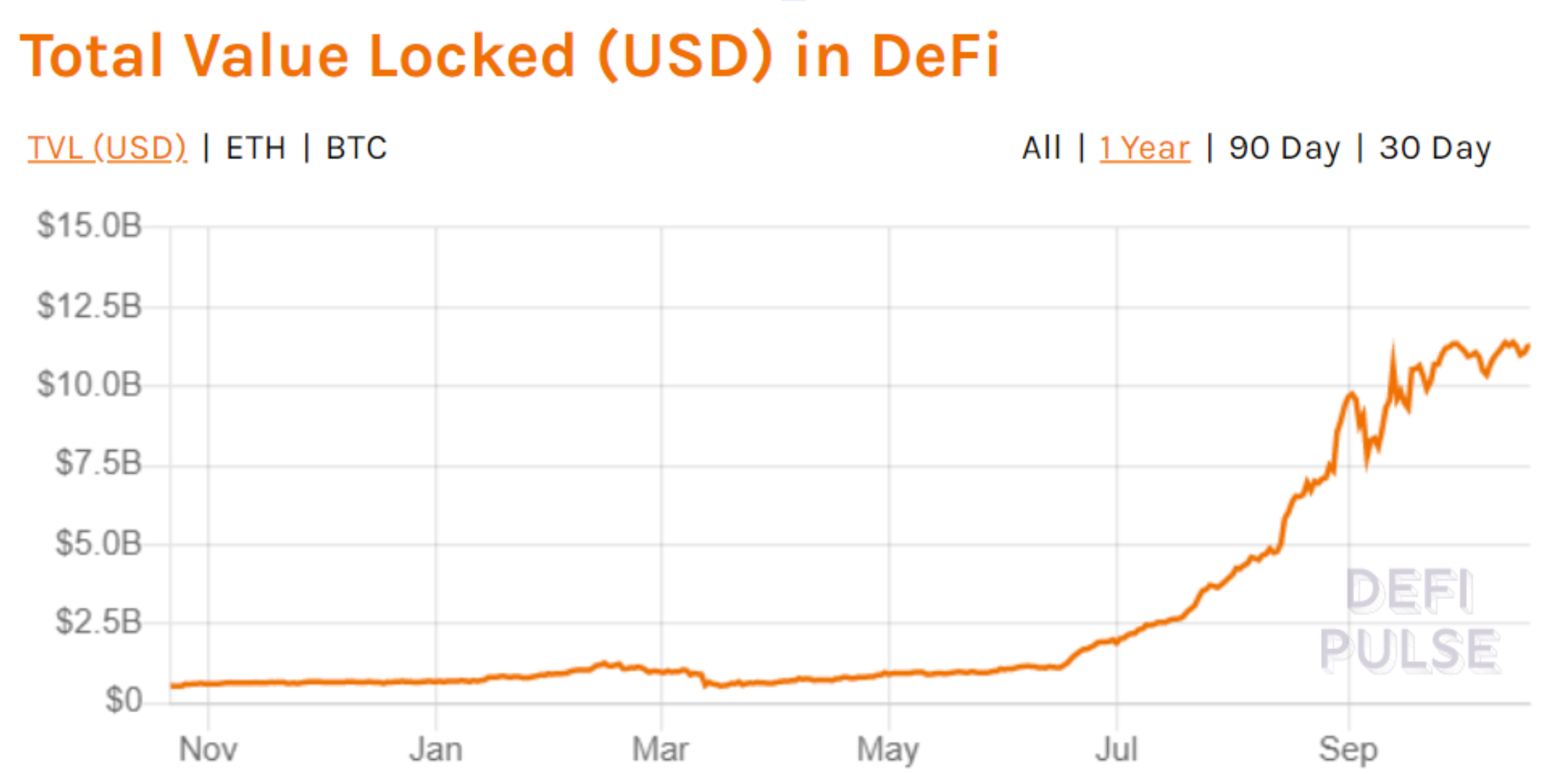

Make no mistake: people are still interested in decentralized finance, an industry that still appears to be growing. According to DeFi Pulse, a metrics site for DeFi protocols, investors have locked up $11 billion worth of cryptocurrency in DeFi protocols.

But whereas that figure used to increase by a billion dollars each week, growth has tapered off as the market hits its ceiling…for now.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.